Recourse Factoring

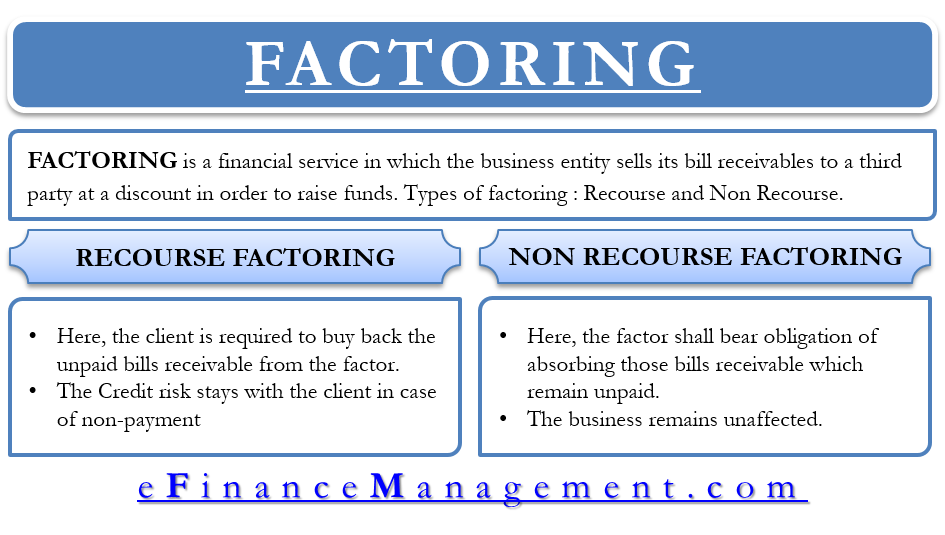

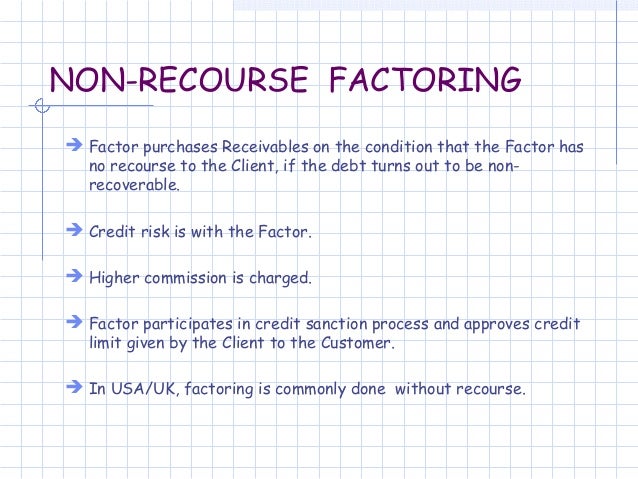

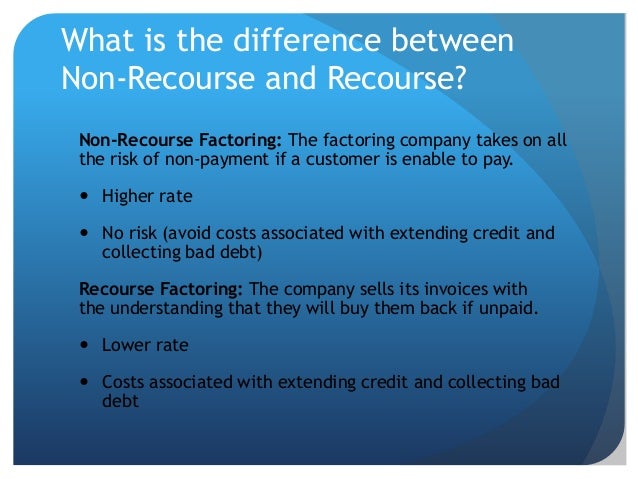

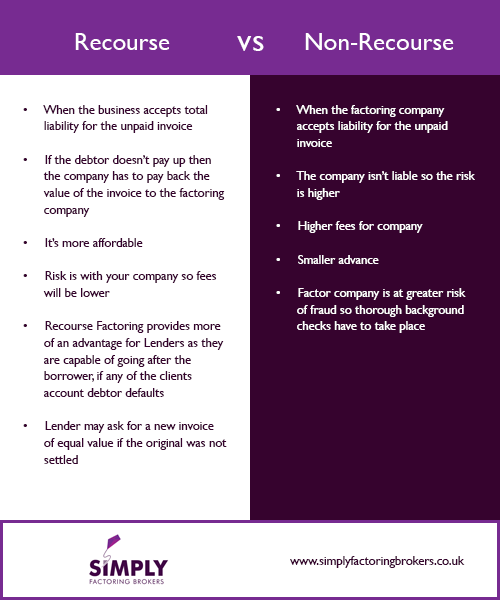

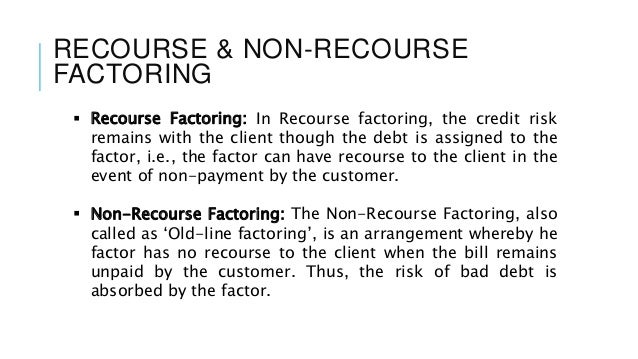

Recourse factoring A form of factoring where the company must pay back the factoring company if the client invoiced is unable to make payments Nonrecourse factoring Another form of factoring where your business cannot be held liable if the factoring company cannot collect your client’s payment.

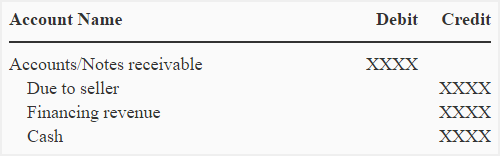

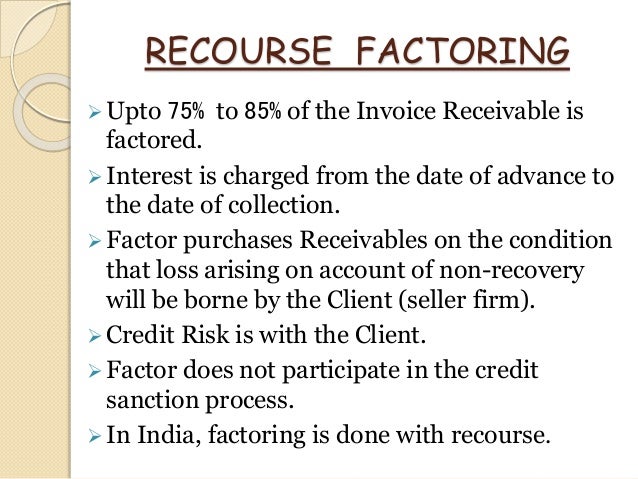

Recourse factoring. Factoring with recourse Factoring with recourse has lower fees since the company does not sell the accounts receivable and the risk of the debtors balance turning out to be not receivable remains with the company and is not transferred to the factor Difference Between a Loan and Factoring There are several differences between a loan that a company can take from a bank and a factoring transaction. Factoring without recourse or non recourse factoring is the transaction where the rights and the obligations (including the risk of the receivables turning out to be a bad debt) are transferred to the factor. Recourse factoring means that in the continued event of nonpayment once an account goes to collections, the original holder of the debt will buy back all of the accounts that remain unpaid The debt is usually sold to a factoring company at a discount as a way to cover unpaid invoices All of the liability remains on the client, not the.

Other factoring companies may market a recourse program as a “nonrecourse program” However, recourse terms still exist at 6090 days, also known as a hybrid nonrecourse program This, in fact, is still a recourse program, but if the broker doesn’t pay within 6090 for any reason, the invoice will be charged back to your trucking company. The first question you are most likely asking is ‘what is factoring’?. Recourse factoring A form of factoring where the company must pay back the factoring company if the client invoiced is unable to make payments Nonrecourse factoring Another form of factoring where your business cannot be held liable if the factoring company cannot collect your client’s payment.

The first question you are most likely asking is ‘what is factoring’?. Recourse factoring is the most common and means that your company must buy back any invoices that the factoring company is unable to collect payment on You are ultimately responsible for any nonpayment Nonrecourse factoring means the factoring company assumes most of the risk of nonpayment by your customers. Recourse factoring Manage your recourse factoring business – agreements where a company sells its current invoices to you with the understanding that the company will buy them back if they go uncollected.

Recourse factoring is an agreement between you and your factor In a recourse factoring, the company is responsible for recovering the cost of any invoices your liable customers fail to pay. What is the difference between recourse and nonrecourse factoring?. Recourse factoring offers advantages that are associated with the lower risk profile for the factor and therefore getting coverage is easier to obtain and at a lower fee Typically the factor charges the exporter a fee, a factoring commission, usually a percentage of the face value of receivables, for its credit cover and collection services.

True NonRecourse Factoring Same Day Funding No Reserves, Full Funding No Monthly Minimums Instant Broker Checks Fuel Advances 7 Days a Week Call Us Today!. Nonrecourse factoring is a type factoring financing in which the factoring company assumes the loss if invoices are not paid due to end customer insolvency It is one of the two common types of invoice factoring offered by finance companies However, it is also widely misunderstood by clients In this article, we discuss. Definition of Recourse Factoring Recourse factoring is an agreement between the client and the factor in which the client is required to buy back the unpaid bills receivable from the factor Thus, the credit risk stays with the client in case of nonpayment by the debtor.

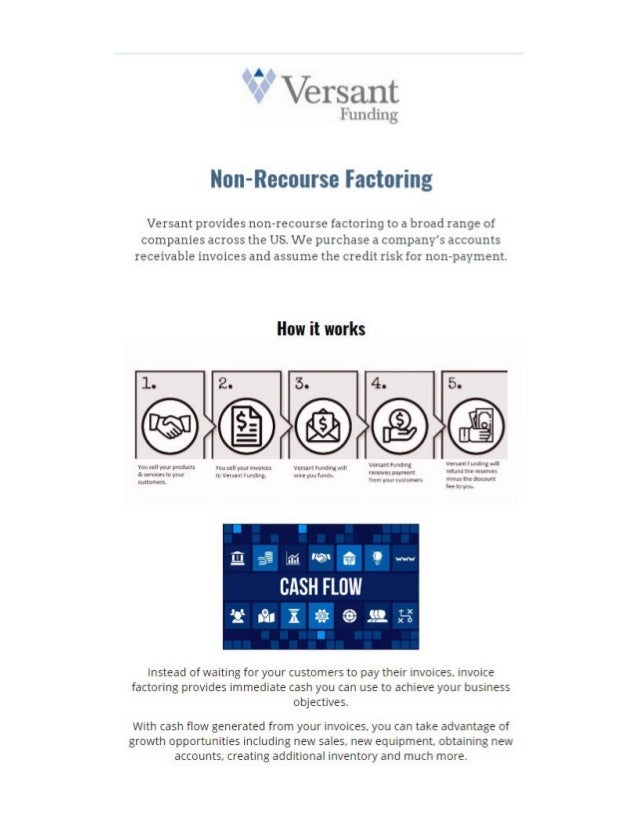

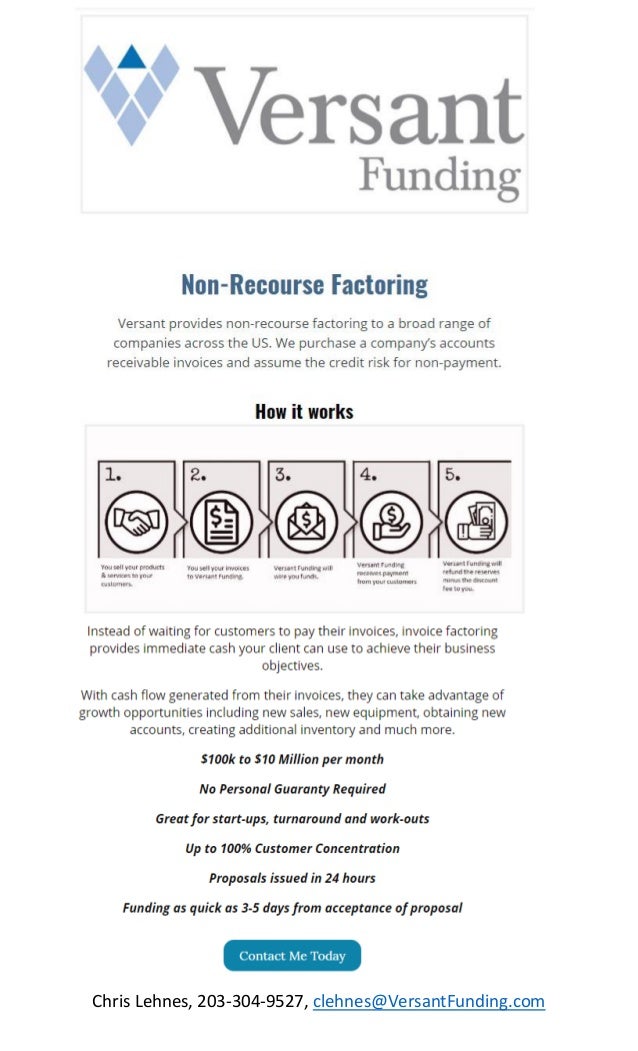

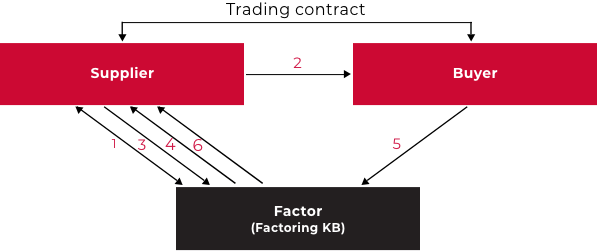

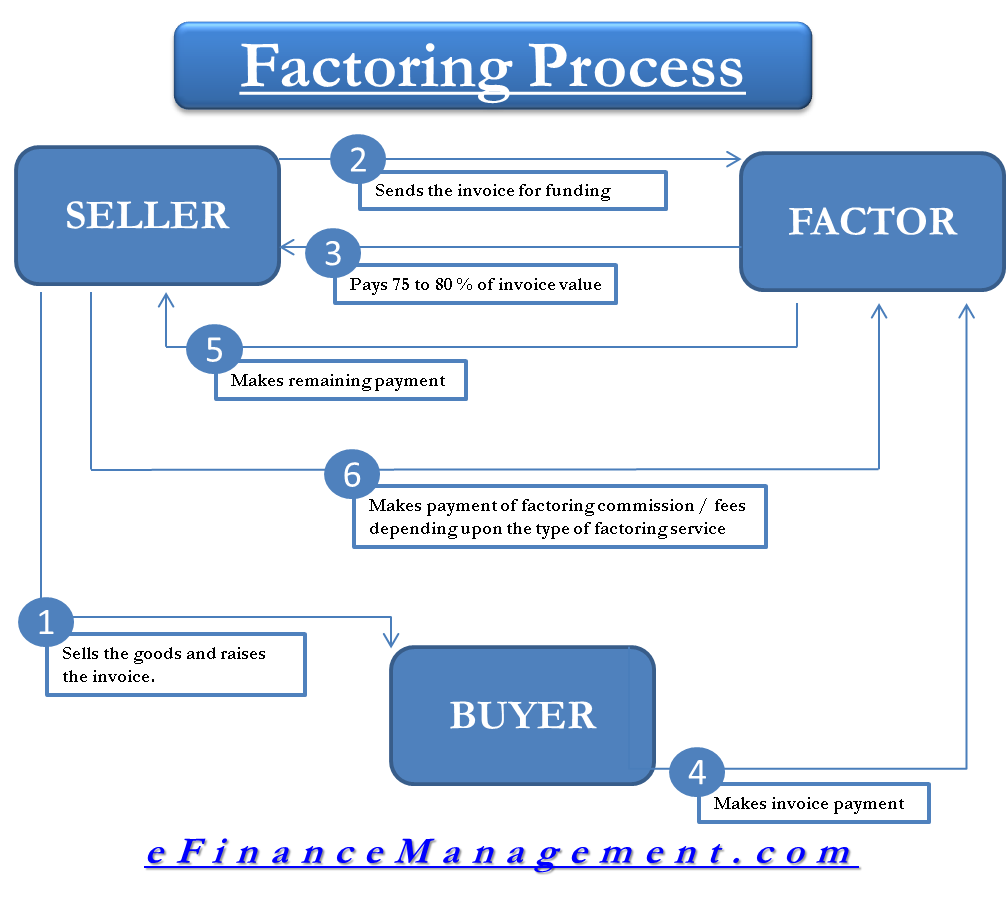

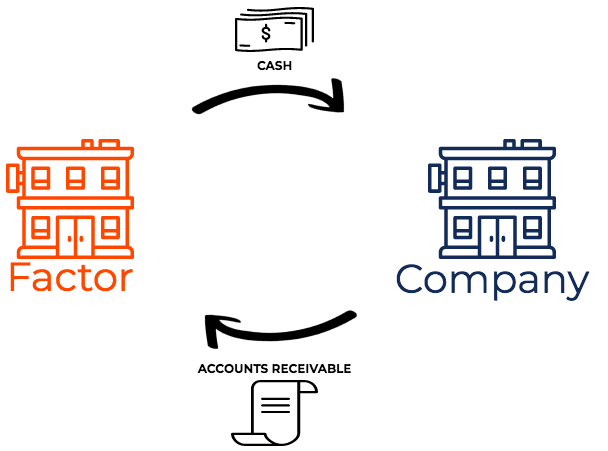

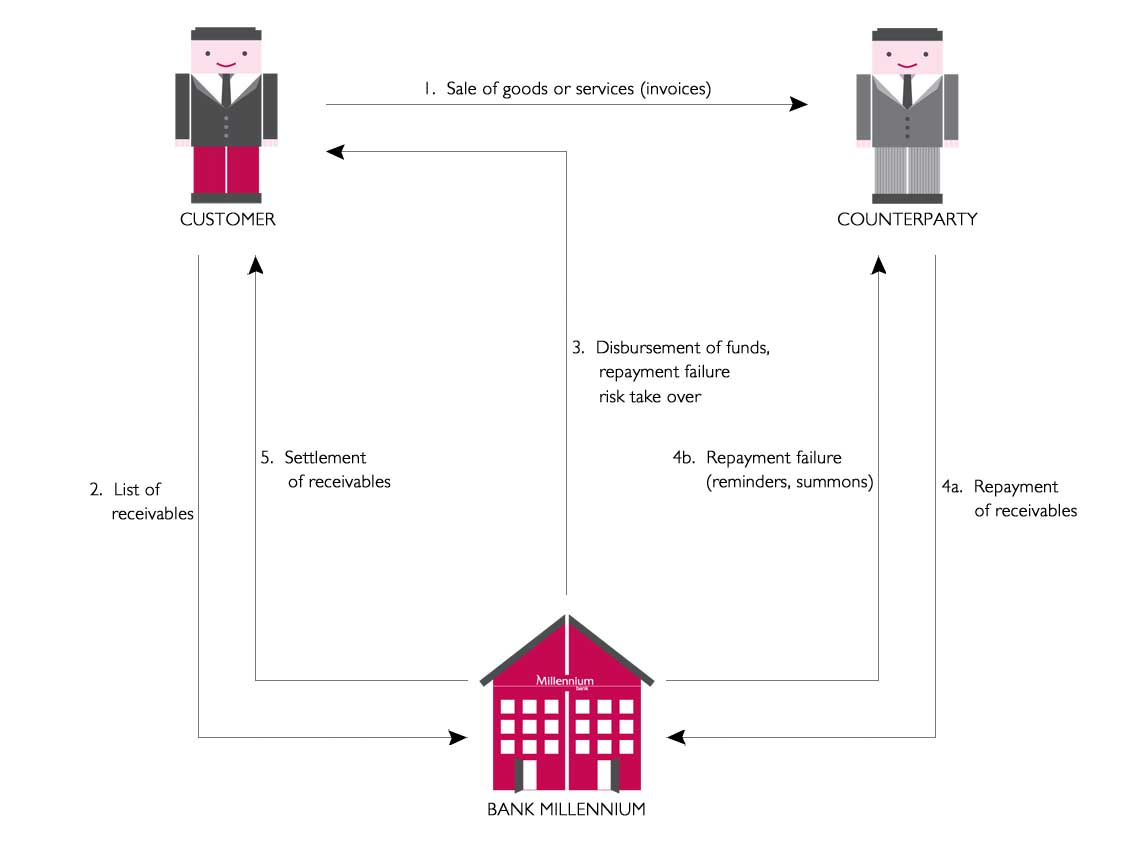

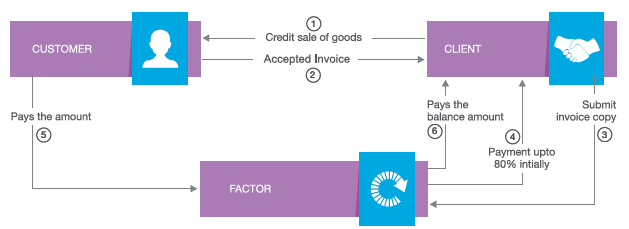

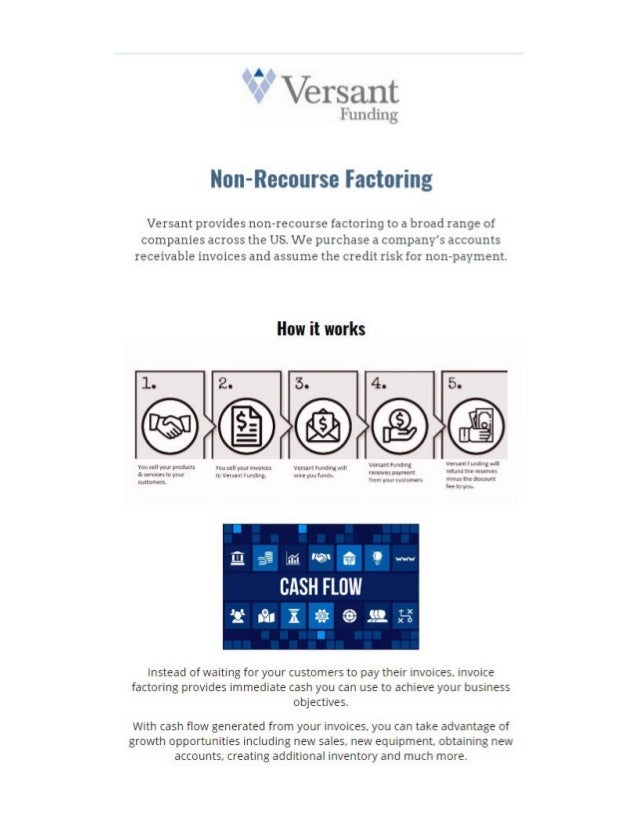

Apply Securely, call ext 1 or email us. Factoring occurs when a company sells one or more accounts receivable invoices owed on credit terms to a financier, known as a factor, for less than what they are owed That discount, plus some. Factoring is the sale of outstanding invoices (accounts receivable) at a discount to a factoring company like Business Factors in exchange for cash It relies on the creditworthiness of your clients and works well for newer companies with short credit history.

Nonrecourse factoring is when a factoring company offers to purchase some, or all, of its clients accounts receivable “without recourse” In theory, a nonrecourse factoring contract means if an account debtor does not pay an invoice, that the factoring company will take the loss on that invoice, not the factoring client. Nonrecourse freight factoring No reserve account you receive 100% of your money up front when you send your factoring bills in No long term contract commitment No minimum factoring requirement (on 1 or 2 trucks) Free credit checks on brokers. With recourse factoring the company selling the invoices (the client) is basically guaranteeing the invoice will be paid in full A factoring company will generally charge back any delinquent invoices to the business client after 90 days, depending on the terms of the agreement.

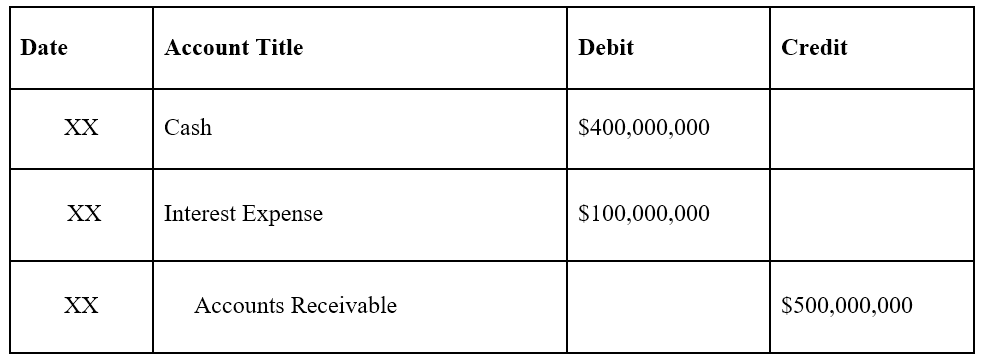

Recourse factoring makes you, the client, pay for any uncollected receivables Most factoring agreements are recourse If your customer becomes insolvent, defaults or goes bankrupt, then you’re liable for the bad debt expense. Freight broker factoring Factoring products for freight brokers trucking and transportation companies including startups Freight factoring companies for brokers offer the needed capital to brokerages quickly without having to wait up to 90 days for invoices to get paid. Example factoring with partial recourse that qualifies for derecognition Entity A enters into a factoring agreement and sells its portfolio of trade receivables to the Factor The face value and carrying amount of those receivables is $1 million and selling price is $09 million After the sale, Entity A absorbs first 18% of credit losses of.

What is the difference between recourse and nonrecourse factoring?. Nonrecourse freight factoring is when a factoring company, Phoenix Capital Group, gives clients the ability to sell their invoices without recourse The typical invoice factoring period usually takes 30, 60 or 90 days for the customer to pay the invoice back. Recourse factoring A form of factoring where the company must pay back the factoring company if the client invoiced is unable to make payments Nonrecourse factoring Another form of factoring where your business cannot be held liable if the factoring company cannot collect your client’s payment.

Recourse is a type of Factoring which happens when an entity has to sell the invoices to the client (factor) with a condition that the entity will purchase back any invoices that remains uncollected, this means that in recourse, the factor (client) is not taking any risk of the uncollected invoices In simple words, it is the selling of account receivables by a company to a factor at a discount. What NonRecourse Factoring Does Cover Let’s talk about what nonrecourse factoring does cover If your customer’s business fails or files for Chapter 11 bankruptcy protection, the factor will be the one standing in line at the bankruptcy hearing, hoping to get paid After all, it bought the invoice based on the creditworthiness of your. Recourse factoring A form of factoring where the company must pay back the factoring company if the client invoiced is unable to make payments Nonrecourse factoring Another form of factoring where your business cannot be held liable if the factoring company cannot collect your client’s payment.

Recourse factoring is an agreement where a company sells its current invoices to a factoring company with the under standing that the company will buy them back if they go uncollected This factoring plan is generally affordable since the company is agreeing to absorb some of the risk involved in the transaction. How recourse factoring works In recourse factoring, a funding partner (aka your lender or the “factor”) buys invoices from you with the agreement that you will buy the invoice back if your customer is unwilling or unable to pay for the invoice when it becomes due In this way, you share the risk of nonpayment with the funding partner. Recourse factoring offers advantages that are associated with the lower risk profile for the factor and therefore getting coverage is easier to obtain and at a lower fee Typically the factor charges the exporter a fee, a factoring commission, usually a percentage of the face value of receivables, for its credit cover and collection services.

Put simply, factoring allows you to improve your business cash flow by accessing a percentage of the value of your unpaid sales invoices in the form of a cash advance. Recourse factoring In recourse factoring, the factor does not take on the risk of bad debts They will be able to reclaim their money from you even if the customer does not pay The factoring agreement will specify how many days after the due date for payment you must refund the advance Whether you refund the advance or not, you will still have to pay the fee and interest (discount charge). Recourse factoring means that in the continued event of nonpayment once an account goes to collections, the original holder of the debt will buy back all of the accounts that remain unpaid The debt is usually sold to a factoring company at a discount as a way to cover unpaid invoices All of the liability remains on the client, not the.

Recourse factoring means that in the continued event of nonpayment once an account goes to collections, the original holder of the debt will buy back all of the accounts that remain unpaid The debt is usually sold to a factoring company at a discount as a way to cover unpaid invoices. What is the difference between recourse and nonrecourse factoring?. Non Recourse factoring With our nonrecourse factoring program, we factor our Clients’ invoices and assume 100% of the risk of credit This protects the trucking company from the effects of bad debt, which gives them the peaceofmind that comes from knowing unpaid invoices are not going to damage their business’s cash flow requirements.

Recourse factoring is an arrangement where the company that factors its invoices assumes responsibility to buy back any loans that end up being uncollected or not able to be collected When the factor is calculated, it does not differentiate based on creditworthiness of any individual customer, but rather the entire sales ledger. These industries have successfully grown their companies with Paragon Financial’s NonRecourse Invoice Factoring, A/R Management, Credit Protection and Purchase Order Financing Programs Get fast working capital for your Charlotte business!. Freight Factoring with Love’s Financial offers competitive recourse factoring plans If you are interested in a custom quote built specifically for your trucking company, please reach out to our sales specialists for more information on recourse factoring You can call us at at LOVES () or fill out this form online.

Nonrecourse factoring (Full factoring) Manage your nonrecourse factoring business, allowing a company to sell its invoices to you without the obligation of absorbing any unpaid invoices Save your team’s time with automated calculation, enjoy collections worksheet functionality for debt management, overview all open Invoices in a single page. Why Choose WEX Fleet One Factoring Trucking experience Massive database for credit checks Secure financial foundation Fast, friendly customer service These are the pillars of a reliable factoring partner and WEX Fleet One Factoring excels in every category We understand your business and customize our programs to fit your fleet’s needs. Recourse factoring is the most commonly used form of AR factoring With recourse factoring, if a customer fails to pay, you are responsible for buying back the invoice from the factoring company The factor tries to offset the risk of nonpayment by assessing the customer’s creditworthiness and applying collection calls between 4090 days.

What is the difference between recourse and nonrecourse factoring?. Factoring without recourse transfers substantially all the risks to the Factor, whereas Factoring with full recourse retains substantially all risks at the Seller IFRS 9 specifically mentions the following as an example of when substantially all risks and rewards are not transferred 25(e) a sale of short term receivables in which. Put simply, factoring allows you to improve your business cash flow by accessing a percentage of the value of your unpaid sales invoices in the form of a cash advance.

Put simply, factoring allows you to improve your business cash flow by accessing a percentage of the value of your unpaid sales invoices in the form of a cash advance. Reverse Factoring – The WinWin Financial Solution for Each Link in the Supply Chain Reverse Factoring or Supply Chain Financing is when a bank or finance company commits to pay a company’s invoices to the suppliers at an accelerated rate in exchange for a discount It is unlike traditional invoice factoring, where a supplier wants to finance his receivables. Recourse factoring offers advantages that are associated with the lower risk profile for the factor and therefore getting coverage is easier to obtain and at a lower fee Typically the factor charges the exporter a fee, a factoring commission, usually a percentage of the face value of receivables, for its credit cover and collection services.

NonRecourse factoring is a type of invoice factoring wherein the factoring company agrees to take on the risk of nonpayment from a client’s customer Unlike recourse factoring, a factoring client would not be required to exchange or repurchase invoices in the case of nonpayment by customer. Some factoring companies offer nonrecourse factoring only Other factoring companies offer a nonrecourse option or an asneeded feature to recourse factoring If you are riskadverse and hate the thought of your customers not paying your invoices, then you may find comfort in nonrecourse factoring You’re off the hook. Recourse factoring In recourse factoring, the factor does not take on the risk of bad debtsThey will be able to reclaim their money from you even if the customer does not pay The factoring agreement will specify how many days after the due date for payment you must refund the advance.

Factoring accounts receivable (also called invoice factoring is the sale of pending invoices to a factoring company (factor), which is a type of financing company that specializes in these transactions It does not involve taking on debt or diluting equity By using factoring – which can monetize invoices in 24 to 48 hours – companies can obtain funds to. True NonRecourse No reserves, no charge backs!. Recourse factoring is the most common type of invoice factoring on offer these days However, it’s not difficult to find an invoice factor that uses nonrecourse services in some form or another How NonRecourse Factoring Works.

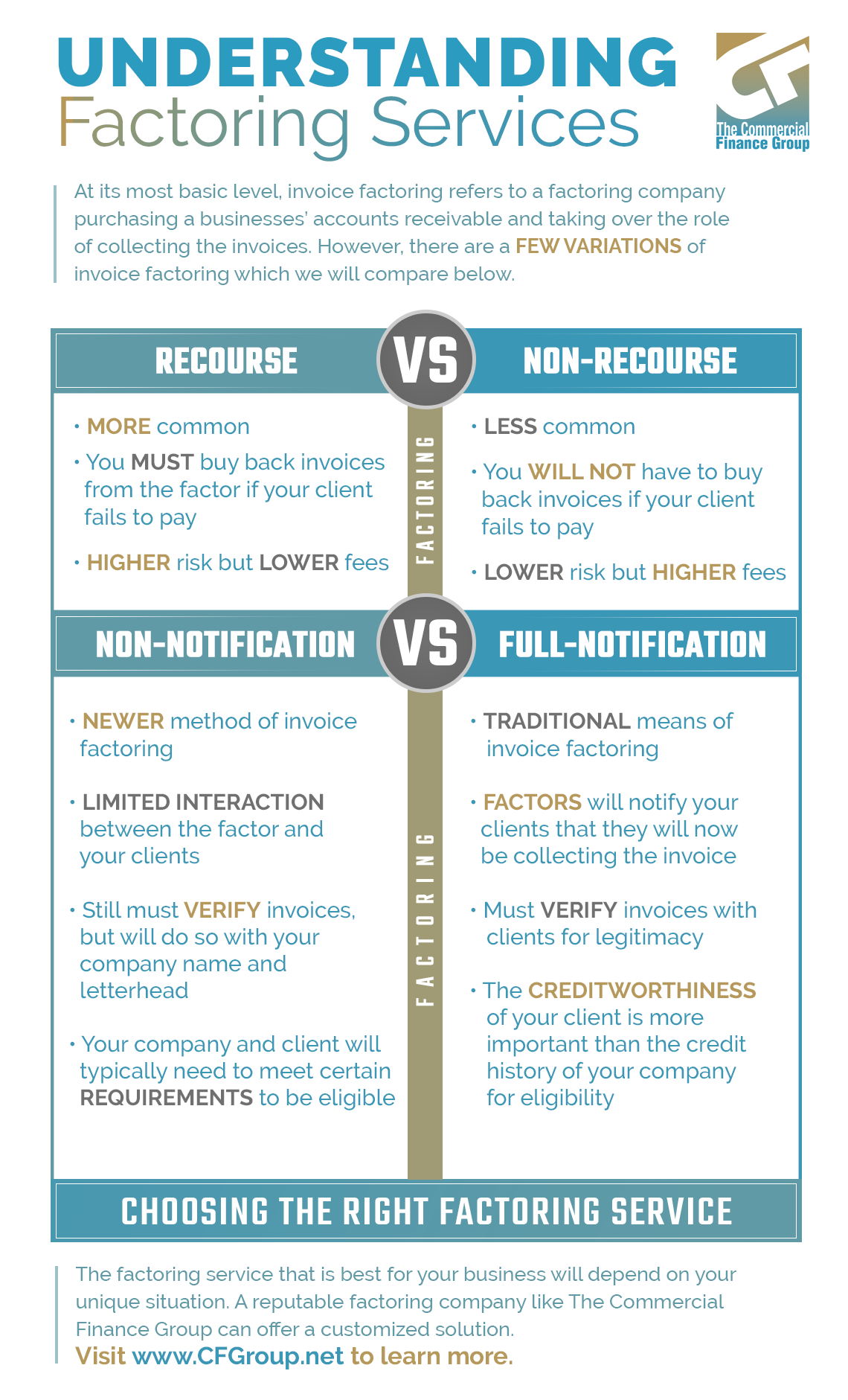

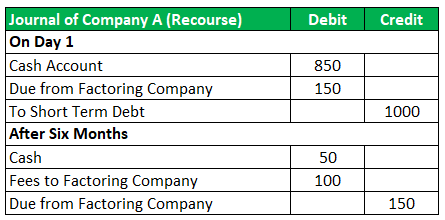

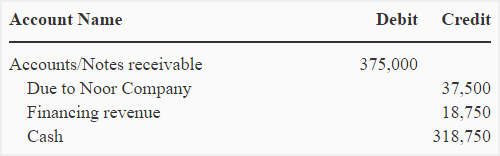

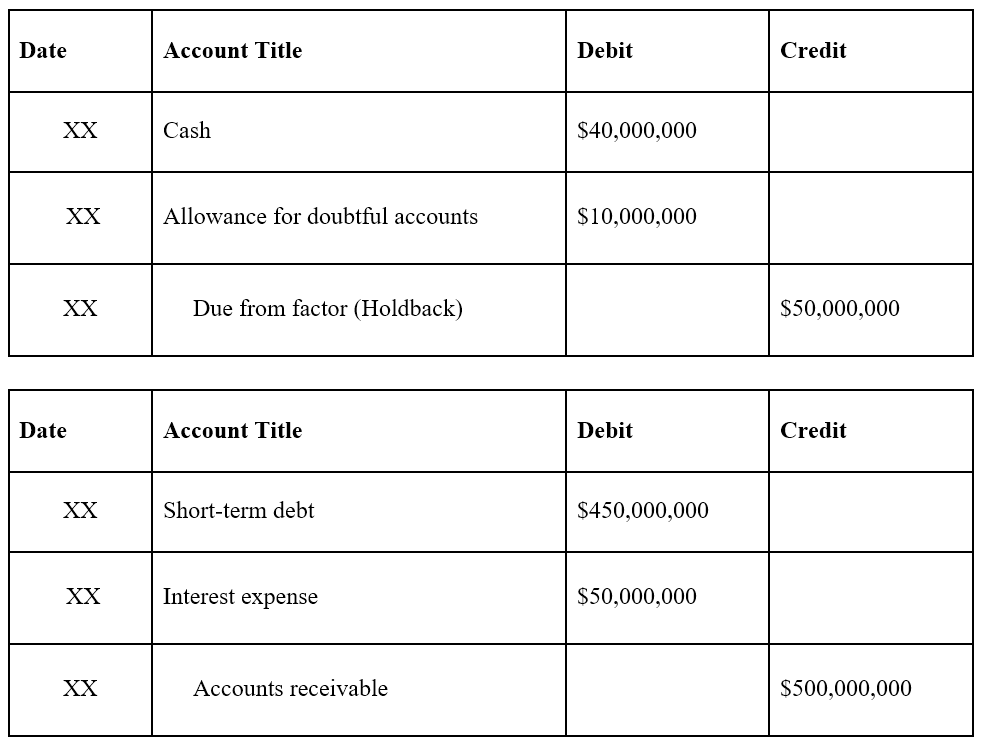

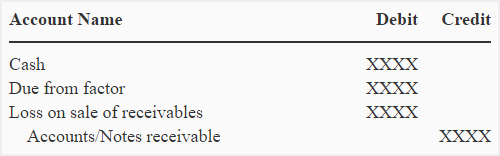

With Recourse Accounts Receivable Factoring In the event that the accounts receivables are factored with recourse (meaning that the business accepts the risk of bad debts not the factoring company, additional factoring of accounts receivable journal entries are required. Recourse factoring offers advantages that are associated with the lower risk profile for the factor and therefore getting coverage is easier to obtain and at a lower fee Typically the factor charges the exporter a fee, a factoring commission, usually a percentage of the face value of receivables, for its credit cover and collection services. How Recourse Factoring Works In this instance, recourse means “the legal right to demand compensation or payment” In the case of invoice factoring, a recourse agreement means that you are responsible for repurchasing the invoice if your customer does not pay for any reason.

Have the peace of mind that we will not charge you back because of slow broker payments No Hidden Fees Our. Example factoring with partial recourse that qualifies for derecognition Entity A enters into a factoring agreement and sells its portfolio of trade receivables to the Factor The face value and carrying amount of those receivables is $1 million and selling price is $09 million After the sale, Entity A absorbs first 18% of credit losses of. With recourse factoring the company selling the invoices (the client) is basically guaranteeing the invoice will be paid in full A factoring company will generally charge back any delinquent invoices to the business client after 90 days, depending on the terms of the agreement.

Recourse Factoring When trying to find a factoring solution, one thing to keep in mind is recourse If the company is not able to collect the invoice, you are forced to pay it back. The first question you are most likely asking is ‘what is factoring’?. Recourse and NonRecourse Plans Available Grow with CCT Factoring Our factoring program provides carriers with necessary capital to haul more freight and to add to their existing fleet.

Recourse factoring fees are typically lower than nonrecourse fees Recourse factoring fees also vary by volume, but average between 15 – 3% With recourse factoring, trucking companies assume the risk of nonpayment If a freight bill is not paid within the recourse period (typically 90 days), the trucking company may be required to repay it If you work with steadypaying and otherwise reliable customers, recourse factoring could be the right option for your company. Recourse factoring enables a business to unlock the working capital tied up in receivable invoices Businesses that factor with recourse sometimes enjoy rates that are lower than nonrecourse factoring fees, since the factoring company does not take on the additional risk from bad debt. Invoice factoring without recourse or nonrecourse factoring is an agreement within a factoring contract where the factor’s client does not have to pay back the factoring company if an invoice is not paid explicitly due to the bankruptcy of the client’s customer (the Account Debtor) under an invoice with credit protection in place.

A true nonrecourse factoring deal, it really means that under no circumstances, would the factoring company ever ask for its money back Make sure you get this in writing Make sure the contract is very clear and make sure that your client knows that the product has been shipped or the service has been performed and you're able to make sure. Put simply, factoring allows you to improve your business cash flow by accessing a percentage of the value of your unpaid sales invoices in the form of a cash advance. Discount Factoring / Recourse Factoring Discount factoring, also known as recourse factoring, provides your business with flexible and immediate funds that will give you the opportunity to grow, restructure, take advantage of supplier discounts through volume purchases or early payments, or even to fund payroll.

Discount factoring, also known as recourse factoring, provides your business with flexible and immediate funds that will give you the opportunity to grow, restructure, take advantage of supplier discounts through volume purchases or early payments, or even to fund payroll.

Accounts Receivable Transfer With Recourse Factoring E7 18 Youtube

Accounts Receivable Factoring With Recourse Sales Of Accounts Receivable Youtube

Recourse Vs Non Recourse Factoring Universal Funding

Recourse Factoring のギャラリー

Recouse Factoring And Non Recourse Factoring Definition And Difference

Factoring Without Recourse Annualreporting Info

How Recourse Factoring Works

Key Differences Recourse And Non Recourse Factoring Solution Scout

Non Recourse Factoring To Improve Cash Flow

Factoring Of Accounts Receivable Accounting Definition Journal Entries Example With Recourse Without Recourse

Factoring With Our Insurance Policy Non Recourse Factoring Products Kuke Finance

Recourse In Factoring Meaning Overview Example With Journal Entries

Recourse Factoring Clessidra Factoring

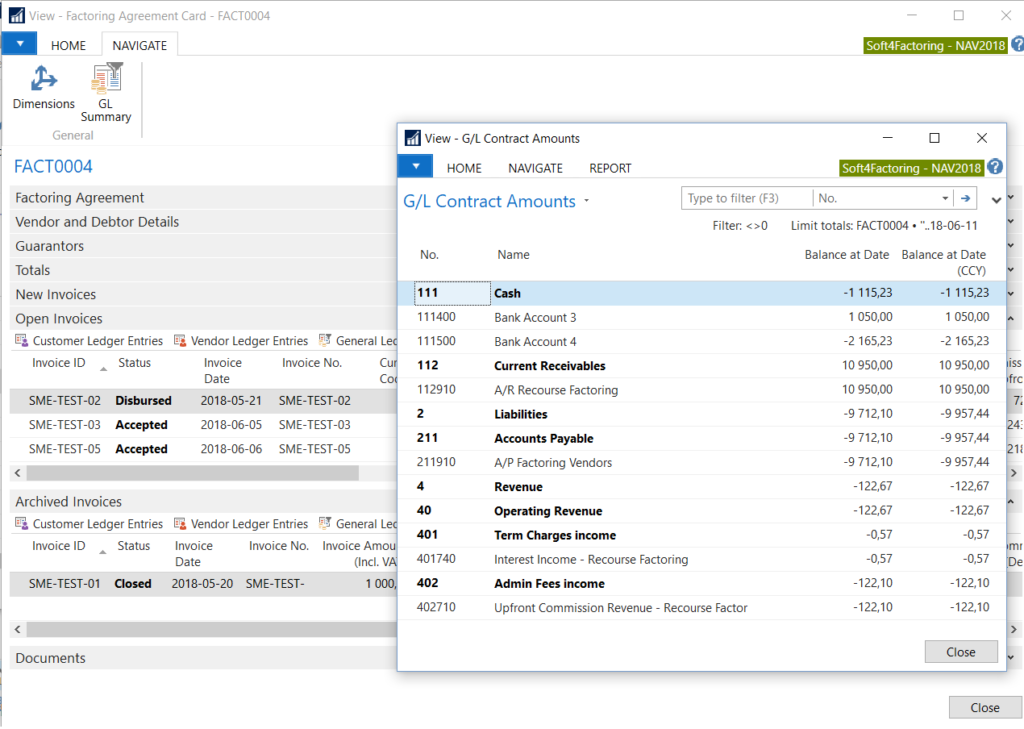

Soft4factoring Factoring Software

Factoring Accounts Receivable Definition Explanation Journal Entries And Example Accounting For Management

Factoring Global Supply Chain Finance Forum

Factoring With Client S Insurance Policy Non Recourse Factoring Products Kuke Finance

Invoice Factoring Four Services Factoring Companies Can Offer

Accounts Receivable Factoring Learn How Factoring Works

Accounts Receivable Factoring With Recourse Versus Without Recourse On Sale Youtube

Q Tbn And9gcqmmgwtobxzmdun8ksyt44mw2ra6 6k 2oaqxliv1fem9ulgf Usqp Cau

Recourse Vs Non Recourse Factoring What S The Difference

Domestic Factoring Factoring Kb

Accounts Receivable Factoring Examples How It Works

Soft4factoring Pya Solutions All Rights Reserved

Q Tbn And9gcqhwgzgwp Fowwyfyb7fn7qebxxhs8hcemopw1i4wwlby4ven09 Usqp Cau

Factoring

What Is Non Recourse Factoring Corsa Finance 855 8 6772

Recourse In Factoring Meaning Overview Example With Journal Entries

Papers Ssrn Com Sol3 Delivery Cfm Abstractid

Recourse Versus Non Recourse Factoring What S The Difference

What Is Invoice Factoring Without Recourse Paragon Financial

1 Concept Of Factoring 2 Numerical Problem On Recourse And Non Recourse Factoring 3 Features Of Factoring 3 Types Of Factoring 5 Characteristic Of Factoring In India Factoring Finance Credit Finance

Factoring Purchase Order Financing Accounts Receivable Factoring

Recourse Factoring Vs Non Recourse Factoring What Will Work For You Handle

Recourse Factoring Vs Non Recourse Factoring Make The Right Choice

Factoring Receivables Double Entry Bookkeeping

Pdf Analysis Of The Importance Of Factoring On The Polish Market And Influence Of Financial Instrument Accounting On Enterprises

Accounts Receivable Factoring Learn How Factoring Works

Factoring Of Accounts Receivable Accounting Definition Journal Entries Example With Recourse Without Recourse

Invoice Factoring All You Need To Know Seriously

Recouse Factoring And Non Recourse Factoring Definition And Difference

Why Non Recourse Factoring Isn T Always The Right Decision

Why And How Does A Supplier Choose Factoring Finance

Factoring In India Howtoexcel

Recourse V Non Recourse Factoring What You Need To Know By Gotmedianow Medium

Non Recourse Factoring Fast Affordable Financing Paragon Financial

Improve Cash Flow With Accounts Receivable Factoring

Factoring Accounts Receivable Definition Explanation Journal Entries And Example Accounting For Management

Factoring And Forfaiting

Recourse Factoring Vs Other Factoring Services Factor Finders

What Is Non Recourse Factoring Paragon Financial

Factoring Without Recourse

Eagle Express Service Recourse Vs Non Recourse Factoring

Accounts Receivable Factoring Learn How Factoring Works

Export Factoring In India Vinod Kothari Consultants

Invoice Factoring Non Recourse Factoring Corsa Finance

Recourse In Factoring Meaning Overview Example With Journal Entries

Q Tbn And9gcsaz00 2atzmx Qbb09ces8oxcsrynh0ex8ltytjkuumtukc8qt Usqp Cau

Sample Receivable Factoring Excel Sheet Effective Rates Interest Rates Driveyoursucce

1

Differences Between Recourse And Non Recourse Factoring

The Difference Between Recourse And Non Recourse Factoring

Factoring Receivables With Without Recourse Youtube

Factoring Accounts Receivable Definition Explanation Journal Entries And Example Accounting For Management

Non Recourse Accounts Receivable Factoring Company Ar Funding Org

What Is Invoice Factoring An Overview

Fci Interview Non Recourse Factoring A Solution For The Economic Crisis For Smes

Non Recourse Factoring With Insurance Corporate Bank Millennium

Solved Points Maximum Score 1 What Is Meant By Factor Chegg Com

Recourse Factoring Vs Non Recourse Factoring Tci Business Capital

Recourse In Factoring Meaning Overview Example With Journal Entries

Recourse Versus Non Recourse Factoring What S The Difference

Non Recourse Factoring Product Sheet

Recourse Factoring Vs Non Recourse Factoring Financial Yard

Recourse Factoring Vs Non Recourse Factoring What Will Work For You Handle

Factoring Of Accounts Receivable Accounting Definition Journal Entries Example With Recourse Without Recourse

Factoring As A Receivable Management Tool

The Differences Between Recourse And Non Recourse Factoring

Non Recourse Factoring Vs Recourse Factoring Novicap

What Is Non Recourse Invoice Factoring Businesscash Com

Factoring Of Accounts Receivable Accounting Definition Journal Entries Example With Recourse Without Recourse

Factoring Of Accounts Receivable Accounting Definition Journal Entries Example With Recourse Without Recourse

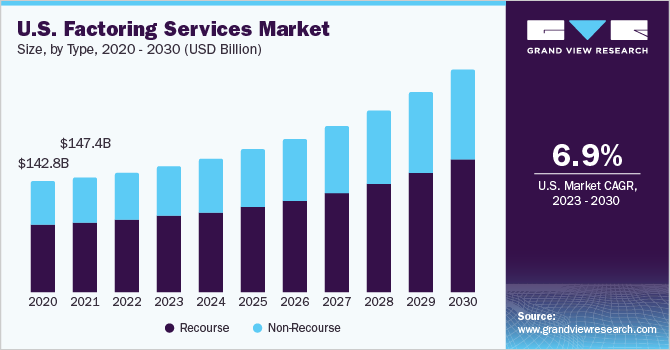

Factoring Services Market Size Industry Report 27

The Pros And Cons Of Using Recourse Factoring

Factoring Purchase Order Financing Accounts Receivable Factoring

Factoring In Practice Advanced Financial Controlling Tools And Articles

What Is Non Recourse Factoring Basics Business Factors

6 Factoring Meaning Different Types Recourse And Non Recourse Youtube

Recourse Vs Non Recourse Factoring Youtube

Recourse Factoring Receivables Financing What Is A Recourse Loan

Accounts Receivable Factoring Without Recourse Sales Of Accounts Receivable Youtube

Factoring

Factoring Receivables With Without Recourse Youtube

Accounts Receivable Factoring Examples How It Works

Outline Of Non Recourse Factoring In The Seller S Books Source Own Download Scientific Diagram

Recourse Factoring Products Kuke Finance

Edkaxdxaashddm

The Difference Between Recourse And Non Recourse Factoring Ebc

Non Recourse Factoring How It Works

Jh Consultancy Basic Knowledge Of Factoring Recourse Facebook

Accounts Receivable Factoring Examples How It Works

Non Recourse Factoring Without Debt Business Factors

Outline Of Recourse Factoring Recorded In The Seller S Books Source Download Scientific Diagram

Recourse Non Recourse Factoring Basics Business Factors