Supply Chain Finance

Supply Chain Finance Global endtoend financing programs including Channel Finance, Sales Finance, and Supplier Finance Best Provider of Supply Chain Finance (15) Working capital to support your goals Increase your cash flow and grow Strengthen relationships Take advantage of extended payment terms.

Supply chain finance. NEW YORK, January 15, 21 – Global Finance magazine has announced its fourteenth annual awards for the World’s Best Supply Chain Finance Providers in an exclusive survey to be published in the February 21 print and digital editions and online at GFMagcom The editorial review board of Global Finance selected the best supply chain finance providers based on entries from banks and other. Nevertheless, complications involved in the supply chain activities and automation can pose a threat to the expansion of the sustainable supply chain finance industry during the period from 19. S&P Global Inc called supplychain finance a “sleeping risk” that can “mask episodes of financial stress” A prime concern is that the banks or other lenders may yank the financing from.

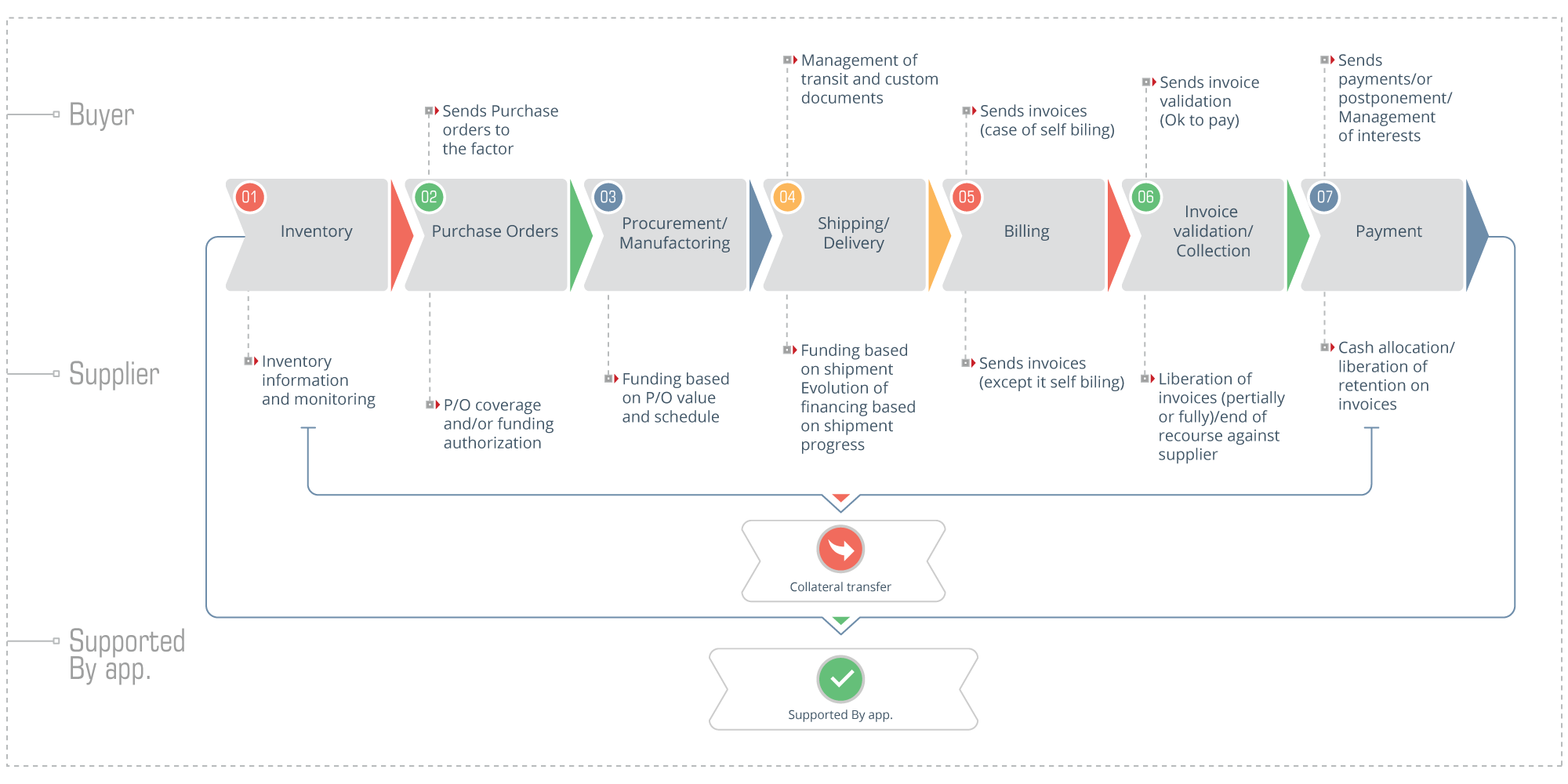

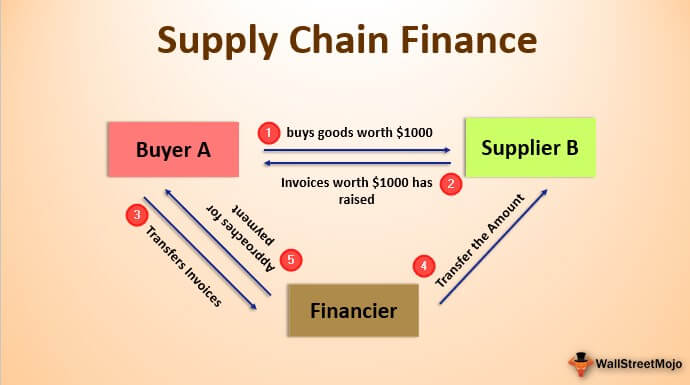

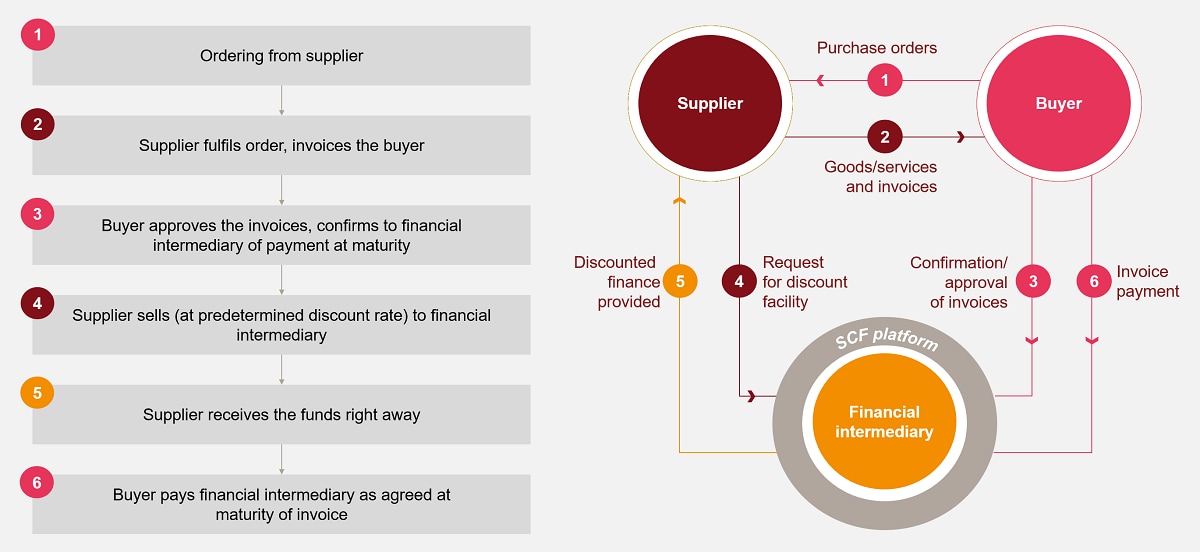

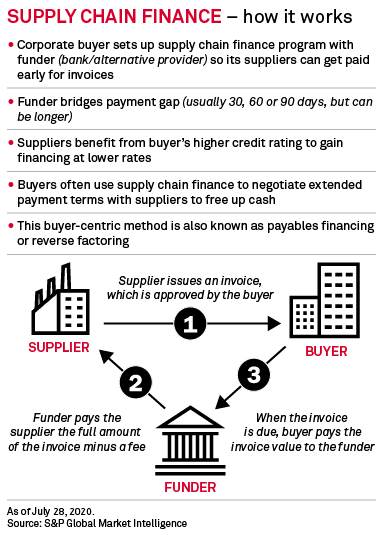

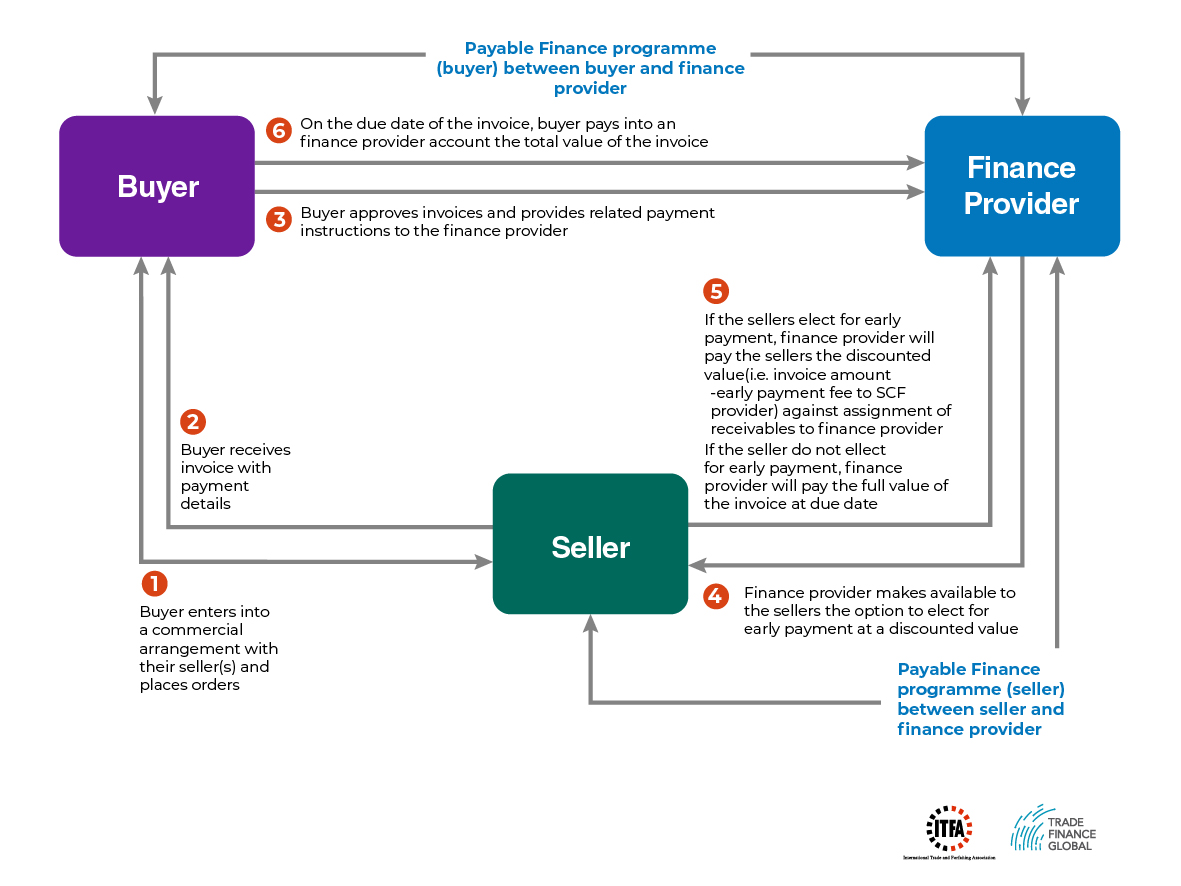

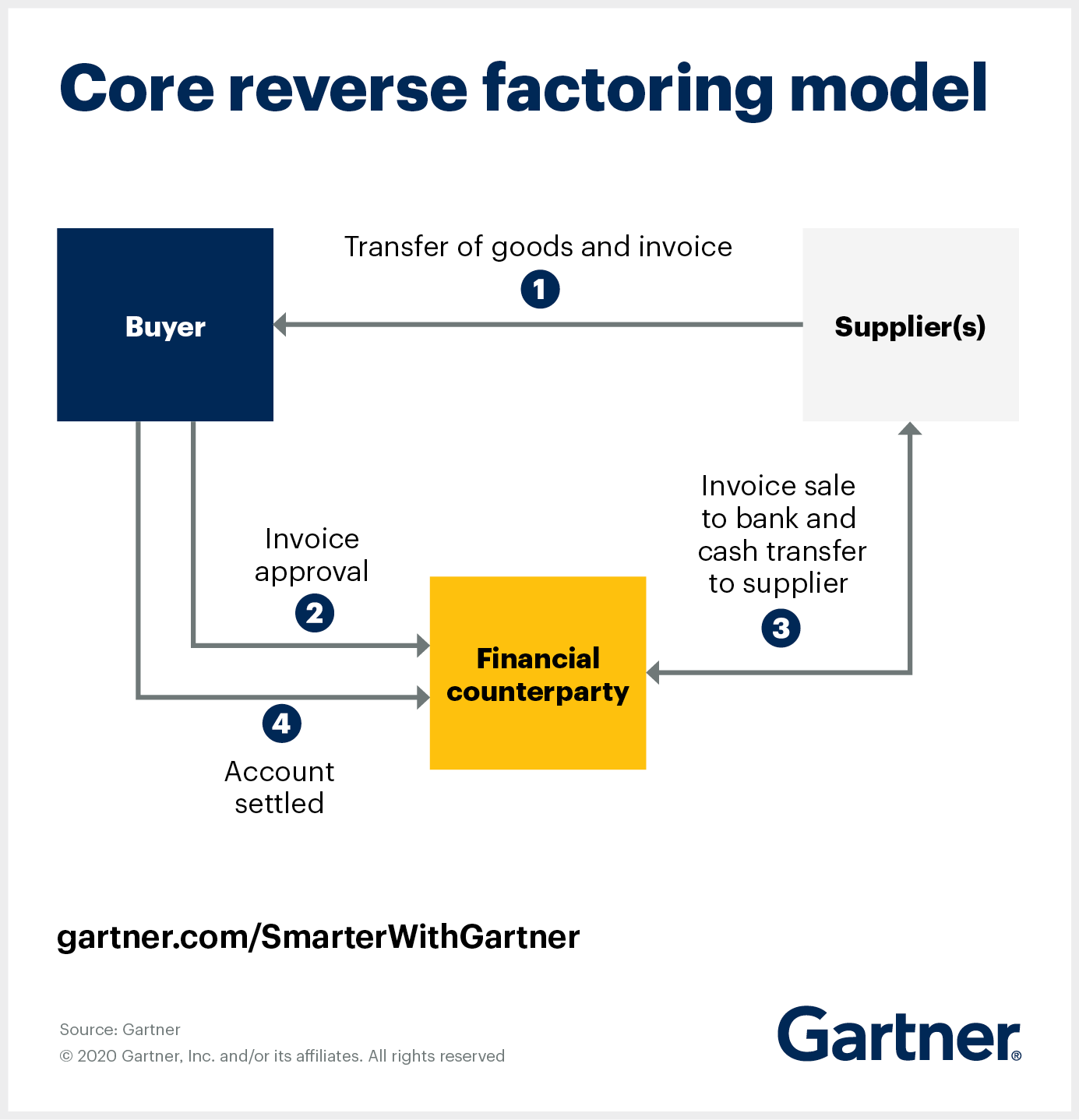

What is supplychain, trade finance In supplychain finance, a bank or other lenders provide liquidity to a large manufacturing corporate, for example, when they place an order with vendors. Supply chain finance helped Coop support suppliers with a scalable, sustainable working capital solution – despite unprecedented disruption. Unlike traditional factoring, where a supplier wants to finance its receivables, supply chain financing (or reverse factoring) is a financing method initiated by the ordering party (the customer) in order to help its suppliers to finance its receivables more easily and at a lower interest rate than what would normally be offeredIn 11, the reverse factoring market was still very small.

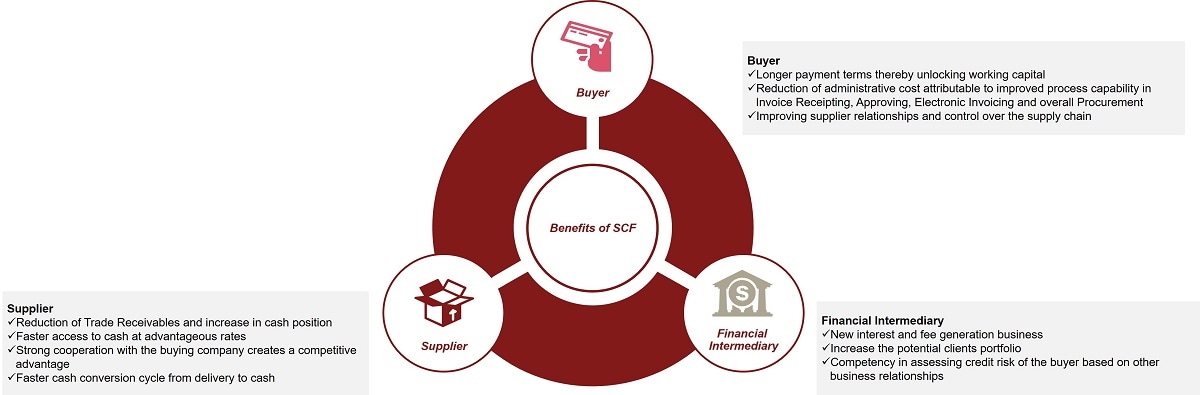

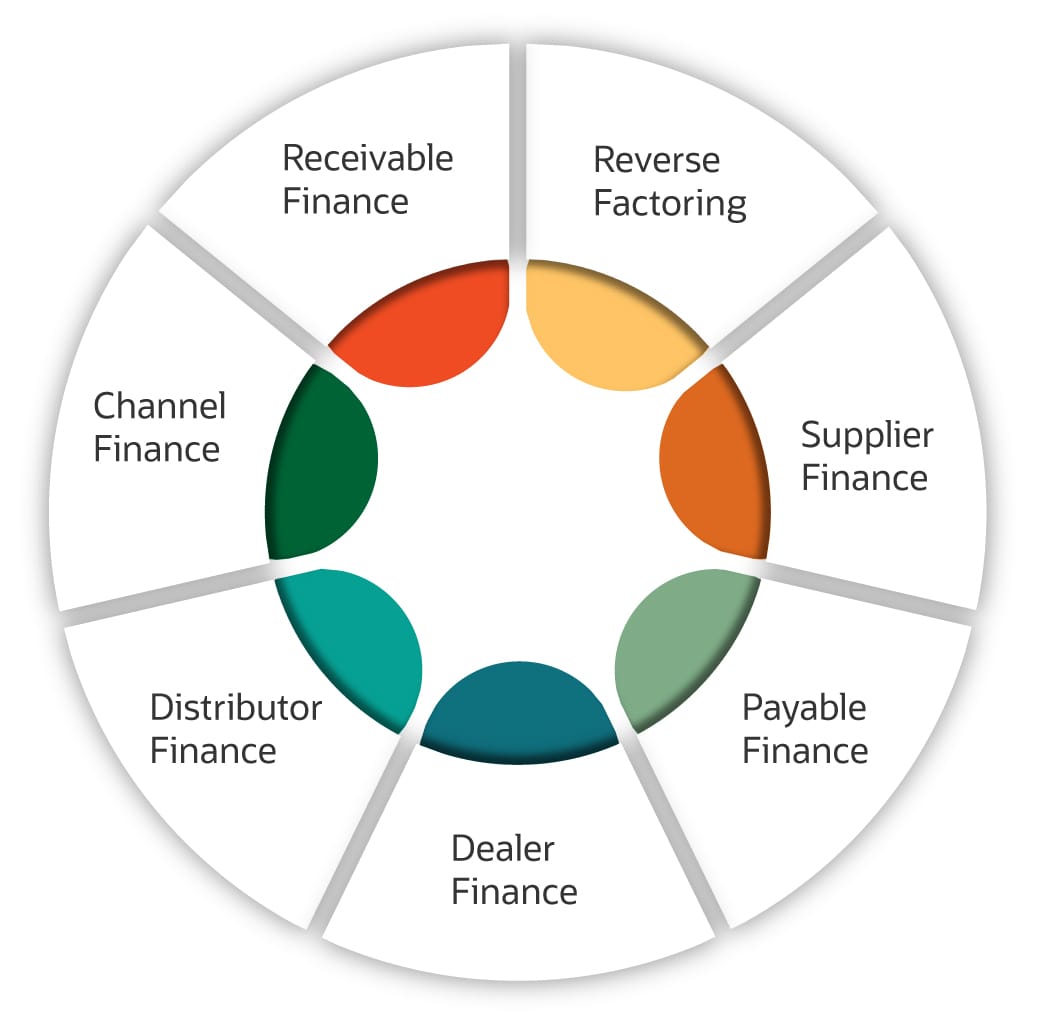

Dynamics 365 for Finance and Operations is now two applications—Dynamics 365 Finance and Dynamics 365 Supply Chain Management—to offer you more flexibility to adopt the capabilities you need, when you need them. Supply Chain Finance (SCF) is a Short Term Working Capital finance to DEALERS/ SUPPLIERS (“Spoke”) having business relationships with LARGE CORPORATE (“Anchor”) to optimise working capital requirements of both Spoke & Anchor Supply Chain Finance is a fine blend of Bill Discounting & Overdraft product with the essence to optimize. Supply chain finance, also known as supplier finance or reverse factoring, is a set of solutions that optimizes cash flow by allowing businesses to lengthen their payment terms to their suppliers while providing the option for their large and SME suppliers to get paid early This results in a winwin situation for the buyer and supplier.

What is supply chain finance?. Supply chain finance helped Coop support suppliers with a scalable, sustainable working capital solution – despite unprecedented disruption. Supply Chain Finance (SCF) is a 40yearold method for achieving both The Global Supply Chain Finance Forum defines SCF as “the use of financing and risk mitigation practices and techniques to (optimize) the management of the working capital and liquidity invested in supply chain processes and transactions”.

Supply Chain Finance UK businesses increasingly look to grow overseas and supply chains are becoming longer and more complex Ensuring your supply chain is sufficiently resilient and flexible is a key business priority You need to be in a position to fully leverage the opportunities presented by new trade relationships and new markets, while. Supply Chain Finance (SCF) can be a solution for companies looking at improving their working capital and cash flow position What is SCF SCF provides efficient financing of the value chain, where both parties (Buyer and Seller) can reduce the working capital and improve cash flow at a reduced cost by utilising the buyer’s credit rating. Supply Chain Finance payment is made by JP Morgan's use of ACH deposits for our US Suppliers and local electronic payment system for our International Suppliers If you select Auto Discount, payment will be sent to you the next business day after JP Morgan receives the Confirmed Receivables file from the Buyer.

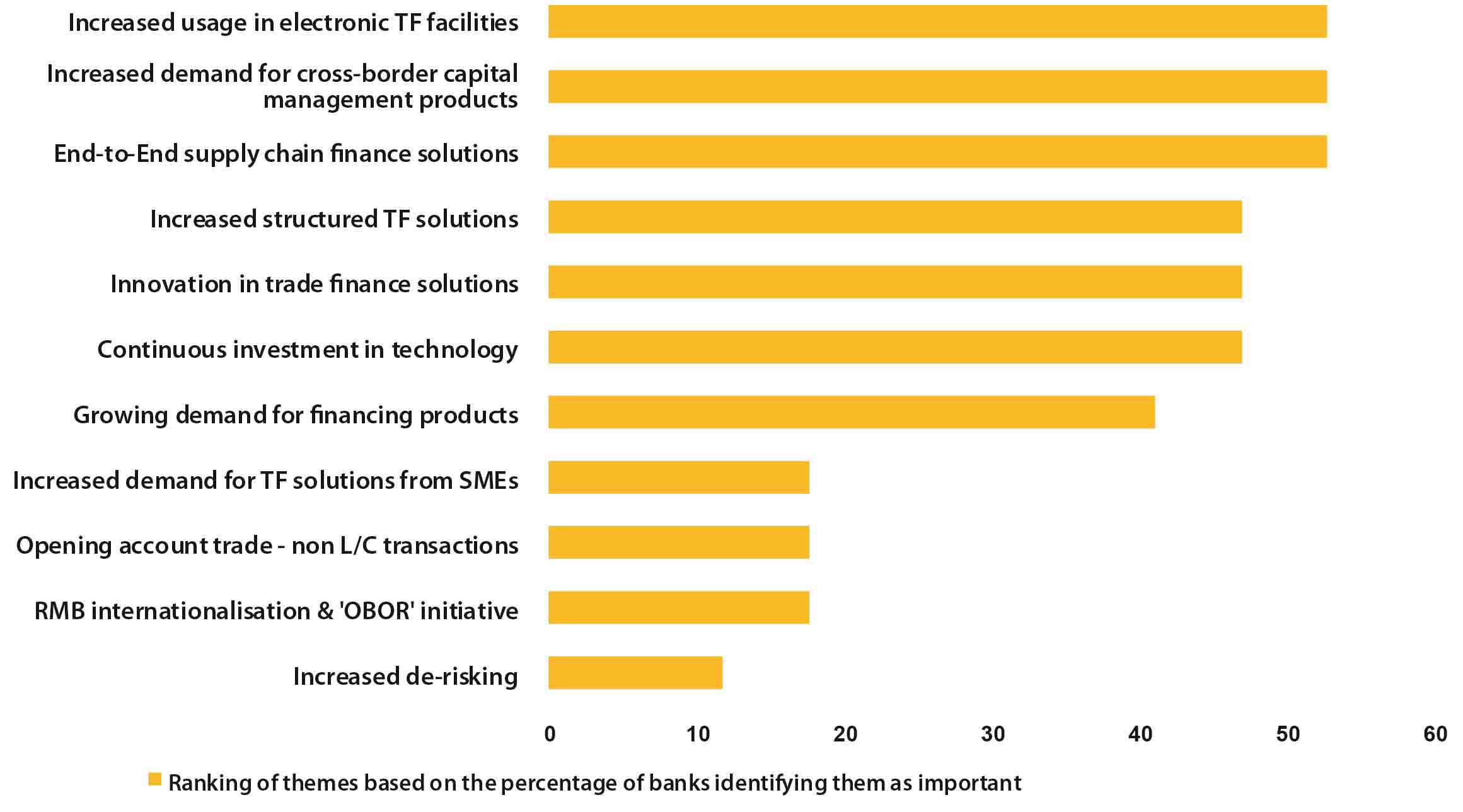

Supply chain finance (SCF) is a large and growing industry In 15, a McKinsey report suggested that SCF had a potential global revenue pool of $ billion, while in 17 China’s supply chain finance sector was tipped to reach US$227 trillion by Additionally, a 17 ICC survey of banks in 98 different countries identified SCF as the most important area for development and strategic. Strengthen Supply Chain The inefficient flow of capital to the supply chain can have negative consequences for the financial health of suppliers Provide a Supply Chain Finance program that allows your suppliers to get paid now if that’s when they need it. The Global Finance editorial team evaluated a host of supply chain finance providers based on several criteria including market share and global coverage, product innovation, customer service.

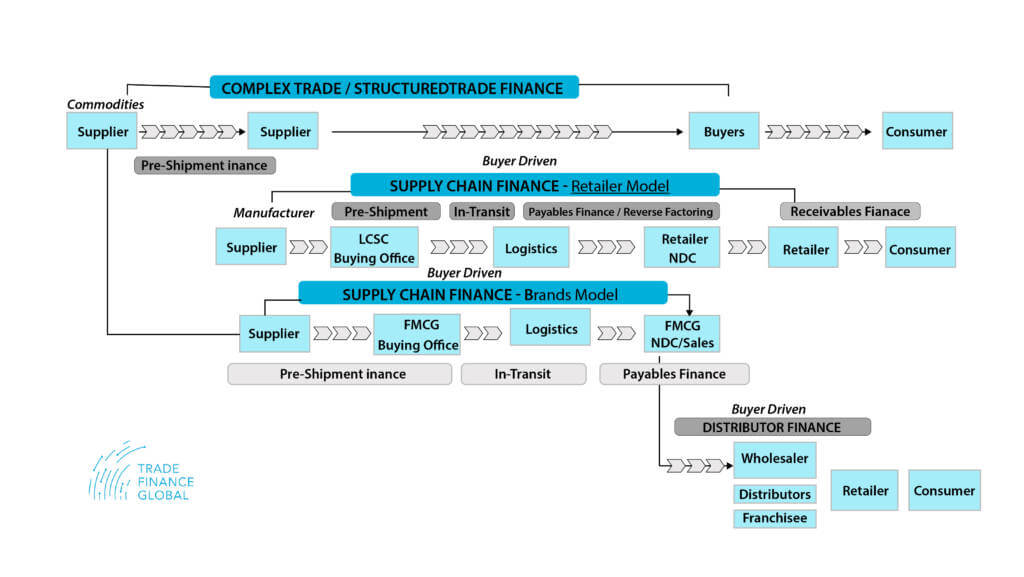

While supply chain finance terminology is a complex issue, supply chain finance is only a subset of trade finance, which also includes letters of credit, collection of bills, bank guarantees, trade loans and trade credit on open account transactions, where the buyer is simply given a period of time to pay for the goods and services supplied. To be considered high performing, global supply chains must be agile, innovative and competitive in spite of these variables – and all that’s fueled by working capital Given these factors, it’s no surprise that finance and procurement professionals are seeking ways to more easily access working capital that is trapped in their supply chains. Supply Chain Finance can be considered as direct descendant from Factoring, and unsurprisingly many people still refer to Supply Chain Finance as ‘Reverse Factoring’ Despite an increase in its popularity over the last ten years, this relatively new financing solution is not as original as you may think.

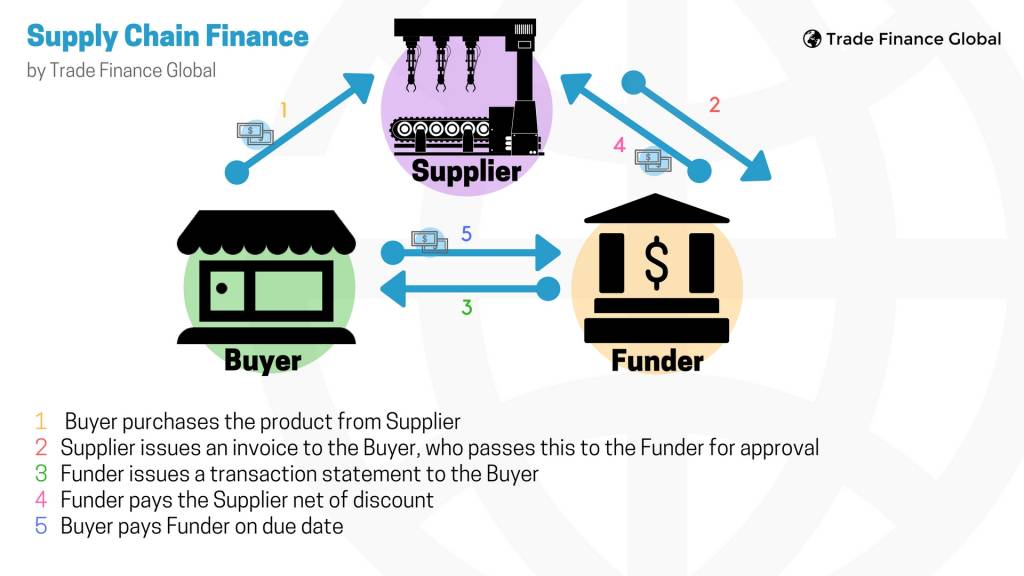

Abu Dhabi The Abu Dhabi Department of Finance (DoF) Sunday announced a Dh6 billion supply chain financing initiative to support a variety of sectors, as a key initiative in its commitment to. NEW YORK, January 15, 21 – Global Finance magazine has announced its fourteenth annual awards for the World’s Best Supply Chain Finance Providers in an exclusive survey to be published in the February 21 print and digital editions and online at GFMagcom The editorial review board of Global Finance selected the best supply chain finance providers based on entries from banks and other. Supply chain finance, also known as reverse factoring, links the seller, the buyer and the financing party to improve business cash flow on all sides How Supply Chain Financing Works In leveraging supply chain finance, suppliers sell outstanding receivables to financial institutions to accelerate payment of receivables and extend payment flexibility to customers.

JP Morgan has named Heather Crowley as its global head of supply chain finance (SCF), a newlycreated role, as the bank sets its sights on expanding its SCF capacity Based in Chicago, Crowley will be responsible for managing and growing the global SCF offering to the JP Morgan client base Crowley originally joined the bank. The Global Finance editorial team evaluated a host of supply chain finance providers based on several criteria including market share and global coverage, product innovation, customer service. While supply chain finance terminology is a complex issue, supply chain finance is only a subset of trade finance, which also includes letters of credit, collection of bills, bank guarantees, trade loans and trade credit on open account transactions, where the buyer is simply given a period of time to pay for the goods and services supplied.

Supply chain finance helped Coop support suppliers with a scalable, sustainable working capital solution – despite unprecedented disruption. Nevertheless, complications involved in the supply chain activities and automation can pose a threat to the expansion of the sustainable supply chain finance industry during the period from 19. Supply Chain Finance (SCF) is a 40yearold method for achieving both The Global Supply Chain Finance Forum defines SCF as “the use of financing and risk mitigation practices and techniques to (optimize) the management of the working capital and liquidity invested in supply chain processes and transactions”.

JP Morgan has named Heather Crowley as its global head of supply chain finance (SCF), a newlycreated role, as the bank sets its sights on expanding its SCF capacity Based in Chicago, Crowley will be responsible for managing and growing the global SCF offering to the JP Morgan client base Crowley originally joined the bank. NEW YORK, January 15, 21 – Global Finance magazine has announced its fourteenth annual awards for the World’s Best Supply Chain Finance Providers in an exclusive survey to be published in the February 21 print and digital editions and online at GFMagcom The editorial review board of Global Finance selected the best supply chain finance providers based on entries from banks and other. Nevertheless, complications involved in the supply chain activities and automation can pose a threat to the expansion of the sustainable supply chain finance industry during the period from 19.

Building on what we have termed as traditional trade finance, there are a number of ways in which banks can help corporate clients trade (both domestically and crossborder) for a fee A typical service offering from a bank will include. Supply chain finance, also known as reverse factoring, links the seller, the buyer and the financing party to improve business cash flow on all sides How Supply Chain Financing Works In leveraging supply chain finance, suppliers sell outstanding receivables to financial institutions to accelerate payment of receivables and extend payment flexibility to customers. Supply chain financing is a general term used to describe a number of financial tools that can be used to improve payments between companies and their suppliers Supply chain finance solutions can be implemented in various ways For example, a supplier that is anticipating large orders and wants to build inventory can use “supplier financing”.

Supply chain finance helped Coop support suppliers with a scalable, sustainable working capital solution – despite unprecedented disruption. Supply chain finance is great for large corporations or SME suppliers/ buyers Whether you’re looking to import automotives and vehicles or retail stock such as clothing, supply chain finance is an innovative solution which the UK government fully supports and encourages. S&P Global Inc called supplychain finance a “sleeping risk” that can “mask episodes of financial stress” A prime concern is that the banks or other lenders may yank the financing from.

Supply chain finance on the other hand looks down the supply chain to the suppliers Whilst some providers of supply chain finance try to dress it up as something else, supply chain finance is a form of working capital finance and provides liquidity in a similar way to an overdraft The main difference being that funds are only used to pay. Supply Chain Finance Our product offering Many corporations are looking for innovations to strengthen relationships with core suppliers or improve the economics of their supply chains Our flexible Supply Chain Finance product range provides both suppliers and buyers with financing opportunities during distinct phases of the financial supply. With the help of powerful advances in technology, business leaders are unifying supply chain and finance teams across everything from daily operations to longterm strategic planning.

Abu Dhabi The Abu Dhabi Department of Finance (DoF) Sunday announced a Dh6 billion supply chain financing initiative to support a variety of sectors, as a key initiative in its commitment to. Supply chain finance, also known as reverse factoring, links the seller, the buyer and the financing party to improve business cash flow on all sides How Supply Chain Financing Works In leveraging supply chain finance, suppliers sell outstanding receivables to financial institutions to accelerate payment of receivables and extend payment flexibility to customers. Another increasingly fashionable technique is a more complicated service known as reverse factoring or supplychain finance This allows a company’s suppliers to get paid what they’re owed.

The Siemens North America Supply Chain Finance program is available to suppliers providing goods and/or services to Siemens with a minimum annual value of $50,000 To learn more about the program details, contact the SCF team or browse the educational material on this page which covers many different aspects of the SCF Program. JP Morgan has named Heather Crowley as its global head of supply chain finance (SCF), a newlycreated role, as the bank sets its sights on expanding its SCF capacity Based in Chicago, Crowley will be responsible for managing and growing the global SCF offering to the JP Morgan client base Crowley originally joined the bank. Nevertheless, complications involved in the supply chain activities and automation can pose a threat to the expansion of the sustainable supply chain finance industry during the period from 19.

NEW YORK, January 15, 21 – Global Finance magazine has announced its fourteenth annual awards for the World’s Best Supply Chain Finance Providers in an exclusive survey to be published in the February 21 print and digital editions and online at GFMagcom The editorial review board of Global Finance selected the best supply chain finance providers based on entries from banks and other. Nevertheless, complications involved in the supply chain activities and automation can pose a threat to the expansion of the sustainable supply chain finance industry during the period from 19. Strengthen Supply Chain The inefficient flow of capital to the supply chain can have negative consequences for the financial health of suppliers Provide a Supply Chain Finance program that allows your suppliers to get paid now if that’s when they need it.

The spread of digital tools for business and finance, and the increasing availability of data on both business and financial interaction, is a boon to the development and deployment of supply chain finance Digitized supply chain interactions are providing useful and valuable information to design new products and manage financial risk more. Supply chain finance is entering a new decade of maturity While buyercentric programs still dominate, focus is increasing on the need to finance the lower tiers of suppliers, those that are not the largest or most strategic companies in global supply chains. Search Supply chain finance manager jobs Get the right Supply chain finance manager job with company ratings & salaries 692 open jobs for Supply chain finance manager.

The benefits of Taulia’s Supply Chain Finance solution will help you to thrive What is Supply Chain Finance?. The Supply Chain Finance @ Siemens Program helps to improve the cash flow of selected Siemens suppliers and optimizes their working capital The cooperation between Siemens and its suppliers will become even more efficient with the utilization of the SCF Program. Buyerled supply chain finance transactions In a buyerled supply chain finance transaction, a buyer establishes a program with one of more of its relationship banks and invites its suppliers to join that program and sell receivables payable by the buyer to those banks.

Abu Dhabi The Abu Dhabi Department of Finance (DoF) Sunday announced a Dh6 billion supply chain financing initiative to support a variety of sectors, as a key initiative in its commitment to. The functions in a supply chain include product development, marketing, operations, distribution, finance, and customer service Supply chain management results in lower costs and a faster. The Global Finance editorial team evaluated a host of supply chain finance providers based on several criteria including market share and global coverage, product innovation, customer service.

Supply chain finance is entering a new decade of maturity While buyercentric programs still dominate, focus is increasing on the need to finance the lower tiers of suppliers, those that are not the largest or most strategic companies in global supply chains. Supply chain finance is a set of techbased business and financing processes that lower costs and improve efficiency for the parties involved in a transaction. Taulia’s Supply Chain Finance, also known as Reverse Factoring, is a type of supplier finance that provides funding in a way that benefits everyoneA thirdparty funder pays your suppliers early, giving them critical liquidity.

Supply chain finance is a set of technologyenabled business and financial processes that provides flexible payment options for a buyer (such as a manufacturer or retailer) and one of their suppliers (for example, a raw materials or inventory supplier), typically through the services of a financial institution at lower financing costs.

A Fresh Approach To Supply Chain Finance Txf News

Q Tbn And9gcrhsj9hjdsy5xlfml6d6nckbls48lo4yfcue3gkcu Cfe Tx0nl Usqp Cau

Supply Chain Finance An Introductory Guide Icc Academy

Supply Chain Finance のギャラリー

Hsbc And Walmart Join Forces On Sustainable Supply Chain Finance Programme Finance

Supply Chain Financing Ppt Powerpoint Presentation Infographics Graphics Template Cpb Powerpoint Slide Templates Download Ppt Background Template Presentation Slides Images

Working Capital Management Solutions Supply Chain Finance

Supply Chain Finance

Supply Chain Finance Sumitomo Mitsui Banking Corporation

Supply Chain Finance Integrating Operations And Finance In Global Supply Chains Lima Zhao Springer

End To End And Innovative Supply Chain Finance Dominates Priority The Asian Banker

Why Supply Chain Finance Still Keeps Bankers Up At Night Aite Group

Supply Chain Finance Banking Oracle

Supply Chain Finance Process Flow 3 1 1 Supply Chain Finance Download Scientific Diagram

1

System For Reverse Factoring Supply Chain Finance Software

Q Tbn And9gcqpjmt36s4inbopypvwskmwxgeot5uu9bi4f5dsejg Usqp Cau

Supply Chain Finance

17 Global Supply Chain Finance Download Scientific Diagram

The Supply Chain Finance Opportunity Accion

Supply Chain Finance Supply Chain Finance Scf Is A Mode Of By Sparkup Medium

A Beginners Guide To Supply Chain Finance Qstock Inventory

Resources Archives C2fo

Supply Chain Finance Definition Example How It Works

Emerging Fintech Trends In Supply Chain Finance

Supply Chain Finance Opportunities For Banks

Supply Chain Finance Solutions Ppt Powerpoint Presentation Infographic Template Vector Cpb Templates Powerpoint Presentation Slides Template Ppt Slides Presentation Graphics

Supply Chain Finance A New Kind Of Financing To Benefit Emerging Market Small And Medium Enterprises And Banks Alike By Ifc Medium

Supply Chain Finance Platforms Manual Build Or Buy

Supply Chain Finance

Growing Supply Chain Focus Prompts Interest In Nascent Form Of Esg Finance S P Global Market Intelligence

Report Logistics Service Providers Are Shaping The Future Of Supply Chain Finance Logistics And Fintech

Supply Chain Finance Wells Fargo Capital Finance

New Opportunities For Corporate Treasury To Exploit In Supply Chain Finance Ctmfile

Supply Chain Finance Meets Trade Finance Primadollar

Supply Chain Financing Dbs Corporate Banking Indonesia

Sibos 13 Supply Chain Finance The New Normal Global Finance Magazine

Predicting The Rise Of Sustainable Supply Chain Finance

Supply Chain Finance 21 Guide Trade Finance Global

What Is Supply Chain Finance Fscf Capital

Supply Chain Finance An Introductory Guide Icc Academy

Mufg Supply Chain Finance Corporate And Investment Banking Products And Services Mufg Bank

Supply Chain Finance On Blockchain Debuts In India Ibm Research Blog

How Is Blockchain Changing The Supply Chain Finance By Sofocle Sofocle Technologies Medium

Win Win Win The Sustainable Supply Chain Finance Opportunity Reports Bsr

Transper Case Studies

Masterclass Supply Chain Finance The Association Of Corporate Treasurers

Infographic The History Of Supply Chain Finance Marco Polo

Supply Chain Finance

Supply Chain Finance Siemens Energy Collaborating With Siemens Energy Siemens Energy Global

Supply Chain Finance Icon Ppt Example File Powerpoint Presentation Templates Ppt Template Themes Powerpoint Presentation Portfolio

Ibm Blockchain Platform For Supply Chain Financing Digital Transformation

How Supply Chain Finance Works Visual Ly

Blockchain Technology And Its Potentials To Accelerate Supply Chain Finance Scf By Ojoh Ifeanyi Data Driven Investor Medium

How Fintech Transforms Supply Chain Finance By Medici Medium

Supply Chain Finance An Introductory Guide Icc Academy

Supply Chain Finance And Blockchain The Future Ahead By Sofocle Sofocle Technologies Medium

Korean Startup Fin2b Provides Innovative Supply Chain Financing Solutions For Smes Koreatechdesk

Win Win Win The Sustainable Supply Chain Finance Opportunity Reports Bsr

Asset Servicing Times Feature Article Transformative Thinking In Trade And Supply Chain Finance

Supply Chain Finance Invoiceinterchange

Supply Chain Finance Working Capital Dbs Sme Banking

Overview Trade And Supply Chain Finance Program Asian Development Bank

Simon Kleine Uk And Europe Supply Chain Finance Overview East Partners

Supply Chain Finance Opportunities For Banks

Masterclass Supply Chain Finance The Association Of Corporate Treasurers

Supply Chain Finance

Chainlink Research Research Supply Chain Finance Networked Platforms Financing Servicessupply Chain Platform Series Part 2c

What Is Supply Chain Financing A Practical Guide

Could Blockchain In Supply Chain Financing Improve Your Business Neurochain

Hsbc And Walmart Join Forces On Sustainable Supply Chain Finance Programme

How Banks Fintechs And Corporations Can Expand Supply Chain Finance Accion

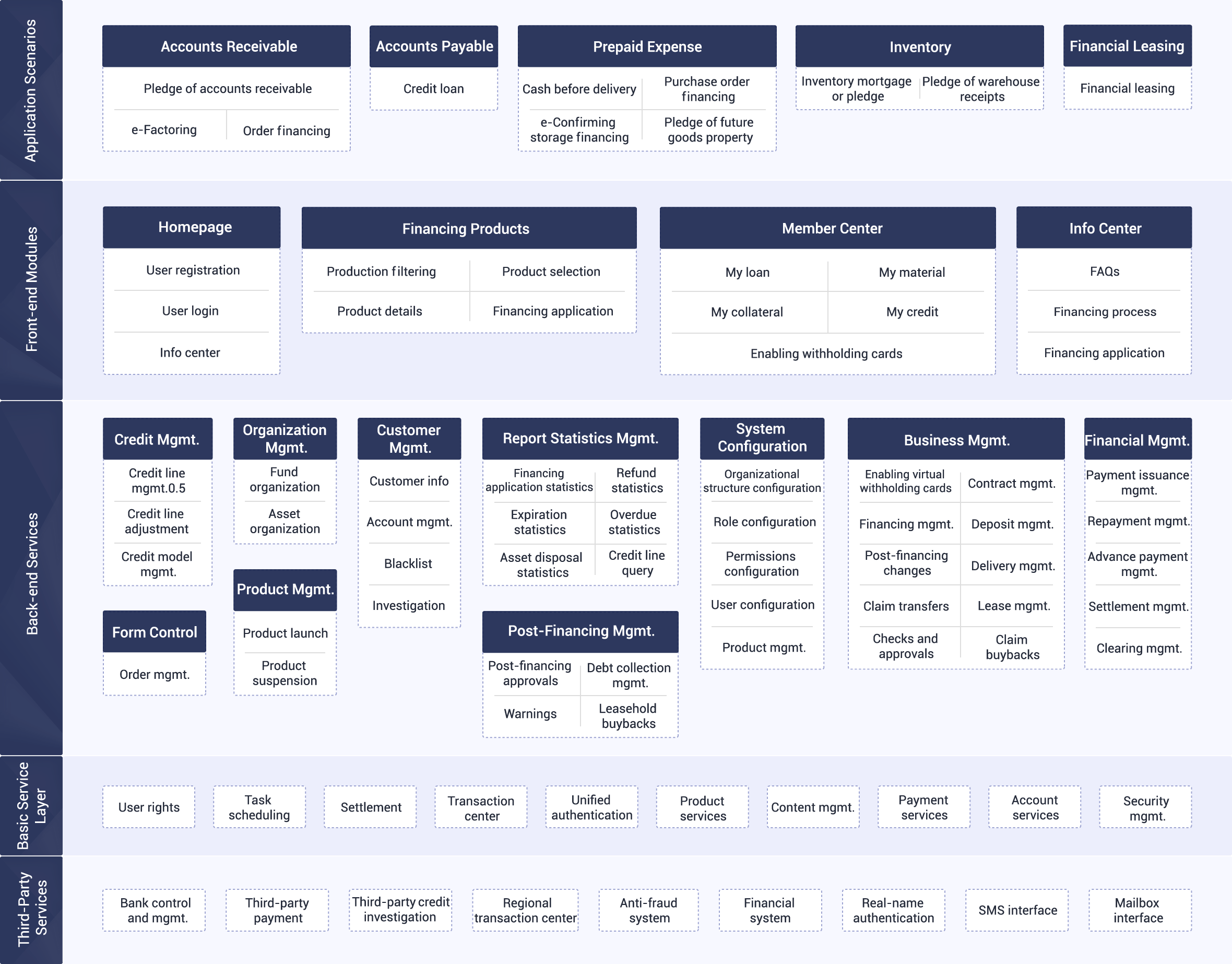

Supply Chain Finance Huawei Cloud

What Is Supply Chain Finance Fsw Trade Finance

Supply Chain Finance An Introductory Guide Icc Academy

Leverage And Cash Flow Effects Of Supply Chain Finance The Footnotes Analyst

Supply Chain Finance In Europe Aite Group

Supply Chain Financing Alternative Finance With Nalinee

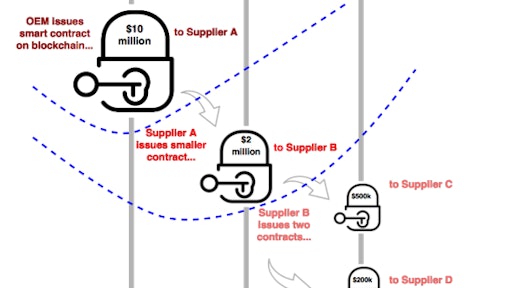

Debt Note A Blockchain Solution To Supply Chain Finance By Fuzamei Medium

How Is Blockchain Changing The Supply Chain Finance By Sofocle Sofocle Technologies Medium

Supply Chain Financing Flavour Of The Year Celent

Supply Chain Finance With An Eye On Size Pymnts Com

A Sample Of The Supply Chain Finance Source Seifert R And Seifert Download Scientific Diagram

European Supply Chain Finance Fintech Companies Aite Group

Supply Chain Finance On The Blockchain Enables Network Collaboration Supply And Demand Chain Executive

Trade Financial Supply Chain Management 19 Trade Finance Global Treasury Management Hub

Benefits And Risks Of Supply Chain Finance For Cfos

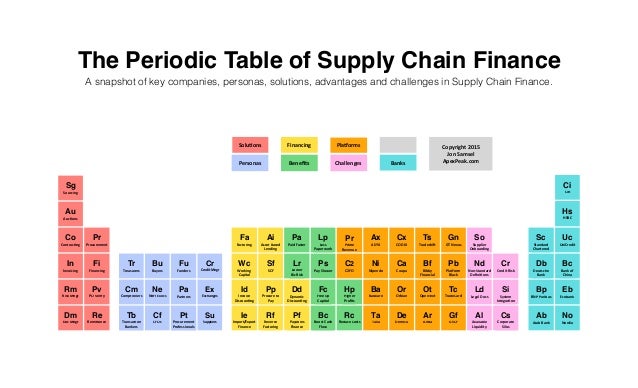

The Periodic Table Of Supply Chain Finance

Supply Chain Finance Grows Amid Pandemic But Faces Stark Risk Warnings S P Global Market Intelligence

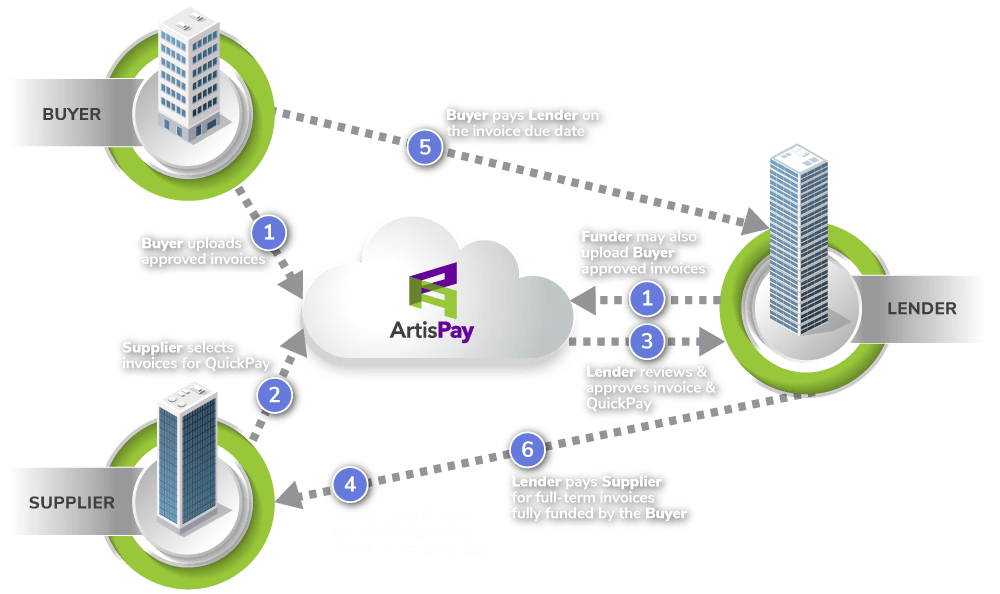

What Is Supply Chain Financing Scf Artis Trade Systems

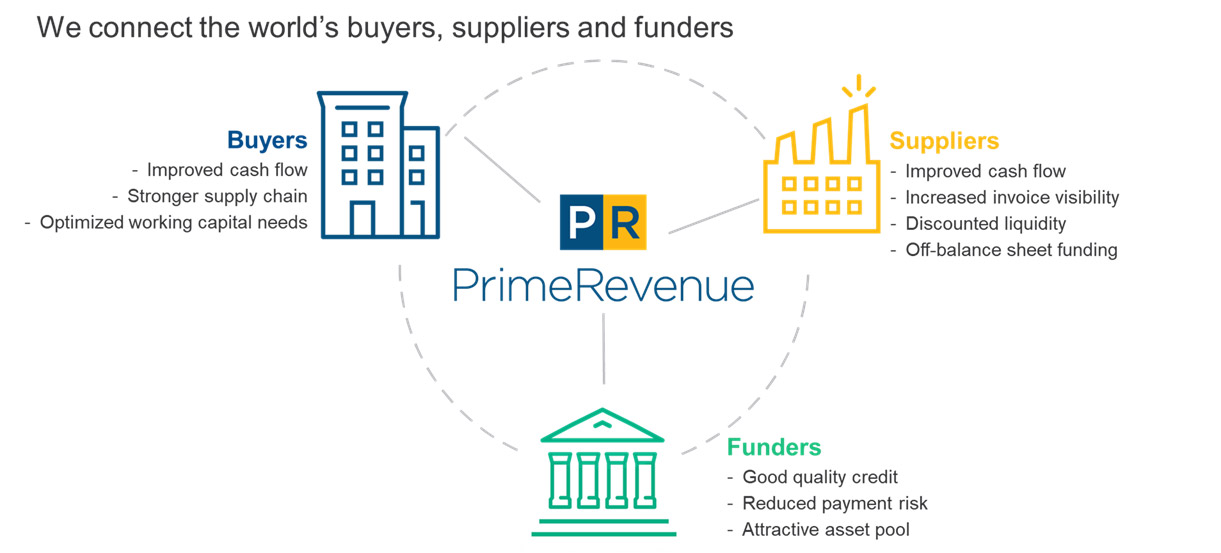

What Is Supply Chain Finance Primerevenue

E Supply Chain Finance Home Icbc China

Q Tbn And9gctyfaztiifso2l3 3pfitrqkd0gzikzvllqjy5bavkfubiuls4z Usqp Cau

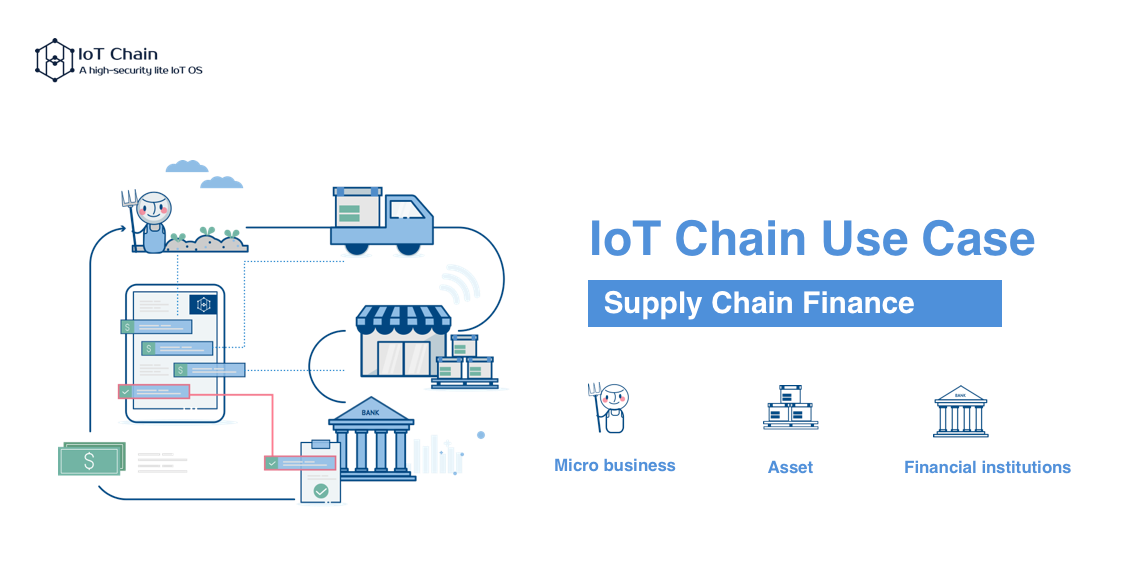

Iot Chain Use Cases Supply Chain Finance By Iot Chain Iot Chain Medium

Interview With Soul Htite Of Dianrong To Understand The Intersection Of Supply Chain Finance And Blockchain Daily Fintech

What Is Supply Chain Finance Primerevenue

Supply Chain Finance Siemens Collaborating With Siemens Siemens Global

What Is Supply Chain Finance Trade Finance

A Lifeline For Business Supply Chain Finance In The Spotlight The Global Treasurer

Tft Takeover Supply Chain Finance Programmes In Asia The Digital Transformation S1e

What Is Supply Chain Finance Kyriba

What Is Supply Chain Financing A Practical Guide

Xxrmwb0p1tfovm

Supply Chain Finance Europe Barometer Screwing Suppliers Dominates Why Introduce Ctmfile

What Is Supply Chain Financing A Practical Guide