Family Trust

A family trust can be either a living trust or a testamentary trust, depending upon the grantor’s objectives A living family trust might involve a married couple serving as cotrustees of a trust that holds title to their home until both have passed on, at which point a successor trustee transfers title to their children outside of probate.

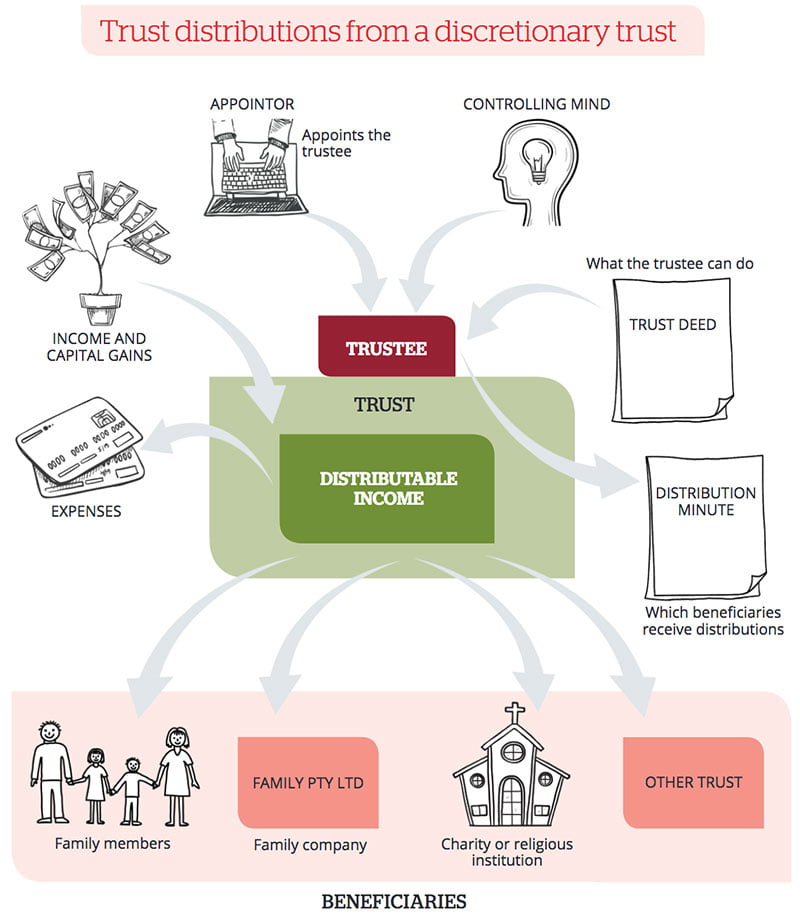

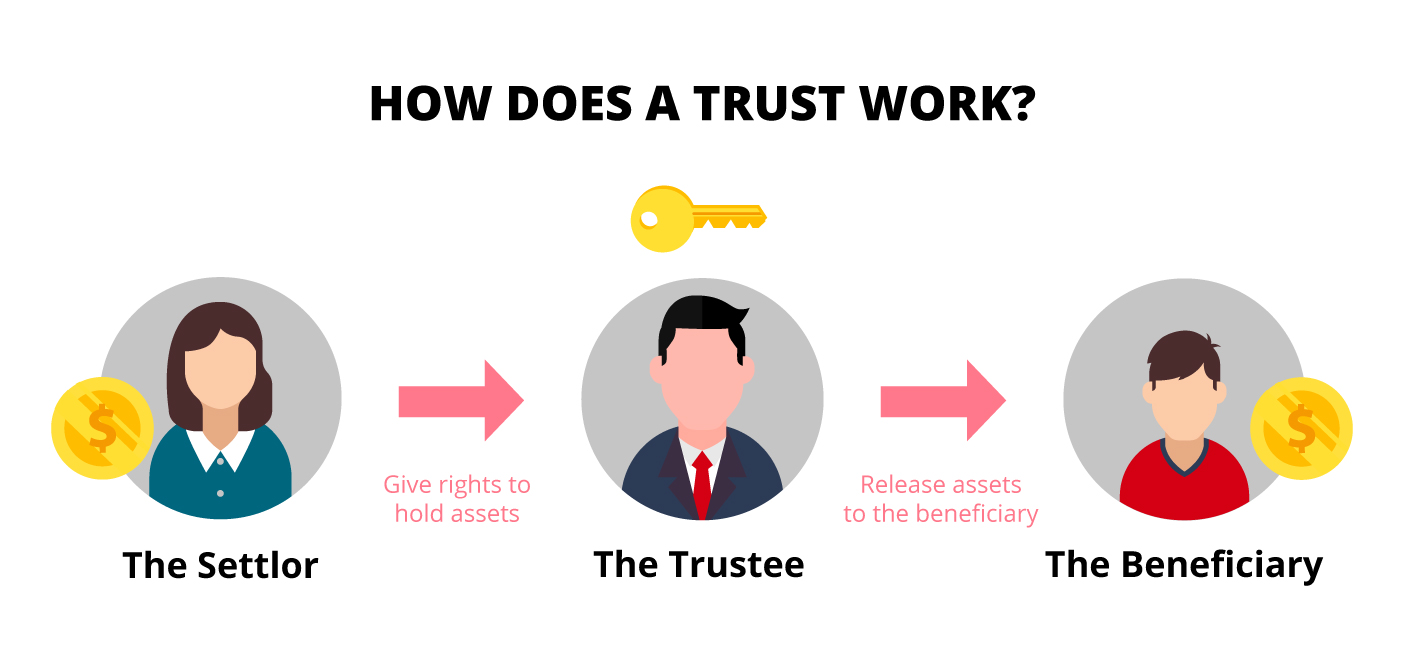

Family trust. A trust can be used to manage estate taxes, shelter assets from creditors and pass on wealth to future generationsA family trust is a specific type of trust families can use to create a financial legacy for years to come There are several benefits to creating one, though not every family necessarily needs one. A family trust is a legal document that gives a trustee, often a family member, the legal authority to make decisions about the distribution of income, property or other assets to identified family members Often, a family member establishes a family trust to protect assets, create tax advantages and avoid probate. A living trust is one way to plan for passing on your estate—property, investments and other assets—to your family or other beneficiaries It’s a legal agreement people often use to plan ahead for the possibility of becoming mentally incapacitated or so that the burdensome probate process can be avoided when they die.

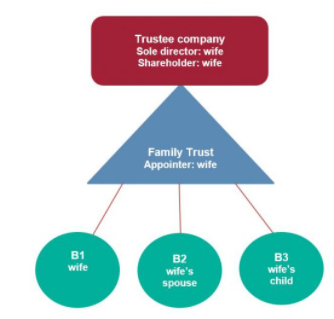

A trust agreement is a document that spells out the rules that you want followed for property held in trust for your beneficiaries Common objectives for trusts are to reduce the estate tax liability, to protect property in your estate, and to avoid probate Think of a trust as a special place in which ordinary. A family trust is a trust established specifically for the benefit of members of a particular family The purpose of creating a family trust is to protect and manage family assets for current and / or future generations. A family trust is a legal document that gives a trustee, often a family member, the legal authority to make decisions about the distribution of income, property or other assets to identified family members Often, a family member establishes a family trust to protect assets, create tax advantages and avoid probate.

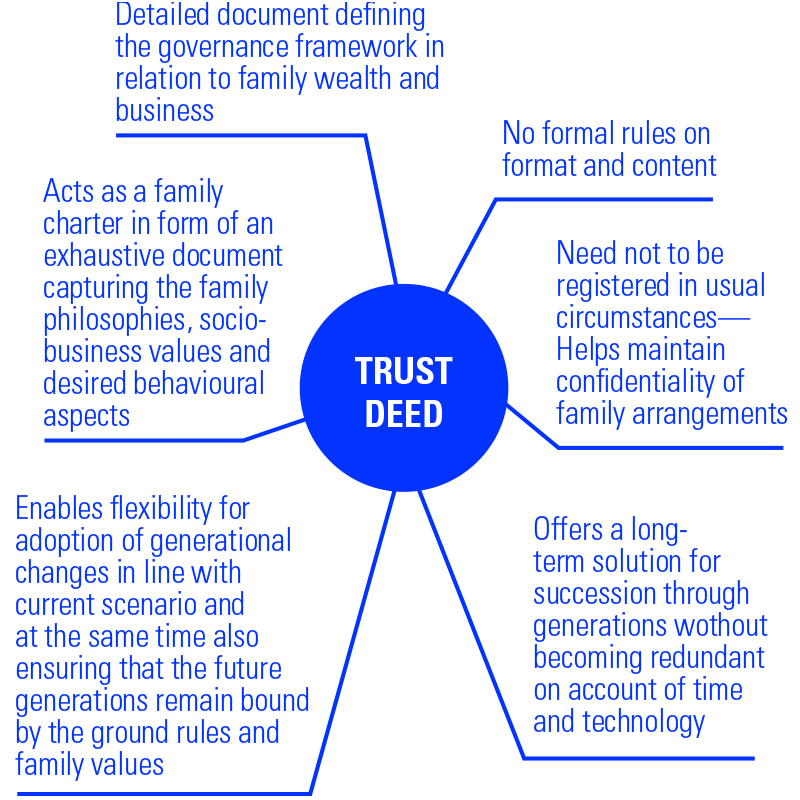

A trust is a legal entity that you can put your money and assets into so that you can then pass it on to one or multiple beneficiaries, typically after your death A family trust is any type of trust that you use to pass on assets to one or multiple family members Anytime you talk about trusts, there are a few terms to make sure you understand. A Family Trust Deed provides the flexibility, control and protection that you need, to give significant gifts in your lifetime with complete peace of mind The deed of family trust lays down the terms and conditions of the trust and provides for the mechanism for the functioning of the same. Confidentiality – Family trusts are not publicly registered and therefore can be kept confidential Disadvantages of Family Trusts The following are a number of the disadvantages of having a family trust Loss of Ownership of Assets – If you transfer your personal assets to a trust, then the trustees of that trust will control the assets.

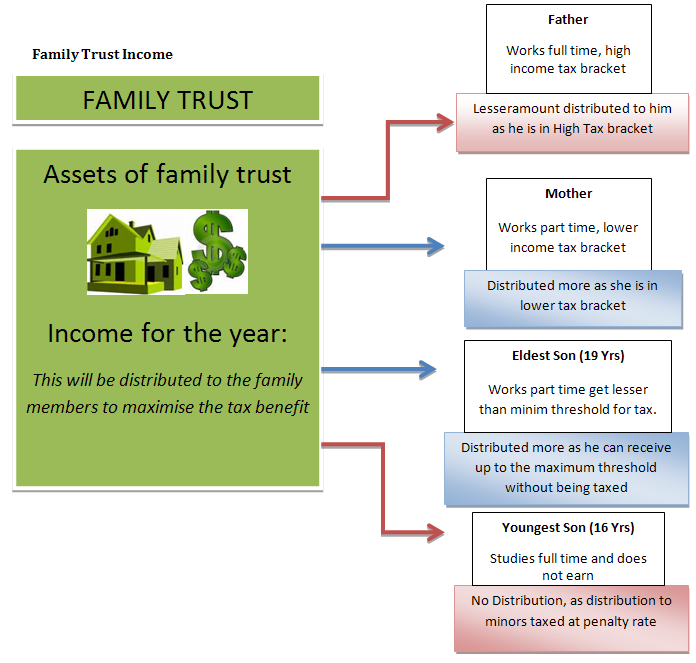

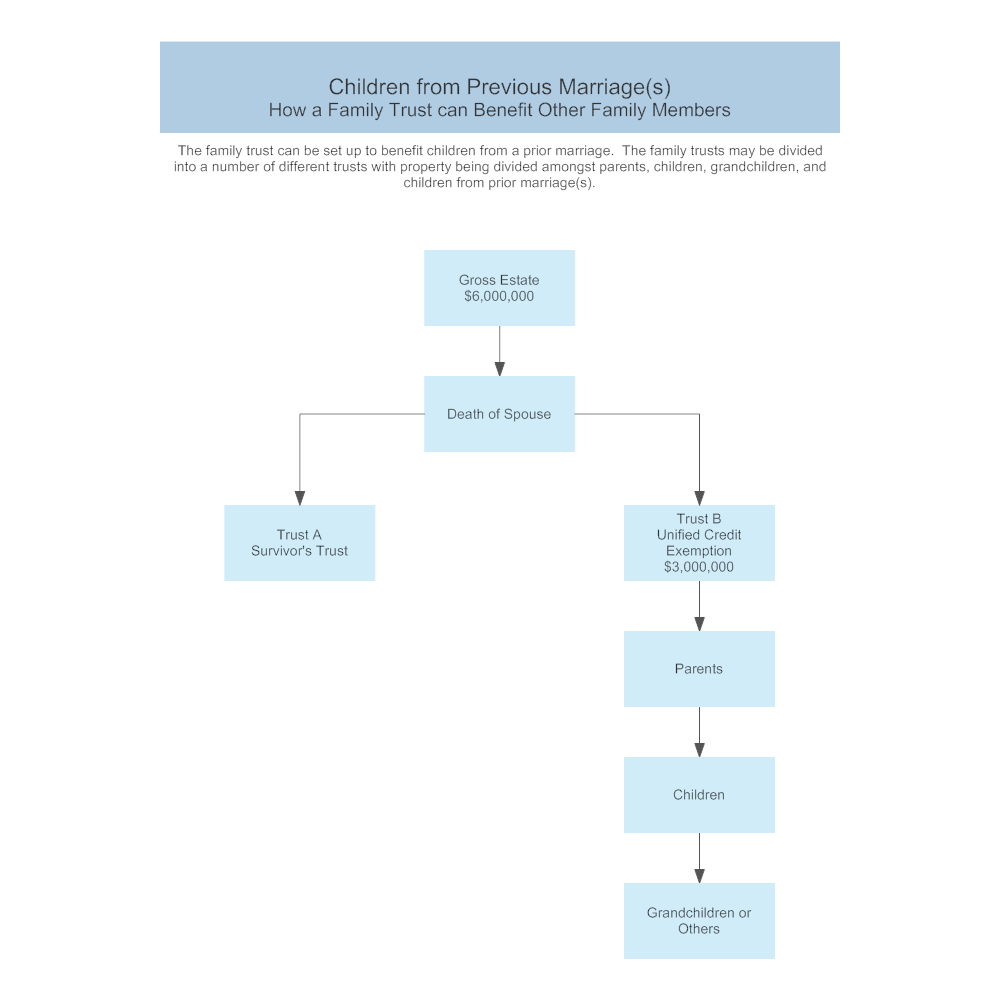

Where family trusts are utilized, and amounts are payable to children The amounts must be used for the benefit of the children Any amounts paid to the children will reduce the amount owing to them The amounts received by the children from the family trust could be used to pay certain expenses, which would otherwise have been paid by the parents. 1 Trust is a separate Legal person hence tax planning tool 2 An individual can control use of his wealth even after death via Trust deed rules for few years when kids or family are yet to be matured enough to manage wealth or business empire. A family trust, also known as a “bypass trust,” is a trust created by a married couple with a large estate for the purpose of avoiding federal estate taxes when the first spouse dies The couple, known together as the “Trustors,” usually place ownership of assets whose value meets, but does not exceed, the federal estate tax exemption.

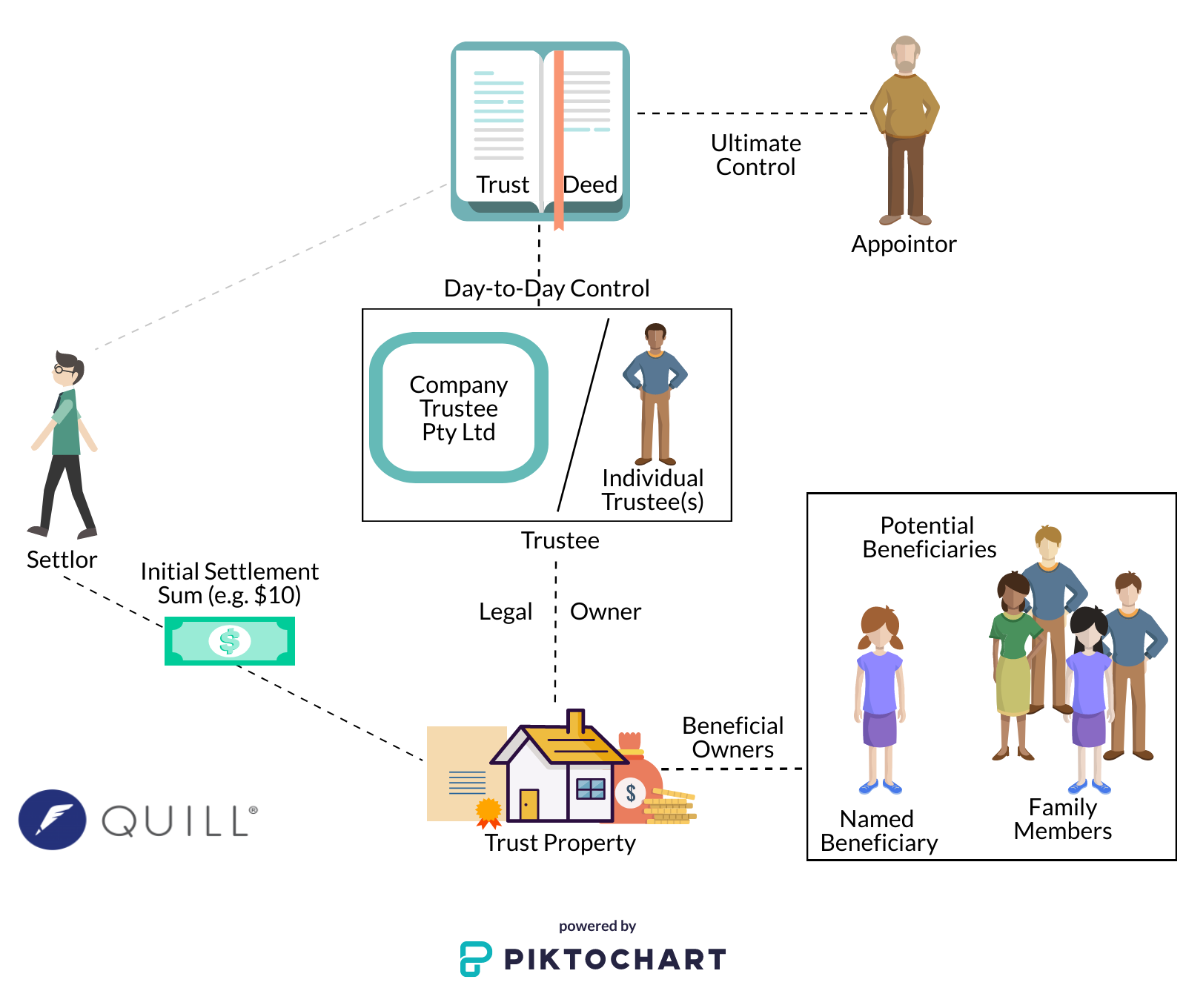

A trust can be used to manage estate taxes, shelter assets from creditors and pass on wealth to future generationsA family trust is a specific type of trust families can use to create a financial legacy for years to come There are several benefits to creating one, though not every family necessarily needs one. How family trusts work A legal document called a ‘trust deed’ will formally set up the family trust It will name the trustees, list the beneficiaries, and state various rules for the administration and management of the trust. A family trust can be either a living trust or a testamentary trust, depending upon the grantor’s objectives A living family trust might involve a married couple serving as cotrustees of a trust that holds title to their home until both have passed on, at which point a successor trustee transfers title to their children outside of probate.

Where family trusts are utilized, and amounts are payable to children The amounts must be used for the benefit of the children Any amounts paid to the children will reduce the amount owing to them The amounts received by the children from the family trust could be used to pay certain expenses, which would otherwise have been paid by the parents. Family foundations are a type of private foundation offering certain tax benefits and flexible giving options, and are generally governed, administered and funded by a family unit See if a private family foundation is the best fit for your family’s philanthropic goals and how it compares with other giving vehicles. Alabama Family Trust is a nonprofit, 501(c) 3, pooled trust company administering special needs trusts for the disabled throughout the United States Disabled individuals, including the elderly entering nursing homes, can place assets from legal settlements, inheritance, gifts, alimony, and other forms of assets with Alabama Family Trust and.

A family trust is a legal device used to avoid probate, avoid or delay taxes, and protect assets Here's an overview of the various types of trusts, what can be accomplished with each, and how they are created Basic Terminology. Alabama Family Trust is a nonprofit, 501(c) 3, pooled trust company administering special needs trusts for the disabled throughout the United States Disabled individuals, including the elderly entering nursing homes, can place assets from legal settlements, inheritance, gifts, alimony, and other forms of assets with Alabama Family Trust and. A family trust is also known as a revocable living trust The family or living trust is a simple yet extremely powerful too One of the most important benefits is that it can help you avoid probate (if set up correctly) But it does much more than just that.

1 Trust is a separate Legal person hence tax planning tool 2 An individual can control use of his wealth even after death via Trust deed rules for few years when kids or family are yet to be matured enough to manage wealth or business empire. A family trust is a way to structure finances that removes them from individual ownership and tax liability It places assets in the care of a third party, who manages the trust on behalf of its. Alabama Family Trust Fulfills a Special Need Alabama Family Trust (Alabama Family Trust Statute) provides for the establishment of a trust that disburses funds to supplement the care, support, and treatment of the designated disabled person or beneficiary in a way that complements any governmental entitlements.

Many families set up trusts to provide for family members in need of financial assistance or to further their own estate planning goals Taxation of trusts can become extremely complicated, and. A revocable family trust is a trust that is set up for the purposes of protecting assets and providing for your family members Trusts can be used to achieve many asset protection and estate planning goals and can be a powerful legal tool for those who want to protect their loved ones and legacy. A trust is a legal document that can be created during a person's lifetime and survive the person's death A trust can also be created by a will and formed after death Common types of trusts are outlined in this article Once assets are put into the trust they belong to the trust itself (such as a bank account), not the trustee (person) They remain subject to the rules and instructions of.

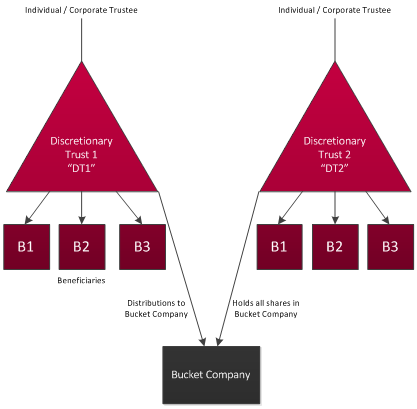

A trust can be an effective way to move taxable income out of the hands of a highincome earner and into the hands of lowertaxed family members Trusts have long been a necessary tool for those. A family trust, also called a trust fund, is a useful estateplanning toolA family trust can be just as beneficial to middleclass America as it is to wealthy people and families In addition to using a family trust to avoid probate, some people use it to provide for the grantor or other family members who are unable to make financial decisions on their own. A family trust, also known as a living trust or revocable living trust, is a legal document that permits the person who prepares it or has it prepared to make changes to it at willThis type of trust covers how a person’s assets are handled before and after death These provisions can include anything from beneficiaries to property and cash allocations.

The Job of a Trustee The responsibilities of a trustee include management of the assets that are identified within a trust A lot of estate holders elect to act as their own trustee This is a perfectly valid option However, if the estate holder should become infirm or die unexpectedly, it is essential to have an estate plan set up in advance. A trust agreement is a document that spells out the rules that you want followed for property held in trust for your beneficiaries Common objectives for trusts are to reduce the estate tax liability, to protect property in your estate, and to avoid probate Think of a trust as a special place in which ordinary. A living trust is one way to plan for passing on your estate—property, investments and other assets—to your family or other beneficiaries It’s a legal agreement people often use to plan ahead for the possibility of becoming mentally incapacitated or so that the burdensome probate process can be avoided when they die.

A family trust is an agreement where a person or a company agrees to hold assets for others’ benefit, usually their family members It is often set up by families to own assets A family trust is also referred to as a “discretionary” trust The word “discretionary” refers to the trustee’s powers or ability to decide which. Many families set up trusts to provide for family members in need of financial assistance or to further their own estate planning goals Taxation of trusts can become extremely complicated, and. Other risks and disadvantages to setting up a family trust can include Tax risks – tax avoidance can be a risky business and a tax accountant should be consulted before you unknowingly get yourself in trouble The name holding the assets – the trustee is the legal owner and this individual’s name will appear across all documentation.

Family Trust FCU is here to help you achieve all of your financial goals, whether you are looking to buy a house or planning for retirement or saving to send your new baby to college We’re also here to make the daily ins and outs of managing your money easier and more convenient. Family trust tax levels depend largely upon the structure of the trust Many trusts are revocable living trusts, and they are taxed at the rate of the trust's owner Some trusts are subject to IRS trust tax rates Understanding how your trust will be taxed helps with longterm financial plans. Creating a family trust is an effective way of managing family assets There are two common types of family trusts revocable and irrevocable living trusts When someone sets up a revocable living trust, they transfer assets into the trust for the purpose of benefiting those to whom the assets ultimately pass, called the beneficiaries.

A Trust is an entity that owns property for the benefit of another, called the beneficiary A family Trust, also called a revocable living Trust, is a Trust created to hold the families assets in order to pass them to family members and avoid probate. A trust is a legal entity set up to manage assets on someone's behalf A living trust is a trust set up while the person is still alive, sometimes with the ability to modify the arrangement A family trust is essentially any trust set up for the benefit of someone's relatives. Since living trusts are revocable, allowing changes or, even, dissolution, at any time, the trust and the grantor enjoy no beneficial tax treatment Creating a trust without a good estate plan.

With Family Trust mobile banking, it’s more convenient than ever to access your Family Trust accounts on your iPhone or iPad The app allows you to transfer money between your Family Trust accounts and other financial institutions, make loan payments, find branches and surchargefree ATMs, and deposit checks. An irrevocable family trust avoids estate taxes by paying the gift taxes on property at the time of deposit into the trust Gift taxes are usually lower than estate taxes Limitations There are some limitations to a family trust When you transfer your ownership of the assets to the trust, you will no longer have control over them. A family trust is used to pass assets on to family members or other beneficiaries and may be set up as part of an estate plan The trust is set up by the settlor – the person who owns the assets The settlor's assets are then transferred to the trust.

A family trust is a common tool in the estateplanning process But while a family trust has many advantages, it's important also to understand the disadvantages What Is a Family Trust A family trust is a legal device set up to benefit family members, most commonly, your spouse and/or your children It is used to avoid probate, delay taxes. Some Family Trust staff are still working remotely, but are available during normal business hours for phone and email questions, consultations and to facilitate trust disbursement requests We encourage you to reach out to your assigned Trust Administrator or to us in general at ext 565 or toll free at. The Family Court has wide powers to decide what can be divided, and generally the court included assets in the discretionary trust to be divided, where a spouse is a trustee, or has the means to.

Family Trust vs Living Trust Quite simply, a “family trust" may refer to any trust created with family members as its beneficiaries A family trust can be set up in two ways Testamentary Trust Set up through a last will and testament, which means it will only come into existence upon the death of the grantor and probating of the will A. Family Trust vs Living Trust Quite simply, a “family trust" may refer to any trust created with family members as its beneficiaries A family trust can be set up in two ways Testamentary Trust Set up through a last will and testament, which means it will only come into existence upon the death of the grantor and probating of the will A. A family trust is also known as a revocable living trust The family or living trust is a simple yet extremely powerful too One of the most important benefits is that it can help you avoid probate (if set up correctly) But it does much more than just that.

A family trust is essentially airtight legally, another potential advantage over a simple will Limitation of exposure to estate taxes, as part of a proper estate planning process Simplicity and Flexibility A family trust is a relatively easy document to prepare and account for, particularly with the help of an estate planning attorney.

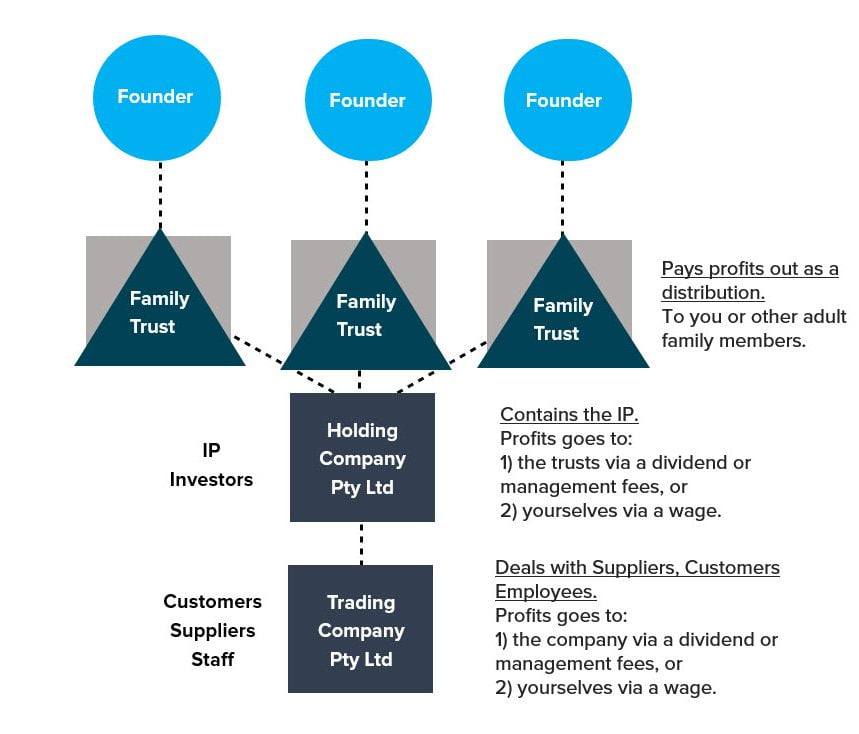

Australian Startup Structures Companies Trusts Corporate Trustees Dissecting All The Options For Founders By Kunal Kalro Medium

Family Trust Ebook By Kathy Wang Rakuten Kobo Singapore

Family Trust Investor Fti Gmbh Overview Competitors And Employees Apollo Io

Family Trust のギャラリー

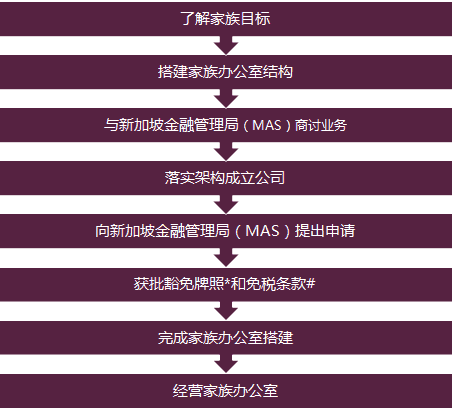

Setting Up Singapore Investment Or Family Trust

Everything You Need To Know About Family Trusts Part 1 Family Law Express Brief

Promoters Finding Family Trusts A Safe Haven To Park Personal Assets The Economic Times

Succession Is The Biggest Challenge Being Faced By Indian Families Campden Fb

Thaluvachira Family Trust Home Facebook

Australian Shelf Companies Your Complete Company Registration And Corporate Compliance Provider

How Does The Recent Ato News Affect Australian Expats With Trusts

Trust Family Quotes Sayings Trust Family Picture Quotes

Discretionary Family Trusts

Family Trust By Kathy Wang

What Is The Fischer Family Trust Fft Answered Twinkl Teaching Wiki

Family Trusts Advantages And Disadvantages Of Having A Trust

Swiss Trust Foss Family Office Advisory

Books Kinokuniya Family Trust Paperback Softback Wang Kathy

.webp)

Home Mysite

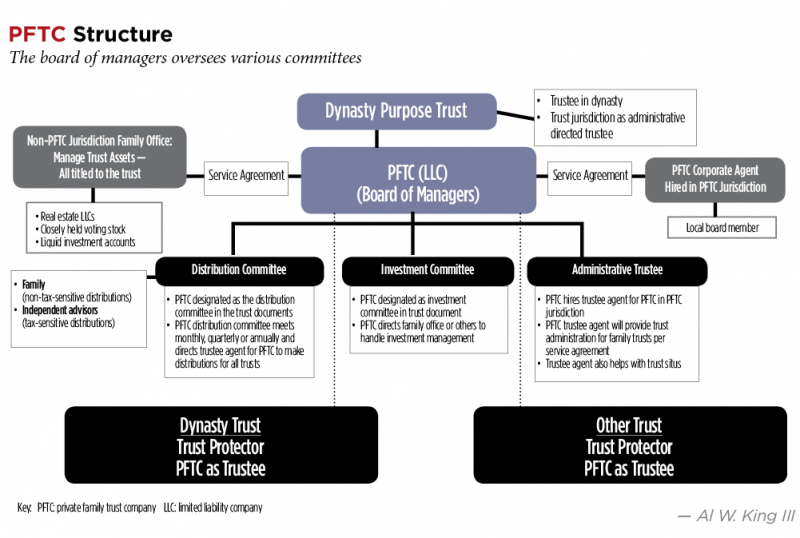

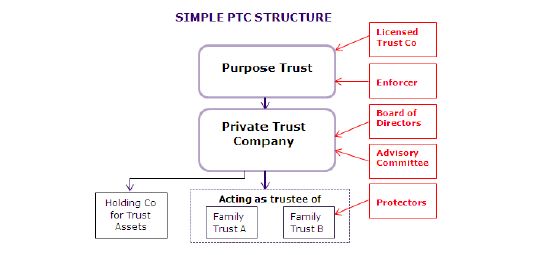

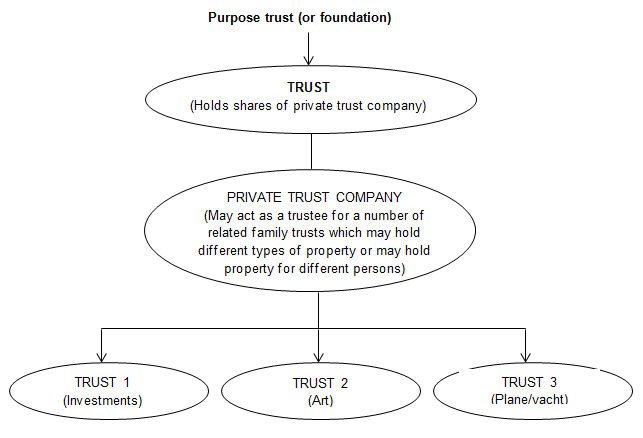

Tips From The Pros The Private Family Trust Company And Alternatives Wealth Management

Family Trusts A Plain English Guide For Australian Families Renton N E Caldwell Rod Amazon Sg Books

Family Management Inheritance Consultant

Private Trust Companies Updated 05 July 18 Corporate Commercial Law Jersey

Guide To Private Trust Companies In Bermuda Wealth Management Bermuda

Csk Advisory Family Trust Planning

Warren Woo And Carey Do Kim Join Panda Express Co Founders Andrew And Peggy Cherng S Family Office To Expand Its Alternative Investment Platform

Trust Services Portcullis Group

Family Trust Infinity Trustee Berhad

Family Trusts Revised And Updated Pdf Chepshydkinddistni5

40 Best Quotes About Trust With Images Pictures Trust Quotes Family Trust Quotes Relationship Quotes

Are Family Trusts Protected From Divorce Lexology

Living Abroad What About My South African Family Trust Family Trust South African South

Csk Advisory Family Trust Planning

/Naming-your-family-trust-funds-e38335a50d1243e5909671395050ad31.gif)

Here Are Some Helpful Tips On How To Name Your Family Trust Fund

Family Trusts A Preferred Option To Protect Children S Interests Post Divorce

Family Trust Federal Credit Union Linkedin

Example How A Family Trust Can Benefit Other Family Members

Family Trusts Inheritance Related Operations Products Trusts In Japan Trust Companies Association Of Japan

Underwriting A Loan Transaction Where The Borrower Is A Family Trust

7 Reasons To Set Up A Family Trust

Can We Vary The Terms Of Our Family Trust Financial Times

Overlooked Family Trust Features For Cost Saving Asset Management

Forbes Family Trust Linkedin

K 1 Taxation Of A Family Trust Jeyakumar1962 General And Health Issues

Is A Family Trust Right For You Adapt Wealth

Should I Have A Family Trust Agilis Ca

Budget 21 Rationalisation Of Tax Provisions For Family Trusts News Chant

What Your Clients Can Gain By Setting Up A Family Trust Acca Global

Q Tbn And9gcrge7qwpjonzfe028qt 4txo71nwtcfupa0pibc Woq3cjbosj8 Usqp Cau

Who Are We To Trust If Not Our Family Picture Quotes

Trusts Weapons Of Mass Injustice A Response To The Critics Tax Justice Network

Sylvester Family Trust Finance Without Borders

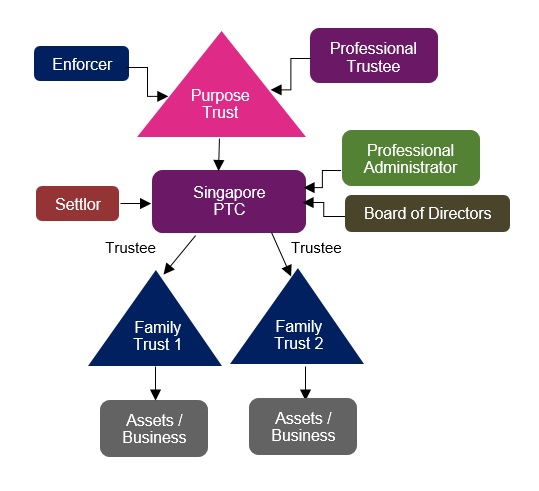

Singapore Private Trust Companies Jtc Kensington

What Is A Trust Trust Law In Singapore Singaporelegaladvice Com

Review Family Trust By Kathy Wang The Nerd Daily

Kroll Family Trust Russian Art Culture Group

Www2 Deloitte Com Content Dam Deloitte Cn Documents Legal Deloitte Cn Legal Yangchan And Jamison Seminar En Pdf

Is My Family Trust Vulnerable In The Event Of A Divorce Financial Times

Family Trust Discretionary A Simple Explanation Jdg Accountants

/what-is-a-revocable-living-trust-3505191-v3-5bfd7964c9e77c0026f13d1d.png)

Revocable Living Trust And How It Works

Australian Startup Structures Companies Trusts Corporate Trustees Dissecting All The Options For Founders By Kunal Kalro Medium

Family Trust And Wills In Chinese Prestige Law

Multi Family Office Forbes Family Trust Raises Usd 100mn For Private Equity Fund

Quotes About Broken Family Trust Top 3 Broken Family Trust Quotes From Famous Authors

Trust Services Ivy Capital Advisors Limited

Quicken Willmaker Plus 19 And Living Trust Software Amazon Sg Software

/family-estate-planning-document-175427818-5a2dd1165b6e2400372f2d2c.jpg)

Sample Chart Of Accounts For Family Trust Lewisburg District Umc

Thaluvachira Family Trust Home Facebook

Setting Up A Private Trust Company In Singapore Paulhypepage My

Family Trusts And The Bucket Company Why Should I Use One

The Benefits Of Family Trusts Advisor S Edge

Everything You Need To Know About Family Trusts Parties To A Trust Settlor Trustees Beneficiaries Part Ppt Download

Family Trust Inheritance Trust New Zealand Family Trust Services

What Are The Benefits Of A Family Trust In South Africa Tat Accounting

1

Quotes About Can T Trust Family 21 Quotes

Powerful Trust Quotes Sayings With Images The Right Messages Trust Quotes Family Trust Quotes Family Quotes

Pros And Cons Of Setting Up A Family Trust Legalzoom Com

Trust Losses Ftes Iees Dsummerson

The Role Of A Trustee In Your Family Trust

The Impact Of Ownership Transferability On Family Firm Governance And Performance The Case Of Family Trusts Sciencedirect

Q Tbn And9gcqtnzam 8ywbl8vfpbsuxalxnirudndmgbgekxniqnqwnneodw2 Usqp Cau

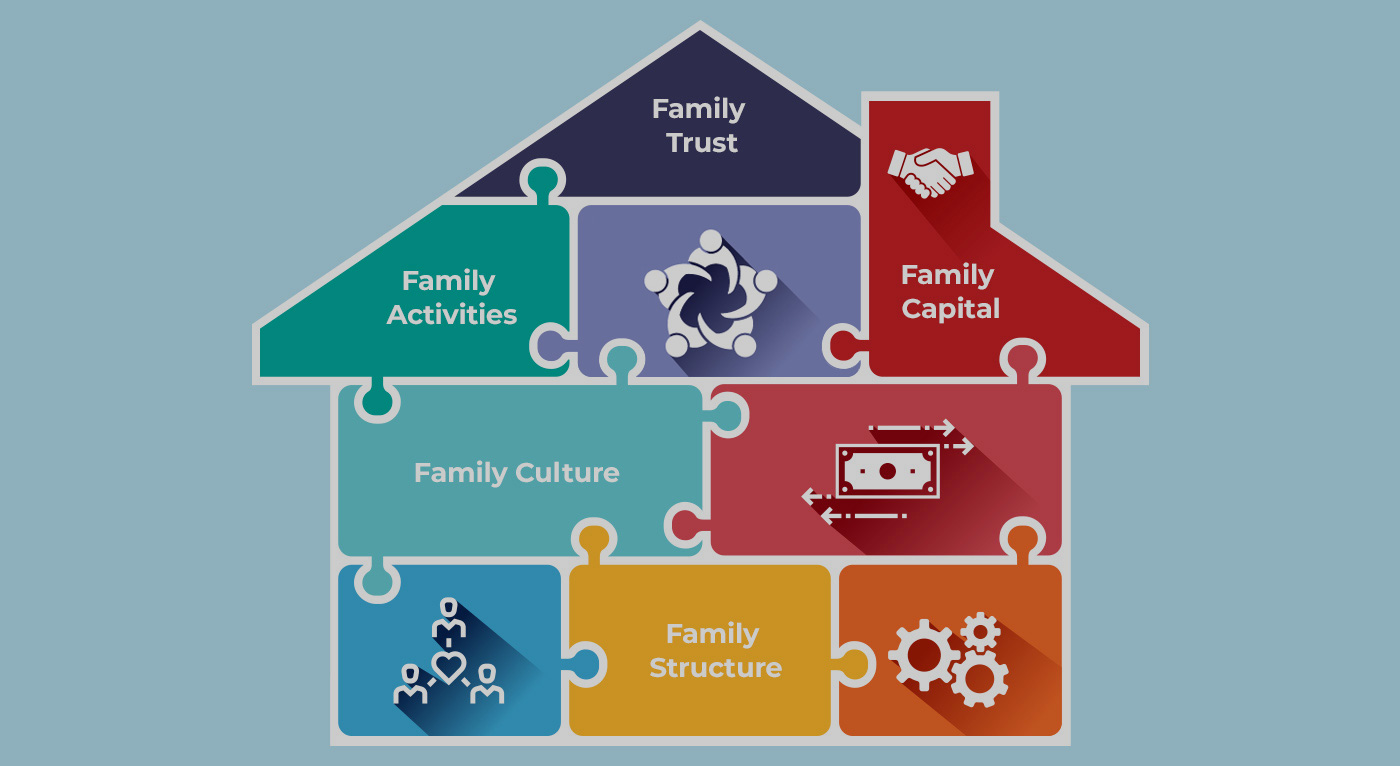

Creating Preserving And Transferring Family Capital The Keys To Family Business Success Ffi Practitioner

The Two Edged Sword Of Family Trust Distributions

Family Trust Home Facebook

Trustee Company Vs Trust Vs Company What S The Difference Fullstack

How To Set Up A Family Trust Quill Group Tax Accountants Gold Coast

Jjrhzzkyvtto M

Private Trust Companies Factsheet By Jersey Finance Issuu

Books Kinokuniya Family Trusts A Guide For Beneficiaries Trustees Trust Protectors And Trust Creators Goldstone Hartley Hughes James E Jr Whitaker Keith

Considering A Family Trust When Married Marriage Com

The Use Of Family Trusts

Books Kinokuniya Family Trust Lgr Wang Kathy

How My Family Trust Fund Was Stolen By Anthony Weldon Issuu

Family Trust Panama Legal Center

Family Trust Inheritance Trust New Zealand Family Trust Services

Succession Is The Biggest Challenge Being Faced By Indian Families Campden Fb

Waltons Transfer 48 Billion Of Walmart Shares To Family Trust Bloomberg

What Is A Trust Lawcrest A Modern Commercial Law Firm

Advantages And Disadvantages Of Family Trusts Ioof

Greenpro Wealth Succession Family Trust Vs Wills Greenpro Capital Group

Forbes Family Trust Crunchbase Company Profile Funding

My Malaysia Wills Family Trust Private Purpose Trust

What Is A Family Trust The Essential Guide Box Advisory Services