Equity Fonds

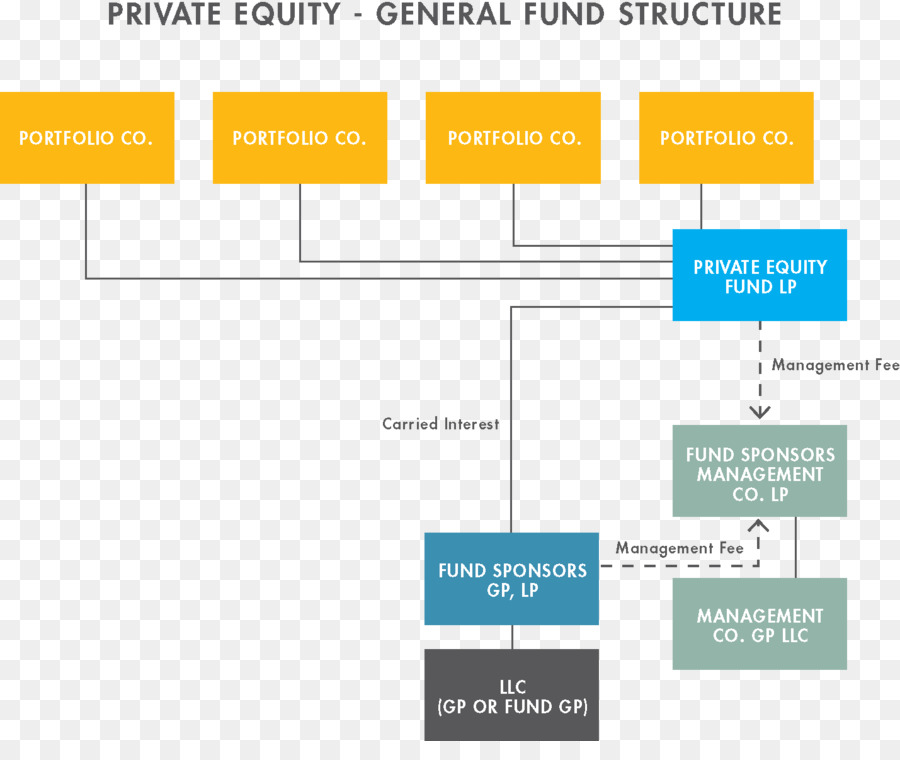

“Typically, the IRR of private equity funds stabilizes in its return quartile six to eight years into the life of the fund, when the fund’s risk/return profile also becomes stable,” says Richard Carson, senior director of private equity at Cambridge Associates.

Equity fonds. With equity funds from Storebrand, Delphi Funds and SKAGEN in Norway, as well as SPP Funds in Sweden, we have a high degree of flexibility and breadth when we compile portfolio solutions We provide a comprehensive range of equity funds within the categories of actively managed funds, factor funds and indexlinked funds. Funds included in the Domestic Equity category have a majority of their assets invested in US issuers, but may also invest in nonUS issuers Investing involving involves risk, including risk of loss Click on the fund's name for more information about its risks Performance and pricing information on this page is provided by Fidelity. Advent has one of the world’s largest and most experienced private equity teams, with more than 235 investment professionals across four continents On average, our managing partners and managing directors have over 18 years of international investment experience.

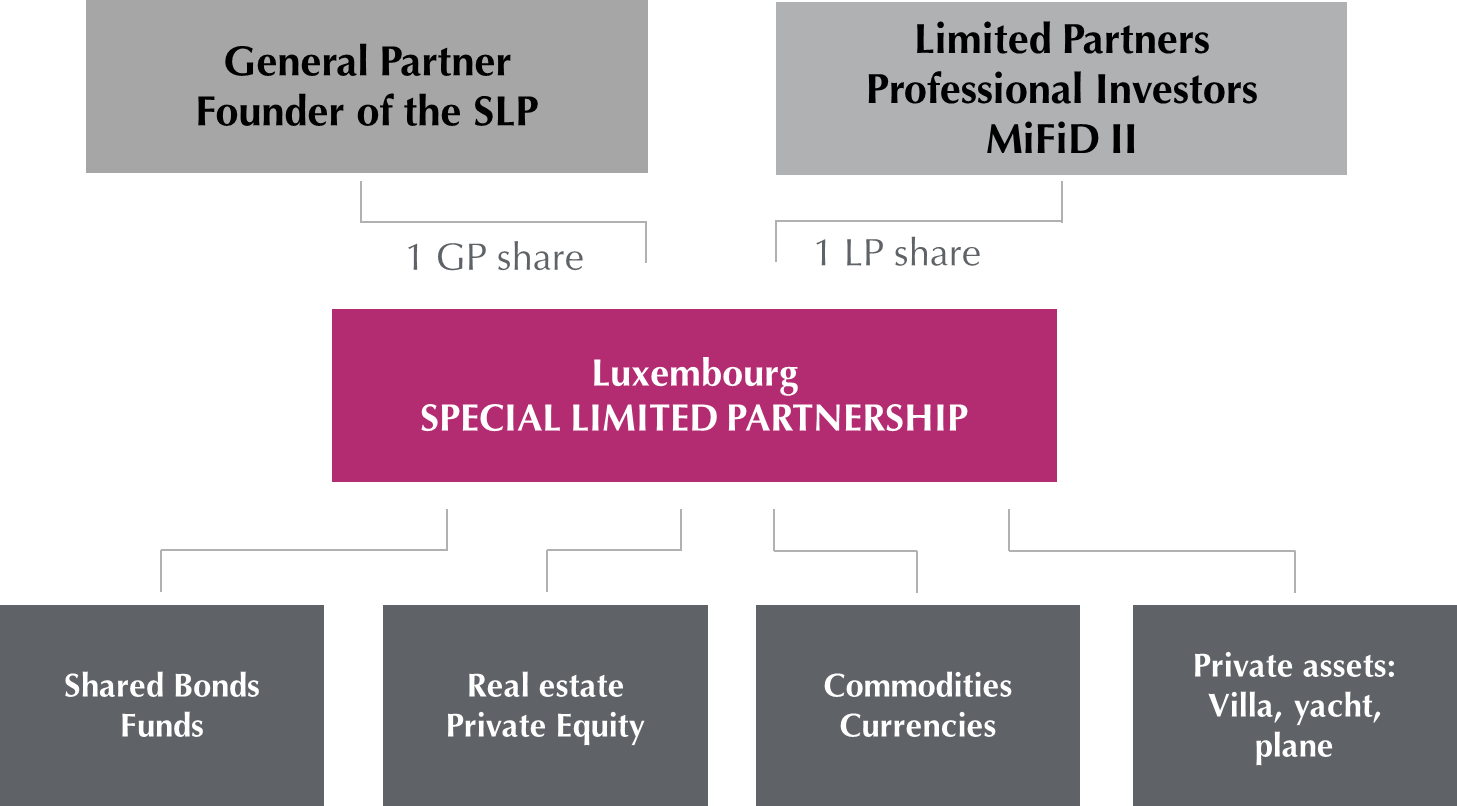

About us Devon Equity Management is an independent fund management company regulated by the Financial Conduct Authority We invest in European equities on behalf of a FTSE 250 investment trust (European Opportunities Trust PLC), a Luxembourg SICAV (Devon Equity Funds RAIF) and institutional investors. What are Equity Funds?. Lone Star Funds Lone Star is a leading private equity firm advising funds that invest globally in real estate, equity, credit and other financial assets Since the establishment of its first fund in 1995, Lone Star has organized 21 private equity funds with aggregate capital commitments totaling more than $85 billion.

An equity fund is a special type of mutual fund or exchangetraded fund (ETF) that invests in common stocks, or equities, rather than bonds As a new investor, you may not have heard of equity funds, but learning about them should be at the start of your financial journey. It isn’t often that you meet a firm with a 25 year track record partnering with owneroperators Seidler’s family office heritage was evident in their patient, longterm approach to helping me build my business. Discover the best equity funds Find mutual fund ratings and information on stockonly mutual funds.

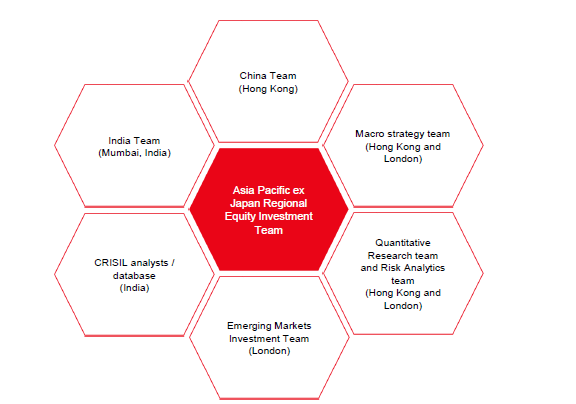

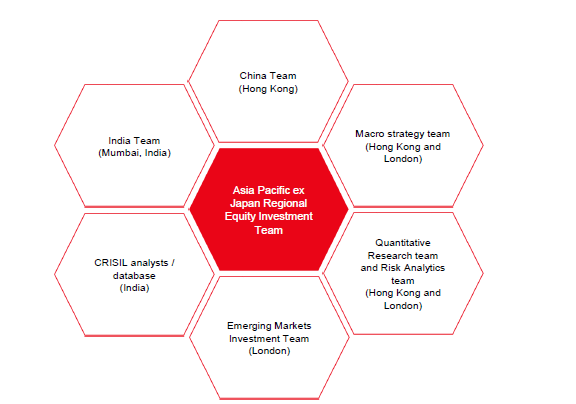

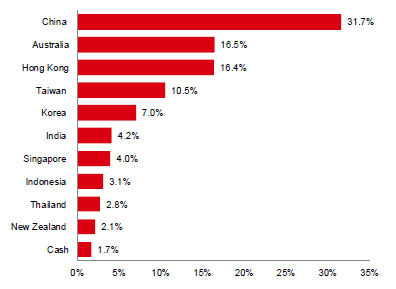

If you want to browse ETFs with more flexible selection criteria, visit our screenerTo see more information of the Asia Pacific Equities ETFs, click on one of the tabs above. AMUNDI GERMAN EQUITY A ND FONDS Fonds (WKN / ISIN DE) – Aktuelle Kursdaten, Nachrichten, Charts und Performance. It isn’t often that you meet a firm with a 25 year track record partnering with owneroperators Seidler’s family office heritage was evident in their patient, longterm approach to helping me build my business.

Private equity investment group, Apax Partners, invest in leveraged and management buyouts, and growth capital Investors in technology, telecommunications, retail. Advent has one of the world’s largest and most experienced private equity teams, with more than 235 investment professionals across four continents On average, our managing partners and managing directors have over 18 years of international investment experience. It isn’t often that you meet a firm with a 25 year track record partnering with owneroperators Seidler’s family office heritage was evident in their patient, longterm approach to helping me build my business.

Growth Equity Investing We are growth equity investors, helping entrepreneurs build remarkable organizations, by providing equity and expertise More About Us Our Current Fund Breaking New Ground TF Investors is the first, and currently only, professionally managed pool of capital providing organizations implementing the Entrepreneurial Operating System® (EOS) access to capital Click here. Growth Equity Investing We are growth equity investors, helping entrepreneurs build remarkable organizations, by providing equity and expertise More About Us Our Current Fund Breaking New Ground TF Investors is the first, and currently only, professionally managed pool of capital providing organizations implementing the Entrepreneurial Operating System® (EOS) access to capital Click here. Funds included in the Domestic Equity category have a majority of their assets invested in US issuers, but may also invest in nonUS issuers Investing involving involves risk, including risk of loss Click on the fund's name for more information about its risks Performance and pricing information on this page is provided by Fidelity.

Private Equity has become an essential element of many portfolios, and investors are seeking to build allocations tailored to their individual needs They seek differentiated strategies matching their specific risk and return objectives, desired cash flow profiles and cost considerations BlackRock’s platform is designed to offer private. Equity We provide equity financing primarily investing or coinvesting along with funds focused on infrastructure, the environment, or small and mediumsized enterprises and midsize corporations In some cases, the Bank also provides direct quasiequity financing to support innovative companies in seek of financing to grow. Montagu Private Equity has been investing in European businesses for more than 50 years Portfolio We specialise in buyouts of performing businesses in Northern Europe Culture At the heart of Montagu is the belief that there is always more to learn and something to improve.

TPG is a global investment firm headquartered in San Francisco, California, and Fort Worth, Texas, with approximately $85 billion in assets under management and 14 offices around the world. An Equity Fund is a Mutual Fund Scheme that invests predominantly in shares/stocks of companies They are also known as Growth Funds Equity Funds are either Active or Passive In an Active Fund, a fund manager scans the market, conducts research on companies, examines performance and looks for the best stocks to invest. Growth Equity Investing We are growth equity investors, helping entrepreneurs build remarkable organizations, by providing equity and expertise More About Us Our Current Fund Breaking New Ground TF Investors is the first, and currently only, professionally managed pool of capital providing organizations implementing the Entrepreneurial Operating System® (EOS) access to capital Click here.

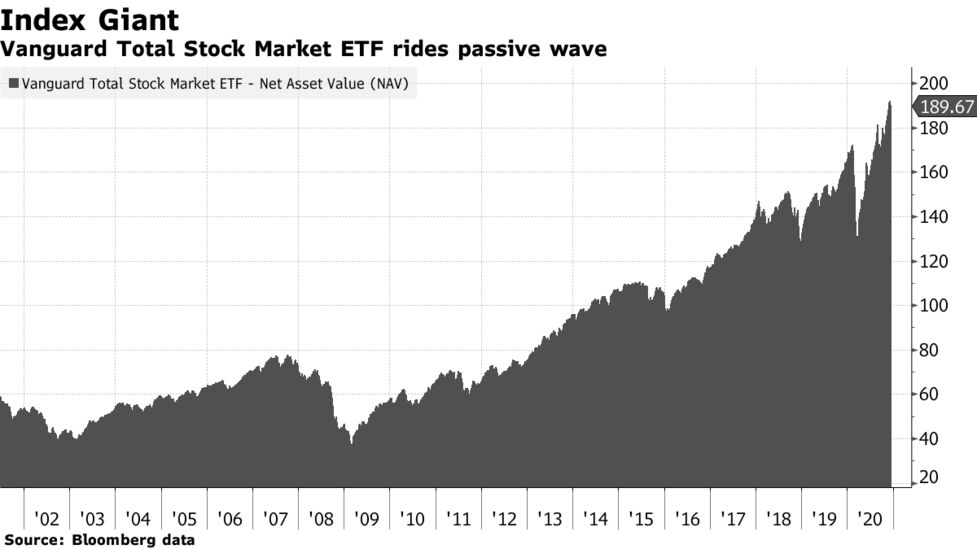

Browse a list of Vanguard funds, including performance details for both index and active mutual funds. One Equity Partners is a middle market private equity firm with over $4 billion in assets under management focused on transformative combinations within the industrial, healthcare and technology sectors in North America and Europe. Apollo Global Management is one of the largest alternative asset managers serving many of the world’s most prominent investors We have a valueoriented approach across private equity, credit, and real estate.

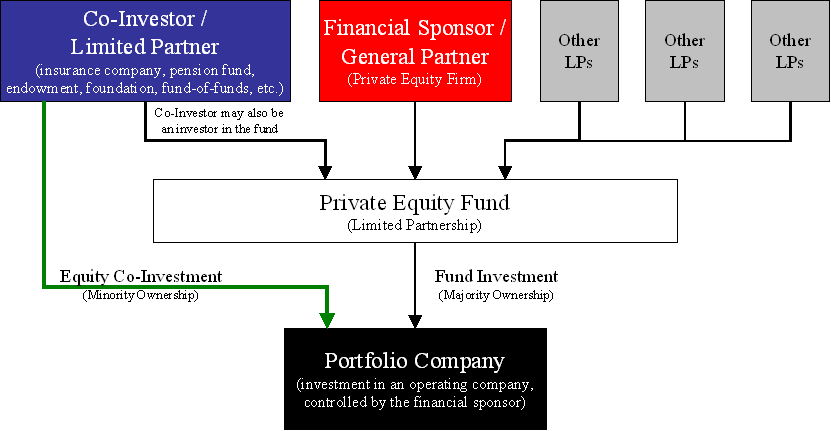

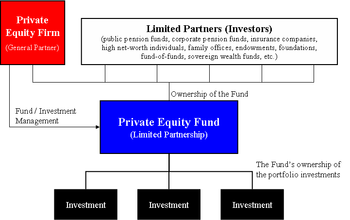

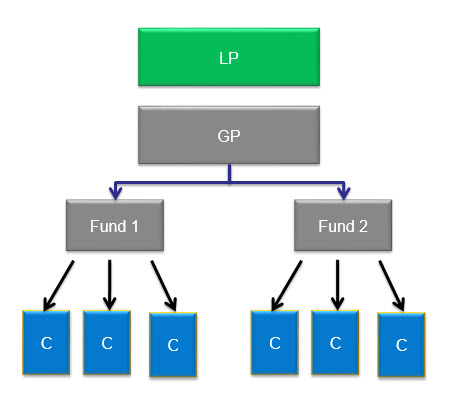

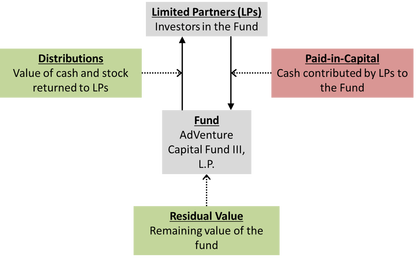

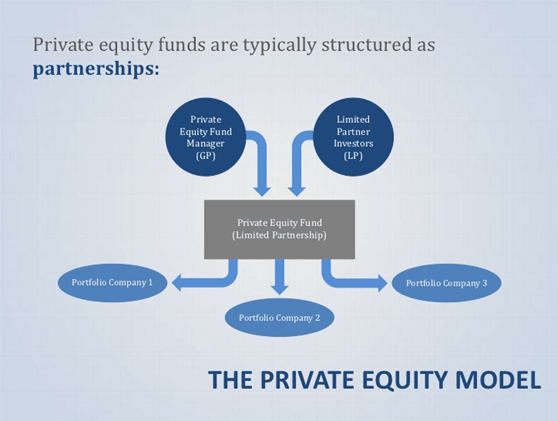

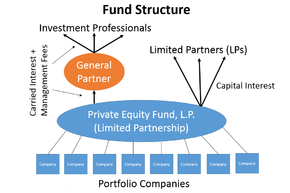

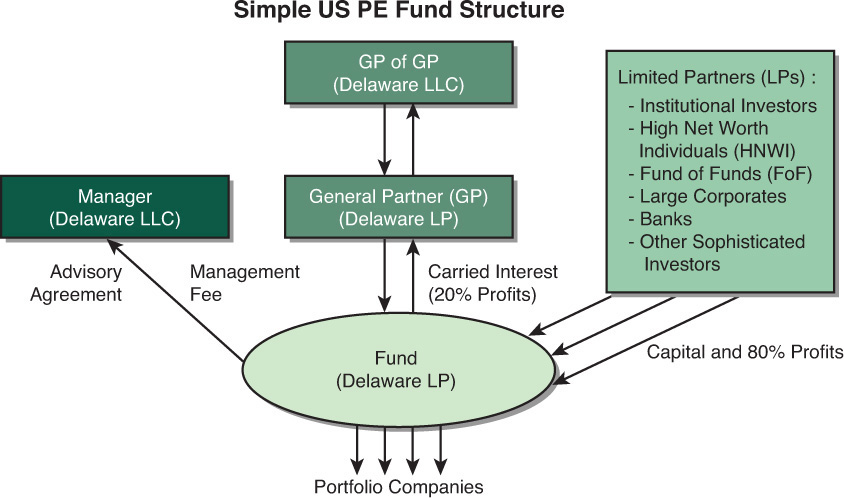

Registered with the United States Securities and Exchange Commission (IARD/CRD Number ). A private equity fund is a collective investment scheme used for making investments in various equity (and to a lesser extent debt) securities according to one of the investment strategies associated with private equity Private equity funds are typically limited partnerships with a fixed term of 10 years (often with annual extensions). A stock fund, or equity fund, is a fund that invests in stocks, also called equity securities Stock funds can be contrasted with bond funds and money funds Fund assets are typically mainly in stock, with some amount of cash, which is generally quite small, as opposed to bonds, notes, or other securities.

Private equity investment group, Apax Partners, invest in leveraged and management buyouts, and growth capital Investors in technology, telecommunications, retail. Funds included in the Domestic Equity category have a majority of their assets invested in US issuers, but may also invest in nonUS issuers Investing involving involves risk, including risk of loss Click on the fund's name for more information about its risks Performance and pricing information on this page is provided by Fidelity. An equity fund is a mutual fund that invests principally in stocks It can be actively or passively (index fund) managed Equity funds are also known as stock funds Stock mutual funds are.

With equity funds from Storebrand, Delphi Funds and SKAGEN in Norway, as well as SPP Funds in Sweden, we have a high degree of flexibility and breadth when we compile portfolio solutions We provide a comprehensive range of equity funds within the categories of actively managed funds, factor funds and indexlinked funds. EQT is a purposedriven global investment organization with a 25year trackrecord of consistent investment performance across multiple geographies, sectors, and strategies. These strategies involve risks that may not be present in more traditional (eg, equity or fixed income) mutual funds These Funds generally may seek sources of returns that perform differently from broader securities markets However, correlations among different asset classes may shift over time, and if this occurs a Fund’s performance may.

The Private Equity Group broadly categorizes its investment strategies as corporate private equity, special opportunities, energy opportunities and infrastructure and power The private equity professionals have a demonstrated ability to deploy flexible capital, which allows them to stay both active and disciplined in various market environments. TPG is a global investment firm headquartered in San Francisco, California, and Fort Worth, Texas, with approximately $85 billion in assets under management and 14 offices around the world. UBAM SWISS EQUITY AC FONDS Fonds (WKN / ISIN LU) – Aktuelle Kursdaten, Nachrichten, Charts und Performance.

EIF for Venture Capital & Private Equity funds how to submit an investment proposal If you are a fund management company We aim at investing in independent management teams that raise funds from a wide range of investors to provide risk capital to growing SMEs in Europe. These strategies involve risks that may not be present in more traditional (eg, equity or fixed income) mutual funds These Funds generally may seek sources of returns that perform differently from broader securities markets However, correlations among different asset classes may shift over time, and if this occurs a Fund’s performance may. About us Devon Equity Management is an independent fund management company regulated by the Financial Conduct Authority We invest in European equities on behalf of a FTSE 250 investment trust (European Opportunities Trust PLC), a Luxembourg SICAV (Devon Equity Funds RAIF) and institutional investors.

Original equity research provides the foundation for our goal of longterm excess return WCM is an independent asset management firm that is motivated by a spirit of broadbased employee ownership We are a profitable, financially sound investment company with no debt Our headquarters is in Laguna Beach, California. Morningstar defines a strategy as a “Sustainable Investment” if it is described as focusing on sustainability, impact, or environmental, social, and governance (ESG) factors in its prospectus. EIF is a leading financial institution in the European Private Equity market Through our venture capital and private equity interventions, we play a crucial role in the creation and development of highgrowth and innovative SMEs by facilitating access to equity for these companies across the entire life cycle of corporate innovation.

Original equity research provides the foundation for our goal of longterm excess return WCM is an independent asset management firm that is motivated by a spirit of broadbased employee ownership We are a profitable, financially sound investment company with no debt Our headquarters is in Laguna Beach, California. Equity funds With equity funds from Storebrand, Delphi Funds and SKAGEN in Norway, as well as SPP Funds in Sweden, we have a high degree of flexibility and breadth when we compile portfolio solutions We provide a comprehensive range of equity funds within the categories of actively managed funds, factor funds and indexlinked funds. You are now leaving AQR FundsWe provide links to third party websites only as a convenience and the inclusion of such links does not imply any endorsement, approval, investigation, verification or monitoring by us of any content or information contained within or accessible from the linked sites.

This is a list of all UStraded ETFs that are currently included in the Asia Pacific Equities ETFdbcom Category by the ETF Database staff Each ETF is placed in a single “best fit” ETFdbcom Category;. Equity We provide equity financing primarily investing or coinvesting along with funds focused on infrastructure, the environment, or small and mediumsized enterprises and midsize corporations In some cases, the Bank also provides direct quasiequity financing to support innovative companies in seek of financing to grow. If you want to browse ETFs with more flexible selection criteria, visit our screenerTo see more information of the Asia Pacific Equities ETFs, click on one of the tabs above.

Similar to a mutual fund or hedge fund, a private equity fund is a pooled investment vehicle where the adviser pools together the money invested in the fund by all the investors and uses that money to make investments on behalf of the fund. Equity Benefit from our independent yet collaborative approach to equity research with equity funds that span a variety of regions, industries, market capitalisations and styles Multiasset Address diverse investment challenges through multiasset funds employing the innovative research and capabilities of our Global MultiAsset Strategies team. Private equity has been a cornerstone of Apollo’s business since its founding in 1990 Imbued with a diverse set of skills developed across market cycles, Apollo pursues many paths to value, including through opportunistic buyouts and buildups, corporate carveouts, and distressed investments, and often goes “against the grain” of what other investors are doing, to target investments on.

Advent has one of the world’s largest and most experienced private equity teams, with more than 235 investment professionals across four continents On average, our managing partners and managing directors have over 18 years of international investment experience. Lone Star Funds Lone Star is a leading private equity firm advising funds that invest globally in real estate, equity, credit and other financial assets Since the establishment of its first fund in 1995, Lone Star has organized 21 private equity funds with aggregate capital commitments totaling more than $85 billion. The type of Mutual Fund schemes investing their assets into shares/stocks of different companies across market capitalisation, with an objective of generating higher returns is called Equity Mutual Funds.

Equity Benefit from our independent yet collaborative approach to equity research with equity funds that span a variety of regions, industries, market capitalisations and styles Multiasset Address diverse investment challenges through multiasset funds employing the innovative research and capabilities of our Global MultiAsset Strategies team. Close The Morningstar Rating™ for this share class is based on Morningstar's extended performance calculation This means that, for a share class that doesn't have a 1, 3, 5, or 10year performance history, the rating shown is a hypothetical Morningstar Rating based first on the oldest active surviving share class of the fund and then any dormant or liquidated share classes. This is a list of all UStraded ETFs that are currently included in the Asia Pacific Equities ETFdbcom Category by the ETF Database staff Each ETF is placed in a single “best fit” ETFdbcom Category;.

Learn about mutual fund investing, and browse Morningstar's latest research on funds Find your next great investment and explore picks from our analysts. In 18, private equity funds managed by Blackstone – together with Canada Pension Plan Investment Board and GIC – acquired a majority stake in Thomson Reuters’ Financial & Risk business, now known as Refinitiv Refinitiv is one of the world’s largest providers of financial markets data and infrastructure, providing leading data and. Infrastructure equity funds invest more than 60% of their assets in stocks of companies engaged in infrastructure activities.

One Equity Partners is a middle market private equity firm with over $4 billion in assets under management focused on transformative combinations within the industrial, healthcare and technology sectors in North America and Europe.

Private Equity Vs Hedge Fund 6 Differences You Must Know

Q Tbn And9gcsvavlbs04zm18t3 Nqfsmilebm Toi6rsk Fjdtmdogd5jvegl Usqp Cau

Private Equity Industry Overview Street Of Walls

Equity Fonds のギャラリー

2

Equity Co Investment Wikipedia

Private Equity Buyout Fonds Value Creation In Portfoliounternehmen Amazon Com Books

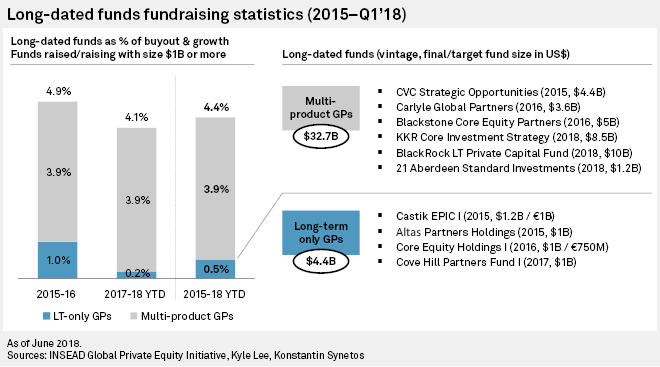

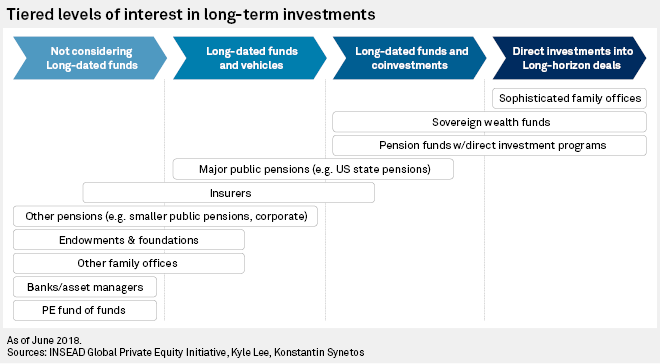

Long Term Fund Strategies Gaining Ground In Private Equity S P Global Market Intelligence

Private Equity Investment Vs Investment Banking Which Is Better

Solutions Vwdservices Com Products Documents 08d964d7 968e 4c32 8de3 0f526a0adab8

Ellipsis Low Vol Equity Fund Jeur Fonds Price Fr Marketscreener

The Largest Russian Equity Fund

Invesco Korean Equity A Usd Ad Fonds Price Lu Marketscreener

Private Equity Vs Hedge Fund 6 Differences You Must Know

Allianz European Equity Div Am H2 Sgd Fonds Price Lu Marketscreener

Private Equity Fund Wikipedia

Plus Eight Equity Fund Lp Crunchbase Investor Profile Investments

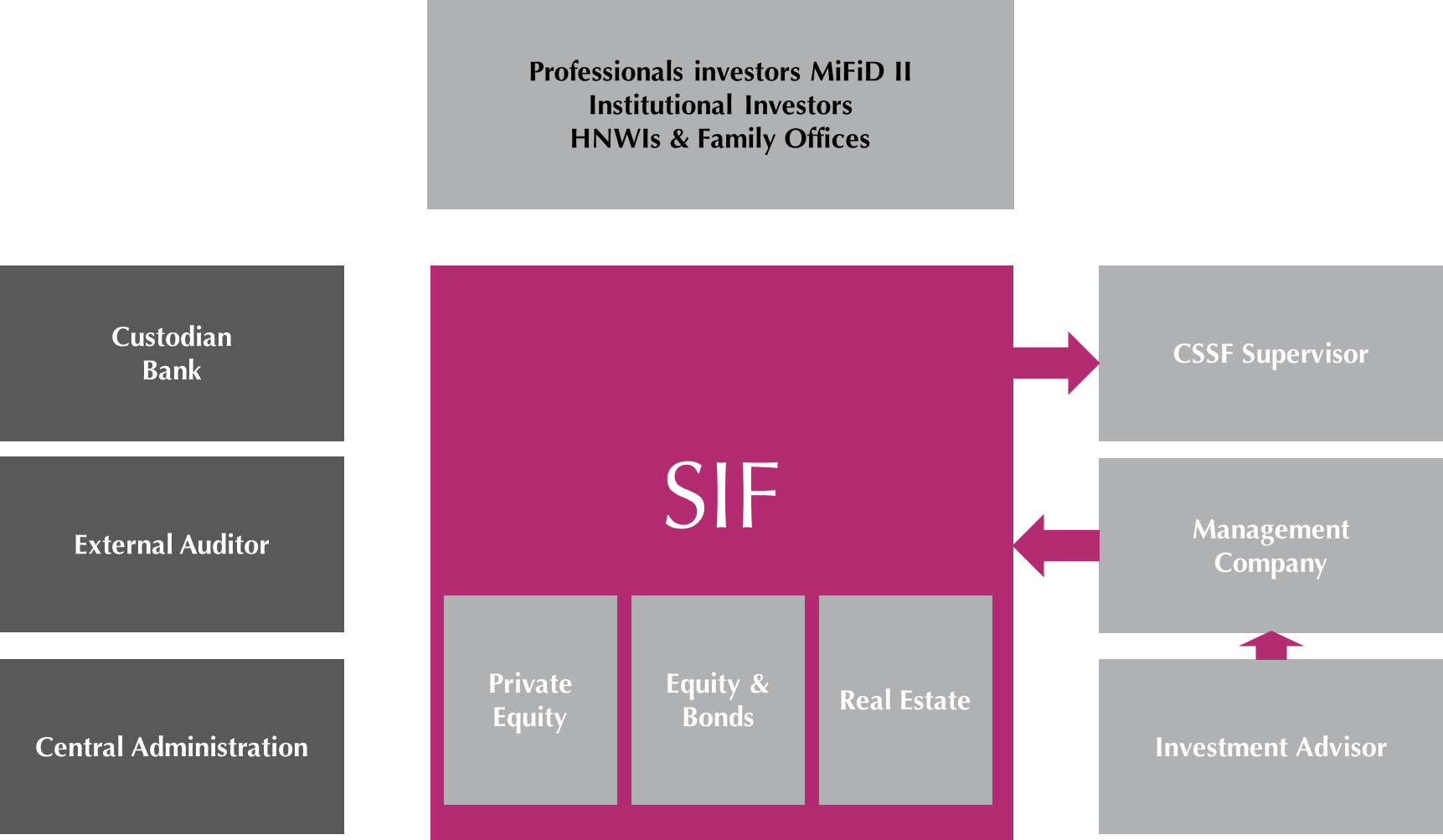

Specialised Investment Fund Sif

Dws Invest Esg Equity Income Lc

Rgixecrfzlxeem

Pei 300 Top Private Equity Firms Private Equity International

Home Uti International

Www Duanemorris Com Site Static Private Equity Fund Fees Pdf

Private Equity Secondary Market Wikipedia

Ubs Lux Equity Fund Pdf Free Download

Q Tbn And9gcqhae7iczhcuffykeemd9k9mhvxvmfp N9 O1irtoipcdoe2uda Usqp Cau

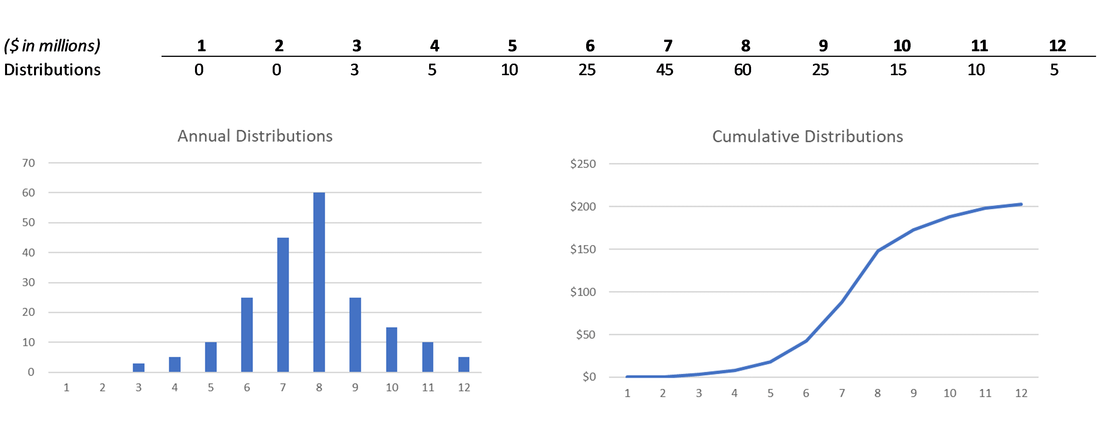

Pdf Modeling The Cash Flow Dynamics Of Private Equity Funds Theory And Empirical Evidence

Ellipsis Risk Adjusted Equity Fund I Fonds Price Fr Marketscreener

Astorius Why Is Private Equity Appealing

Private Equity Funds Know The Different Types Of Pe Funds

Hedge Fund Wikipedia

Tiana Rambatomanga

Mvision Press

Private Equity Fund Accountants Need This Explanation Of Subsequent Closings And Equalisation Aka True Ups Quickstep Training

Blueorchard Announces Usd 80 Million Final Closing Of The Iif Private Equity Sub Fund Blueorchard

Amundi Funds European Equity Value F Eur C Lu Amundi International Global Distributor

Product Flash Clariden Leu Lux Generics Equity Fund

Qjp0e 6 Rjwdam

Best Equity Mutual Funds Top Equity Mutual Fund Schemes Offered Over 15 Annual Returns In 10 Years

Fidura Capital Consult Crunchbase Investor Profile Investments

Private Equity Powerpoint Templates Slides And Graphics

Carried Interest And Performance Fee Incentives Stout

Equity Fund

The Business Model Of Vcs Vs Venture Debt Funds By Joyce Mackenzie Liu Medium

Caceis Is A Privileged Partner Of Private Equity Funds Caceis

/TheBlackstoneGroup-5c3dffbe46e0fb000134aa4c.jpg)

The 8 Best Private Equity Firms Of

Avesco Shc Com

Feng Private Equity Fonds D Investissement Entreprises

Private Equity Kkr

Pei 300 Top Private Equity Firms Private Equity International

On Equity Fonds Price Marketscreener

Amundi Funds European Equity Conservative Eur C Lu Amundi Singapore Retail

Columbia Select Large Cap Equity Fund I2 Markets Insider

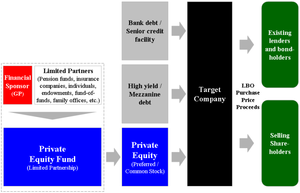

Private Equity Fund Structure Asimplemodel Com

Asia Pacific Fund From Hsbc More Stable Growth With Dividend Strategy

Eservices Mas Gov Sg Opera 9cff7e48 603a 4701 Ae75 E987a1cdaa7f Publishresource

Funds

Investec Gsf Asian Equity A Acc Usd Fonds Price Lu Marketscreener

Paper Background Png Download 1429 1177 Free Transparent Organization Png Download Cleanpng Kisspng

Private Equity Fund Accountants Need This Explanation Of Subsequent Closings And Equalisation Aka True Ups Quickstep Training

Private Equity Kkr

Special Limited Partnership Slp As An Alternative Investment Fund

Asia Pacific Fund From Hsbc More Stable Growth With Dividend Strategy

/MutualFund2-0ca2ba12fdc4424cb0e4155bf9ef3c25.png)

Mutual Fund Definition

Limited Partners Lp Vs General Partners Gp In Private Equity

Vantage World Equity Fund Fonds Price Kyg Marketscreener

Allen Latta S Blog On Private Equity Allen Latta S Thoughts On Private Equity Etc

Global Sustainable Equity Fund Janus Henderson Investors

/thinkstockphotos-487491909-5bfc2b8346e0fb00260b2253.jpg)

Hedge Fund Vs Private Equity Fund What S The Difference

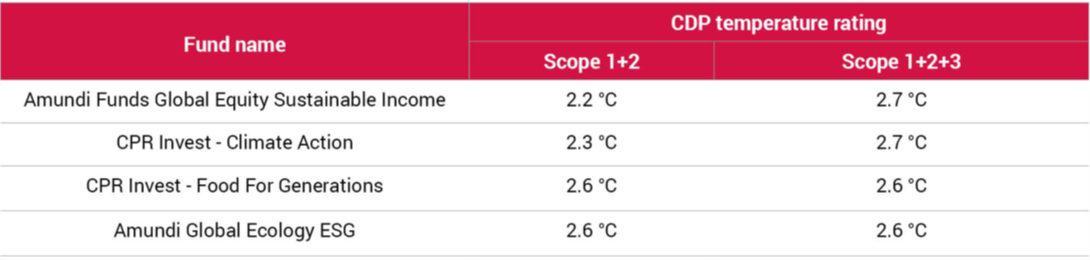

Press Release Cdp Pioneers New Temperature Rating Of Companies For Investors Cpr Asset Management Investment Solutions Cpr Am

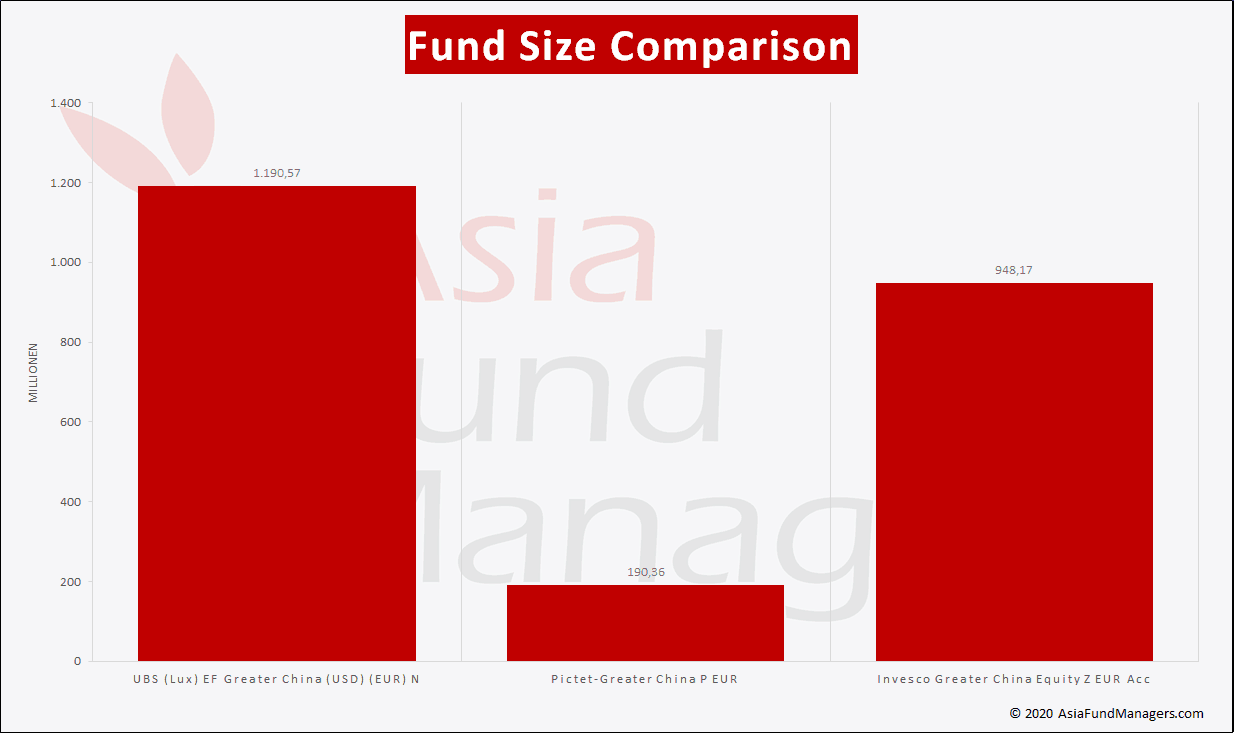

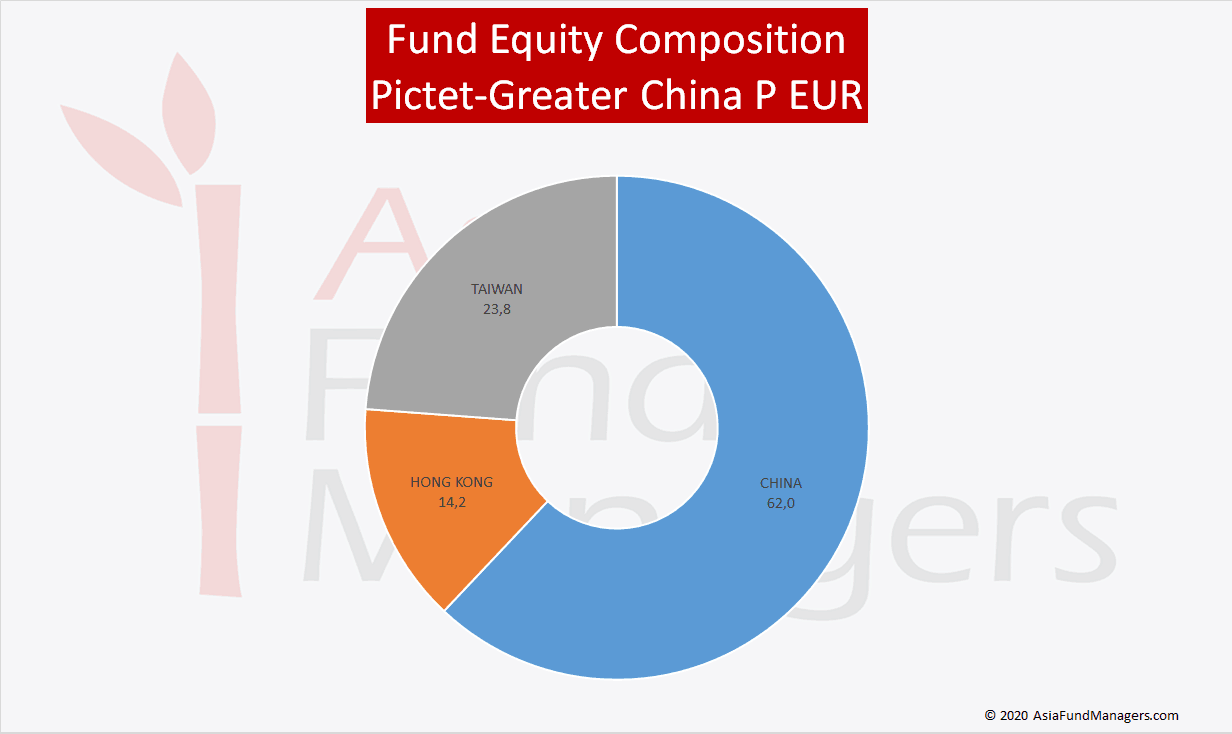

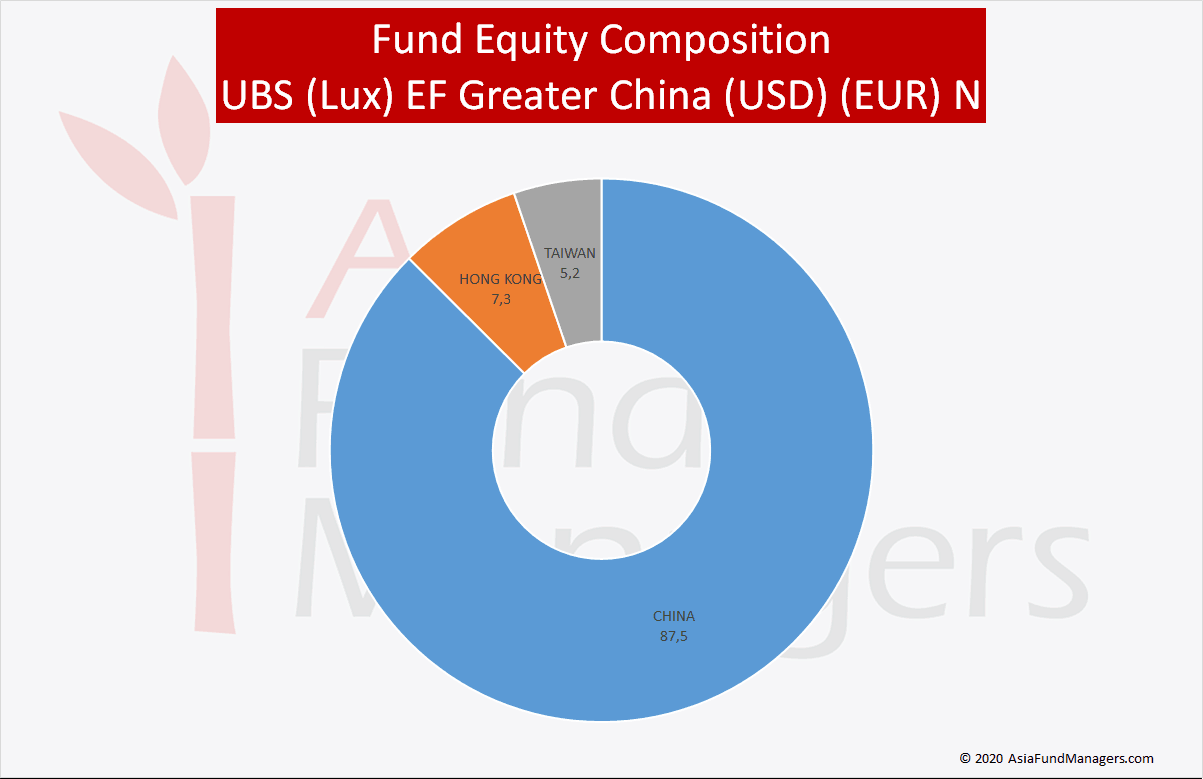

China Equity Funds Comparing Three Of The Best Strategies

Portrait Chairman Of A Private Equity Fund Management Company 18 Activity Report De Gaulle Fleurance Associes

Private Equity S New Take On Diversification Don T Stray Too Far Bain Company

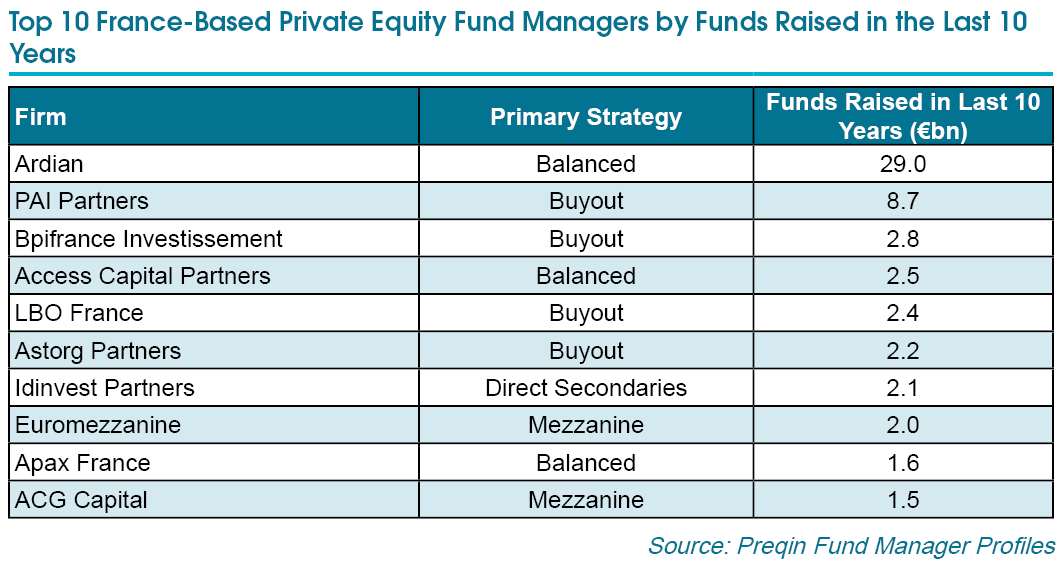

France Based Private Equity Fund Managers Who Are The Biggest Players Preqin

Private Equity Wikipedia

Anlagefonds Ausland Fonds De Placement Etrangers Fondi D

Q Tbn And9gctkmkkvxzdyjvwbz6p2 8a643awuqnbzzrkouul9vc2xeadqjxm Usqp Cau

Long Term Fund Strategies Gaining Ground In Private Equity S P Global Market Intelligence

Tiana Rambatomanga

Mitteilungspflichten Bei Private Equity Fonds Dac 6 Co Youtube

World Stars Global Equity Fund J Stern Co

Neuberger Berman Greater China Equity Fund Inst Funds Markets Insider

Q Tbn And9gcqgovzttbut5olsl Sf8crvxnm1nxudbmp50jjmxtw0tymv06 Usqp Cau

Allen Latta S Blog On Private Equity Allen Latta S Thoughts On Private Equity Etc

Equity Allocation Sinks To Five Month Low

Private Equity Vs Hedge Fund Guide Risk Liquidity Time Horizon

The Life Cycle Of A Private Equity Or Venture Capital Fund

:max_bytes(150000):strip_icc()/MutualFund2-0ca2ba12fdc4424cb0e4155bf9ef3c25.png)

Mutual Fund Definition

Career Guide To Private Equity Jobs What You Need To Know

Leaked Fbi Report Reveals Private Equity Under Enhanced Money Laundering Scrutiny Money Laundering Watch

Pdf What Drives Private Equity Fund Performance

2

Astorius What Is Private Equity

Vanguard Makes History With The First 1 Trillion Equity Fund Bloomberg

Carried Interest Wikipedia

Luxembourg Private Equity Fund Size 17 19 Statista

Main Building Blocks And Vehicles Of A Pe Structure Private Equity Structures And Their Impact On Private Equity Accounting And Reporting Informit

Private Equity Funds Know The Different Types Of Pe Funds

Fidura Private Equity Funds Successful Exit Fidura Rendite Sicherheit Plus Ethik 4 Gmbh Co Kg Press Release Pressebox

China Equity Funds Comparing Three Of The Best Strategies

China Equity Funds Comparing Three Of The Best Strategies

Private Equity Funds Leverage And Performance Evaluation Cfa Institute Enterprising Investor

Better Liquidity For Private Equity Funds By Nyppex Private Markets Issuu

Allianz Us Equity Fund At Sgd Fonds Price Lu Marketscreener

How Selling To Yourself Became Private Equity S Go To Deal Financial Times