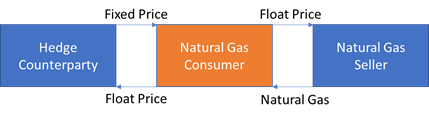

Natural Hedge Example

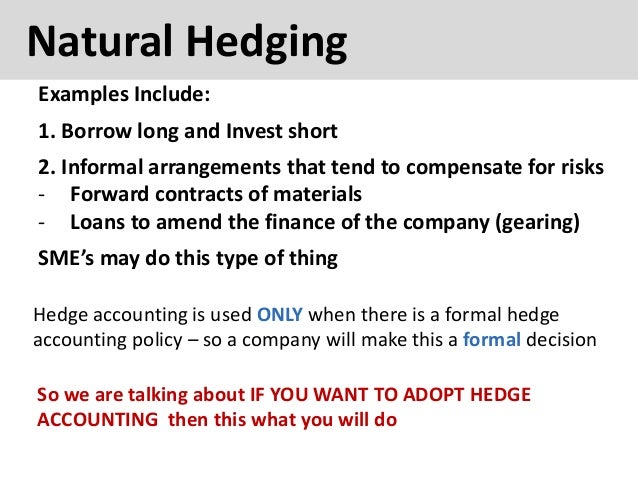

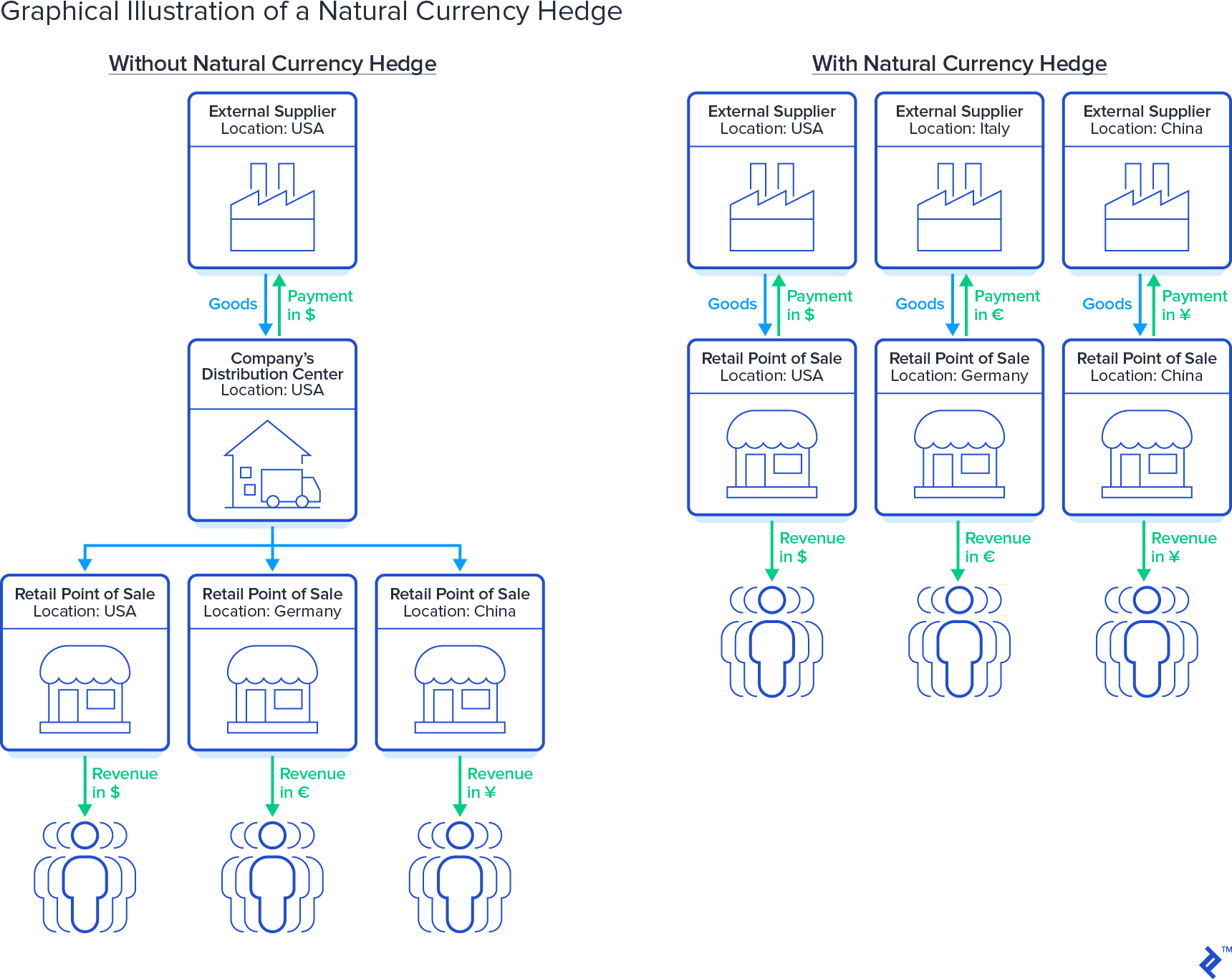

So now the company's going to have what we call a natural hedge For example, if the dollar depreciates your revenues go down, but your costs also go down in the end, right?.

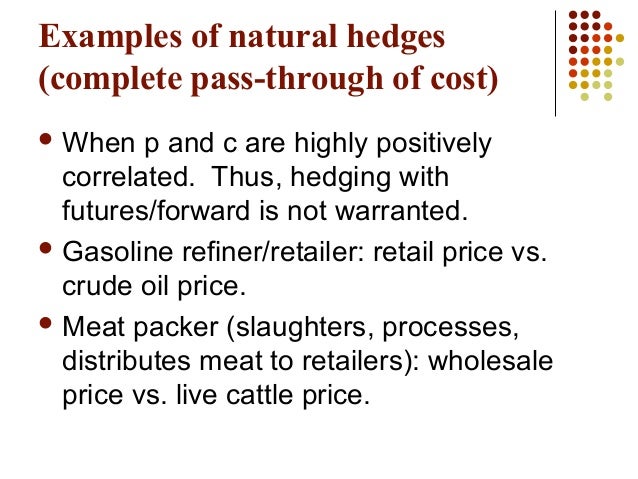

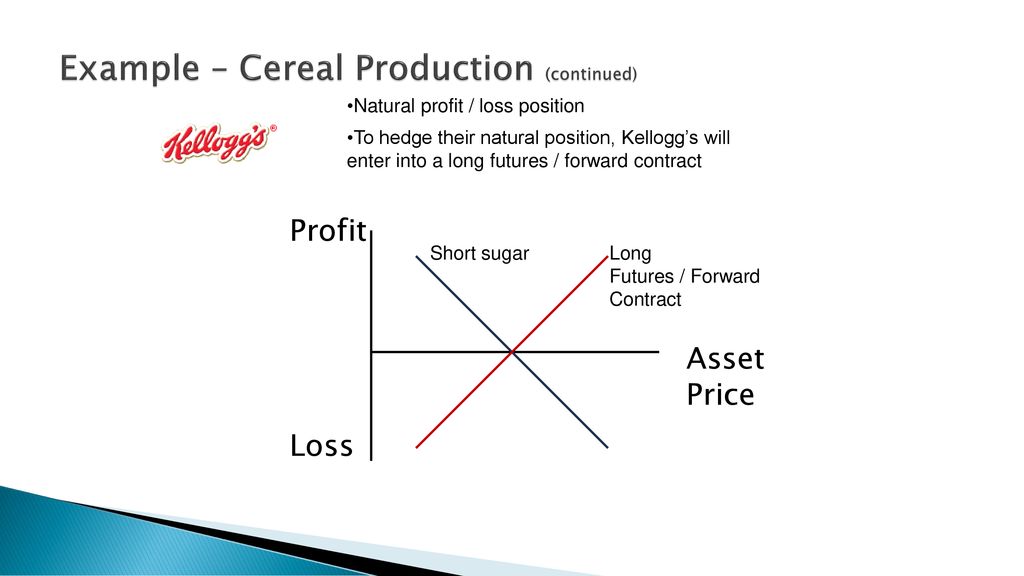

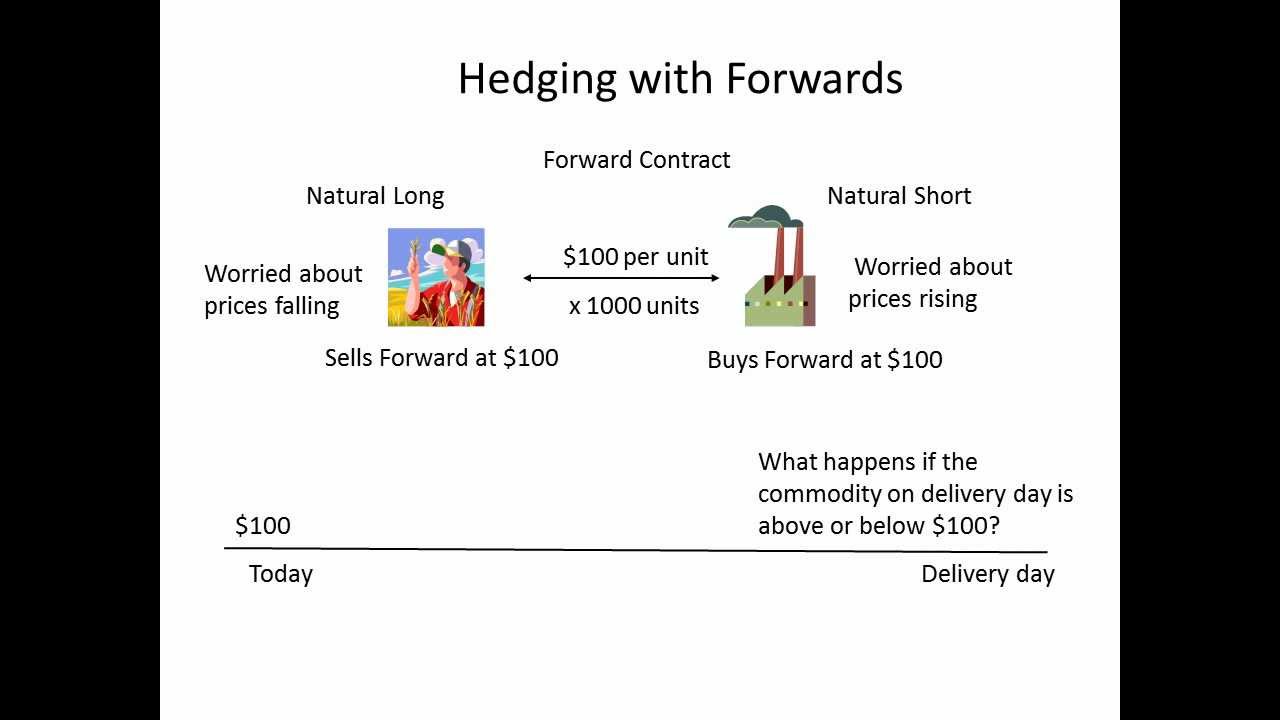

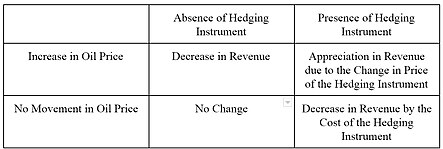

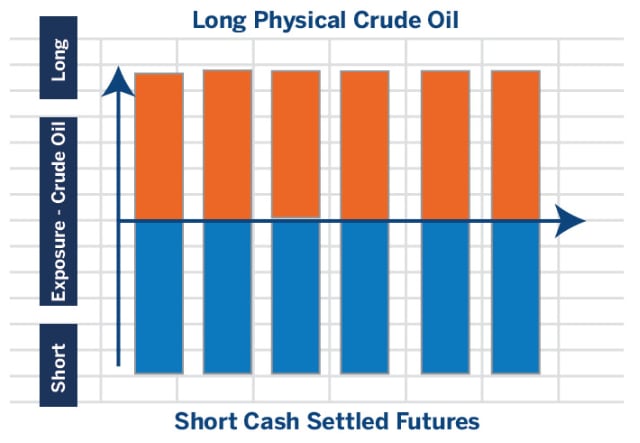

Natural hedge example. IFRS Perspectives IFRS and US GAAP long awaited changes to hedge accounting IFRS 9 1 introduces an approach that aligns hedge accounting more closely with risk management, which many corporates view as a positive step forward In the United States, the FASB recently issued ASU 1712 2, which provides new opportunities to use hedge accounting – some of which are similar to IFRS 9. For instance, an oil company may relocate its refining operations in the United States to naturally hedge against the cost of crude oil The reason being that the cost of crude oil is denominated in US dollars Another example of a natural hedge is that a company’s suppliers, production and customers belong to the same country. Hedging example The below example provides an overview of a typical offset hedge strategy conducted on the LME An offset hedge is designed to remove the basis price risk of the physical operation by offsetting it with an equal and opposite sale or purchase of a futures contract on the Exchange.

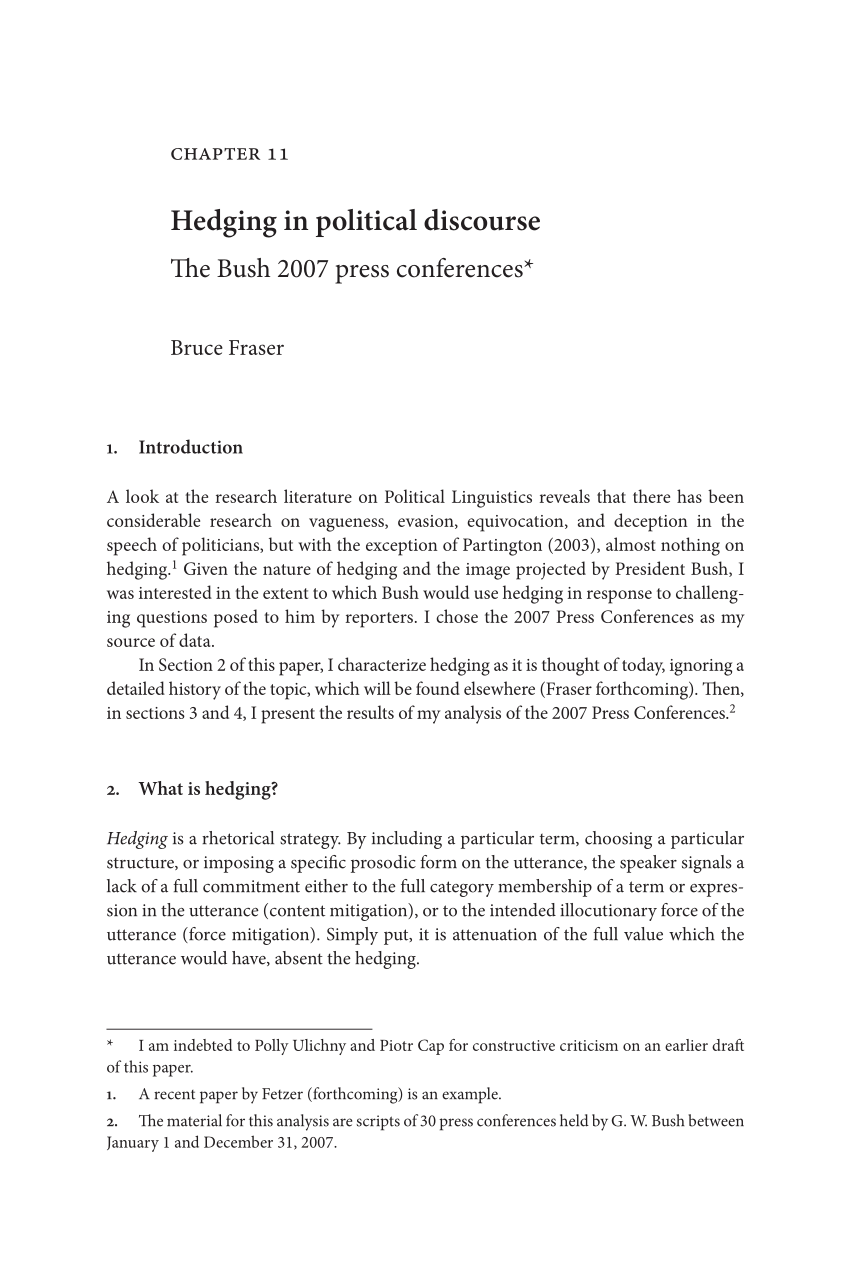

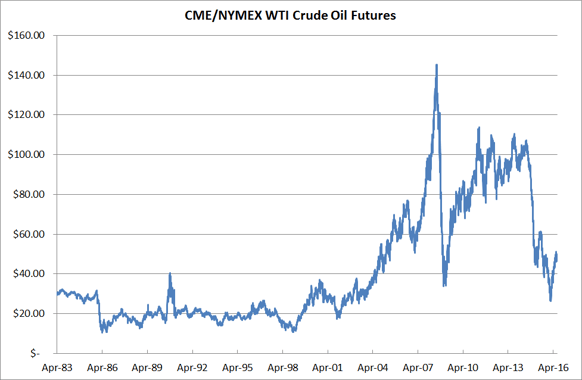

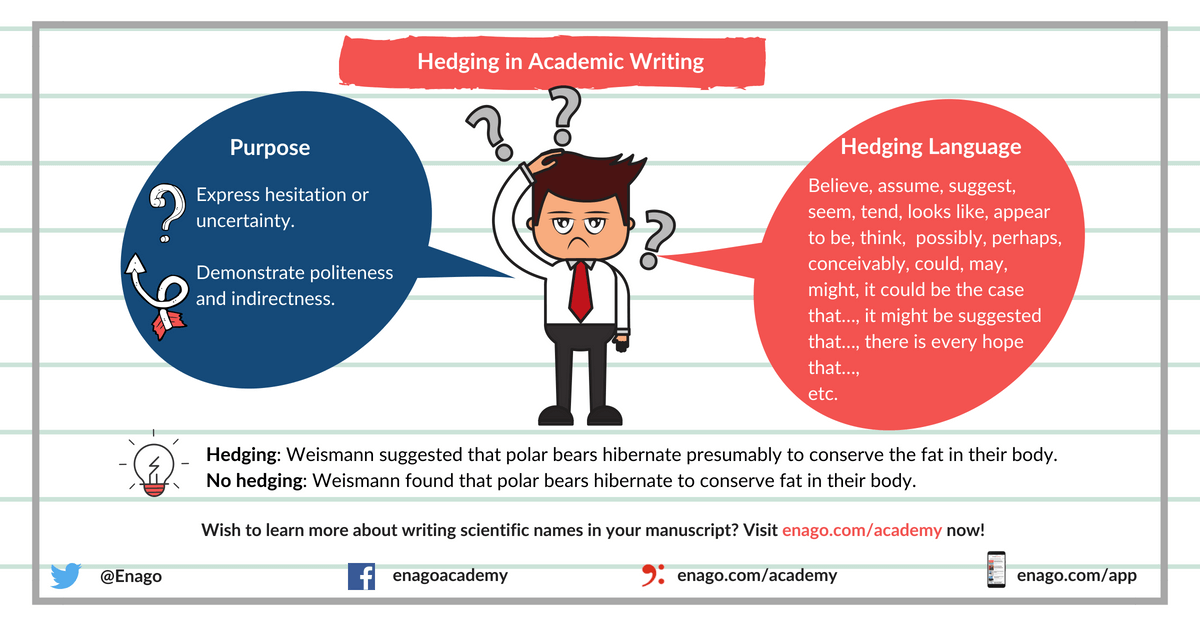

4 3 Natural gas and propane are offered in abbreviated evening sessions Electricity contracts trade exclusively on NYMEX ACCESS® for approximately 23 hours a day Terminals are in use in major cities in the United States and in London, Sydney, Hong. In writing, hedging words are used to convey certainty In academic writing, the use of hedging language is crucial to increase the credibility of your work In this post, we discuss hedging in academic writing and look at some examples of hedging sentences. A hedge is an investment that protects your finances from a risky situation Hedging is done to minimize or offset the chance that your assets will lose value It also limits your loss to a known amount if the asset does lose value It's similar to home insurance You pay a fixed amount each month.

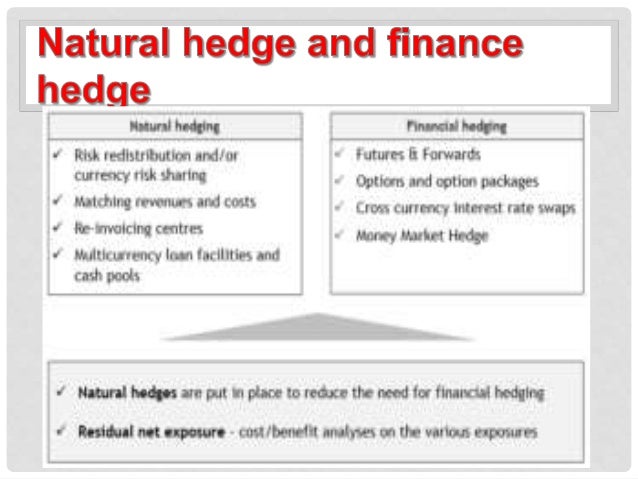

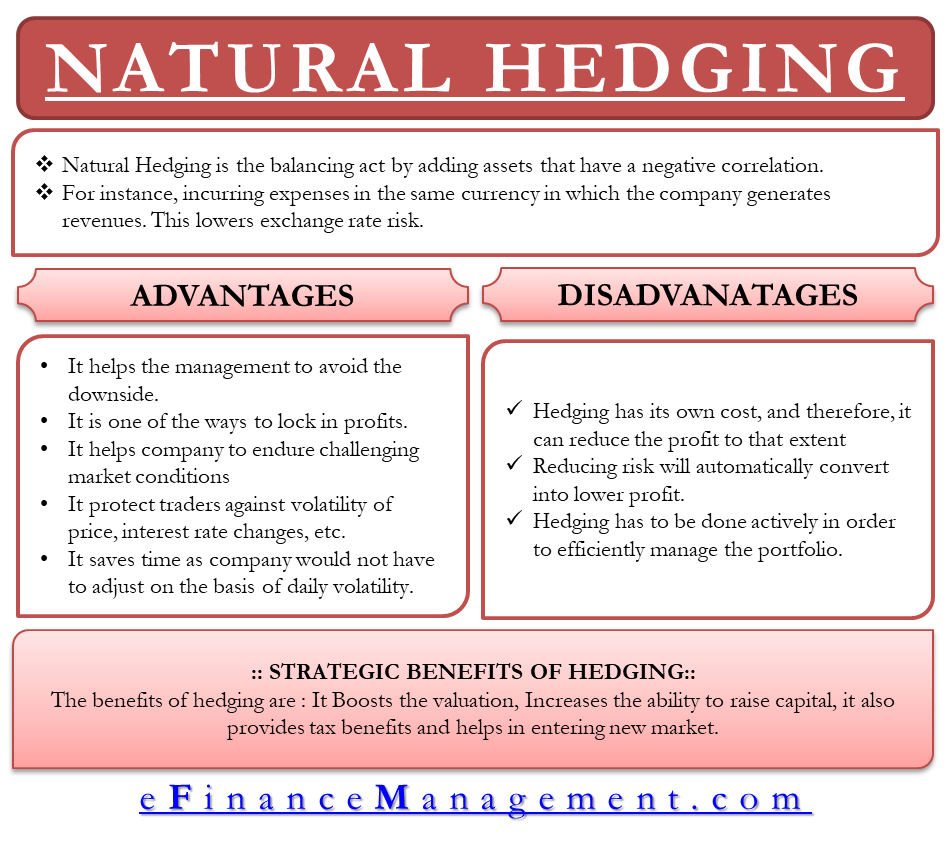

Or when a company. Natural hedges also occur when a business's structure protects it from exchange rate movements For example, when suppliers, production, and customers are all operating in the same currency, large. Examples of Natural Hedging 3 Advantages of Natural Hedging 4 Disadvantages of Natural Hedging 5 Natural Hedge and Finance Hedge 6 Conclusion 3 A natural hedge is a management strategy that seeks to mitigate risk by investing in assets whose performance is negatively correlated It can also be implemented when institutions exploit their.

11 A contract entered into or asset held as a protection against possible financial loss ‘inflation hedges such as real estate and gold’ More example sentences ‘So, as beautiful as the yellow metal might be, gold is neither a hedge against inflation nor a protection against uncertainty’. Natural hedge A natural hedge is the reduction in risk that can arise from an institution’s normal operating procedures A company with significant sales in one country holds a natural hedge on its currency risk if it also generates expenses in that currency For example, an oil producer with refining operations in the US is (partially) naturally hedged against the cost of dollardenominated crude oil. High quality example sentences with “natural hedge for” in context from reliable sources Ludwig is the linguistic search engine that helps you to write better in English.

Risk (for example, macro hedges of commodity price risk) 122 Accounting policy choice IFRS 9 provides an accounting policy choice entities can either continue to apply the hedge accounting requirements of IAS 39 until the macro hedging project is finalised (see above), or they can apply IFRS 9 (with. Hedge effectiveness test, a simulation analysis is typically used to demonstrate that the dollar offset ratio is expected to be effective under a series of reasonably likely/possible changes in the hedged risk For example, when hedging interest rate risk, simulations of the cumulative dollar offset ratio can. Get to grips with hedging and price risk management on the London Metal Exchange.

This example is one of the types of decisions you'll make as a trader You could certainly close your initial trade, and then reenter the market at a better price later The advantage of using the hedge is that you can keep your first trade on the market and make money with a second trade that makes a profit as the market moves against your. Currency Hedging Explained Through a Real Example Currency hedging example Let’s imagine you have $ to invest and you decide to invest the money abroad in the European market The first thing you need to do so you can have access to the European market is to exchange your US dollar into euros. So the company is naturally hedged, not natural in this case, it involves the decision of the company.

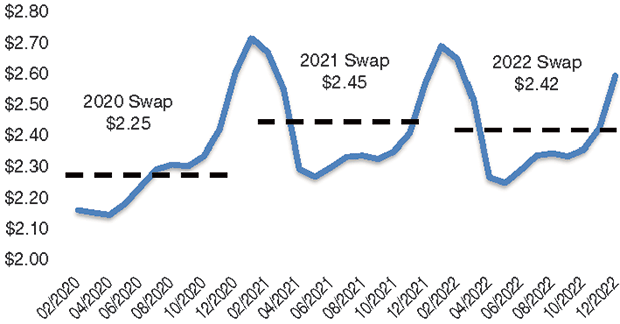

Appendix A Example 1 Fair Value Hedge of Natural Gas Inventory with Futures Contracts 73 Company A has ,000 MMBTU's of natural gas stored at its location in West Texas To hedge the fair value exposure of the natural gas, the company sells the equivalent of ,000 MMBTU's of natural gas futures contracts on a national mercantile exchange. For instance, if a company is exposed to the euro and the US dollar, it can offset any euro depreciation with the gains by the dollar The more equal the value of the total exposure of each currency, the better Like any form of hedging, natural hedging has its limits and does provide total protection against currency risk. The negative foreign currency effect of CHF 06 million on operating results for the first half of 12 remained moderate The company maintains a ‘ natural hedge ’ ( a combination of US dollars and Euros ) of just over 80 % AMP strengthens technology base The acquisition of Alliance Medical Products, Inc ( AMP ) in Irvine, California is a further step in Siegfried ’ s overall.

Portfolio hedging is an important technique to learn Although the calculations can be complex, most investors find that even a reasonable approximation will deliver a satisfactory hedge Hedging is especially helpful when an investor has experienced an extended period of gains and feels this increase might not be sustainable in the future. A hedging example is shown in Example 4 From the time the hedge is placed until it is lifted, the hedger can ignore both cash and futures markets because the gain (loss) in one market will offset the loss (gain) in the other market For example, if the price declines after the hedge is placed, the decline in the cash market is offset by the. Overhedging is a situation where a firm sets up an offsetting position that exceeds the firm's actual exposure or risk Essentially the hedge is for a greater amount than the underlying position.

More on Hedging ;. For example, an oil manufacturer with improving functions in the US is (partially) naturally hedged against the cost of dollardenominated raw oil While an organization can modify its functional behavior to take advantage of an allnatural protect, such bushes are less versatile than economical bushes. English holly, with its prickly leaves, makes a better hedge plant than Japanese holly if you wish to combine security with aesthetic considerations This is one type of holly that grows big enough to serve as a privacy screen (the 'Ferox Argentea' cultivar is 15 feet tall by 8 to 10 feet wide) Holly berries are toxic and should be kept away from children and pets.

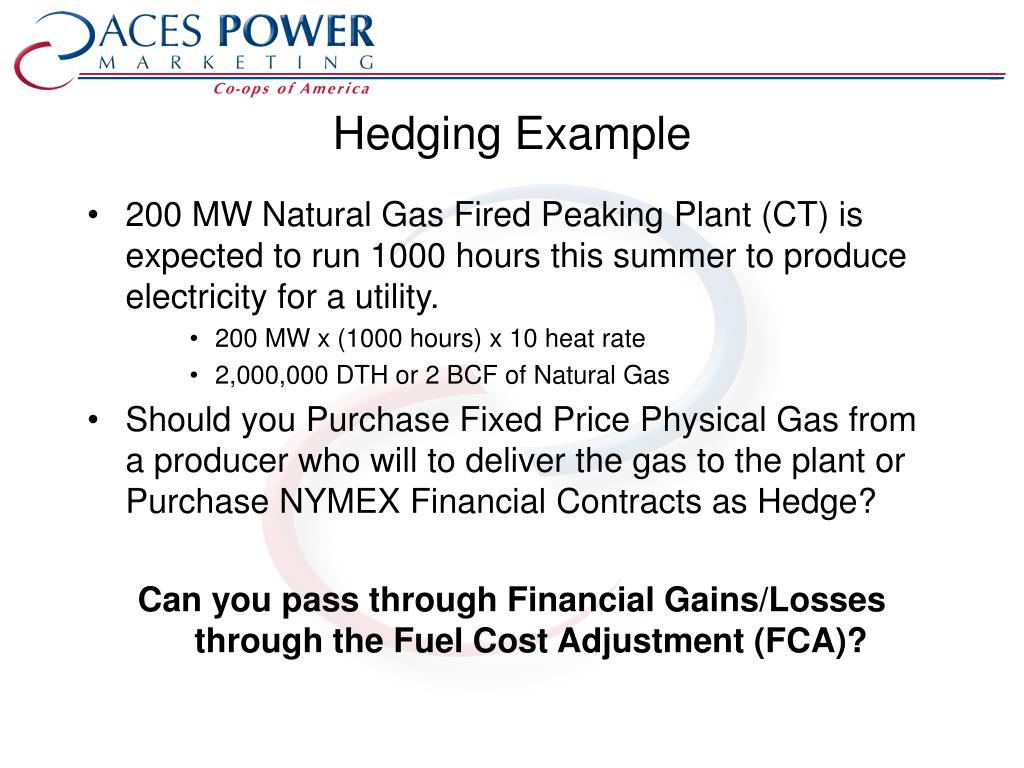

Disadvantages of Hedging Following are the disadvantages of Hedging Hedging involves cost that can eat up the profit Risk and reward are often proportional to one other;. Case examples and problemsolving illustrations optimized for power and natural gas trading are used throughout the course to enhance the understanding of the material Finally, it will identify and illustrate best practices associated with the sound measurement of uncertainty and building solid risk metrics for portfolio management and risk. Nifty Futures for Hedging a Stock Portfolio – Example Let us now demonstrate an example of hedging a stock portfolio by employing Nifty futures When it comes to offsetting the systematic risk on a stock portfolio, the Nifty futures is the natural choice to hedge and mitigate the risk.

Portfolio hedging is an important technique to learn Although the calculations can be complex, most investors find that even a reasonable approximation will deliver a satisfactory hedge Hedging is especially helpful when an investor has experienced an extended period of gains and feels this increase might not be sustainable in the future. Currency Hedging Explained Through a Real Example Currency hedging example Let’s imagine you have $ to invest and you decide to invest the money abroad in the European market The first thing you need to do so you can have access to the European market is to exchange your US dollar into euros. For example, a company that conducts operations in another country will have minimal currency risk, because cash inflows and outflows are in the same currency.

Natural Hedge Using financial assets with contrasting performance which hedges each other's downside risk, instead of using Example Hedging a long position in Stocks by shorting bonds This works theoretically because usually stocks do well This can be a useful method if you want to avoid. The meaning of hedging A good analogy would be an insurance policy For example, if you live in an area prone to forest fires, then you will probably pay for and take out insurance against that eventually In finance, hedging risk works in much the same way It reduces the risk in an investment portfolio. The most popular method to mitigate currency exchange risk is the simple “natural hedge” This is when an exporter and importer complete a transaction in the same currency;.

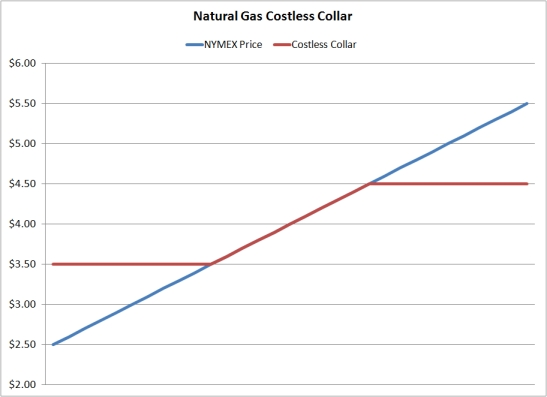

Natural Gas Futures Long Hedge Example A power company will need to procure 100 million mmbtus of natural gas in 3 months' time The prevailing spot price for natural gas is USD /mmbtu while the price of natural gas futures for delivery in 3 months' time is USD /mmbtu. A naturalgas producer that hedges its entire annual production output, valued at $3 billion in sales, for example, would be required to hold or post capital of around $1 billion, since gas prices can fluctuate up to 30 to 35 percent in a given year. Crosshedging, or a cross hedge, refers to an investment strategy that involves covering the financial risk arising from a certain trading position by purchasing another financial instrument whose price action is correlated so that the variations in the former are offset by those in the latter.

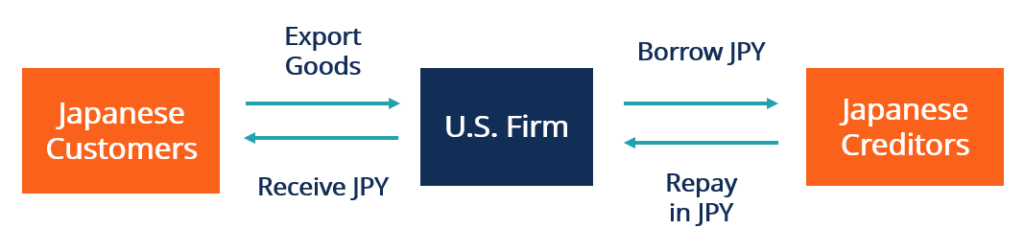

In its purest form, a natural hedge is simply a preexisting byproduct of a company’s operations that requires no action to cover a risk For instance, a US airline doing business in Japan could naturally hedge the risk of currency fluctuation against the dollar in its future yendenominated sales by paying in yen for future operating costs of its Japanese operations. Requirements of IAS 39 until the macro hedging project is finalised (see above), or they can apply IFRS 9 (with the scope exception only for fair value macro hedges of interest rate risk) This accounting policy choice will apply to all hedge accounting and cannot be made on a hedgebyhedge basis. Natural Gas Futures Short Hedge Example A natural gas producer has just entered into a contract to sell 100 million mmbtus of natural gas, to be delivered in 3 months' time The sale price is agreed by both parties to be based on the market price of natural gas on the day of delivery.

The small hedge not only keeps the flowers in check, it also forms a clean line with the lawn making up keep easier This keyhole hedge makes a natural entrance without compromising the beauty of the hedge It also maintains the privacy of the garden beyond The whimsical entrance created by the arched hedge leads into a fitting garden. The garden in the background is a great example of using different shapes to complement each other The vertical flow of the branches and leaves makes these rounded hedges appear taller and draws the eye upward instead of settling on the hedge Even hedges are beautiful in the autumn. Lesson 6 Natural Gas Logistics & Value Chain/US LNG Exports & Global Markets;.

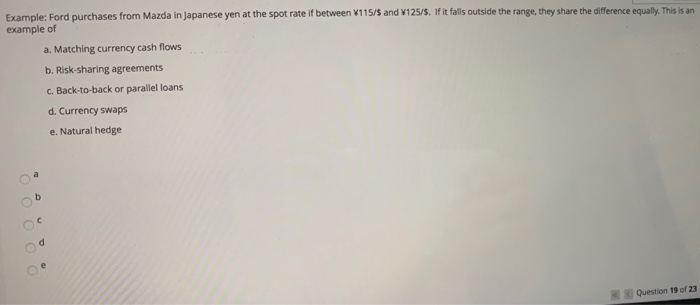

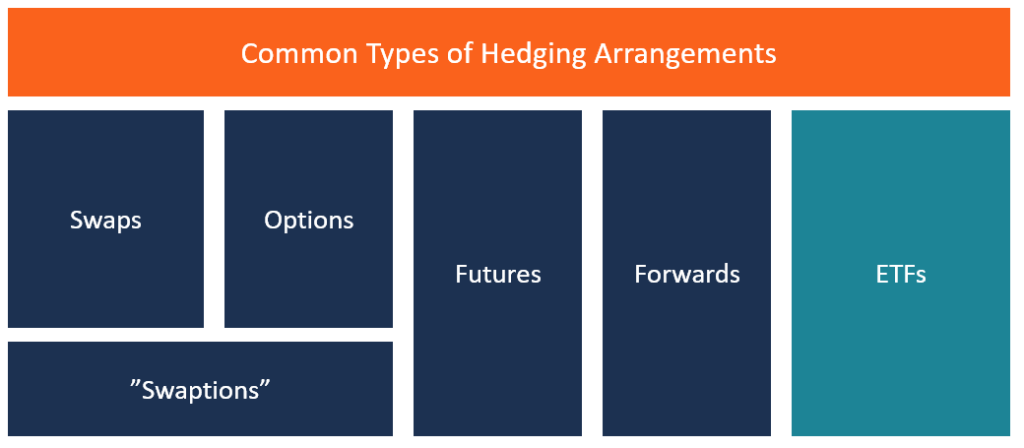

A hedge is an investment that protects your finances from a risky situation Hedging is done to minimize or offset the chance that your assets will lose value It also limits your loss to a known amount if the asset does lose value It's similar to home insurance You pay a fixed amount each month. En (2) Hedging against currency risk can take different forms, including natural hedging, when a household/nonfinancial corporation receives income in foreign currency (for example remittances/export receipts), and financial hedging, which presumes a contract with a financial institution. Lesson 7 Basic Energy Risk “Hedging” using Financial Derivatives Lesson 7 Introduction;.

Reading Assignment Lesson 7;. Many investors, for example, will buy stock in a company and then hedge that risk by opening up an option to sell stock in that same company, but this is not an example of natural hedging By contrast, natural hedges occur when two contrasting investments are made in different securities. So now the company's going to have what we call a natural hedge For example, if the dollar depreciates your revenues go down, but your costs also go down in the end, right?.

This hedging guide is designed to help you manage this increased market volatility It will focus on and incorporate a variety of CME Group Dairy products in price risk management examples CME Group offers a range of Dairy futures and options that address specific needs, and while it is not feasible to include all products. An example of a long hedger would be a cattle feeder planning to put feeder cattle in the feedlot in three months but wanting to establish a price and protect against a price rise during the next three months This hedger would buy feeder cattle futures to protect against a cash price rise. Currency hedging is the use of financial instruments, called derivative contracts, to manage financial risk It involves the designation of one or more financial instruments as a buffer for.

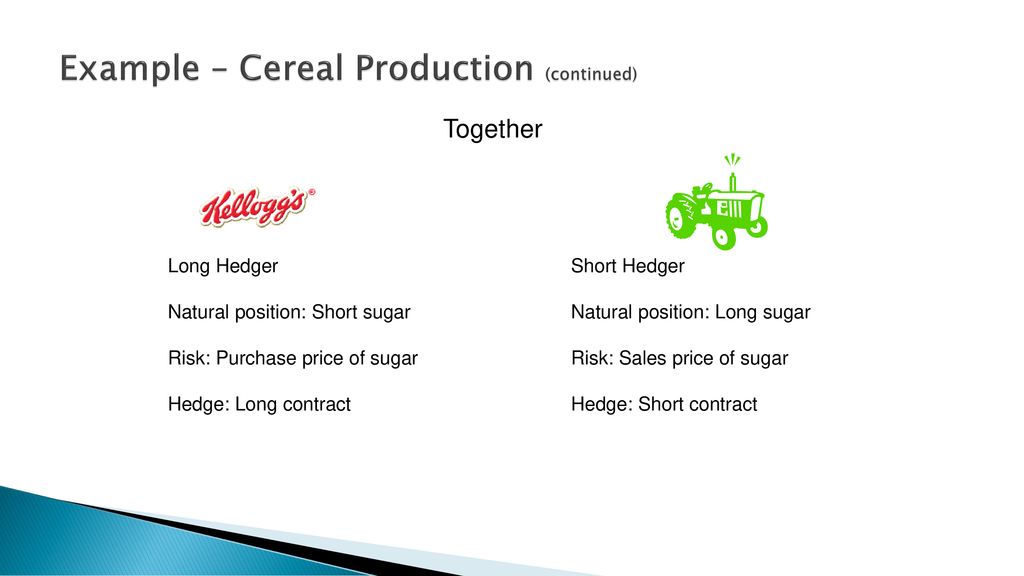

For example, if a company has a liability to deliver 1 million euros in six months, it can hedge this risk by entering into a contract to purchase 1 million euros on the same date, so that it can buy and sell in the same currency on the same date We note below several ways to engage in foreign currency hedging Loan Denominated in a Foreign Currency. Hedging behaviour is an approach taken by many businesses and investors to reduce risk For example you can hedge against commodity price uncertainty by buying in futures markets Or you can hedge against stock market volatility by also taking a stake in the government bond markets Natural hedges occur when a business's structure of production protects it from exchange rate volatility, such as when suppliers, factories and customers operate in the same currency. 5 (6) Contents1 Hedging Definition2 Futures Hedging Strategies3 Futures Hedging Examples Hedging Definition A hedging is designed to protect the value of a share of market volatility Hedging strategies may include derivatives, short selling and diversification Coverage usually involves placing a trade or investment in an asset that moves in the opposite direction of stock.

Hedging Example – Fixed Value items Let us say the organization has issued nonconvertible debentures at an 8% pa coupon rate, and coupons are paid annually In this case, the organization feels that the interest rate prevailing in the market at the time of the next coupon payment (due in a month) is going to be lower than 8% pa. A naturalgas producer that hedges its entire annual production output, valued at $3 billion in sales, for example, would be required to hold or post capital of around $1 billion, since gas prices can fluctuate up to 30 to 35 percent in a given year. Natural Gas Futures Long Hedge Example A power company will need to procure 100 million mmbtus of natural gas in 3 months' time The prevailing spot price for natural gas is USD /mmbtu while the price of natural gas futures for delivery in 3 months' time is USD /mmbtu.

13 Best Shrubs for Making Hedges Japanese Holly (Ilex crenata) Japanese holly looks more like a boxwood shrub than holly shrub, bearing small, oval English Holly (Ilex aquifolium) English holly, with its prickly leaves, makes a better hedge plant than Japanese holly Barberry Bushes (Berberis. A natural hedge is an investment that reduces the undesired risk by matching cash flows (ie revenues and expenses) For example, an exporter to the United States faces a risk of changes in the value of the US dollar and chooses to open a production facility in that market to match its expected sales revenue to its cost structure. 4 3 Natural gas and propane are offered in abbreviated evening sessions Electricity contracts trade exclusively on NYMEX ACCESS® for approximately 23 hours a day Terminals are in use in major cities in the United States and in London, Sydney, Hong.

The most popular method to mitigate currency exchange risk is the simple “natural hedge” This is when an exporter and importer complete a transaction in the same currency;. Another natural hedge method for currency risk is to borrow in the same foreign currency For example, a US company sells its products in Japan and collects its revenue in JPY It will face a foreign exchange loss if JPY devalues relative to USD To hedge the risk, the company can borrow money around the amount of estimated revenue in JPY. So the company is naturally hedged, not natural in this case, it involves the decision of the company So the word natural may be a little funny.

Or when a company’s. Last but not least, while this example addressed how a crude oil producer can hedge with futures, one can employ similar methodologies to hedge the production of other commodities as well This post is the first in a series on hedging crude oil and natural gas production The subsequent posts can be viewed via the following links. Summary and Final Tasks.

Thus reducing risk means reducing profits For most shortterm traders, eg for a day trader, hedging is a difficult strategy to follow. Hedging is a temporary substitute, since the corn will eventually be sold in the cash market Hedging is defined as taking equal but opposite positions in the cash and futures market For example, assume a producer who has harvested 10,000 bushels of corn and placed it in storage in a grain bin. A natural hedge is a risk mitigation technique that involves investing in asset pairings that are negatively correlated Natural hedges also occur through the normal course of business;.

Natural Hedging All You Need To Know About It

:max_bytes(150000):strip_icc()/96303186-5bfc388546e0fb00260eb58a.jpg)

Natural Hedge Definition

Managing Industrials Commodity Price Risk Mckinsey

Natural Hedge Example のギャラリー

Give Me Shelter How To Grow A Native Irish Hedge

:max_bytes(150000):strip_icc()/foreign-currency-804917648-053324a1c58746af86bfb9aab260f7f0.jpg)

Natural Hedge Definition

Difference Between Hedging And Derivatives Difference Between

Hedge Finance Wikipedia

Hedge Ratio Definition Formula Example To Calculate Hedge Ratio

View Through Opening In Hedge Of Gardens Buy Image Living4media

Pdf Variation In Hedging Across Psychology Medicine And Chemical Engineering Research Articles And Across Different Rhetorical Sections Of The Ras

Simple Hedging Techniques Of A Firm Foreign Exchange Management

Natural Hedge Overview Applications In Business And Investing

Foreign Currency Exposure And Hedging In Australia Bulletin December Quarter 17 Rba

Example Of Yew Evergreen Hedging Providing Structure And Colour In A Winter Or Spring Garden March Yorkshire England Uk Stock Photo Alamy

Solved Example Ford Purchases From Mazda In Japanese Yen Chegg Com

:max_bytes(150000):strip_icc()/bmp_005-5bfc37ffc9e77c00587a66c9.jpg)

Natural Hedge Definition

Core Ac Uk Download Pdf Pdf

How Companies Use Derivatives To Hedge Risk

Foreign Currency Exposure And Hedging In Australia Bulletin December Quarter 17 Rba

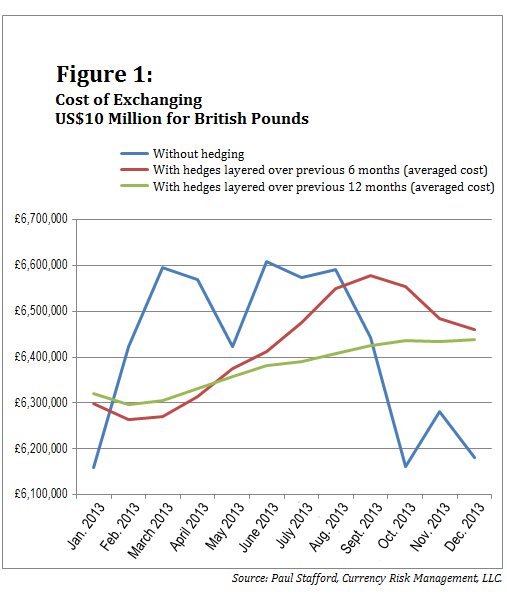

Getting A Better Handle On Currency Risk Mckinsey

Chapter 13 Hedging Foreign Exchange Risk

Repository Upenn Edu Cgi Viewcontent Cgi Article 1096 Context Accounting Papers

Chapter 13 Hedging Foreign Exchange Risk

1st Example Of Long Hedge

Ifrs09 Ifrs9 Hedging Accounting For Hedges Hedge Accounting Inves

How Companies Use Derivatives To Hedge Risk

1 Example Of A Perfect Cash Flow Hedge Of Interest Rate Risk Download Table

Hedging Swaps Interest Rate Swaps And Risk

/thespruce.com-best-shrubs-for-hedges-4151139-1-1a4352e0ea274ccd8bc39402e2bace06.jpg)

13 Best Shrubs For Making Hedges

Grain Price Hedging Basics Ag Decision Maker

Chapter 13 Hedging Foreign Exchange Risk

Why Hedging Helps To Combat Currency Risk

Hedge Finance Wikipedia

Hedging Costs And Types Company Financial Management

Derivatives Lecture Ppt Download

How Do Japanese Exporters Manage Their Exchange Rate Exposure Vox Cepr Policy Portal

Hedging Meaning Example Areas And Risks Types Strategies

Foreign Currency Exposure And Hedging In Australia Bulletin December Quarter 17 Rba

Natural Hedging Benefits Disadvantages And More

On Hedging By Richardrichard Macminnmacminn 8 14 152 Objectives What Are The Goals Of Risk Management Premises For Risk Management Is Risk Management Ppt Download

Natural Hedge Overview Applications In Business And Investing

Foreign Exchange Hedging For Businesses Your Questions Answered Cambridge

:max_bytes(150000):strip_icc()/GettyImages-936533430-f2aad79f5972445685642805c06a4574.jpg)

Natural Hedge Definition

/GettyImages-84743727-22a22c147d164cf59a35e4500cb45933.jpg)

Verbal Hedge Definition And Examples

Difference Between Hedging And Derivatives Difference Between

Hedging Examples Strategies How Does Hedging Work

1 Example Of A Perfect Cash Flow Hedge Of Interest Rate Risk Download Table

Q Tbn And9gcrdjnlhtamx2odaubqda1kzfg1hdeimp7nu6qqlhtu Aoxvjaxz Usqp Cau

Managing Economic Operating Exposure Ppt Video Online Download

17 Examples Of Natural Frames Digital Photo Secrets

Q Tbn And9gcsdfl1esyxcjiz 9dcamm7hdilryk Bhmukjccjy8v3kjzylt0m Usqp Cau

The Right Way To Hedge Mckinsey

The Right Way To Hedge Mckinsey

Realising The Potential Of The Humble Hedge Hedges Hedgerow Forest Garden

Basis An Often Overlooked Aspect Of Natural Gas Hedging

Natural Hedging All You Need To Know About It

Guide To Managing Foreign Exchange Risk Toptal

Pdf Chapter 11 Hedging In Political Discourse

The Fundamentals Of Oil Gas Hedging Futures

Hedging Strategy

Using Hedging In A Marketing Program Ag Decision Maker

2

Still Living With Mortality The Longevity Risk Transfer Market After One Decade British Actuarial Journal Cambridge Core

Foreign Currency Exposure And Hedging In Australia Bulletin December Quarter 17 Rba

Guide To Managing Foreign Exchange Risk Toptal

1

How Companies Use Derivatives To Hedge Risk

Hedges Of Biodiversity National Geographic Society

Tools For Hedging Foreign Exchange Risk Video Lesson Transcript Study Com

Q Tbn And9gcrozgqkoljdndicplinac7p5ieny Ajficg2lzyc94pr1ktf0ls Usqp Cau

Hedging And Risk Management Renesource Capital

2

Using Hedging In A Marketing Program Ag Decision Maker

How Companies Use Derivatives To Hedge Risk

Ifrs09 Ifrs9 Hedging Accounting For Hedges Hedge Accounting Inves

Guide To Managing Foreign Exchange Risk Toptal

Derivatives Lecture Ppt Download

Example Of Yew Evergreen Hedging Providing Structure And Colour In A Winter Or Spring Garden March Yorkshire England Uk Stock Photo Alamy

Hedges Online Good Example Of A Customers Red Robin Hedge T Co Twiopm8fnm Hedging Red Photinia Plantpic Surrey

Hedging With Forwards Youtube

Cash Flow Hedging Best Practices Treasury Risk

How To Get Craft The New Hedge Fence Nature Day In Animal Crossing New Horizons

Natural Hedging All You Need To Know About It

Hedge Finance Wikipedia

Solved 1 A Natural Short Exposure Can Be Hedged With A S Chegg Com

What Is Natural Hedge Definition By All Finance Terms

How Is A Hedge Of Interest Rate Risk Impacted Kpmg Global

Hedging Vs Forward Contracting Ag Decision Maker

Derivatives And Hedging Accounting Vs Taxation

Natural Hedging All You Need To Know About It

What Is Hedging In Academic Writing Enago Academy

Swaptions Give Producers Increased Hedging Flexibility

Hedge Funds Fund Investing Hedges

Natural Hedging All You Need To Know About It

The Right Way To Hedge Mckinsey

Hedging Arrangement Overview Types Examples How They Work

Hedging Examples Strategies How Does Hedging Work

Natural Hedge What Is Natural Hedge Fincash

Energy Hedging 101 Collars

Introduction To European Crude Oil

Chapter 18 Option Finance Futures Contract

Accounting For Fair Value Of Hedges Examples Journal Entries

The Insurance Industry And Hedging With Derivative Instruments

Ppt Hedging Energy In The New Marketplace Powerpoint Presentation Free Download Id