Ifrs 9 Deutsch

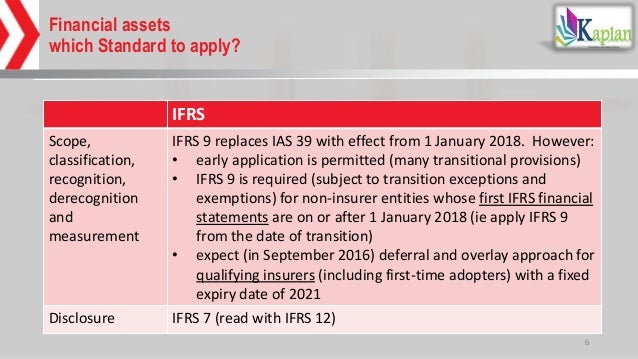

The effective date of IFRS 9 is annual periods commencing on or after 1 January 18 There is a choice of full retrospective application (ie restating comparatives as if IFRS 9 had always been in force, provided that this can be done without the use of hindsight), or retrospective application without restatement of prior year comparatives.

Ifrs 9 deutsch. These Guidelines have been developed in accordance with of the new Article 473a, paragraph Eight, included in the Proposal for a Regulation of the European Parliament and of the Council amending Regulation (EU) No 575/13 as regards the transitional period for mitigating the impact on own funds of the introduction of IFRS 9 and the large exposures treatment of certain public sector exposures. IFRS 9 behandelt drei großen Themen, die in drei Phasen erarbeitet wurden Deshalb werden sie auch jetzt noch so bezeichnet Phase 1 behandelt das Thema Klassifizierung und Bewertung von Finanzinstrumenten, Phase 2 das Thema Wertminderung, Phase 3 die Bilanzierung von Hedgegeschäften Entwicklung IFRS 9 wurde am 24. IFRS 9 is effective for annual periods beginning on or after 1 January 18 However, the Standard is available for early application In addition, the own credit changes can be early applied in isolation without otherwise changing the accounting for fi nancial instruments 4.

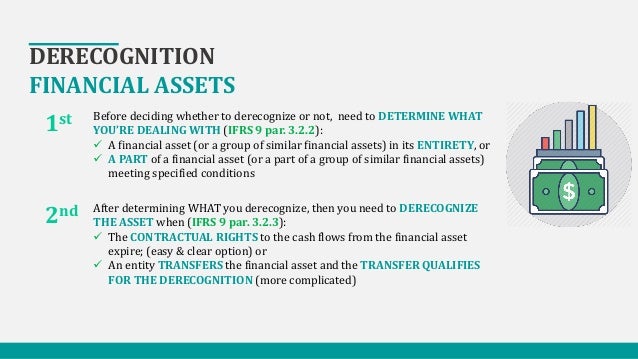

IFRS 16 presentation of financial statements IAS 1 inventories IAS 2 accounting policies, changes in accounting estimates and errors IAS 8 PPE IAS 16 revenue IAS 18 accounting for government grants and disclosure of government assistance IAS earnings per share IAS 33 impairment of assets. IFRS fokussiert IFRS 9 – Das neue Wert minderungsmodell im Überblick IFRS Centre of Excellence Juli 14 Das Wichtigste in Kürze Mit dem jüngst veröffentlichten IFRS 9 (14) Finan zinstrumente werden neben den Vorschriften für Wertminderungen auch die Klassifizierung und Bewer tung von Finanzinstrumenten endgültig geregelt. Derecognition financial assets (IFRS 9) 9 9 Derecognition Issue Complicated when Definition • When should an entity remove a financial asset from its financial position?.

The PRA letter is helpful in providing specific guidance to assist banks in navigating the significant judgements required to comply with IFRS 9 in uncertain conditions and follows similar statements from the European Securities and Markets Authority (ESMA) and the European Banking Authority (EBA) this week. And (b) paragraph B63 of IFRS 15 on consideration in the form of salesbased or usagebased royalties on licences of intellectual property (Example 4) Example 1—Collectability of the consideration. Listing of International Financial Reporting Standards International Financial Reporting Standards are developed by the International Accounting Standards Board Access to IFRS technical summaries and unaccompanied standards (the core standards, excluding content such as basis for conclusions) is available for free from the IASB website.

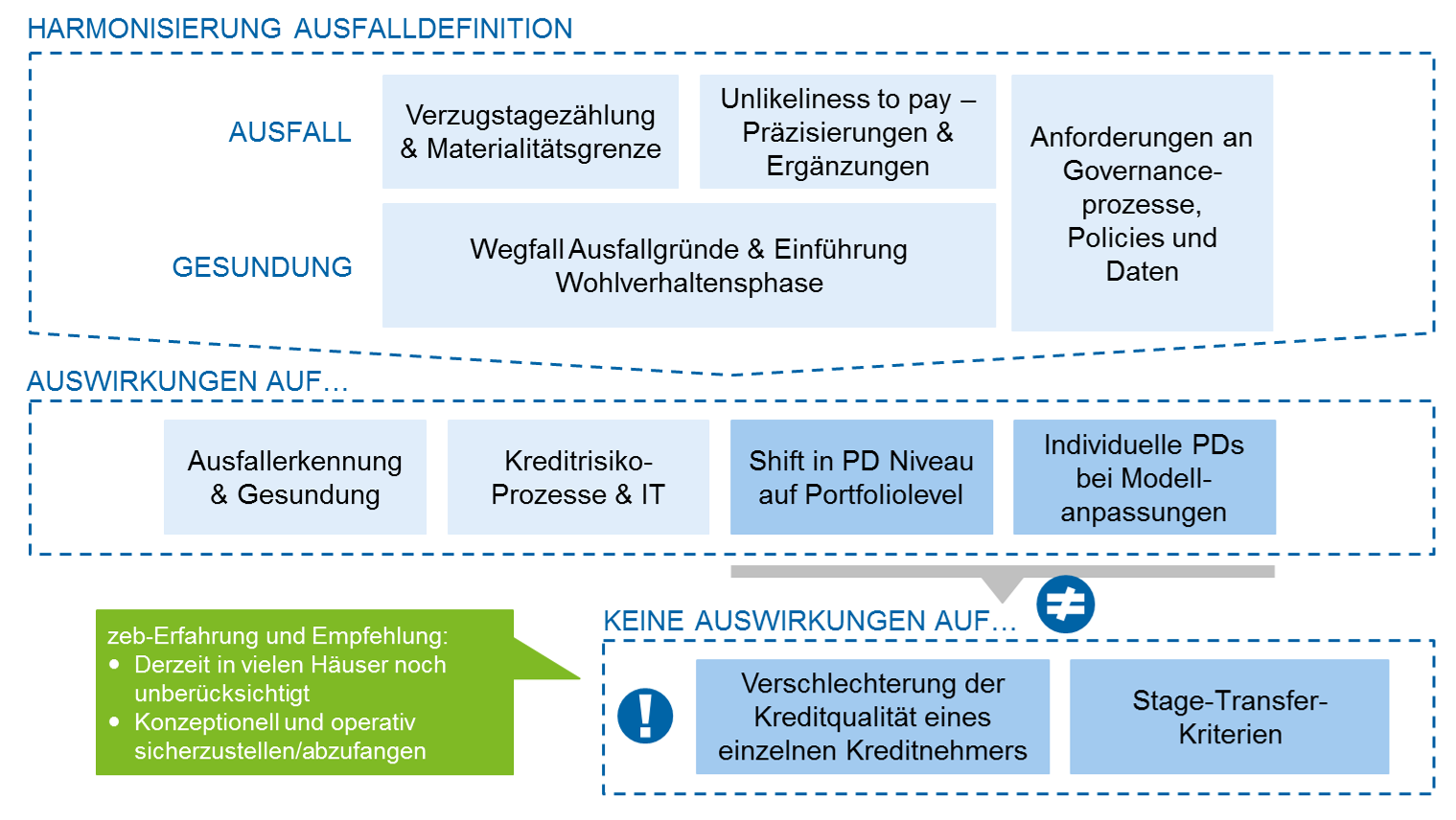

Not sure if TurnKey Lender or IFRS 9 Impairment Solution is best for your business?. IFRS 9 Finanzinstrumente aus der Sicht von Industrie unternehmen 7 für das Liquiditätsrisiko sowie Verwaltungskosten dürfen ebenfalls enthalten sein Der Principal ist der Marktwert des Schuldinstrumentes bei Ersterfassung Erfüllen Schuldinstrumente den SPPITest nicht, sollen diese dem Geschäfts. IFRS 9 states that firms shall apply a definition of default consistent with the definition used for internal credit risk management purposes However, there is a rebuttable presumption that a default does not occur later than when the instrument is 90 days pastdue.

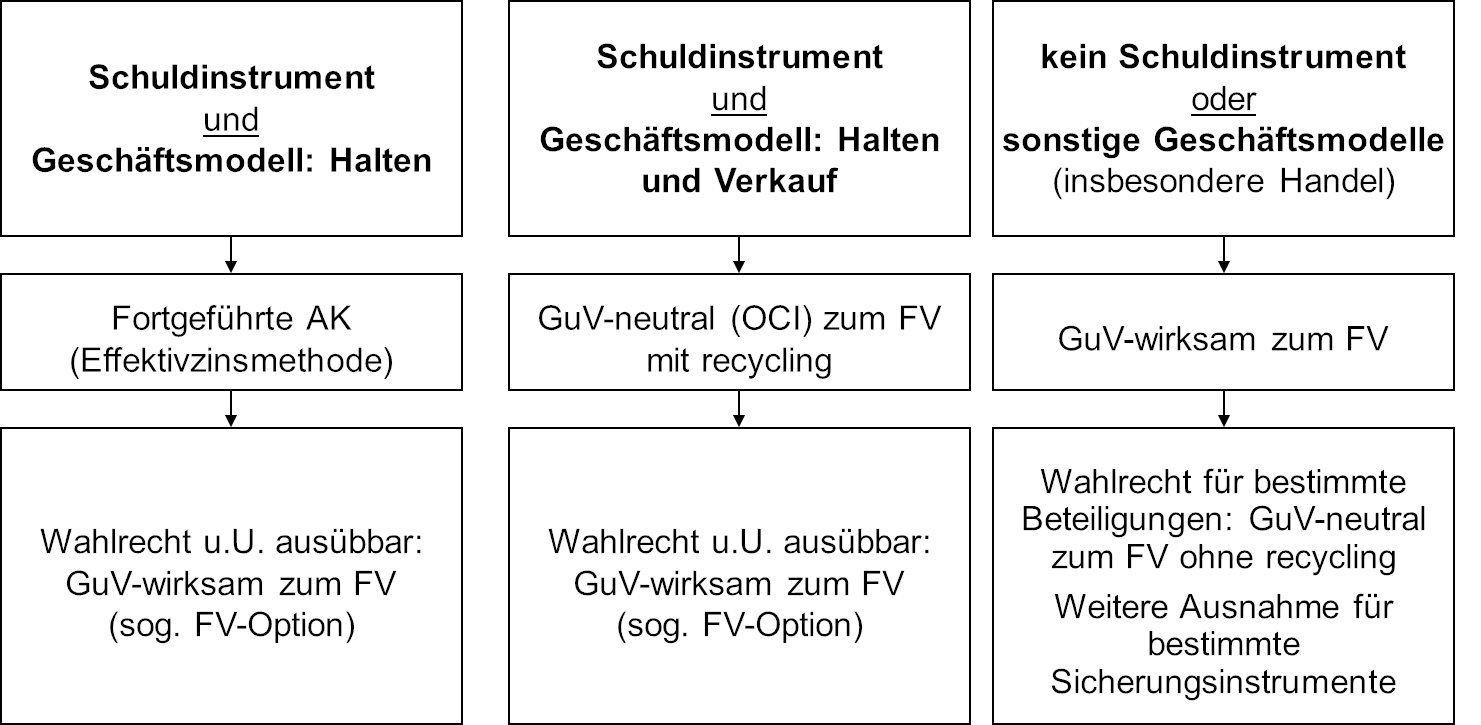

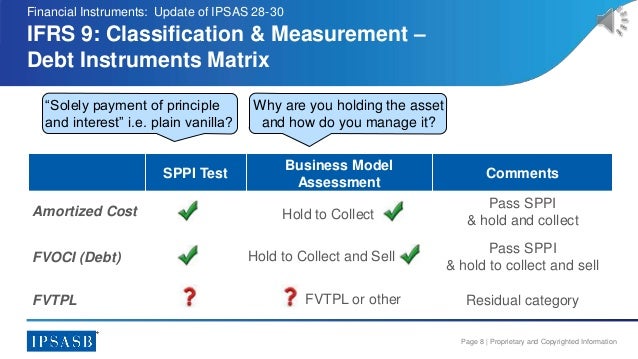

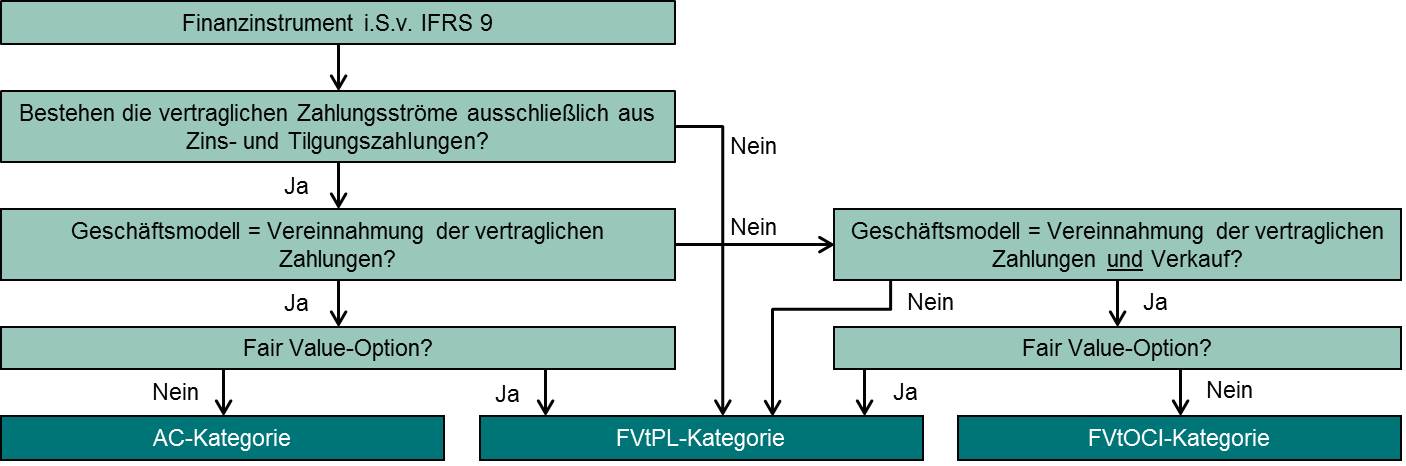

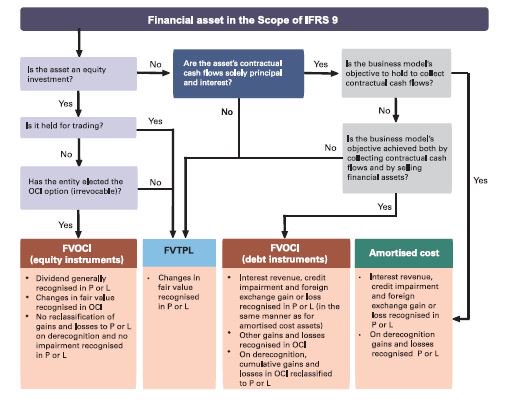

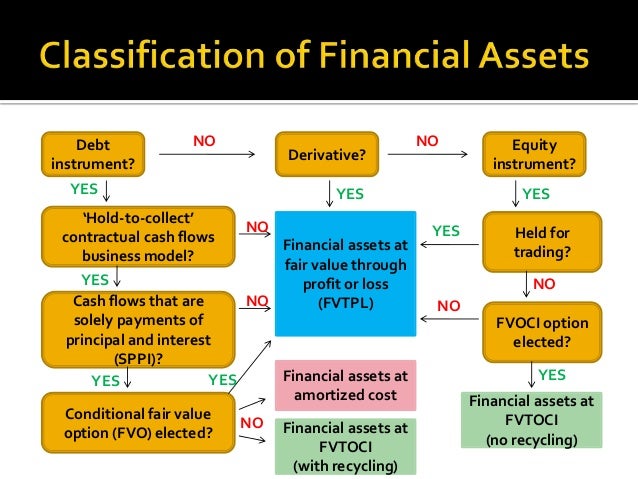

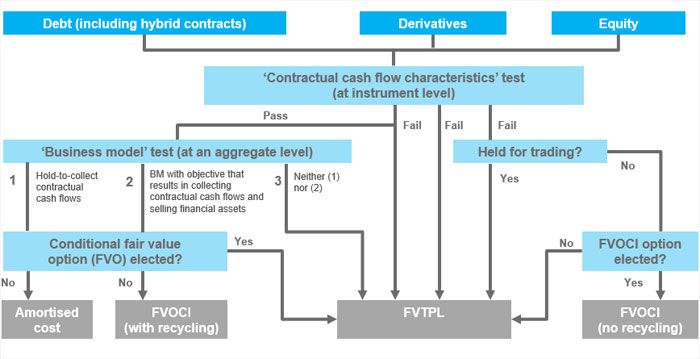

IFRS 9 has three classification categories for debt instruments amortised cost, fair value through other comprehensive income (‘FVOCI’) and fair value through profit or loss (‘FVPL’) Classification under IFRS 9 for debt instruments is driven by the entity’s business model for managing the financial assets and. Compliance with the new regulations will already be mandatory for banks and corporates in January 18 Because of dependencies between IFRS 9 and the standard for booking insurance contracts IFRS 17 insurance companies are allowed to postpone the introduction of IFRS 9 until 21 at the latest Your Goals Resultsfocused interpretation. IFRS 9 Financial Instruments—Fair value hedge of foreign currency risk on nonfinancial assets (Agenda Paper 9) 17 Sep 19 IFRS 9 — Fair value hedge of foreign currency risk on nonfinancial assets 11 Jun 19 IFRS 9 — Curing of a creditimpaired financial asset 05 Mar 19 IFRS 9 — Application of the highly probable requirement.

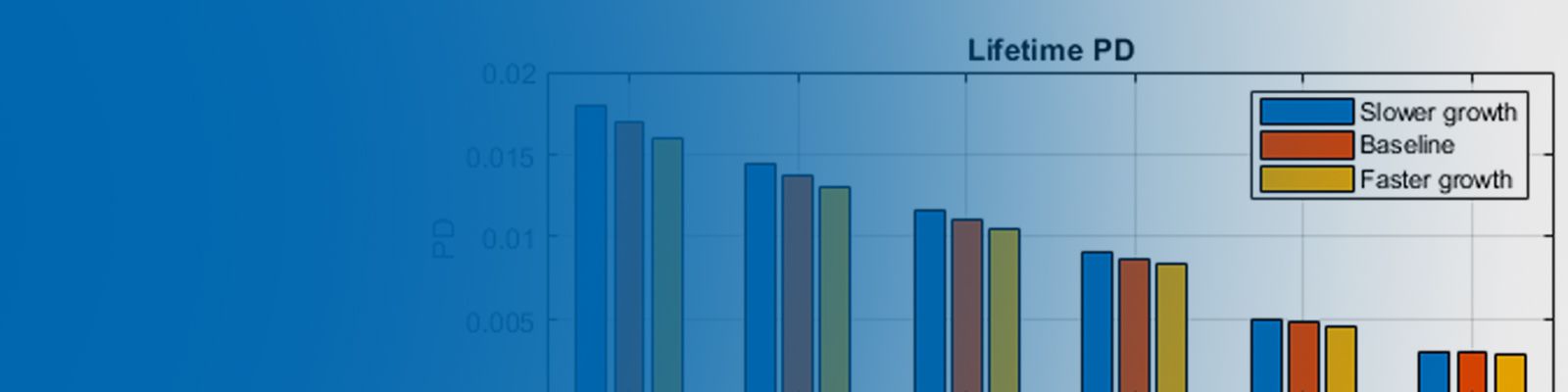

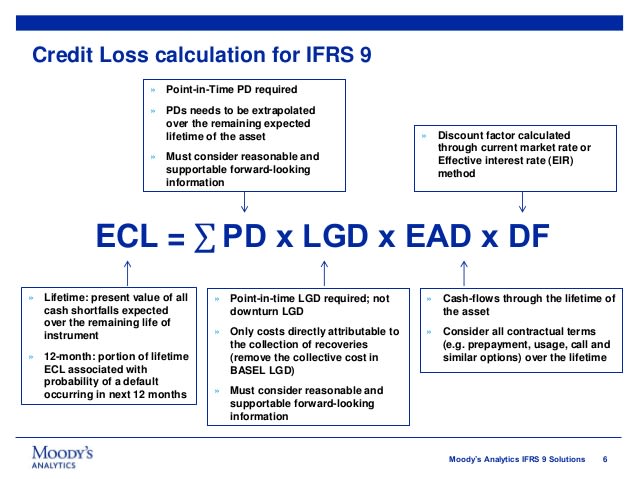

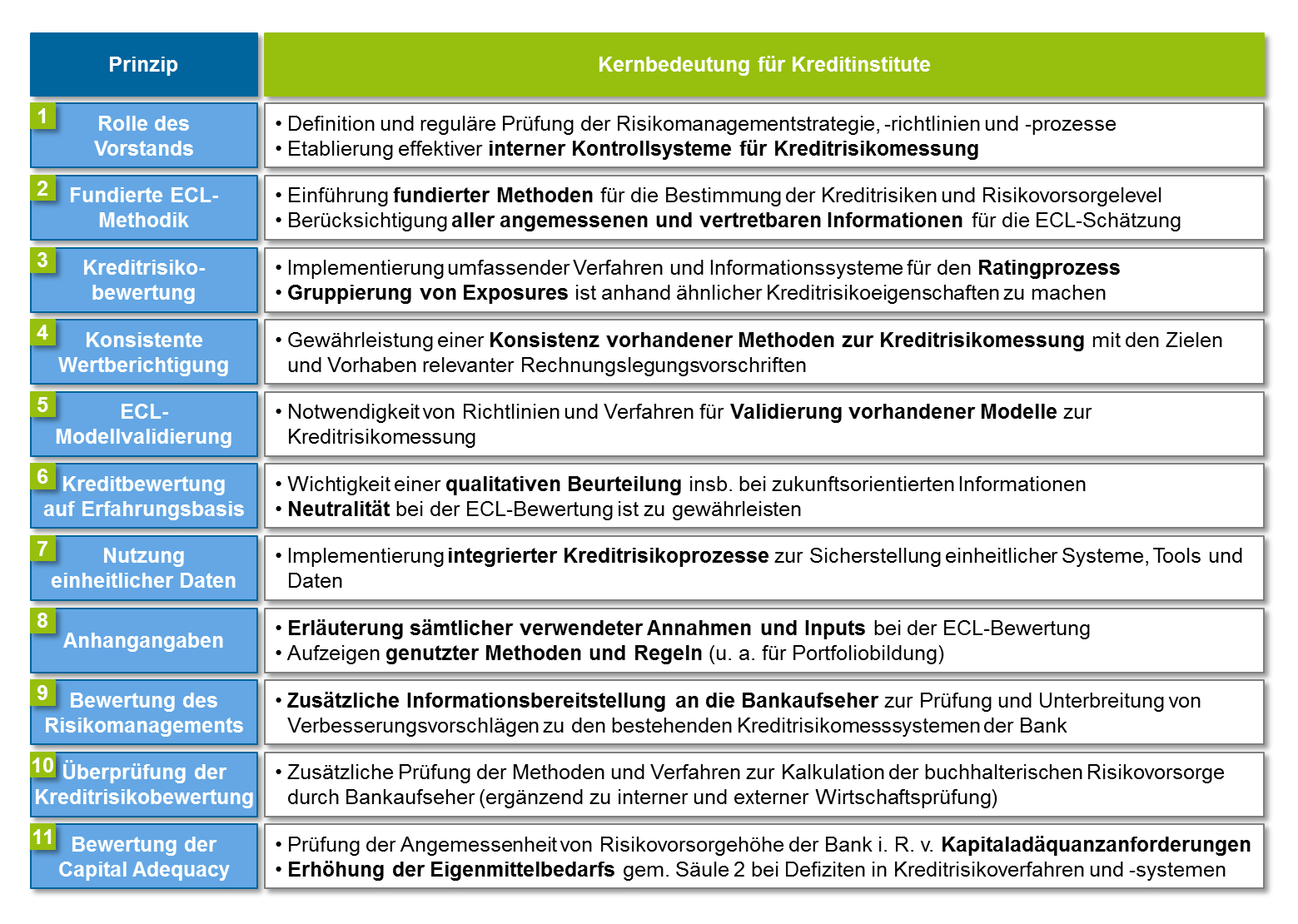

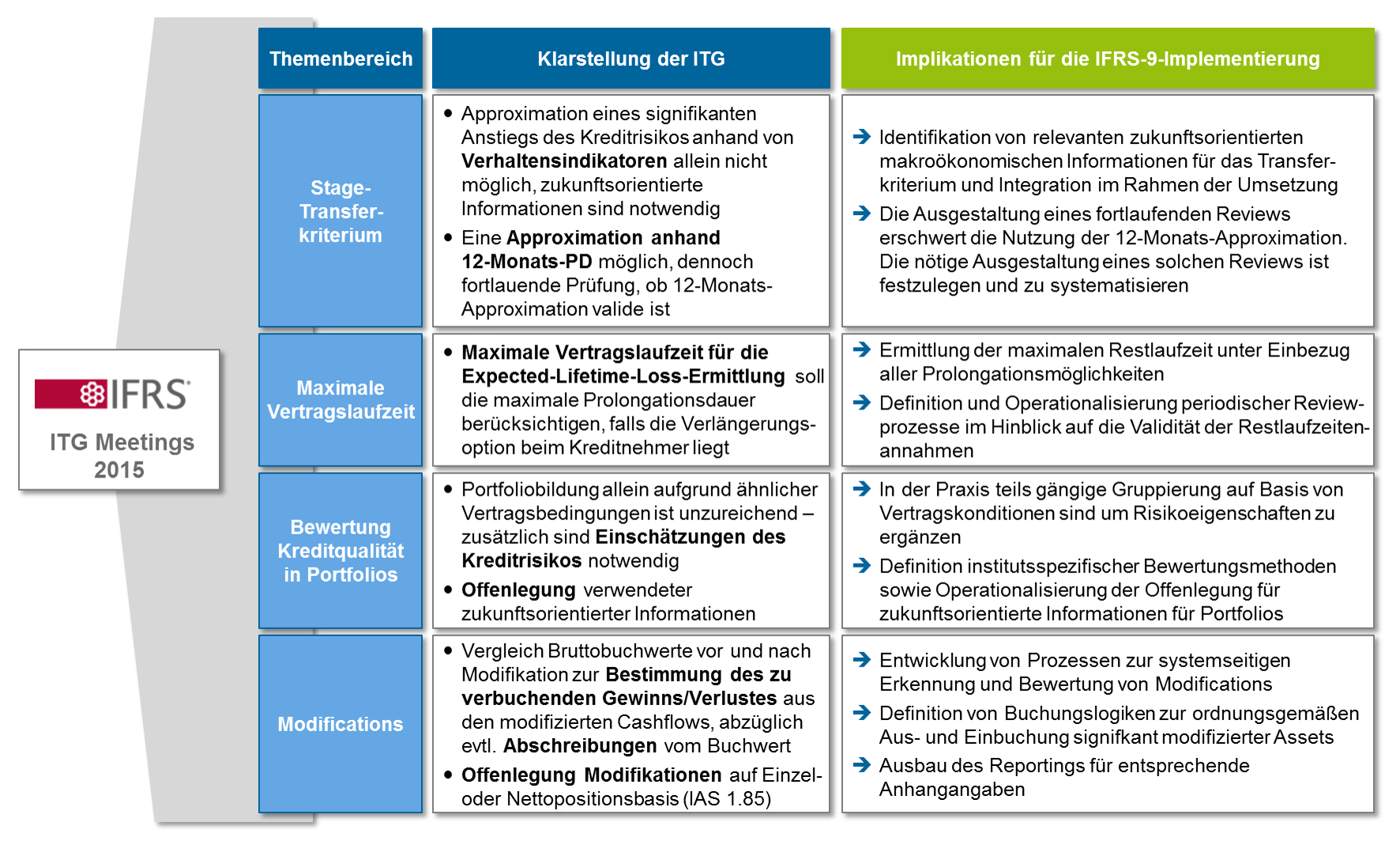

IFRS 9 Financial Instruments has brought fundamental changes to financial instruments accounting in recent years Our materials will help you understand the requirements of this standard as they relate to your company, as well as offering insights and guidance on the application of IFRS ® Standards. IFRS is short for International Financial Reporting Standards IFRS is the international accounting framework within which to properly organize and report financial informationIt is derived from the pronouncements of the Londonbased International Accounting Standards Board (IASB) It is currently the required accounting framework in more than 1 countries. IFRS 9 requires the institution to consider, where pertinent, the evolution of credit quality to maturity, which, from a risk management perspective, is a more transparent approach This approach should, in addition to satisfying the regulators, lead to better credit approval decisions, which also will improve over time as the supporting data.

Https//wwwcpdboxcom/This is just the short executive summary of IFRS 9 and does NOT replace the full standard you can see the full text on IFRS Foundati. So far, the result consists of the publication of IFRS 9 “Financial Instruments” issued by IASB and an exposure draft on financial instruments issued by FASB This paper aims at analyzing the new rules, concepts and principles introduced by IFRS 9 In addition, it attempts to identify some possible consequences of its application. Contract often still can be measured at Amortized Cost Under IFRS 9, the entire contract will have to be measured at FVPL in all but a few cases The IFRS 9 model is simpler than IAS 39 but at a price— the added threat of volatility in profit and loss IFRS 9 replaces IAS 39’s patchwork of arbitrary bright line tests, accommodations,.

AnaCredit means Analytical Credit Datasets AnaCredit is a draft regulation published by the European Central Bank Since AnaCredit will request detailed data to each individual loan, there are synergies between its implementation and the implementation of IFRS 9, a new accounting standard for financial loan instruments. BOZ IFRS 9 Guidance Note & Deferment of Compliance with Corporate Governance Directives Dear esteemed member, The Bank of Zambia has issued circulars on implementation of IFRS 9 for regulatory purposes and Deferment of Compliance with Corporate Governance Directives To access these two (2) documents, you can follow the links below and download. IFRS1 Australia, New Zealand and Israel have essentially adopted IFRS as their national standards2 Brazil started using IFRS in 10 Canada adopted IFRS, in full, on Jan 1, 11 Mexico will require adoption of IFRS for all listed entities starting in 12 Japan is working to achieve convergence of IFRS and began permitting certain qualifying.

The international Accounting Standards Board (IASB) published the complete version of IFRS 9, which replaced most of the guidance in IAS 39 IFRS 9 includes amended guidance for the classification and measurement of financial assets It outlines recent developments in hedge accounting, as well as examines the principles contained in the expected loss from credit impairment. New ifrs 9 1 Accounting for financial instruments IFRS 9 2 2 »Classifying financial instruments »Recognising and derecognising financial assets »Impairment of financial assets Note other aspects of accounting for financial instruments have been covered in other sessions at this workshop Overview 3 Definitions 4. IFRS 9 soll zukünftig IAS 39 als Standard für die Bilanzierung von Finanzierungsinstrumenten ablösen Wie IAS 39 behandelt somit auch IFRS 9 alle Themen mit.

The standard IFRS 9 has been effective from January 18, yet after its first year, we have an amendment This amendment relates to the classification of certain financial assets, namely those with specific prepayment options Let me explain this a bit more since I received some questions what the negative compensation in prepayment option is. IFRS 9 – Financial Instruments „Der Weg zu einer erfolgreichen Implementierung der neuen Anforderungen“ Bereits seit den ersten Diskussionen im Jahr 08, aber spätestens seit der Veröffentlichung des „IFRS 9 – Financial Instruments“ durch das IASB im Juli 14 steht fest – die neuen Bilanzierungs und Bewertungsregelungen für finanzielle Vermögenswerte stellen einen Umbruch in der Bankenlandschaft dar. • An entity has ongoing involvement with a transferred financial asset • Removal of a previously recognised financial asset from the statement of financial position.

IFRS 9 and CECL Credit Risk Modelling and Validation A Prac £4761 starrating (13) International Financial Reporting Standards (IFRS) Deutsch £2495 starrating. IFRS 9 Instead, they set out the principal changes to the disclosure requirements from those under IFRS 7 Financial Instruments Disclosures under each of classification and measurement, impairment and hedging A separate section sets out the disclosures that an entity is required to make on transition to IFRS 9 Disclosures under IFRS 9 1. The submitter asked whether an entity recognises a gain or loss, in profit or loss, when a financial liability is modified or exchanged and that modification or exchange does not result in derecognition of the financial liability The submitter noted that paragraph 543 of IFRS 9 requires an entity to recognise any gain or loss arising from a modification of a financial asset that does not result in its derecognition in profit or loss immediately.

Der International Financial Reporting Standard 9 (IFRS 9) löst den derzeitigen Standard IAS 39 ab und wird ab für alle nach IFRS bilanzierenden Unternehmen verbindlich. Read our product descriptions to find pricing and features info. In order to determine the appropriate classification category under IFRS 9, entities must assess whether their financial assets meet the SPPI test at the date of initial recognition While financial assets that contained nonclosely related embedded derivatives under IAS 39 are more likely to fail this test, it is important that the contractual.

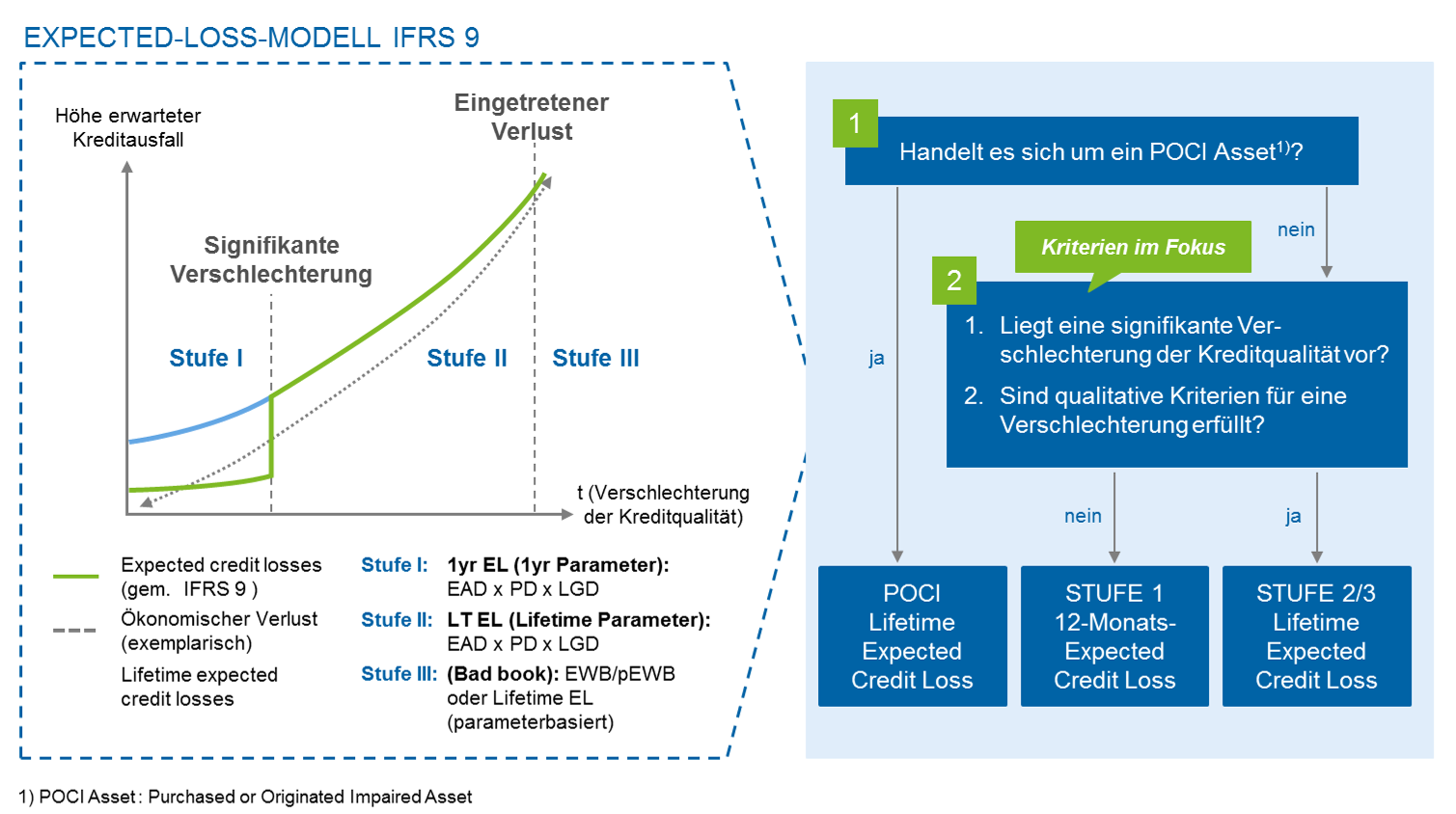

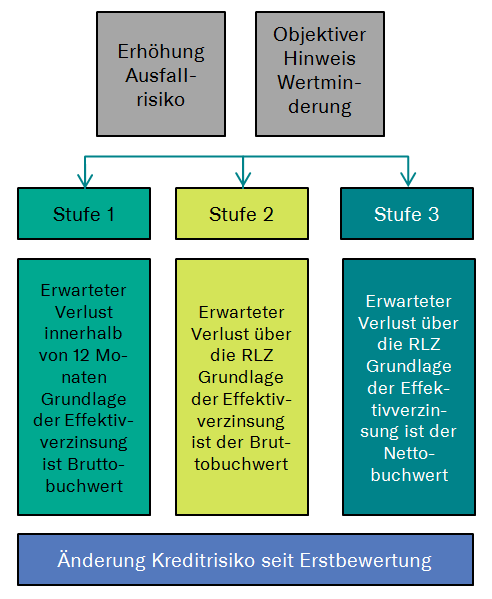

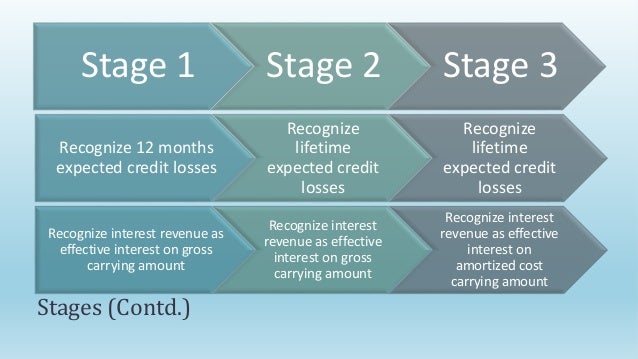

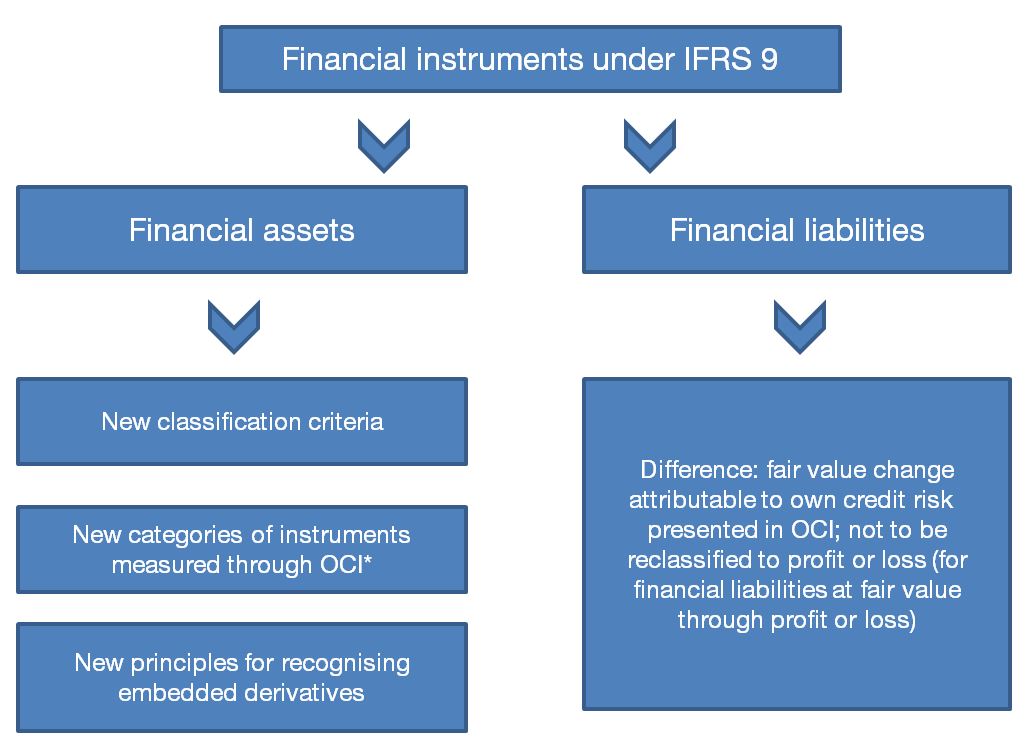

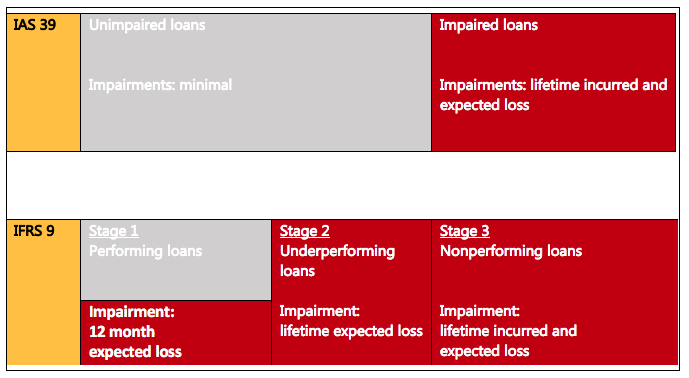

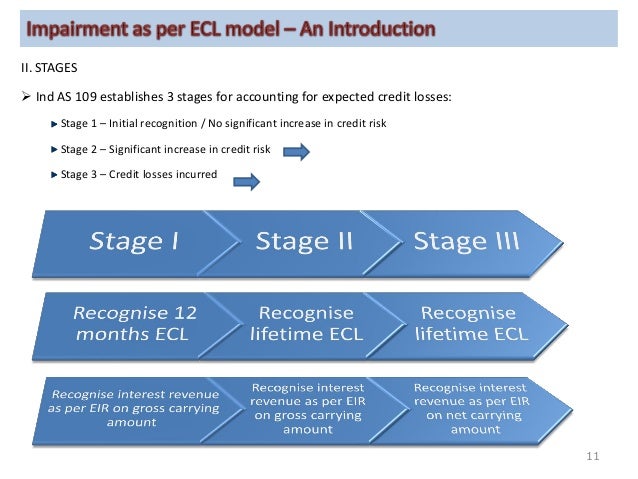

December 17 In depth IFRS 9 impairment significant increase in credit risk The introduction of the expected credit loss (‘ECL’) impairment requirements in IFRS 9 Financial Instruments represents a significant change from the incurred loss requirements of IAS 39. Contract assets are subject to impairment requirements of IFRS 9 These requirements relate to measurement, presentation and disclosure with respect to impairment (IFRS ) Specifically, entities are required to recognise expected credit losses on their contract assets More about IFRS 15. IFRS 9 removes the requirement to separate embedded derivatives from financial asset host contracts (it instead requires a hybrid contract to be classified in its entirety at either amortised cost or fair value) ject to criteria being met).

This newsletter provides updates on IFRS developments that directly impact banks, and considers the potential accounting implications of regulatory requirements For our latest take on how banks are implementing the new financial instruments standard – IFRS 9 – read our online magazine, Realtime IFRS 9. Thailand defers adoption of IFRS 9 While Thailand was scheduled to replace IAS 39 with IFRS 9 from 1 January 19 (one year after the IASB effective date), the Federation of Accounting Professions (FAP) has now decided to postpone the mandatory effective date of the standard in Thailand by one year to. The implementation of IFRS 9 as of January 1, 18, led to a decrease of Deutsche Bank’s Shareholders’ equity of € 671 million including a tax benefit of € 199 million Regulatory capital decreased by € 393 million due to a lower deduction of expected credit.

Guidance on reporting under IFRS 9 (which relates to the recognition of financial assets and liabilities) in the context of expected losses as a result of defaults treatment of borrowers who breach covenants due to COVID19, and regulatory capital treatment of IFRS 9 The overwhelming theme of the letter is that the PRA is advising calm and pragmatism regarding recognising and acting on defaults. IFRS 9 replaces the rules based model in IAS 39 with an approach which bases classification and measurement on the business model of an entity, and on the cash flows associated with each financial asset This has resulted in i Elimination of the ‘held to maturity’, ‘loans and receivables’ and ‘availableforsale’ categories Instead, IFRS 9 introduces. Example 9 Reconciliation of changes in property, plant and equipment These examples are based on illustrative examples from the IFRS for SMEs They represent how reconciliation of gross carrying amount, accumulated depreciation and carrying amount of property, plant and equipment might be tagged using detailed XBRL tagging Inline XBRL;.

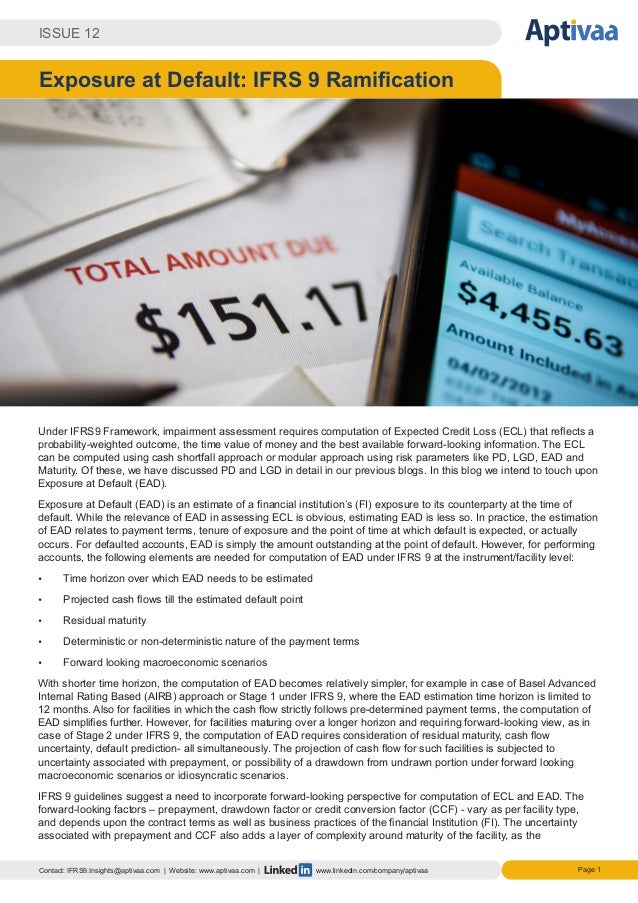

IFRS 9 is the International Financial Reporting Standard that addresses the accounting of financial instruments, such as loans, mortgages, and other credit instruments The directive has three core components classification of instruments, impairment calculation, and hedge accounting Because credit instruments are at risk of default, accounting for instruments in accounts must consider likelihood of future impairment, through expected loss and lifetime expected credit loss. IFRS 9 – Financial Instruments „Der Weg zu einer erfolgreichen Implementierung der neuen Anforderungen“ Bereits seit den ersten Diskussionen im Jahr 08, aber spätestens seit der Veröffentlichung des „IFRS 9 – Financial Instruments“ durch das IASB im Juli 14 steht fest – die neuen Bilanzierungs und Bewertungsregelungen für finanzielle Vermögenswerte stellen einen Umbruch in der Bankenlandschaft dar. International Financial Reporting Standard 9 (IFRS 9) is a new accounting standard set to replace International Accounting Standard 39 (IAS 39) It introduces a new approach to accounting for financial instruments and is expected to become effective in December 18 The three main areas covered by IFRS 9 are.

Nized and measured in accordance with IFRS 9, Financial Instruments The benefit of the belowmarket rate of interest shall be measured as the difference between the initial carrying value of the loan determined in accordance with IFRS 9 and the proceeds received The benefit is accounted for in accordance with this Standard. With the help of Capterra, learn about IFRS 9 Impairment Solution, its features, pricing information, popular comparisons to other Banking Systems products and more Still not sure about IFRS 9 Impairment Solution?. IFRS 9 introduces a new impairment model based on expected credit losses, resulting in the recognition of a loss allowance before the credit loss is incurred Under this approach, entities need to consider current conditions and reasonable and supportable forwardlooking information that is available without undue cost or effort when estimating expected credit losses.

Deloitte elearning — IFRS 9 classification and measurement This Deloitte elearning module provides training in the classification and measurement of financial assets and liabilities under IFRS 9 Financial Instruments Topics covered include the three financial asset categories and two financial liability categories, the appropriate measurement basis for each category, and accounting for embedded derivatives and guarantee contracts. IFRS 9, as amended, introduces a logical approach for the classification of financial assets, which is driven by cash flow characteristics and the business model in which an asset is held and a new, expectedloss impairment model that will require more timely recognition of expected credit losses. IFRS 9 – Classification and measurement At a glance On July 24, 14 the IASB published the complete version of IFRS 9, Financial Instruments, which replaces most of the guidance in IAS 39 This includes amended guidance for the classification and measurement of financial assets by introducing a.

IFRS 9, IFRS 15 and IFRS 16 What the figures mean The accounting rules for the balance sheet came into force in 05 Since then, they have been continuously updated Accordingly, the figures conceal the newly published IFRS standards. IFRS 9 IFRS 9 is the new international financial reporting standard for financial instruments, replacing IAS 39, and is applicable from 1 January 18 (with early application permitted) The principal updates of IFRS 9 relate to Classification and measurement classification of financial instruments is now driven by cash flow characteristics and the business model inRead More. IFRS 9 specifies how an entity should classify and measure financial assets, financial liabilities, and some contracts to buy or sell nonfinancial items IFRS 9 requires an entity to recognise a financial asset or a financial liability in its statement of financial position when it becomes party to the contractual provisions of the instrument.

Check out alternatives and read real reviews from real users. IFRS 9 Financial Instruments issued on 24 July 14 is the IASB's replacement of IAS 39 Financial Instruments Recognition and Measurement The Standard includes requirements for recognition and measurement, impairment, derecognition and general hedge accounting. IFRS 9 – Classification and measurement At a glance On July 24, 14 the IASB published the complete version of IFRS 9, Financial Instruments, which replaces most of the guidance in IAS 39 This includes amended guidance for the classification and measurement of financial assets by introducing a.

(a) the interaction of paragraph 9 of IFRS 15 with paragraphs 47 and 52 of IFRS 15 on estimating variable consideration (Examples 2–3);. Ifrs 9 1 AVC Learning Solutionswwwavclscominfo@avclscom91 0014 55 2 Financial InstrumentsIAS 32 / 39 / IFRS 9. IFRS 9 introduces a new impairment model based on expected credit losses, resulting in the recognition of a loss allowance before the credit loss is incurred Under this approach, entities need to consider current conditions and reasonable and supportable forwardlooking information that is available without undue cost or effort when estimating expected credit losses.

Ifrs 9 Overview For All Accountants

Ifrs 9 Financial Instruments

Ifrs 9 Impairment Ein Blick Uber Den Tellerrand Der Lifetime Loss Modellierung Bankinghub

Ifrs 9 Deutsch のギャラリー

Ifrs 9 For Corporates Is The Grass Greener On The Other Side

Ifrs 9 Ind As 109 Impairment Of Financial Asset

Challenges Of Ifrs 9 Impairment Requirement To Prepare Early For The New Impairment Approach Bankinghub

Ifrs 9 Im Ubergang Von Theorie Zu Praxis Rodl Partner

Credit Impairment Under Ifrs 9 For Banks

Eur Lex 316r67 Lt Eur Lex

Hedge Accounting Nach Ifrs 9 German Edition Lotz Marcus Amazon Com Books

Zbam9t27vrui5m

Ifrs 9 Finanzinstrumente Institut Fur Rechnungslegung

Ifrs 9 Impairment Practical Implications Protiviti Singapore

Ilyassaeed Ilyas Saeed Chartered Accountants Ias Ifrs Summary Series Financial Instruments Ifrs 9 Ifrs9 Ilyassaeedcharteredaccountants T Co Amwez10nvr

Financial Instruments Education Session Part A

Ifrs 9 For Corporates Is The Grass Greener On The Other Side

Ifrs Developments Issue 165 Ibor Reform Iasb Publishes Phase 2 Exposure Draft Ey Global

Www Bundesbank De Resource Blob Ee512ea96c8aaf5e5f1b0 Ml 19 01 Ifrs9 Data Pdf

Ifrs 9 And Ecl Cva Services Gmbh

How To Make Sense Of Transition To Ifrs 9 Expected Credit Loss Model Ey Global

Disclose Update Ifrs 9 Betrifft Alle Ifrs Anwender

Ifrs 9

Ifrs

Ifrs

Q Tbn And9gct98btwfityu5at0 Qnlhlsgq3npwykandwejj5svieskeizins Usqp Cau

Ifrs

Download E Book How To Model And Validate Expected Credit Losses For Ifrs 9 And Cecl

Ifrs 9 Financial Instruments High Level Summary Deloitte Cis Audit

Ifrs 9 Impairment Practical Implications Protiviti Singapore

Ifrs 9 For Corporates Is The Grass Greener On The Other Side

International Financial Reporting Standards Ifrs 9 Linkedin

After The First Year Of Ifrs 9 Deloitte Uk

Implementation Of The Expected Credit Loss Model Kpmg Germany

Challenges Of Ifrs 9 Impairment Requirement To Prepare Early For The New Impairment Approach Bankinghub

Ifrs 9 Financial Instruments

Financial Assets Under Ifrs 9 The Basis For Classification Has Changed o Australia

How The Decl Recommendations On Ifrs 9 Could Affect Credit Risk Disclosures Ey Global

Mns Ifrs 9 11 Translation English Deutsch Francais Italiano By Gretk417 Issuu

Hedge Accounting Nach Ifrs 9 German Edition Lotz Marcus Amazon Com Books

Ifrs 9 Finanzinstrumente Onlinekurs Videoausschnitt Ifu Online Campus De Youtube

Ifrs 9 Financial Instruments Overview

Financial Assets Under Ifrs 9 The Basis For Classification Has Changed o Australia

Ifrs 9 Ansatz Ausbuchung Und Modifizierung

International Financial Reporting Standards Ifrs 9 Linkedin

Ias 39 Ifrs 9 International Financial Reporting Standards Impairment International Accounting Standards Board Angle Text Png Pngegg

Cecl And Ifrs 9 Modeling In Matlab Measuring Lifetime Expected Credit Losses Matlab Simulink

Ifrs 9 Financial Instruments Deloitte Cis Audit

Ifrs 9 Impairment Ein Blick Uber Den Tellerrand Der Lifetime Loss Modellierung Bankinghub

Ifrs 9 Finanzinstrumente Youtube

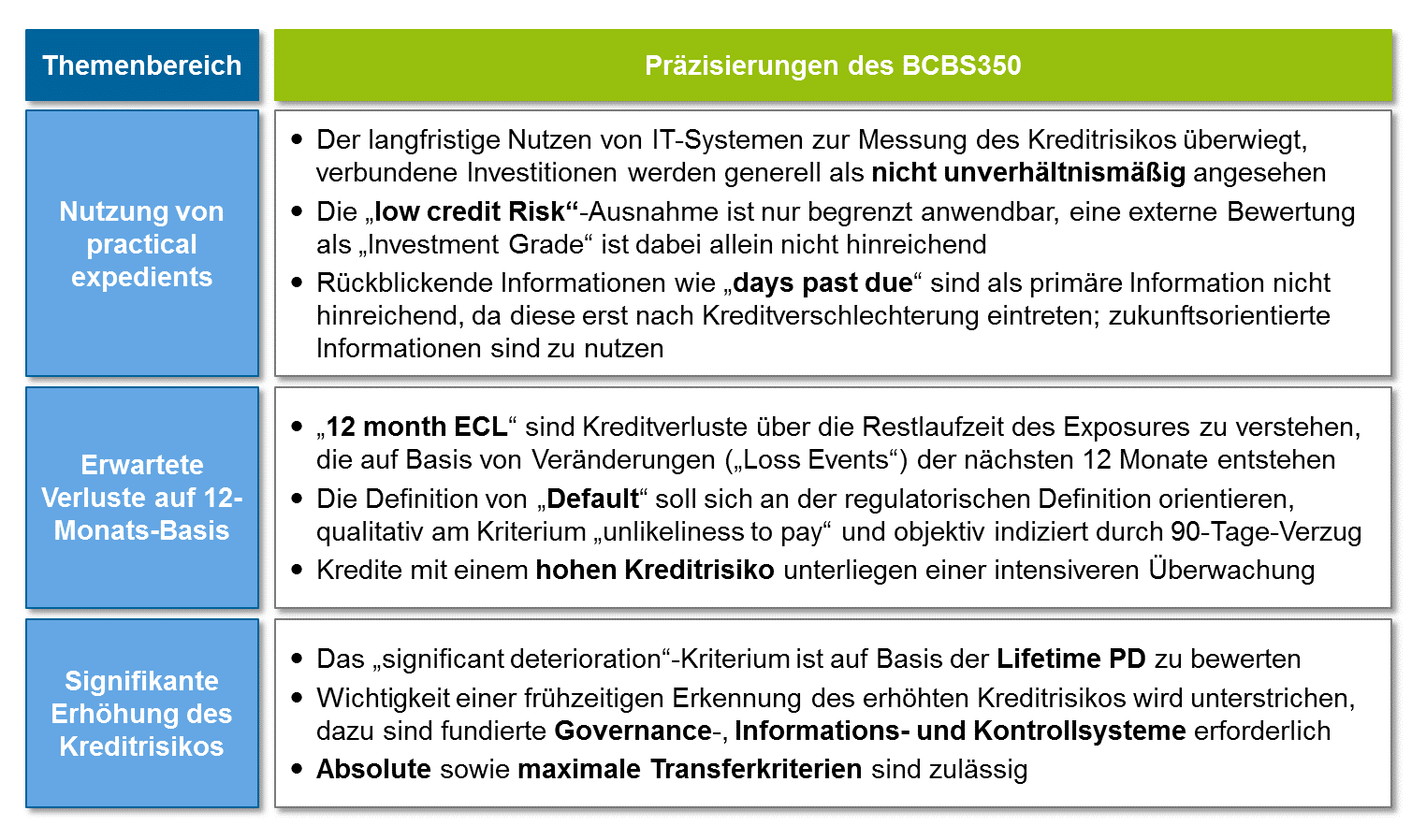

Ifrs 9 Impairment Konkretisierung Der Umsetzungsanforderungen Bankinghub

Validation Of Ifrs 9 Models

Iasb And Regulators Highlight Ifrs 9 Ecl Requirements In Coronavirus Pandemic Pagetitlesuffix

Ifrs 9 Financial Instruments High Level Summary Deloitte Cis Audit

Deloitte Webinar The Impact Of Covid 19 On Assessing The Impairment Of Financial Instruments In Accordance With Ifrs 9

Ias 39 Financial Instruments Recognition And Measurement

Modelling For Provisioning Of Bad Debt Under Ifrs 9

Post Implementation Of Ifrs 9 Analysis Of The Impact On Nigerian Banks

File Ifrs9 Classification Png Wikimedia Commons

Heads Up Iasb Completes Its Project On Accounting For Financial Instruments Under Ifrs 9

Ifrs 9 Wikipedia

Pwc Cambodia In Brief Ifrs 9 Impairment Facebook

Q Tbn And9gcrkdrbqx5zjyfhms0okf49mlrgq151q5mk5ckkehhg5myl7xnyv Usqp Cau

Sap Bank Analyzer Afi

Prepare Ifrs 9 Ecl Model Using Both General And Simplified Approach By Basit

Ifrs 9

Ifrs 9 Financial Instruments Overview

Ifrs 9 And Ecl Cva Services Gmbh

Ifrs 9 Financial Instruments

Challenges Of Ifrs 9 Impairment Requirement To Prepare Early For The New Impairment Approach Bankinghub

Salient Differences Between Ias 39 And Ifrs 9 International Financial Reporting Standards Fair Value

Q Tbn And9gcr79qqrjgrb3ar3fzlqfgx9v I2hlqooektpmstevuwyooia98j Usqp Cau

Ifrs 9 Finale Fassung Zur Bilanzierung Von Finanzinstrumenten Rodl Partner

Ifrs 9 Summary Requirements Changes Deloitte Cfr

Kpmg Nigeria Classification And Measurement Of Financial Assets In The Scope Of Ifrs 9 Africaifrsacademy T Co Huhoia3yok

1

New Ifrs 9

Pkf Polska

Ifrs 9

Ifrs 9 Eroffnet Chancen Fur Die Portfoliostruktur

How To Make Sense Of Transition To Ifrs 9 Expected Credit Loss Model Ey Global

Moody S Offers Riskintegrity Ifrs 17 Software For Insurers Preparing For Reporting Standards The Digital Insurer

Bilanzierung Aktuelles Zur Internationalen Rechnungslegung Ifrs 9 Icon Wirtschaftstreuhand Gmbh

Ifrs 9 Overview For All Accountants

Konzernanhang Puma Annual Report 17 Forever Faster Puma

Zbam9t27vrui5m

Baker Tilly Hk From The Archives Ifrs 9 Specifies How An Entity Should Classify And Measure Financial Assets Financial Liabilities And Some Contracts To Buy Or Sell Non Financial Items T Co Fc7qniup0g

Ifrs 9 Impairment Konkretisierung Der Umsetzungsanforderungen Bankinghub

Hedge Accounting Kritischer Vergleich Des Ias 39 Und Ifrs 9 German Edition Sabov Roland Amazon Com Books

Ifrs 9 Impairment Konkretisierung Der Umsetzungsanforderungen Bankinghub

Loan Valuations In The Age Of Expected Loss Provisioning Vox Cepr Policy Portal

Ifrs 9 Ready For Impact Deloitte Jordan Me Pov Issue 24

Ifrs 9 Ind As 109 Impairment Of Financial Asset

Bilanzierung Nach Ifrs 9 Im Uberblick Deloitte Deutschland

Blog 16 12 Ead Ifrs 9 Ramifications

Ifrs Hot Topic New Standards

Ifrs 9 Financial Instruments Reporting Solutions November 17

Financial Instruments Recognition Measurement Presentation And

Fas Ag Ifrs 9 Finanzinstrumente

Emirates News Agency Cbuae Issues Guidance To Financial Institutions On Application Of Ifrs 9

Www Bundesbank De Resource Blob 71c8cf60bc9784d052a5d5afd810f0d1 Ml 19 01 Ifrs9 Data Pdf

Ifrs 9

Practical Guide Phase 2 Amendments To Ifrs 9 Ias 39 Ifrs 7 Ifrs 4 And Ifrs 16 For Interest Rate Benchmark Ibor Reform Pwc

International Financial Reporting Standards Ifrs And Ifric Interpretations

Ifrs 9 Solution For Sap Trm Fam Compiricus