Asset Accounting

Go to start of metadata Purpose The purpose of this page is to clarify the understanding of the system logic and requirements about period control.

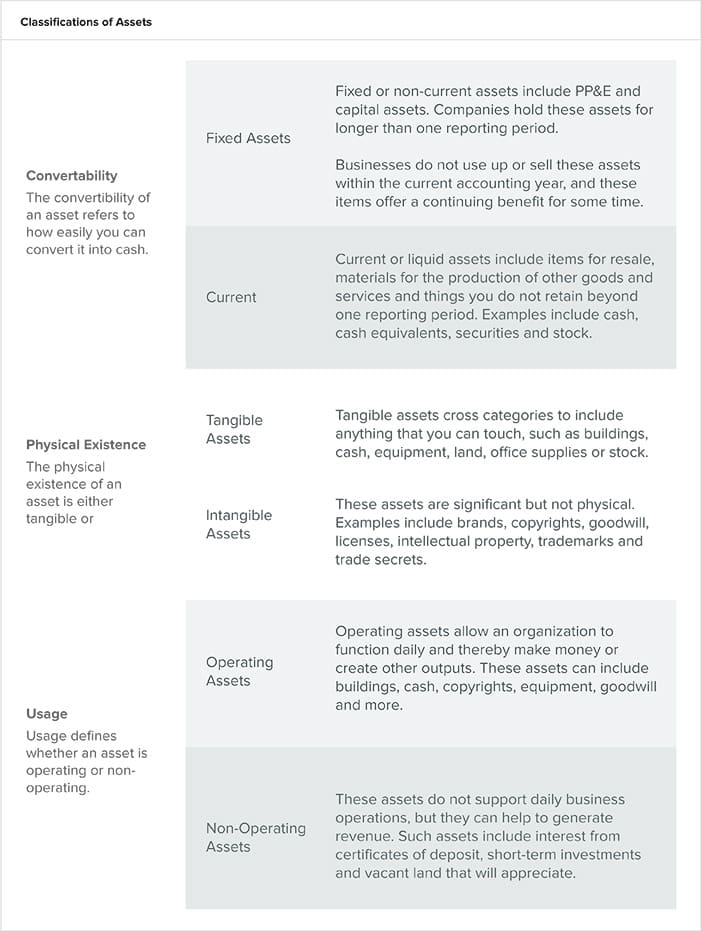

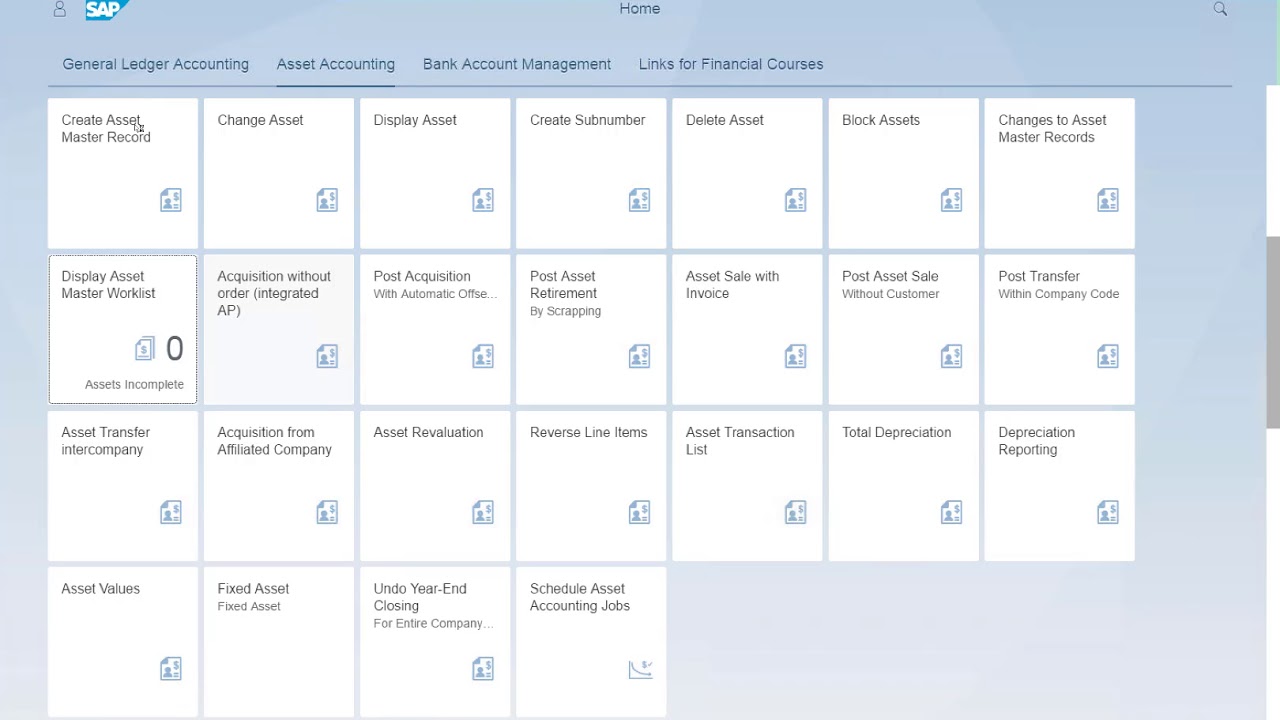

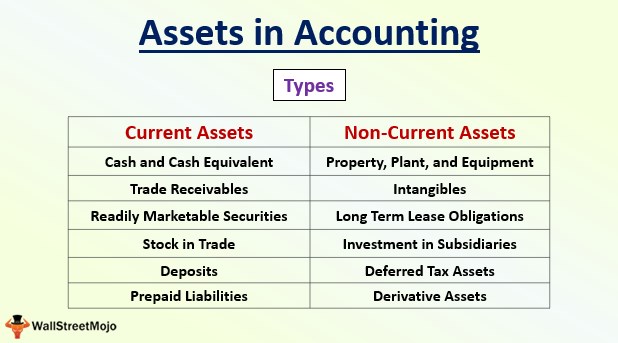

Asset accounting. What are the Main Types of Assets?. Asset Accounting is based on the universal journal entry This means there is no longer any redundant data store, General Ledger Accounting and Asset Accounting are reconciled Key changes are listed below –. Asset Accounting in Simple Finance is used for monitoring of assets in SAP system In SAP Accounting powered by HANA system, you have only new asset accounting available with new G/L accounting As SAP Finance system is integrated with other modules, you can move data to and from other systems, ie.

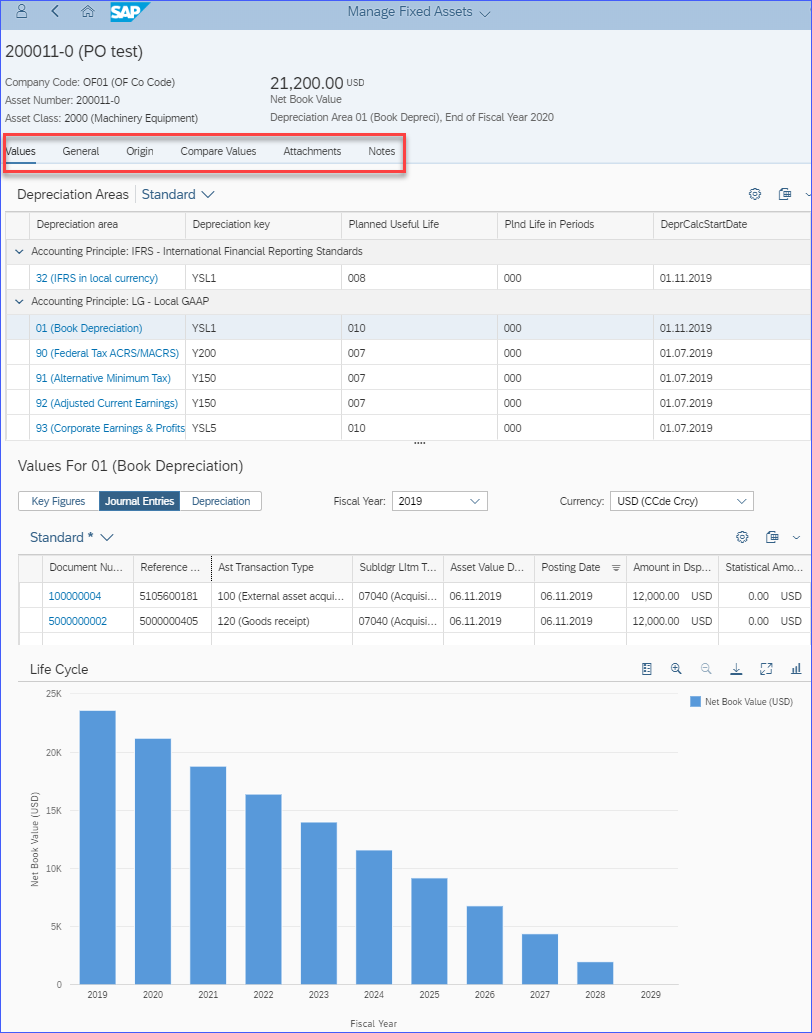

The Asset Accounting Overview (Figure 10), is a single app showing many KPI’s on one screen Some allow further drilldown and some have dropdowns, eg to show asset balances by segment or cost center, or special and unplanned depreciation instead of ordinary and so on Figure 10 Asset Accounting Overview. An asset is an expenditure that has utility through multiple future accounting periods If an expenditure does not have such utility, it is instead considered an expense For example, a company pays its electrical bill. Definition An asset is a resource that has some economic value to a company and can be used in a current or future period to generate revenues These resources take many forms from cash to buildings and are recorded on the balance sheet until they are used.

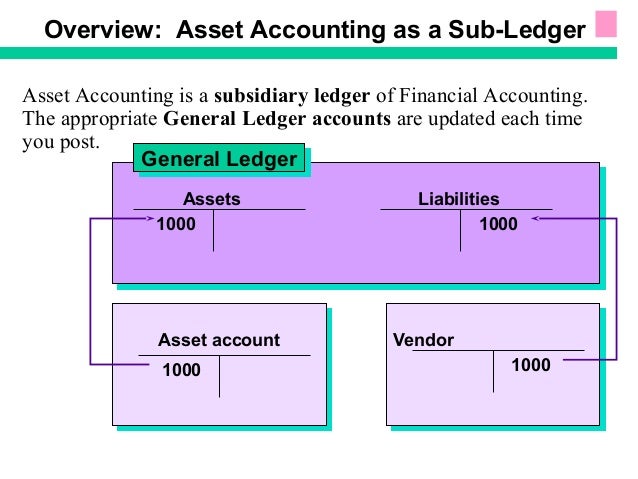

Some assets like goodwill, stock investments, patents, and websites can’t be touched These intellectual assets can be quite substantial, however There are many more types of assets that aren’t mentioned here, but this is the basic list We will discuss more assets in depth later in the accounting course. Fixed asset accounting is a specific process that tracks the value and changes in the items a company uses to complete business processes Fixed assets can include a variety of different items, such as computers, software, buildings, equipment, office décor or vehicles, among other items. Participants will learn something about organizational structures in Asset Accounting and FI, as FIAA is a subledger of FI They will also configure FIAA in Customizing, to find out how configuration possibilities can affect the application and the business processes.

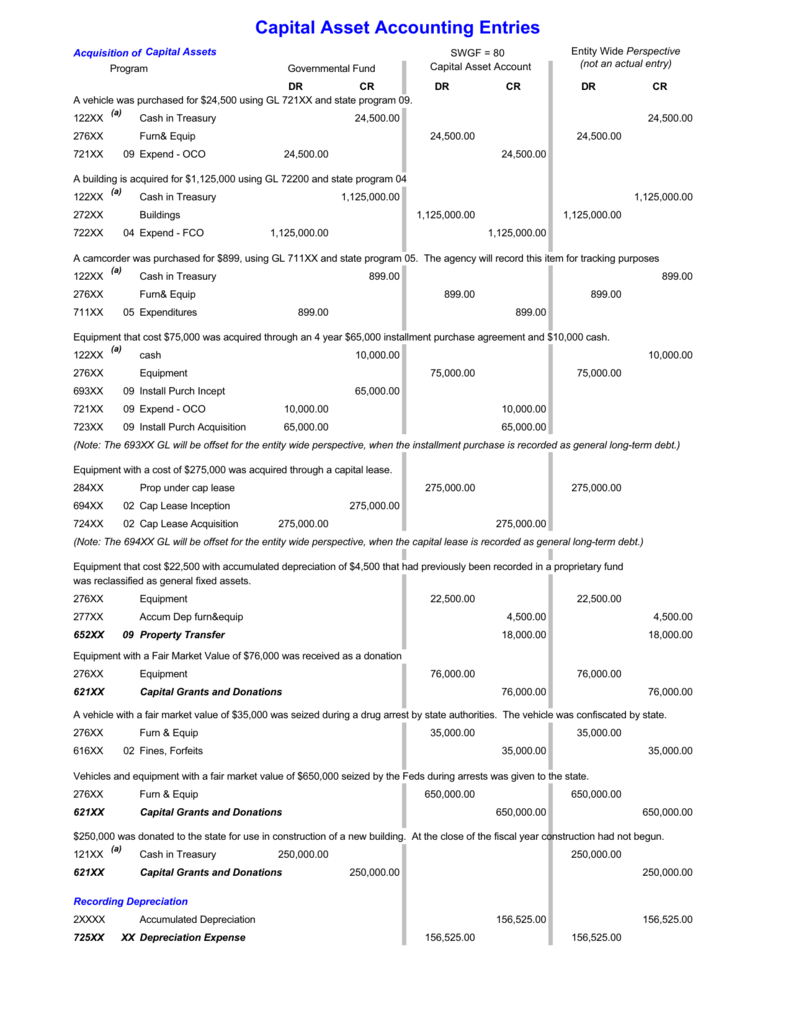

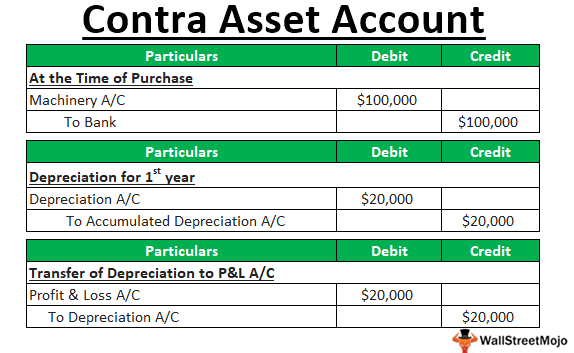

Capital assets are real or personal property that have a value equal to or greater than the capitalization threshold for the particular classification of the asset and have an estimated life of greater than one year. Asset Accounting Creating journal entries is a two step process 1 At the end of each accounting period, run the depreciation program for each of your books Running the depreciation program closes the current period and opens the next period 2 Run the Create Journal Entries program to create journal entries to your general ledger. For accounting purposes, an asset’s service life may not match its item life The service life of an asset is an accounting and management estimate of the useful life of an object Base the service life estimate on the following General knowledge of how long similar items last.

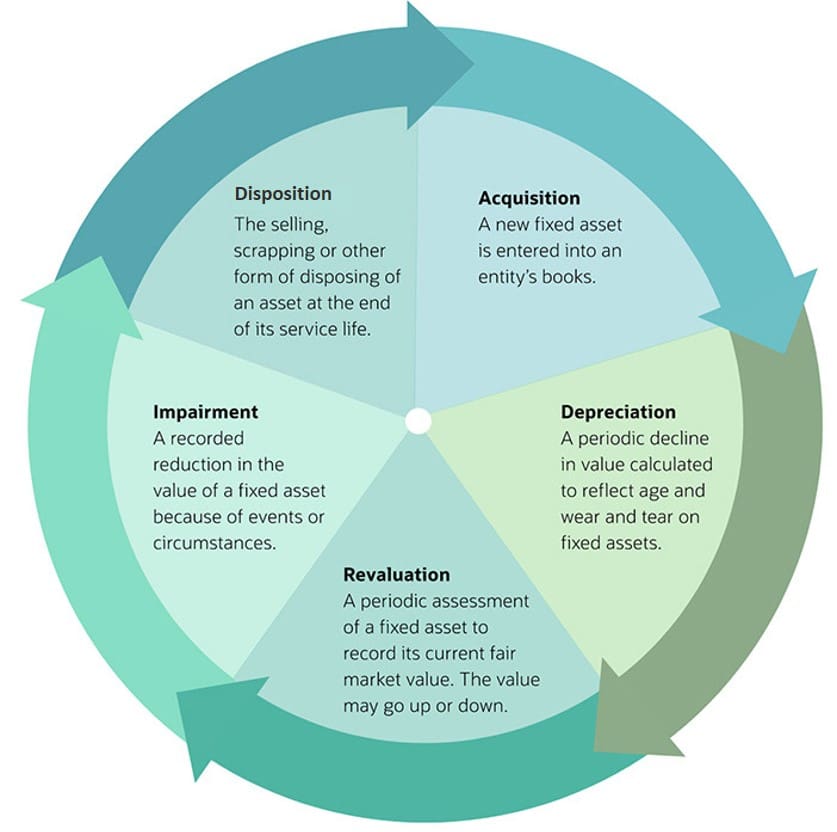

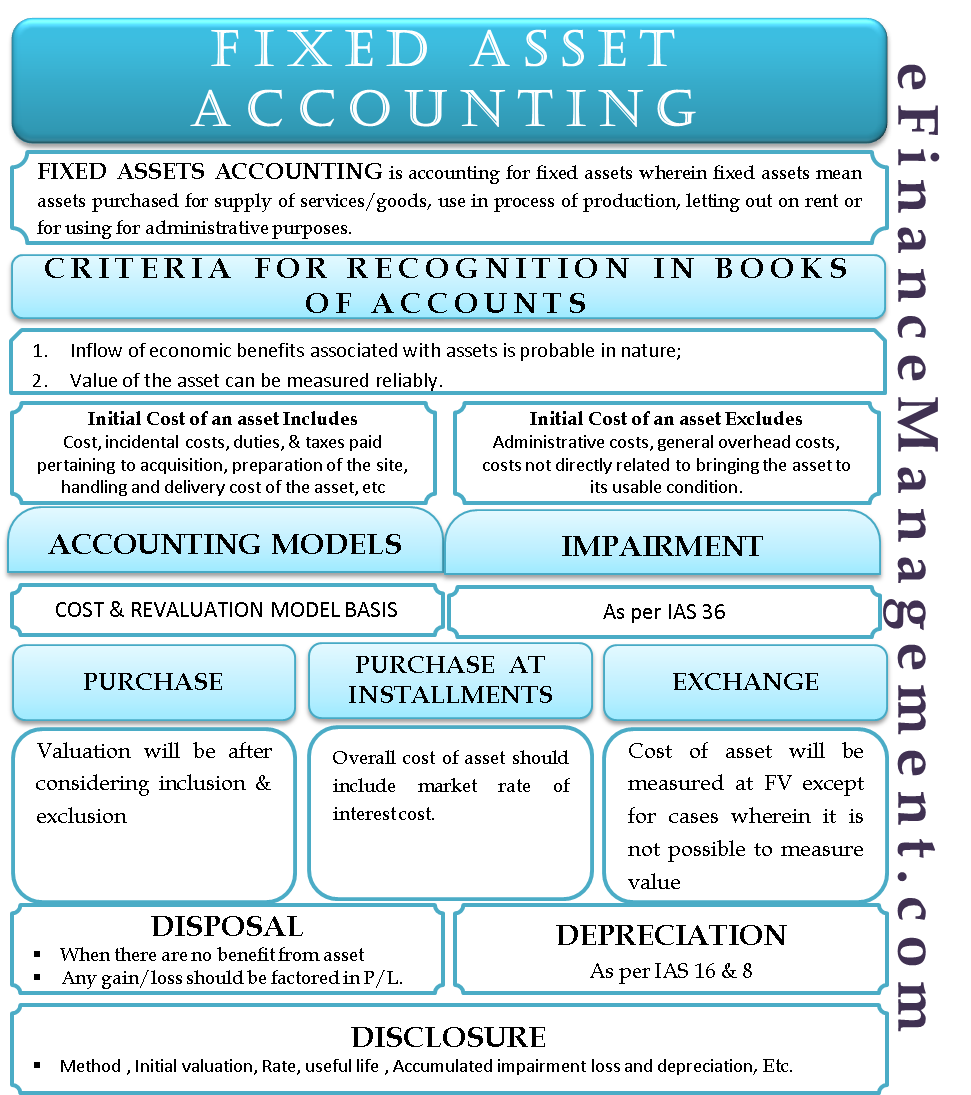

Accounting Models for Measurement of Asset post its Initial Measurement Cost Model Basis The valuation of the asset is at its cost price less accumulated depreciation and impairment cost Revaluation Model Basis The valuation of the asset is the fair value less its subsequent depreciation and impairment. Asset Accounting Creating journal entries is a two step process 1 At the end of each accounting period, run the depreciation program for each of your books Running the depreciation program closes the current period and opens the next period 2 Run the Create Journal Entries program to create journal entries to your general ledger. Asset Accounting Our Team Our Services Your results We are a team of professional accountants, dedicated to providing efficient and effective advice, to help make the most of your business and financial future Menu admin@assetaccountingcomau 07 5491 3750 This is a static image header.

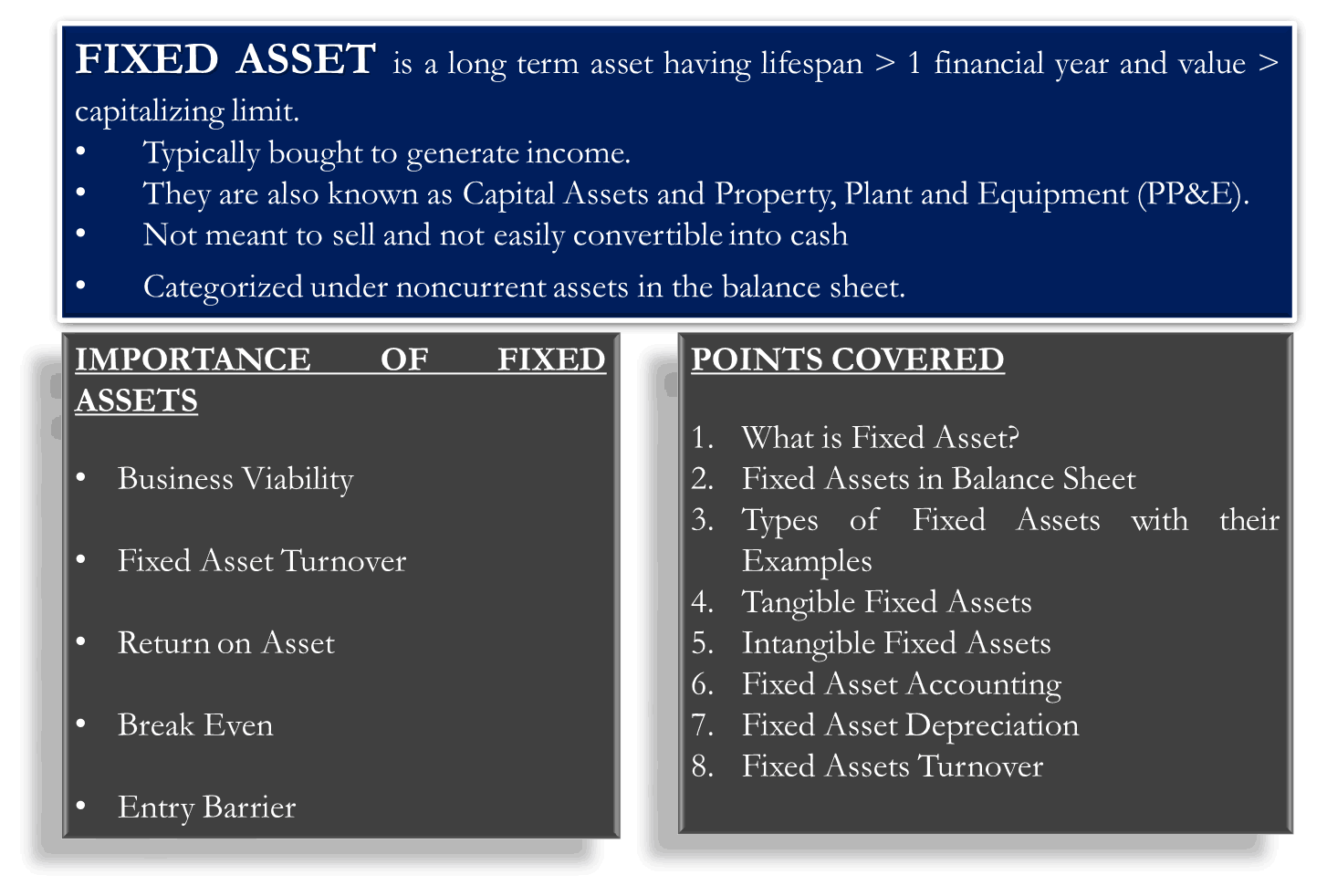

The Fixed Asset Accounting Software primarily caters to the accurate calculation of depreciation values and comprehensive reporting of all financial information related to fixed assets on the balance sheet The Fixed Asset Accounting software is used for preventive maintenance procedures, detailed financial accounting and asset tracking implementations Deployed in various SMEs, small and. FIXED ASSET ACCOUNTING AND MANAGEMENT PROCEDURES MANUAL SECTION 1 Organizational Responsibilities REVISION 3 February 4, 04 4 7 Retirements and Disposals Departments will identify and record all fixed assets and controlled items that are removed from service, retired, and disposed of All assets that are sold, exchanged, traded, stolen,. Capital Assets Accounting FAQs What is the definition of a capital asset?.

Asset Accounting Period Control Skip to end of metadata Created by Former Member on Sep 26, 13;. What is an asset account?. With the SAP New Asset Accounting, many of the underlying principles and structures remain the same Thus, the existing Asset Accounting users will see many familiar transactions For Example, the Asset Explorer screen However, other transactions are enhanced by SAP with additional fields or functionality.

Capital Assets Accounting FAQs What is the definition of a capital asset?. This document describes the measures necessary in asset accounting at yearend You need to change the fiscal year and close old the year Fiscal year change (AJRW) When the year changes, all the dates in asset accounting start to point to the new fiscal year The Asset Explorer shows the new fiscal year and all the reports default the last day. The most important accounting issue for financial assets involves how to report the values on the balance sheet Balance SheetThe balance sheet is one of the three fundamental financial statements These statements are key to both financial modeling and accounting.

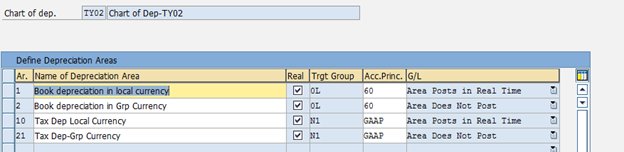

This blog is focused on New Asset accounting for ledger approach in multiple currency environment New Asset Accounting is the only Asset Accounting solution available in S/4 HANA, classic Asset Accounting is not available any more. Fixed Assets vs Current Assets The concept of fixed and current assets is simple to understand The short explanation is that if it is an asset and is either in cash or likely to be converted into cash within the next 12 months (or accounting period), it is considered a current asset. The words “asset” and “liability” are two very common words in accounting/bookkeeping Assets are defined as resources that help generate profit in your business You have some control over it Liability is defined as obligations that your business needs to fulfill In simple words, Liability means credit.

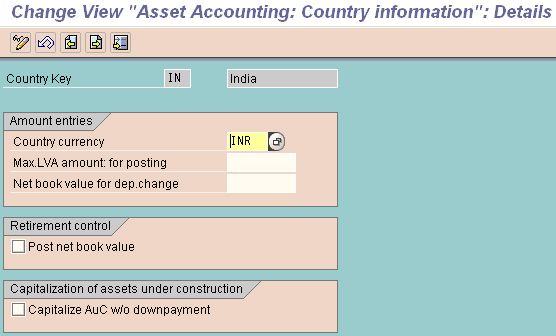

Asset Accounting is intended for international use in many countries, irrespective of the nature of the industry This means, for example, that no countryspecific valuation rules are hardcoded in the system You give this component its countryspecific and companyspecific character with the settings you make in Customizing To minimize the. In this section, you define the features of the Asset Accounting organizational objects (chart of depreciation, FI company code, asset class) All assets in the system have to be assigned to these organizational objects that you define. Capital assets are real or personal property that have a value equal to or greater than the capitalization threshold for the particular classification of the asset and have an estimated life of greater than one year.

Gain best practices insight into the efficiency and effectiveness of your business entity's fixed asset and capital project accounting process groups by completing the Fixed Assets Accounting Open Standards Benchmarking Assessment Key metrics aligned to this assessment include. Featured topics COVID19 Accounting and reporting resource center Acquisitions and strategic investments Compensation and benefits accounting Corporate turnarounds and impairments Derivatives and hedge accounting Fair value measurement Financial instruments IFRS in the US Income tax and tax reform Insurance contracts Lease accounting Notfor. Go to start of metadata Purpose The purpose of this page is to clarify the understanding of the system logic and requirements about period control.

For fixed asset accounting, the International Financial Reporting Standards (IFRS) is a framework that provides uniform guidelines to prepare and organize financial data Actively endorsed by more than 1 countries, the IFRS has been derived from the International Accounting Standards Board based in London. The Asset Accounting (FIAA) sub module in SAP manages a company’s fixed assets, right from acquisition to retirement/scrapping All accounting transactions relating to depreciation, insurance, etc, of assets are taken care of through this module, and all the accounting information from this module flows to FIGL on a realtime basis. Assets are economic resources controlled by a business which can potentially benefit its operations or are convertible to cash (cash itself is also an asset) Examples of Assets Following are the common assets of a business Cash Cash includes physical money such as bank notes and coins as well as amount deposited in bank for current use.

An asset is a resource owned or controlled by an individual, corporation Corporation A corporation is a legal entity created by individuals, stockholders, or shareholders, with the purpose of operating for profit Corporations are allowed to enter into contracts, sue and be sued, own assets, remit federal and state taxes, and borrow money from financial. What are Assets in Accounting?. Asset Accounting Asset Accounting Overview Asset Accounting is an important module in SAP and manages assets of an organisation by master records Asset accounting is a sub ledger to the SAP FI module for managing the Asset records SAP Asset Accounting Configuration Steps Step 1 Copy Reference Chart of Depreciation/ Depreciation Area.

Accounting Standard 6 issued by the Institute of the Chartered Accountants of India defines ‘depreciation’ as “a measure of the wearing out, consumption or other loss of value of a depreciable asset arising from use, effluxion of time or obsolescence through technology and market changes. Contact us Tilburg University , Room E 106 E 108 Warandelaan 2, Tilburg, NoordBrabant 5037 AB The Netherlands Phone 31 (0) Info@AssetAccountingFinancenl. An asset is a resource owned or controlled by an individual, corporation Corporation A corporation is a legal entity created by individuals, stockholders, or shareholders, with the purpose of operating for profit Corporations are allowed to enter into contracts, sue and be sued, own assets, remit federal and state taxes, and borrow money from financial.

3,141 Fixed Asset Accountant jobs available on Indeedcom Apply to Accountant, Staff Accountant, Senior Accountant and more!. Fixed asset accounting is a specific process that tracks the value and changes in the items a company uses to complete business processes Fixed assets can include a variety of different items, such as computers, software, buildings, equipment, office décor or vehicles, among other items. Overview of what is financial modeling, how & why to build a model and accounting The balance sheet displays the company’s total assets, and how these assets are financed, through either debt or equity It can also be referred to as a statement of net worth, or a statement of financial position.

Asset Accounting Period Control Skip to end of metadata Created by Former Member on Sep 26, 13;. Asset to the first accounting period If the entity uses the asset for five years, as it expects to do, each of the next four years will absorb depreciation charges for a full 12 months, or $12,000, and in the fifth year, the entity would only record three months, or $3,000, of depreciation expense Determination of Depreciable Lives. Some assets like goodwill, stock investments, patents, and websites can’t be touched These intellectual assets can be quite substantial, however There are many more types of assets that aren’t mentioned here, but this is the basic list We will discuss more assets in depth later in the accounting course.

Capital assets are real or personal property that have a value equal to or greater than the capitalization threshold for the particular classification of the asset and have an estimated life of greater than one year. Definition of an Asset Account An asset account is a general ledger account used to sort and store the debit and credit amounts from a company's transactions involving the company's resources The balances in the asset accounts will be summarized and reported on the company's balance sheet Generally, the asset account balances are debit balances and are increased. Asset An asset is a resource with economic value that an individual, corporation or country owns or controls with the expectation that it will provide future benefit Assets are reported on a.

#assetaccounting, #sap, #sapassetaccountingAsset Accounting part 1 This video explains the concept of Asset Accounting in SAP FICO Learn how to configure. Contact us Tilburg University , Room E 106 E 108 Warandelaan 2, Tilburg, NoordBrabant 5037 AB The Netherlands Phone 31 (0) Info@AssetAccountingFinancenl. Contact us Tilburg University , Room E 106 E 108 Warandelaan 2, Tilburg, NoordBrabant 5037 AB The Netherlands Phone 31 (0) Info@AssetAccountingFinancenl.

Financial assets can be categorized as either current or noncurrent assets on a company’s balance sheet Balance Sheet The balance sheet is one of the three fundamental financial statements These statements are key to both financial modeling and accounting Measurement of Financial Assets. Asset Accounting Purpose The University of Idaho has a significant investment in fixed assets, such as land, buildings, other improvements, and fixed and moveable equipment which are used to accomplish the primary missions of instruction, research and public service. Asset Accounting Run the Create Accounting process to create accounting entries Run the Create Accounting process to create accounting entries Note You do not need to run Depreciation before creating accounting transactions.

What are the Main Types of Assets?. Capital Assets Accounting FAQs What is the definition of a capital asset?. A fixed asset is a longterm tangible asset that a firm owns and uses to produce income and is not expected to be used or sold within a year.

What are Assets in Accounting?. Definition An asset is a resource that has some economic value to a company and can be used in a current or future period to generate revenues These resources take many forms from cash to buildings and are recorded on the balance sheet until they are used.

Process Fixed Assets Accounting In Sap Erp Solutions For Apparel And Footwear Implement Applications Frameworks Process

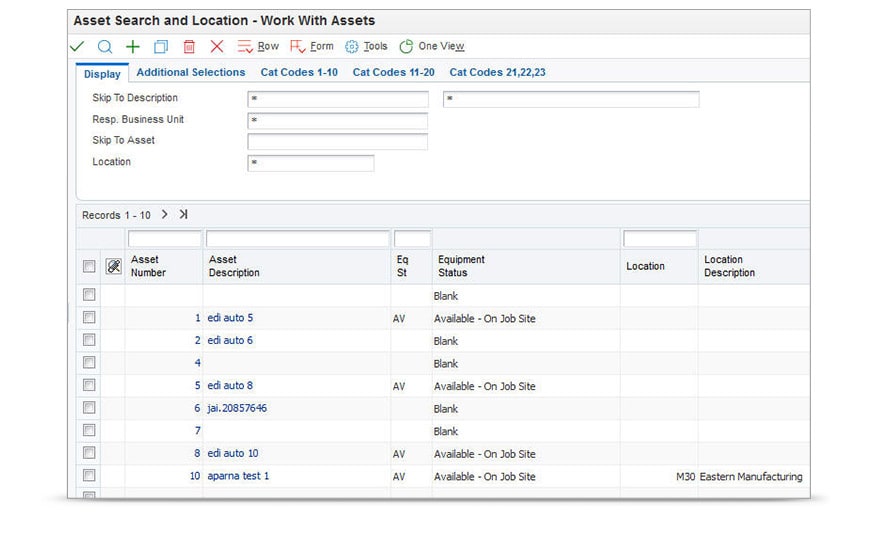

Jd Edwards Fixed Asset Accounting Resources Oracle

Fixed Asset Accounting Mri Software

Asset Accounting のギャラリー

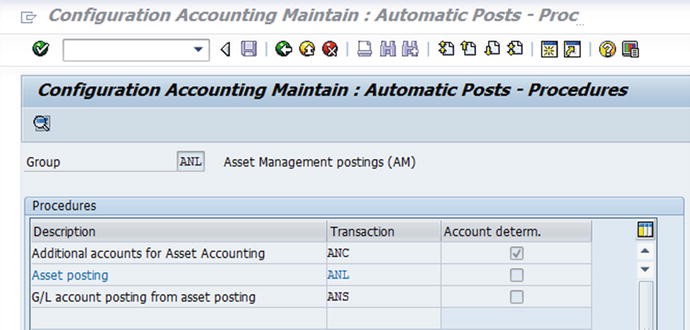

Additional G L Accounts For Asset Accounting Sapspot

Asset Accounting In Sap S 4hana

What Fixed Asset Accounting Has To Do In A Business Asset Infinity

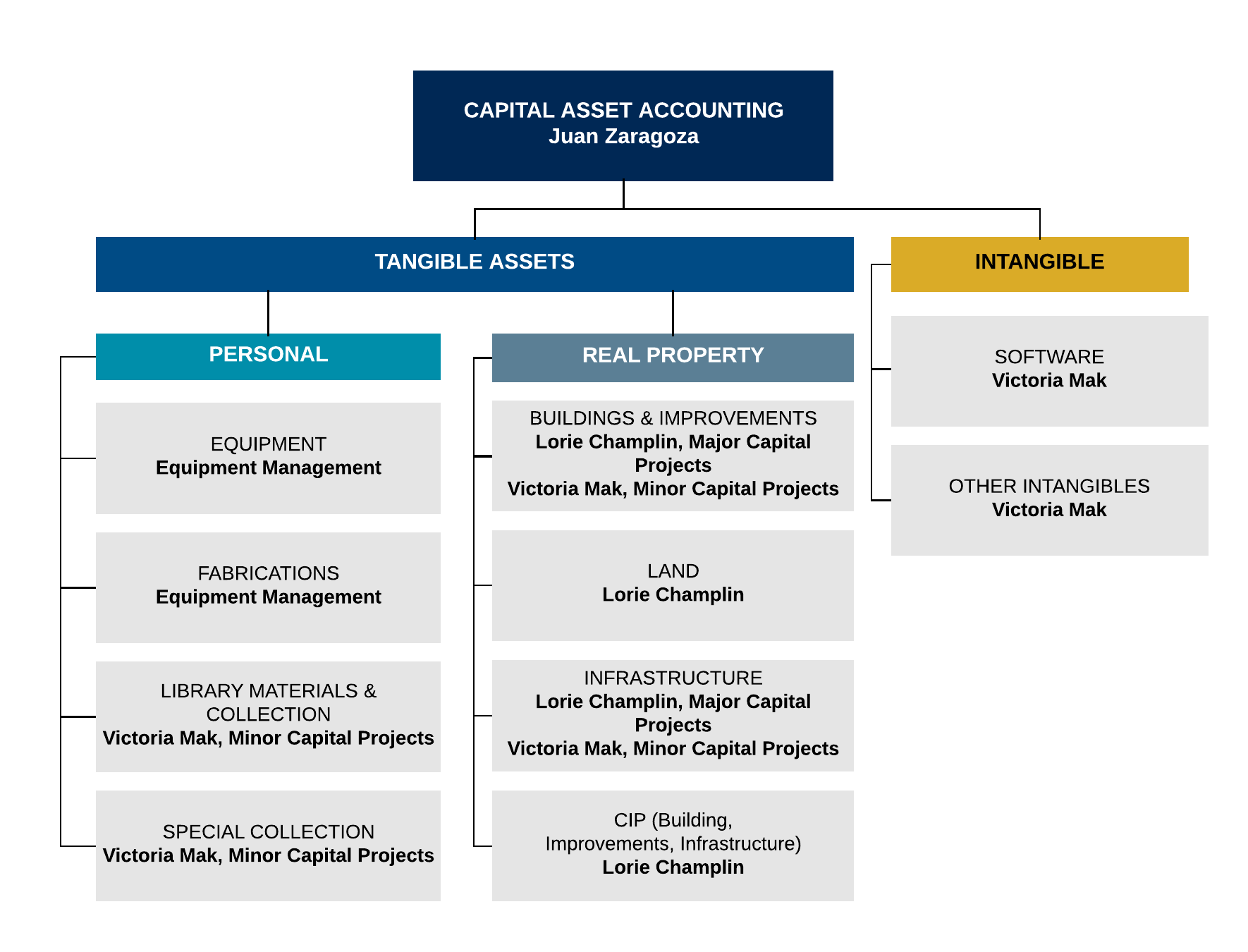

Capital Asset Accounting Finance Business

Edify A Virtual Learning Platform

Integrating Asset Accounting With The General Ledger Fi Gl Springerlink

Fixed Asset Accounting Overview And Best Practices Involved

Fixed Asset Accounting Made Simple Netsuite

Asset Accounting In S4hana

Basics Of Asset Accounting Asset Explorer Sap Simple Docs

Introducing New Asset Accounting In S 4 Hana

What Does A Fixed Asset Accountant Do Zippia

Examples Of Assets In Accounting Top 12 Balance Sheet Assets

Fixed Asset Accounting Depreciation Finance Png 975x3px Fixed Asset Account Accounting Accounting Software Area Download Free

Chapter 9 2 Double Entry Accounting Accounting Debits Credits

18 Reviews Of Fixed Asset Accounting Systems Cpa Practice Advisor

Sap Fixed Assets Accounting

Fixed Asset Accounting Made Simple Netsuite

Fixed Assets Accountant Resume Sample Mintresume

25 Best Fixed Asset Accounting Software For Your Business

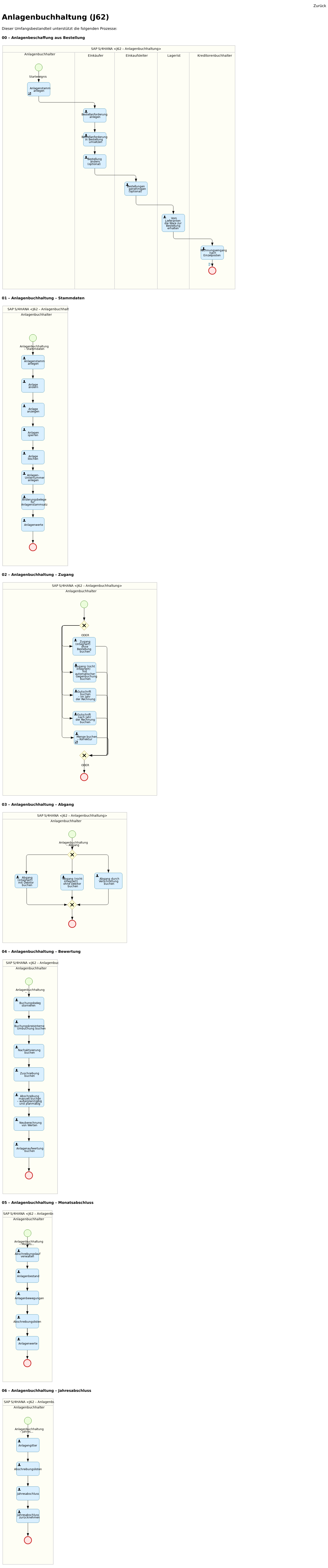

Best Practice Scenario Asset Accounting J62 S4hana 1909 Release

(1).jpg)

Asset Accounting Data Flow What Model Type To Use Aris Bpm Community

Fixed Asset Accounting Examples Journal Entries Dep Disclosure

Jd Edwards Fixed Asset Accounting Oracle

Fixed Asset Accounting In Sap S 4 Hana A Case Study Fixed Asset Sap Hana

F3096 Asset Accounting Overview Sap Fiori Apps

Fixed Asset Life Cycle In Asset Accounting Powerpoint Slides Diagrams Themes For Ppt Presentations Graphic Ideas

Capital Asset Accounting Entries

Sap S 4hana Finance Fixed Asset Accounting Fi Youtube

New Asset Accounting Fiaa

Fixed Assets Basics In Accounting Double Entry Bookkeeping

Espresso Tutorials Reporting For Sap Br Asset Accounting

Controlling Espresso Tutorials Com Onix Leseprobe 53 Pdf

Activate Am V62a Norming S Asset Accounting Error Sage 300 Financials Suite Sage 300 Sage City Community

Bloomberg Tax Releases New Leased Asset Accounting Tool Accounting Today

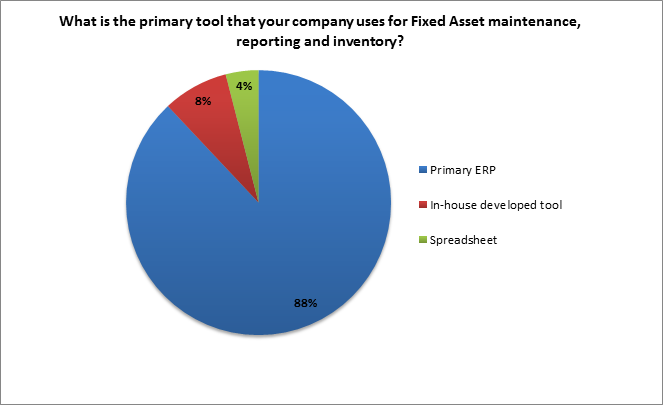

Software Selection For Fixed Asset Accounting Peeriosity

What Is Fixed Asset Everything You Need To Know About Fixed Assets

Fixed Asset Accountant Resume Samples Qwikresume

Best Practice Scenario Asset Accounting J62 S4hana 1909 Release

Sap Asset Accounting Training Depreciation Mergers And Acquisitions

Fixed Asset Accounting Investment Business People Investment Png Pngegg

Ppt Fixed Asset Accounting Powerpoint Presentation Free Download Id

Sap New Asset Accounting Certification Training Coursesit Us

3

Asset Accounting Finance Linkedin

Sap Library Asset Accounting Fi

Fixed Asset Trade In Double Entry Bookkeeping

Asset Accounting Fi New Sap Documentation

Asset Accounting Fi Create View

Asset Accounting In Central Finance Sap Modulleri Kullanici Destek Ve Egitim Platformu

An Overview Of Sap Asset Accounting Mastering Sap S 4hana 1709 Strategies For Implementation And Migration

Sap Simple Finance Asset Scrapping Tutorialspoint

Introduction To Fixed Assets Process Youtube

Sap S 4hana For Sap Asset Accounting Sap Fi Beg By Sap Press

Fixed Asset Accountant Resume Example Accountant Resumes Livecareer

Learn Inventory And Physical Inventory In Sap Fixed Asset Accounting Zarantech

The Dos And Don Ts Of Fixed Asset Accounting Assertive Industries Inc

Sap Asset Accounting Aumtech Solutions Sap Training

Everything You Must Know On Asset Accounting

Fixed Asset Software Easy Compliance Mri Software

Asset Accounting Fiori Apps

Fixed Asset Accounting Software Access Group

Asset Accounting

Fixed Assets Accounting Abacus It Solutions

Accountant Fixed Assets Resume Sample Mintresume

Top 250 Sap Asset Accounting Interview Questions And Answers 08 January 21 Sap Asset Accounting Interview Questions Wisdom Jobs India

Fixed Assets Accounting In South Extension Ii New Delhi Id

Q Tbn And9gcsmzwidbrgpuruec16bk4hfooji3zxkjbsy Uhpzy1scia8ozih Usqp Cau

Fixed Asset Accounting Life Cycle Template Presentation Sample Of Ppt Presentation Presentation Background Images

Asset Accounting Overview Sap Documentation

What Are Fixed Assets Type Tangible Intangible Accounting Dep

Additional G L Accounts For Asset Accounting Sapspot

Everything You Must Know On Asset Accounting

Fi332 Umoja Asset Accounting Process Manualzz

Amazon Com Reporting For Sap Asset Accounting Learn About The Complete Reporting Solutions For Asset Accounting Michael Thomas Books

S 4hana New Asset Accounting Part 1 Introduction Serio Consulting

Fixed Asset Accounting Overview And Best Practices Involved

New Asset Accounting In Sap Account Vs Ledger Approach Skillstek

Depreciation Fixed Assets Accounting In Mailapur Chennai Svv Solutions Services Id

Asset Accounting Overview Sap Help Portal

Sap S 4hana Conversion Projects Tips On Asset Accounting Preparation Phase

What Is Asset Accounting In Sap Fi Tutorialkart Com

Fame Asset Accounting App For Sap Business One

Introduction To Sap Fico

Structuring Fixed Assets Sap Library Asset Accounting Fi

Asset Accounting Integration With General Ledger Accounting Fi

Asset Accounting Finance

S 4hana New Asset Accounting Changes In Legacy Data Takeover Serio Consulting

Contra Asset Account Definition List Examples With Accounting Entry

Fixed Asset Accounting Overview And Best Practices Involved

Pdf Human Asset Accounting And Measurement Moving Forward Semantic Scholar

Q Tbn And9gcqs Hzarmlv6bncim9omt7evyiiyg M15lez46mgio Rkmr6hnz Usqp Cau

Sap Asset Accounting Aumtech Solutions Sap Training

Fixed Asset Reports 5 Accounting Reports You Should Be Running

Posting Via A Clearing Account Excerpt From Sap Fixed Asset Accounting Espresso Tutorials Blog

Assets In Accounting Definition Examples Of Assets On Balance Sheet

Sap Library Asset Accounting Fi

Fiscal Year Variants In Sap S 4hana Asset Accounting Zarantech

Abt1n Intercompany Asset Transfer Sapsharks

Asset Accounting Tax Solutions Tax And Accounting About Us