Asset Accounting Definition

Required a) State, or otherwise explain, the accounting definition of an asset 2 marks b) Discuss (giving reasons for and against) if VEVO’s videos match the definition that you gave in part a) well enough to be shown as an asset in the Statement of Financial Position of i) VEVO;.

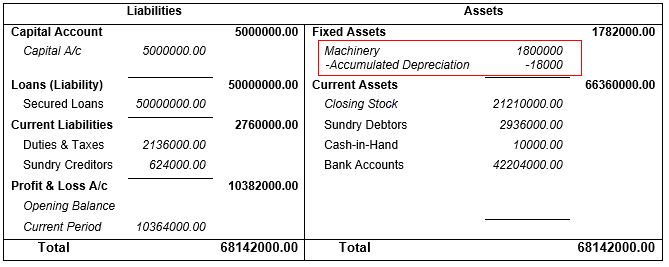

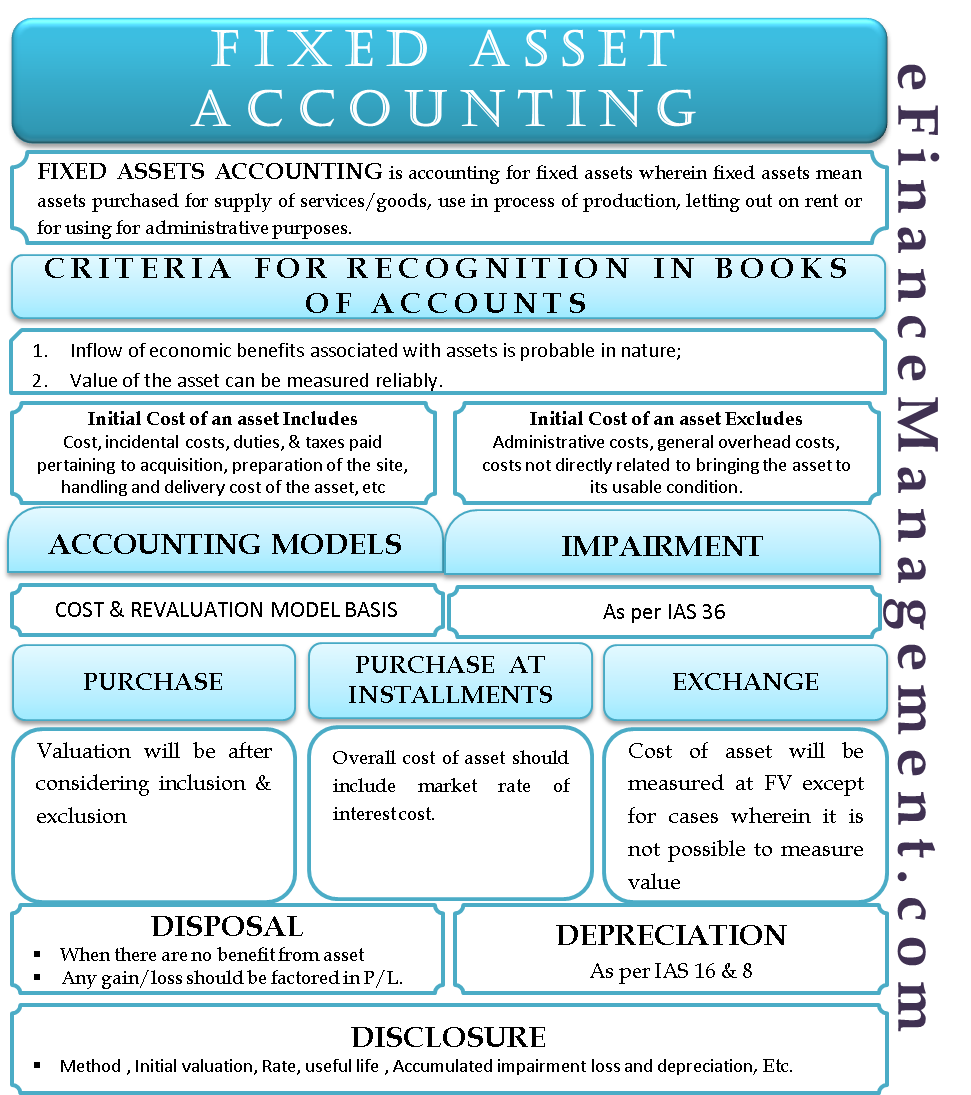

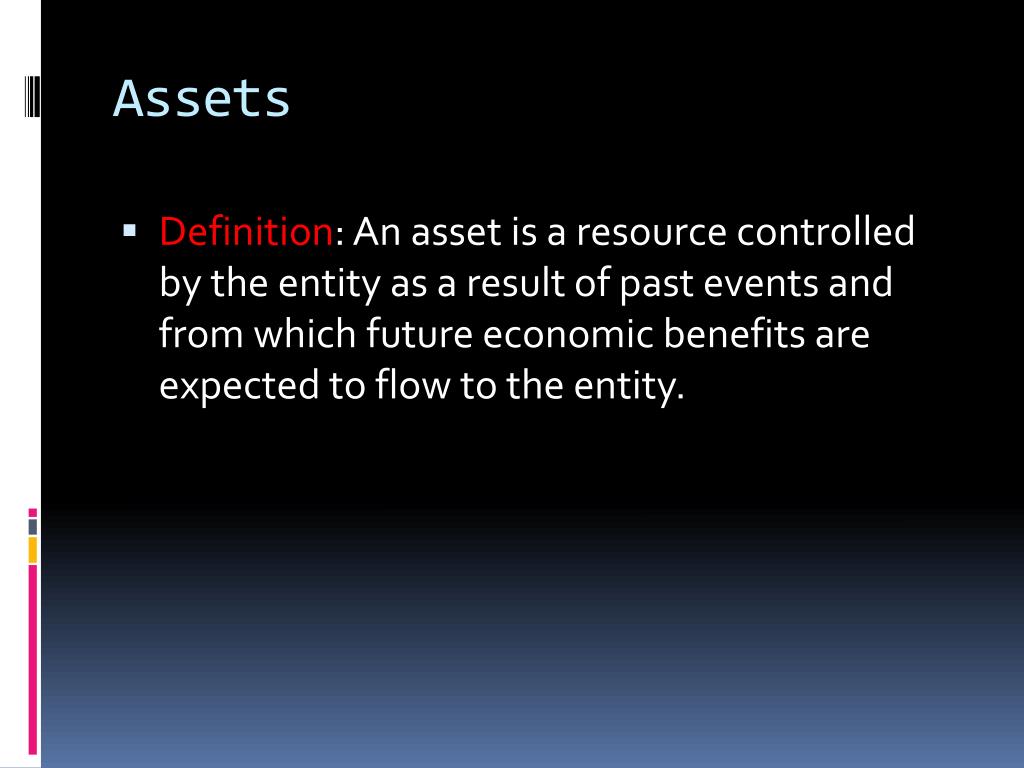

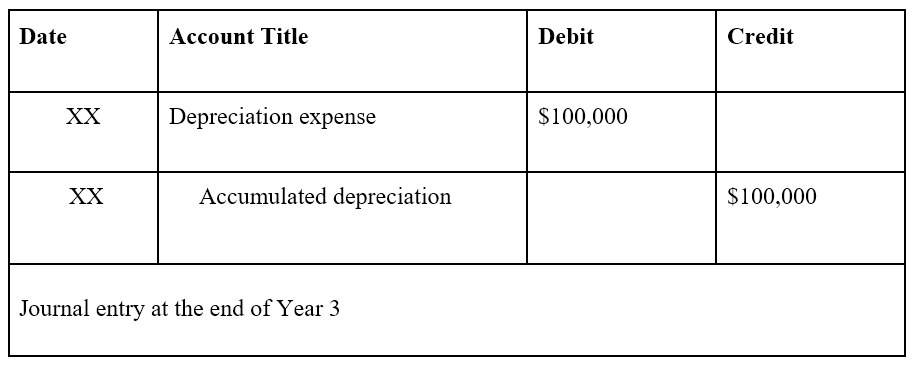

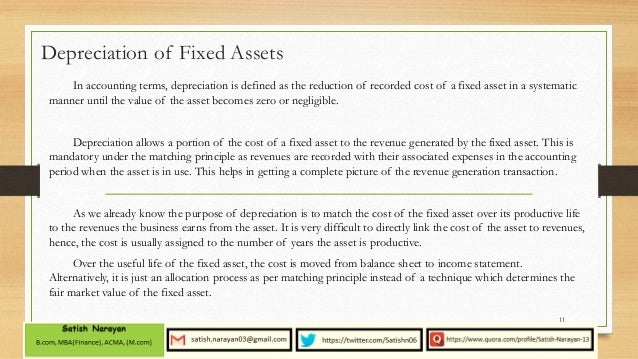

Asset accounting definition. And ii) YouTube 12 marks c) YouTube and VEVO are both examples of brands. IAS 16 outlines the accounting treatment for most types of property, plant and equipment Property, plant and equipment is initially measured at its cost, subsequently measured either using a cost or revaluation model, and depreciated so that its depreciable amount is allocated on a systematic basis over its useful life IAS 16 was reissued in December 03 and applies to annual periods. Depreciation is the accounting term used for assets such as buildings, furniture and fittings, equipment etc Companies use this to record the diminishing value of their assets as they are used in the business from the time of purchase of such assets.

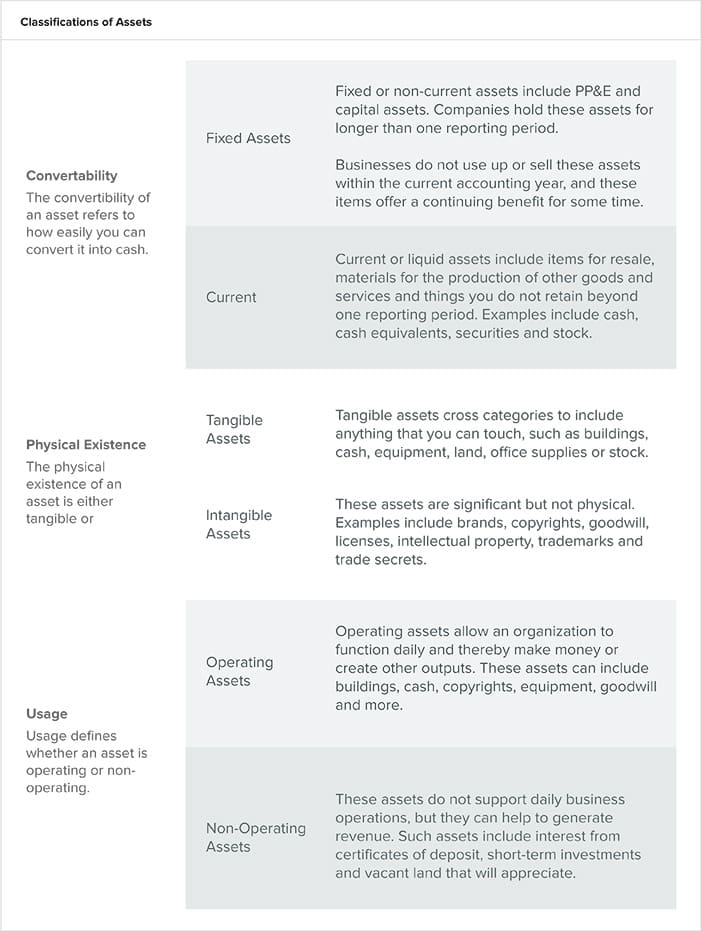

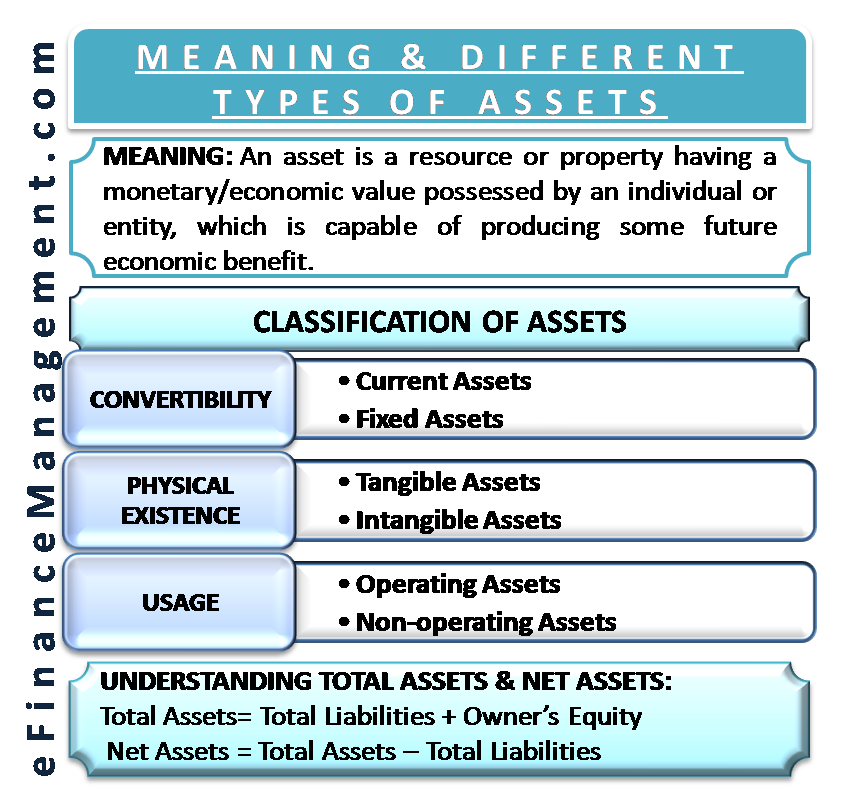

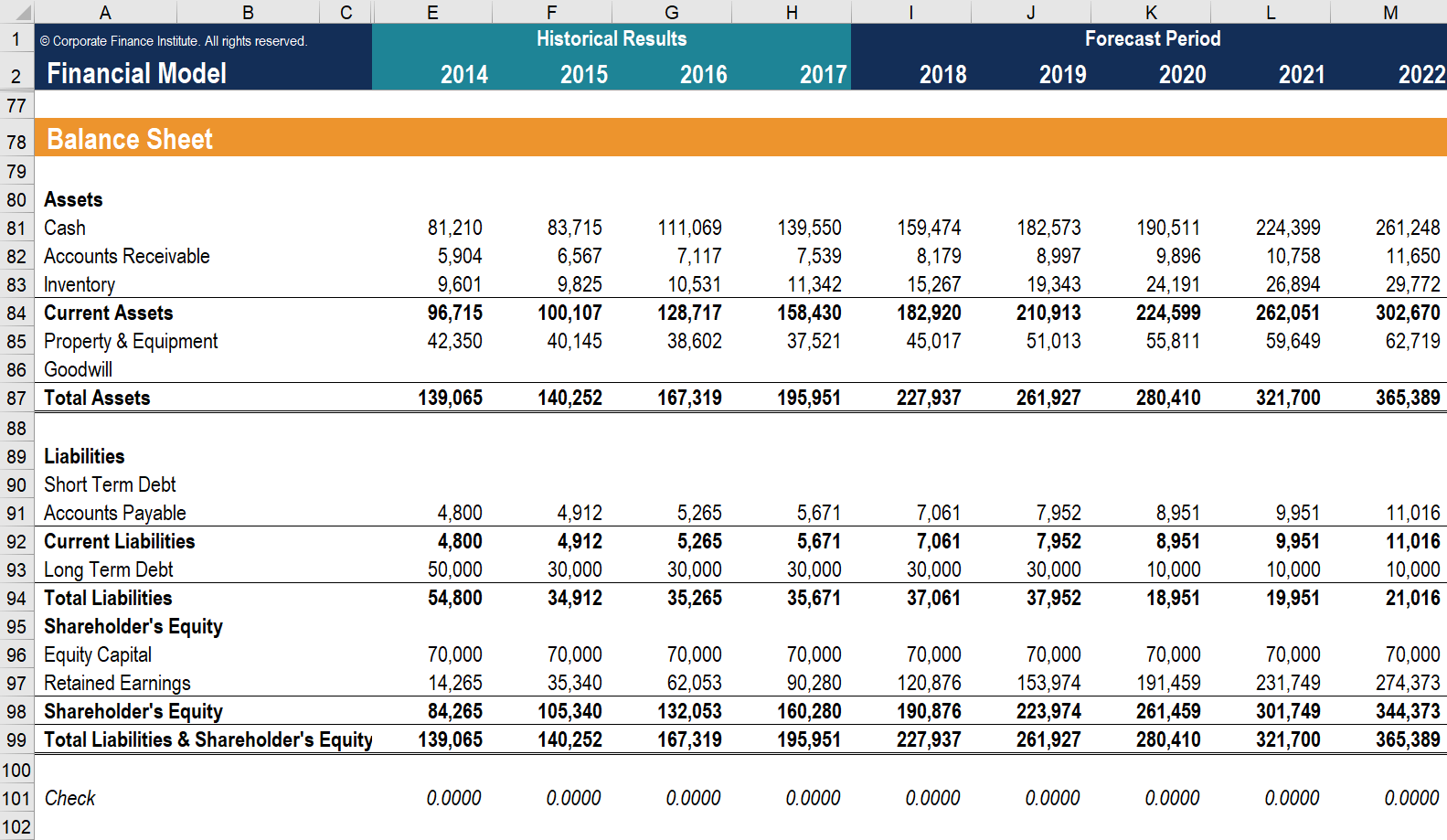

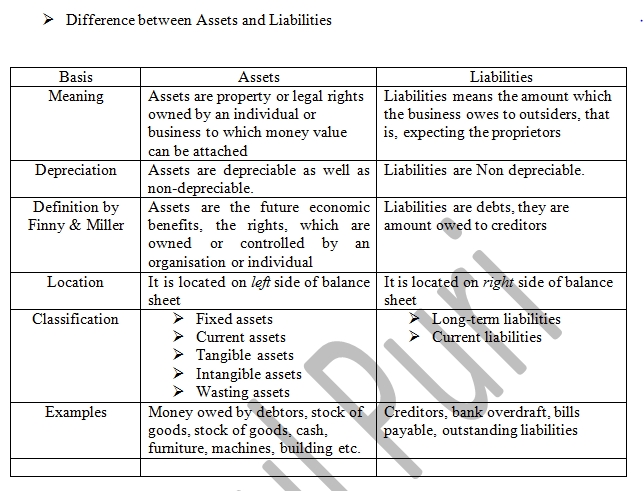

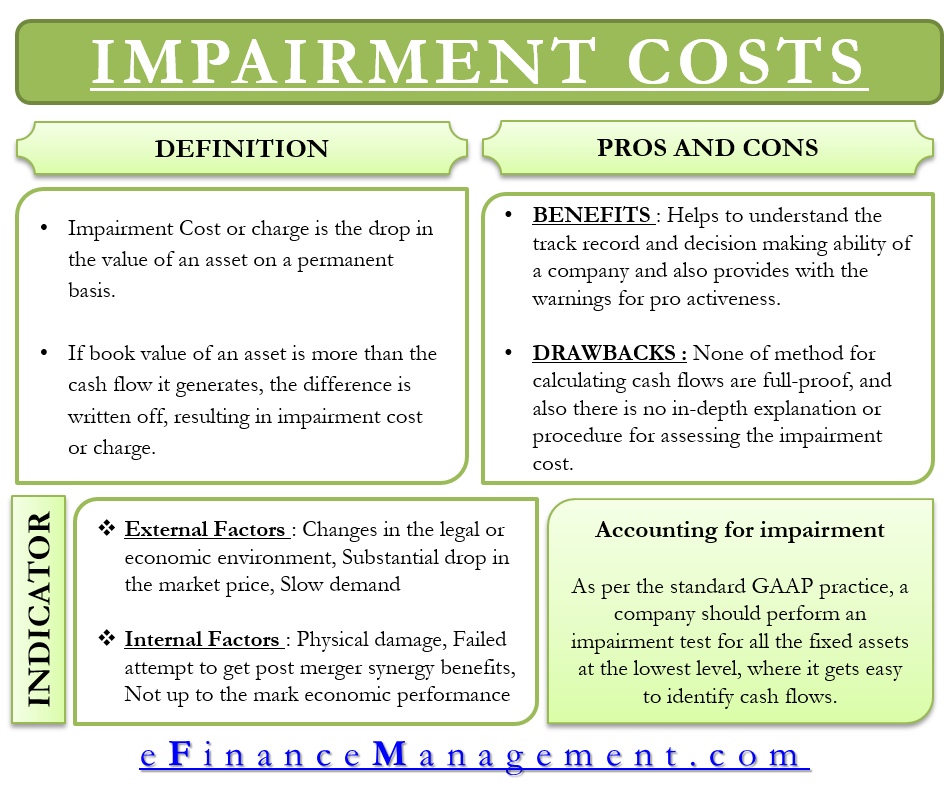

Capital assets are significant pieces of property such as homes, cars, investment properties, stocks, bonds, and even collectibles or art For businesses, a capital asset is an asset with a useful. Asset an item or property which is owned by a business or individual and which has a money value Assets are of three main types physical assets such as plant and equipment, land, consumer durables (cars, etc);. Asset impairment accounting affects asset reduction in the balance sheet and impairment loss recognition in the income statement Please note that goodwill and some tangible assets are required to make an annual impairment test.

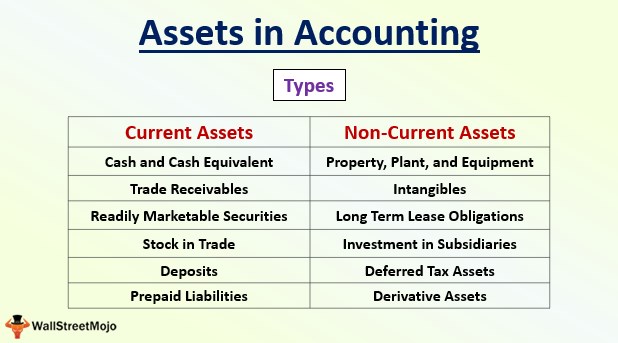

Also the principles and procedures of this system How to use accounting in a sentence. Financial Assets Accounting Asset Definition In accounting, an asset has two criteria a company must own or control it, and it must be expected to generate future benefit for that company Assets on Balance Sheet A company records the value of its assets on the balance sheet Assets can be classified as current assets or as noncurrent assets. Capital assets are real or personal property that have a value equal to or greater than the capitalization threshold for the particular classification of the asset and have an estimated life of greater than one year.

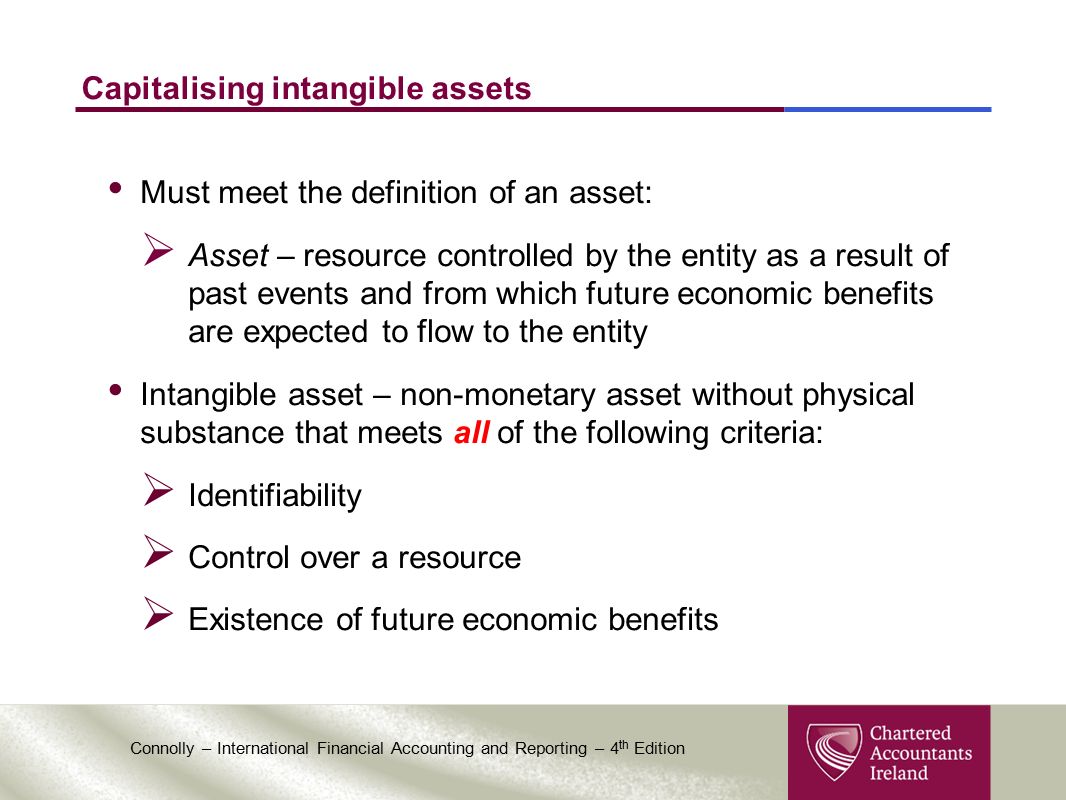

An asset is a resource with economic value that an individual, corporation, or country owns or controls with the expectation that it will provide a future benefit Assets are reported on a. Required a) State, or otherwise explain, the accounting definition of an asset 2 marks b) Discuss (giving reasons for and against) if VEVO’s videos match the definition that you gave in part a) well enough to be shown as an asset in the Statement of Financial Position of i) VEVO;. And ii) YouTube 12 marks c) YouTube and VEVO are both examples of brands.

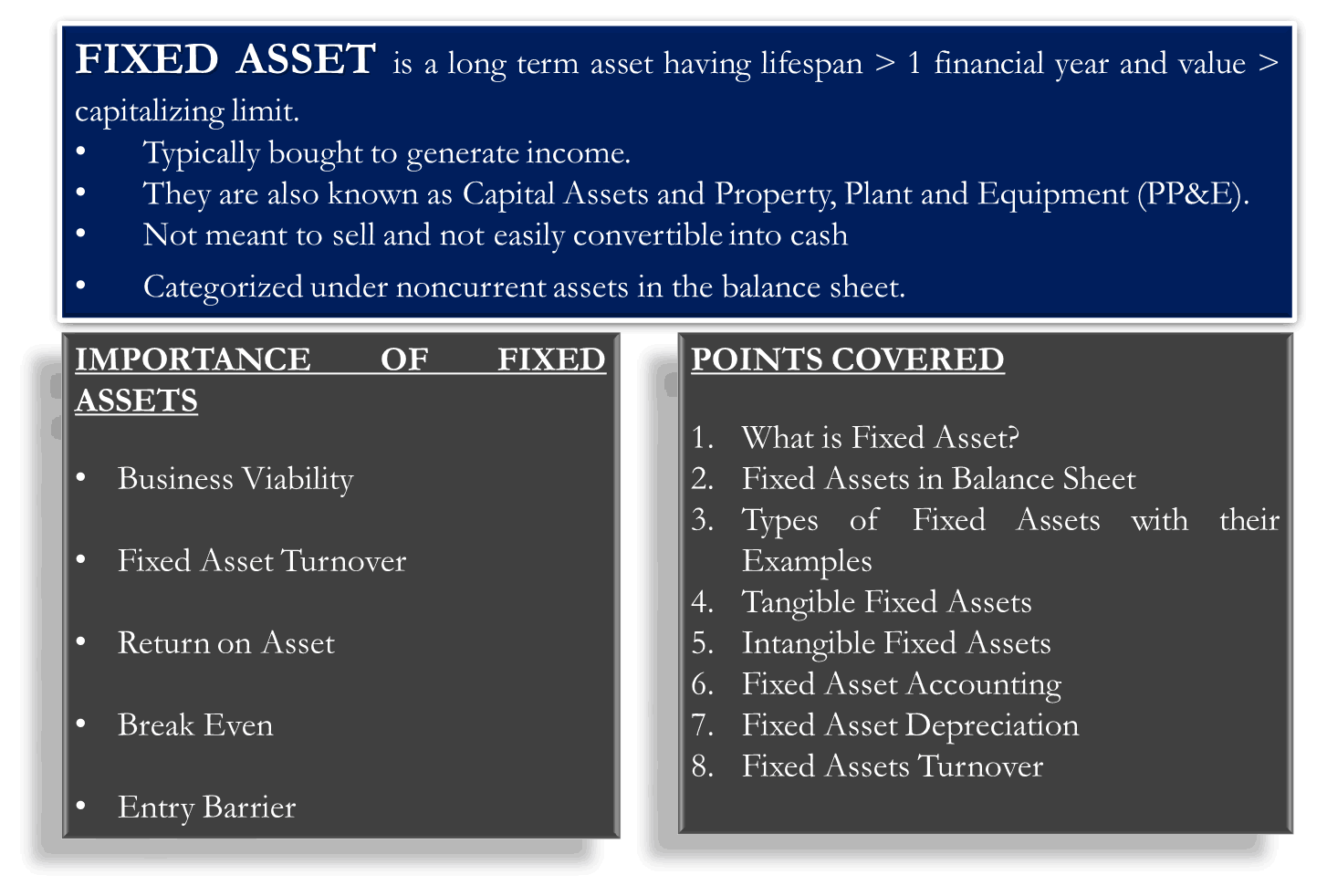

Definition and Explanation Fixed assets, also known as Property, Plant and Equipment, are tangible assets held by an entity for the production or supply of goods and services, for rentals to others, or for administrative purposes These assets are expected to be used for more than one accounting period. Fixed Assets normally refer to property, plant, and equipment that are held for use in the production or supply of goods or services, for rental to others, or for administrative purposes, and they are expected to be used with more than one year accounting period Those assets included land, building, machinery, cars, computers, and other similar kinds of assets defined by law, the accounting standard and company policies. Asset Management Account An account at a bank or other financial institution that allows the account holder to place money for both banking and investment services When money is placed into the account, it is automatically placed into a money market account, which carries a higher interest rate than normal checking or savings accounts.

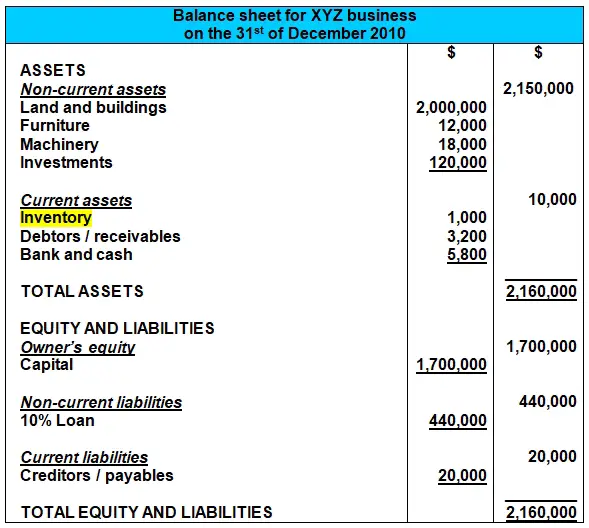

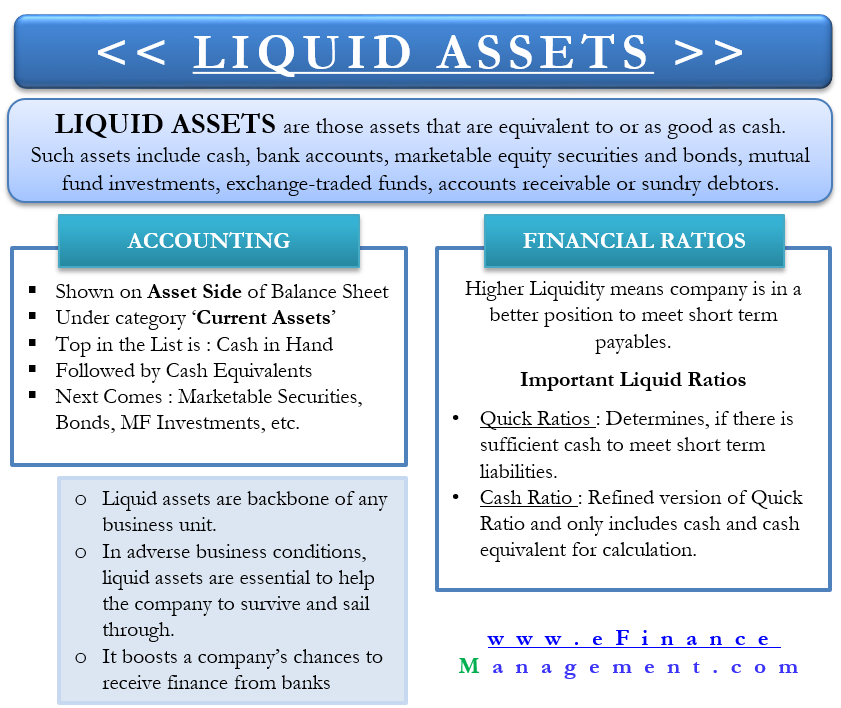

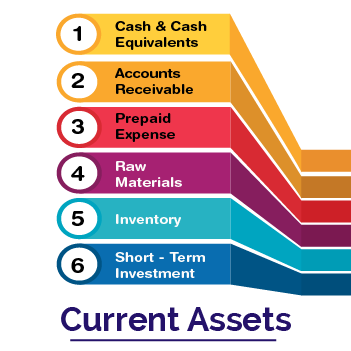

Different accounting methods can be used to inflate inventory, and, at times, it may not be as liquid as other current assets depending on the product and the industry sector. Definition An asset is a resource that owned or controlled by a company and will provide a benefit in current and future periods for the business In other words, it’s something that a company owns or controls and can use to generate profits today and in the future What Does Asset Mean?. Fixed Assets vs Current Assets The concept of fixed and current assets is simple to understand The short explanation is that if it is an asset and is either in cash or likely to be converted into cash within the next 12 months (or accounting period), it is considered a current asset.

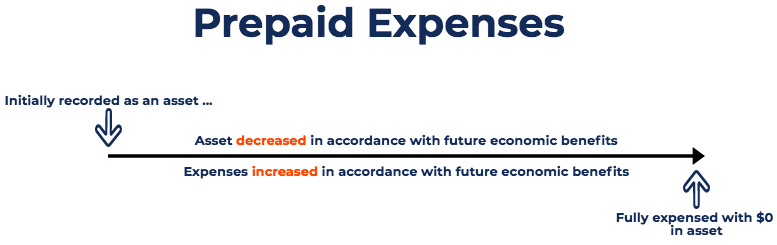

Definition of Assets In accounting and bookkeeping, a company's assets can be defined as Resources or things of value that are owned by a company as the result of company transactions Prepaid expenses that have not yet been used up or have not yet expired Costs that have a future value that can. Expenses are decreases in economic benefits during the accounting period in the form of outflows or depletions of assets or incurrences of liabilities that result in decreases in equity, other than those relating to distributions to equity participants F 425(b) The definition of income encompasses both revenue and gains. Required a) State, or otherwise explain, the accounting definition of an asset 2 marks b) Discuss (giving reasons for and against) if VEVO’s videos match the definition that you gave in part a) well enough to be shown as an asset in the Statement of Financial Position of i) VEVO;.

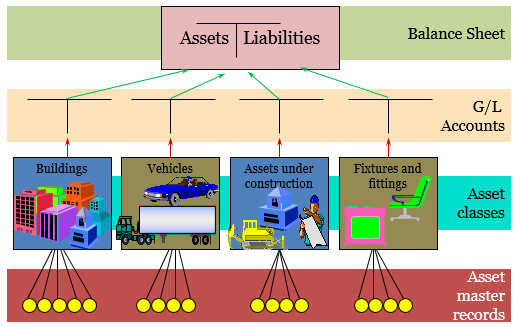

Accounting Books Defining asset books is required for accounting entry processing Asset books are used to store financial information about assets such as cost history, depreciation rules, and retirement information An unlimited number of asset books per business unit can be defined The number of books that you use depends on your reporting. Definition of Assets The General Accounting Plan (GCP) gives a definition of an asset that may seem rather abstract in the first place an asset is an identifiable element of the entity’s assets having a positive economic value for the entity, that is to say, An element generating a resource that the entity controls because of past events and from which it expects future economic benefits. A fixed asset is an item having a useful life that spans multiple reporting periods, and whose cost exceeds a certain minimum limit (called the capitalization limit)There are several accounting transactions to record for fixed assets, which are noted below Initial Asset Recordation On the assumption that the asset was purchased on credit, the initial entry is a credit to accounts payable.

An asset is anything that will add future value to your business Asset Recognition Criteria in Accounting But the definition of assets above is not yet complete In accounting we have specific criteria which need to be fulfilled in order to recognize an asset in our accounting records. This accounting definition of assets necessarily excludes employees because, while they have the capacity to generate economic benefits, an employer cannot control an employee Similarly, in economics, an asset is any form in which wealth can be held. The words “asset” and “liability” are two very common words in accounting/bookkeeping Assets are defined as resources that help generate profit in your business You have some control over it Liability is defined as obligations that your business needs to fulfill In simple words, Liability means credit.

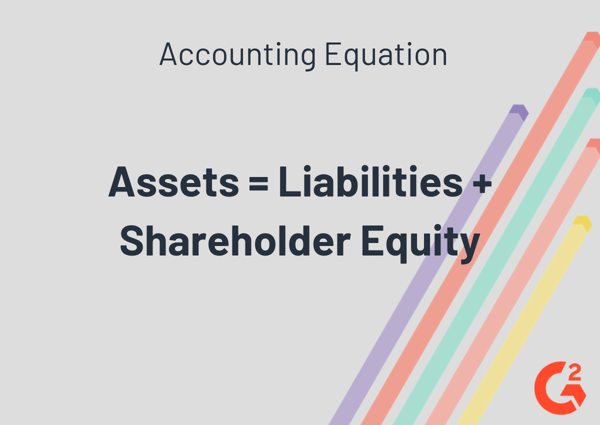

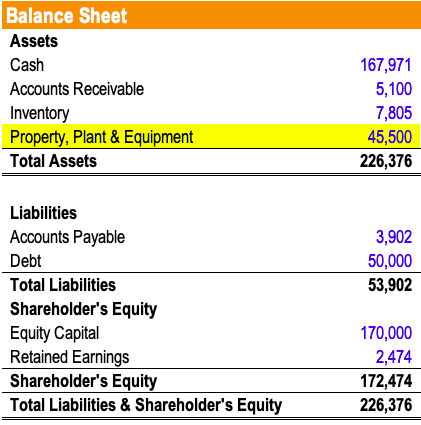

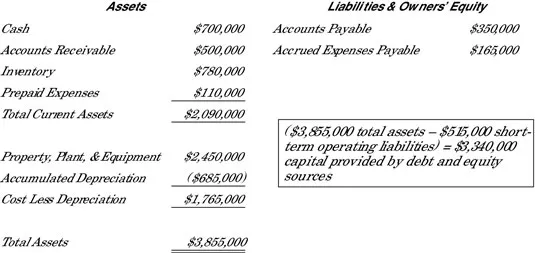

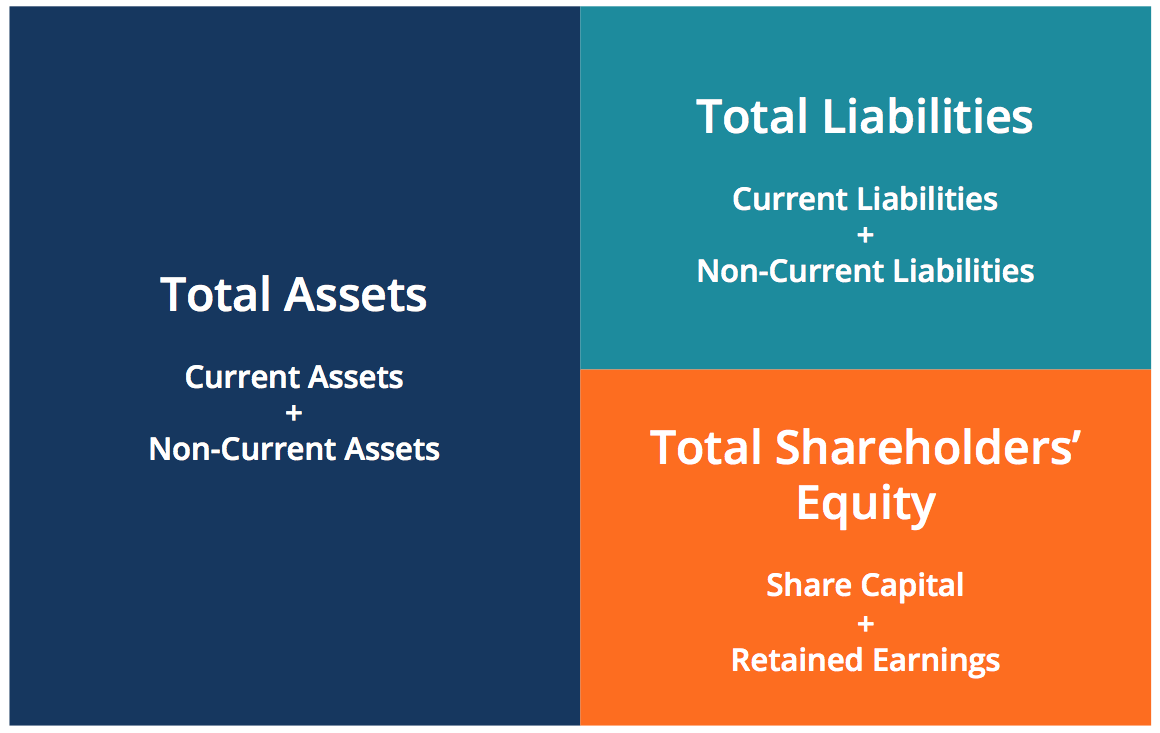

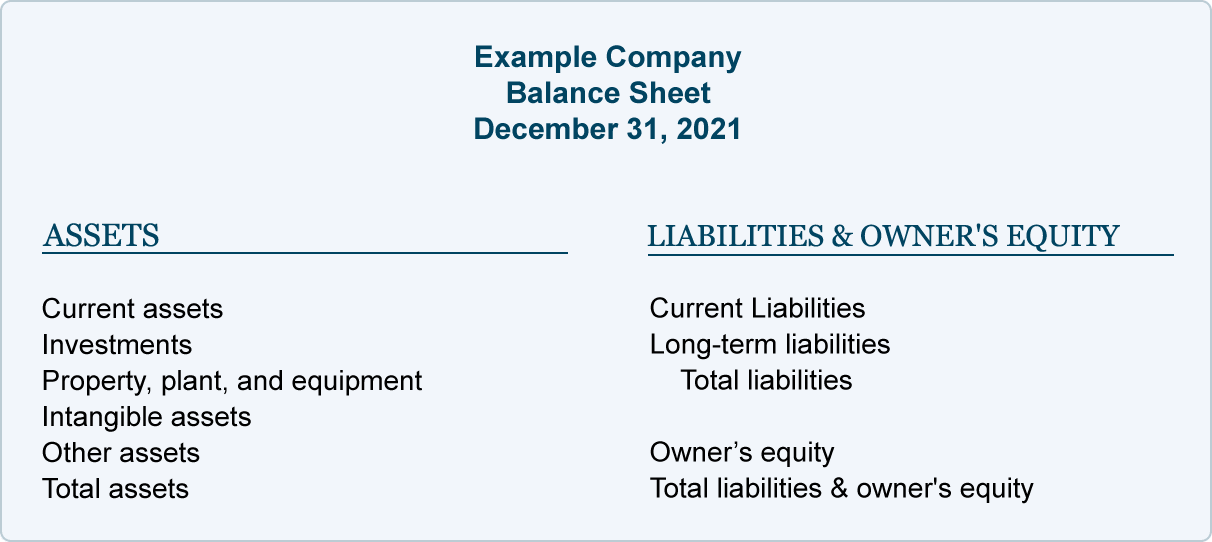

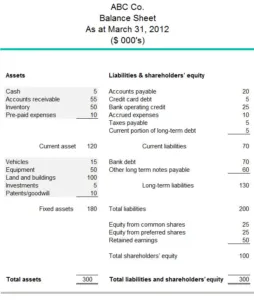

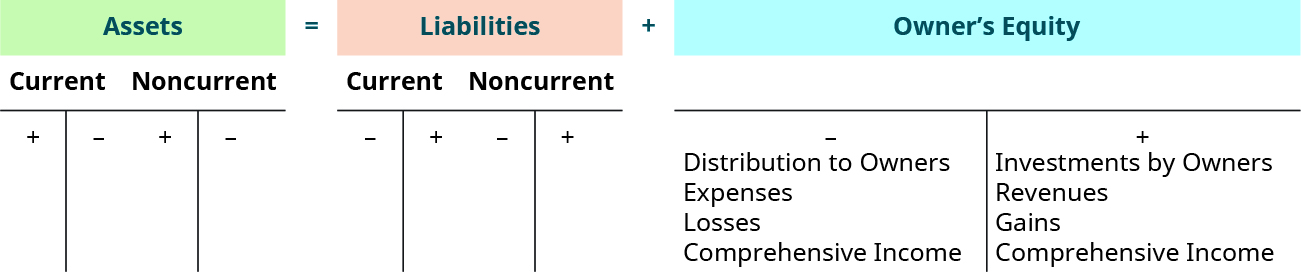

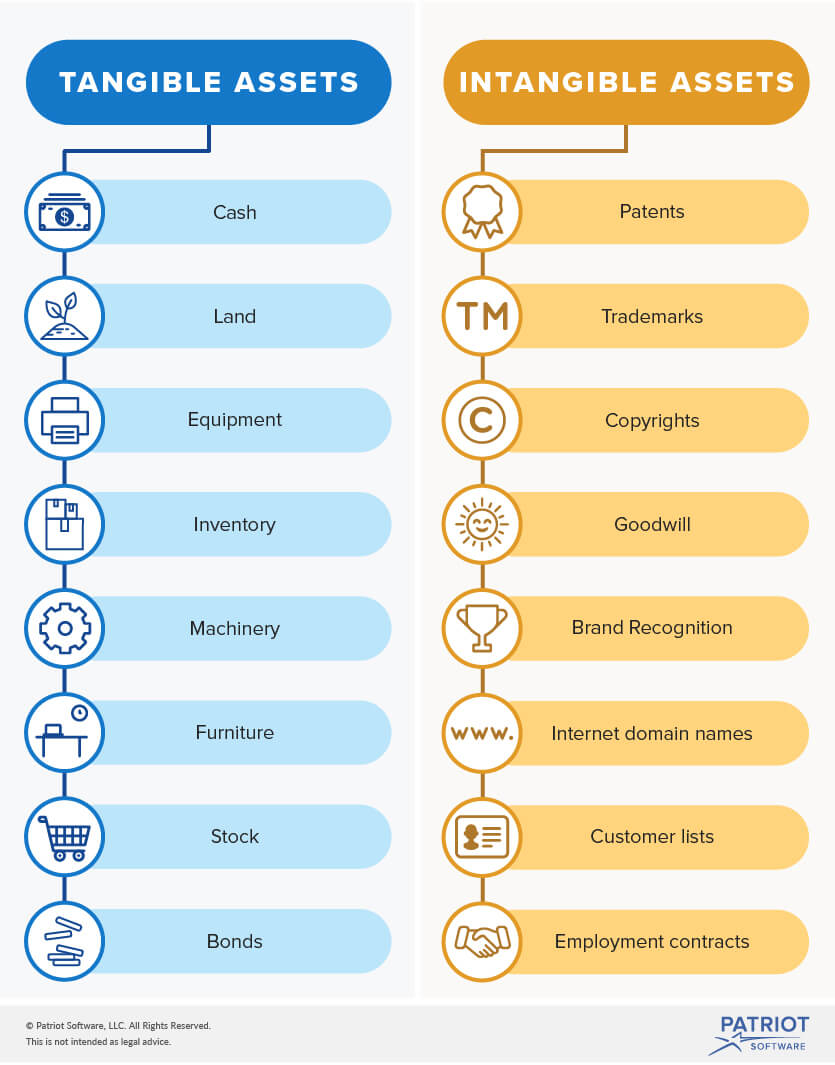

And turn it into the following Assets = Liabilities Equity Accountants call this the accounting equation (also the “accounting formula,” or the “balance sheet equation”) It might not seem like much, but without it, we wouldn’t be able to do modern accounting. Required a) State, or otherwise explain, the accounting definition of an asset 2 marks b) Discuss (giving reasons for and against) if VEVO’s videos match the definition that you gave in part a) well enough to be shown as an asset in the Statement of Financial Position of i) VEVO;. Assets in the accounting world, items that have monetary value and are owned by a business Tangible asset asset that has a physical form, such as a building.

Fixed asset accounting relates to the accurate logging of financial data regarding fixed assets For this purpose, companies require details on a fixed asset’s procurement, depreciation, audits, disposal, and more. And ii) YouTube 12 marks c) YouTube and VEVO are both examples of brands. Accounting (ACCG) definition A systematic way of recording and reporting financial transactions for a business or organization 3 Accounts payable (AP) Accounts payable (AP) definition The amount of money a company owes creditors (suppliers, etc) in return for goods and/or services they have delivered 4 Assets (fixed and current) (FA, CA).

Definition of Assets The General Accounting Plan (GCP) gives a definition of an asset that may seem rather abstract in the first place an asset is an identifiable element of the entity’s assets having a positive economic value for the entity, that is to say, An element generating a resource that the entity controls because of past events and from which it expects future economic benefits. Definition Capital growth is the appreciation in the value of an asset over a period of time It is calculated by comparing the current value, sometimes known as market value of an asset or investment, to the amount paid when you originally bought it. Need to apply the definition of a business in Accounting Standards Codification (ASC) 805 10, Business Combinations — Overall When an acquired asset or group of assets does not meet that definition, the transaction is accounted for as an asset acquisition in accordance with ASC , Business Combinations — Related Issues.

Capital Asset Accounting (CAA) is responsible for managing and ensuring proper financial treatment and reporting of tangible and intangible capital assets of the Davis campus, Medical Center (UCDMC), and Agricultural Natural Resources (ANR) The accounting functions are performed in accordance with GAAP, GASB, and university policy and procedures. An asset is a possession of a business that will bring the business benefits in the future An asset is anything that will add future value to your business Asset Recognition Criteria in Accounting But the definition of assets above is not yet complete. These assets are expected to be used for more than one accounting period Fixed assets are generally not considered to be a liquid form of assets unlike current assets Examples of common types of fixed assets include buildings, land, furniture and fixtures, machines and vehicles.

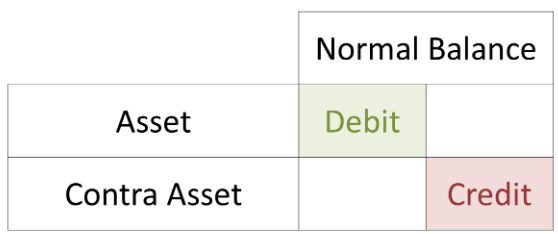

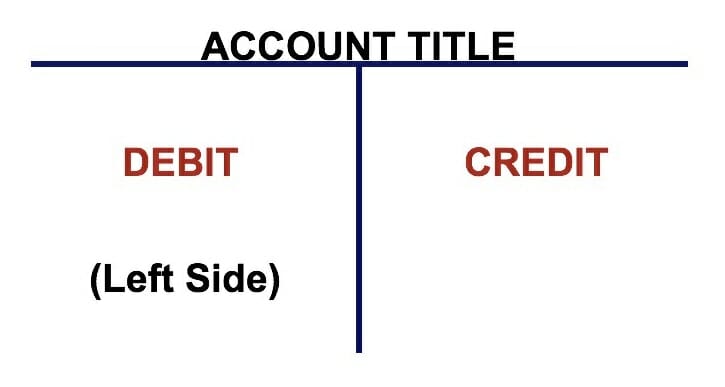

– Definition An asset is defined as a resource that is owned or controlled by a company that can be used to provide a future economic benefit In other words, assets are items that a company uses to generate future revenues or maintain its operations Assets accounts generally have a debit balance. An asset group is a cluster of longlived assets that represents the lowest level at which cash flows can be identified that are independent of the cash flows generated by other clusters of assets and liabilities Related Courses Fixed Asset Accounting. In finance and accounting, an asset refers to anything of economic value that we own In fact, it is anything that a person finds useful or valuable Anything that we can convert to cash is probably an asset Assets are items that people, companies, or even a country owns or controls.

Assets are economic resources controlled by a business which can potentially benefit its operations or are convertible to cash (cash itself is also an asset) Examples of Assets Following are the common assets of a business Cash Cash includes physical money such as bank notes and coins as well as amount deposited in bank for current use. Capital Assets Accounting FAQs What is the definition of a capital asset?. Assets in accounting are the medium through which business can be undertaken, are either tangible or intangible and have a monetary value can be associated with it due to the economic benefits that can be derived from them.

Asset – definition and meaning In finance and accounting, an asset refers to anything of economic value that we own In fact, it is anything that a person finds useful or valuable Anything that we can convert to cash is probably an asset Assets are items that people, companies, or even a country owns or controls We also expect that assets. A Definition of Inventory Accounting Because inventory is a business asset , accountants must consistently and appropriately use an acceptable, valid method for assigning costs to inventory to record it as an asset. From an accounting perspective, fixed assets – an item with a useful life greater than one reporting period, depreciated over time Fixed assets are also known as capital assets and tangible assets These are items that an organization purchases for longterm business purposes This is not inventory that business is planning to resell to make a profit, but rather an investment.

Accounting Standard 6 issued by the Institute of the Chartered Accountants of India defines ‘depreciation’ as “a measure of the wearing out, consumption or other loss of value of a depreciable asset arising from use, effluxion of time or obsolescence through technology and market changes. Definition of Assets In accounting and bookkeeping, a company's assets can be defined as Resources or things of value that are owned by a company as the result of company transactions Prepaid expenses that have not yet been used up or have not yet expired Costs that have a future value that can be measured. What are Assets in Accounting?.

Fixed assets—also known as tangible assets or property, plant, and equipment (PP&E)—is an accounting term for assets and property that cannot be easily converted into cashThe word fixed indicates that these assets will not be used up, consumed, or sold in the current accounting year Yet there still can be confusion surrounding the accounting for fixed assets. A Definition of Inventory Accounting Because inventory is a business asset , accountants must consistently and appropriately use an acceptable, valid method for assigning costs to inventory to record it as an asset. Accounting Models for Measurement of Asset post its Initial Measurement Cost Model Basis The valuation of the asset is at its cost price less accumulated depreciation and impairment cost Revaluation Model Basis The valuation of the asset is the fair value less its subsequent depreciation and impairment.

Accounting definition is the system of recording and summarizing business and financial transactions and analyzing, verifying, and reporting the results;. Accounting goodwill is the excess value of a firm’s net assets and is recorded at time of business acquisition or combination Goodwill is not associated with a physical object that the business owns, so it is an intangible asset and is listed on a company’s balance sheet. Definition An asset is a resource that has some economic value to a company and can be used in a current or future period to generate revenues These resources take many forms from cash to buildings and are recorded on the balance sheet until they are used.

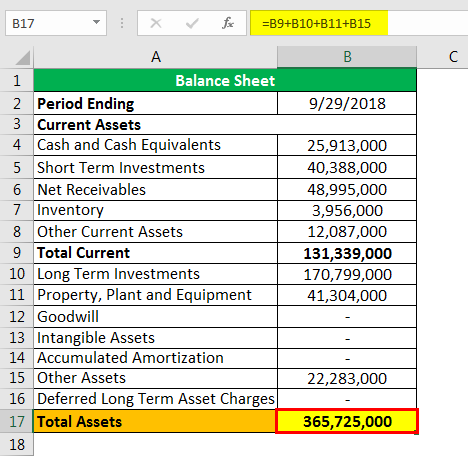

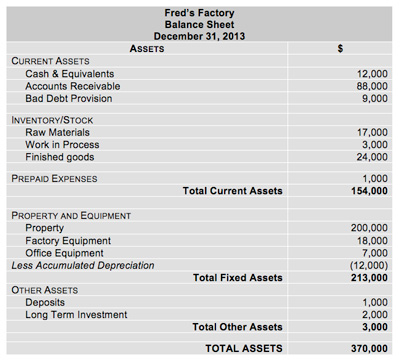

Assets definition Things that are resources owned by a company and which have future economic value that can be measured and can be expressed in dollars Examples include cash, investments, accounts receivable, inventory, supplies, land, buildings, equipment, and vehicles Assets are reported on the balance sheet usually at cost or lower. The objective of IAS 16 is to prescribe the accounting treatment for property, plant, and equipment The principal issues are the recognition of assets, the determination of their carrying amounts, and the depreciation charges and impairment losses to be recognised in relation to them. In financial accounting, an asset is any resource owned or controlled by a business or an economic entity It is anything that can be utilized to produce value and that is held by an economic entity and that could produce positive economic value Simply stated, assets represent value of ownership that can be converted into cash The balance sheet of a firm records the monetary value of the assets owned by that firm It covers money and other valuables belonging to an individual or to a business.

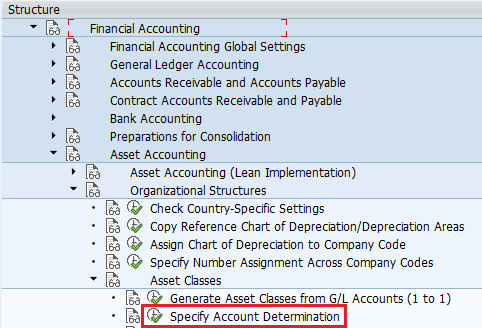

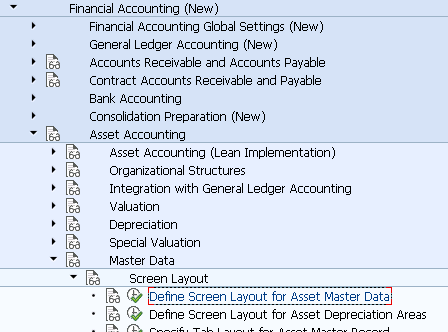

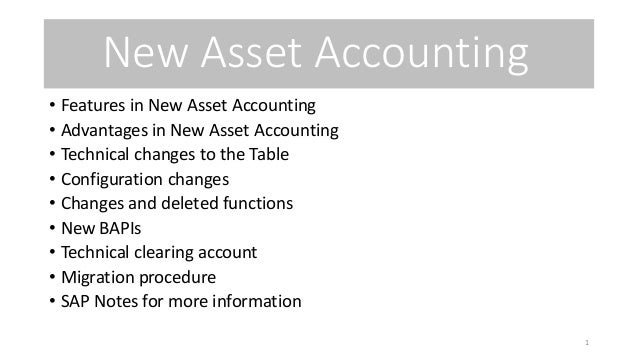

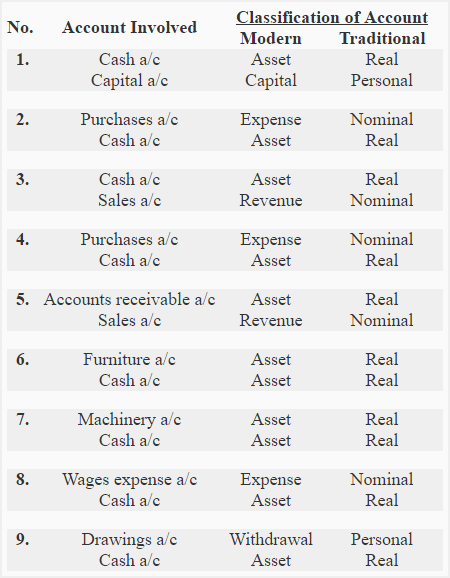

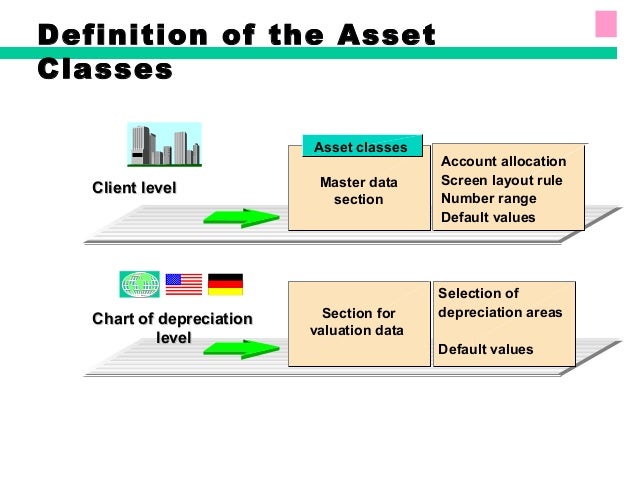

An asset is an expenditure that has utility through multiple future accounting periods If an expenditure does not have such utility, it is instead considered an expense For example, a company pays its electrical bill. Asset Accounting Configuration The Asset Accounting module 1 Organizational structures In this section, you define the features of the Asset Accounting organizational objects (chart of depreciation, FI company code, asset class) All assets in the system have to be assigned to these organizational objects that you define In this way,. The International Financial Reporting Standards (IFRS) framework defines an asset as follows “An asset is a resource controlled by the enterprise as a result of past events and from which future economic benefits are expected to flow to the enterprise” Examples of assets include Cash and cash equivalents.

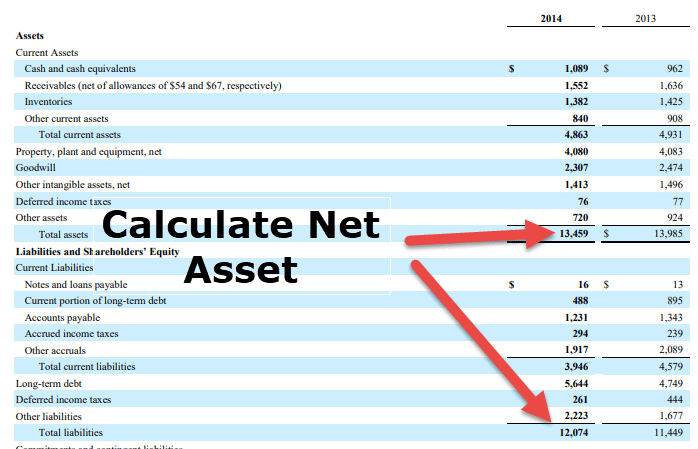

Since, by definition, an asset must be controlled by the entity in order for it to be recognized in the financial statements, certain ‘Assets’ would not qualify for recognition Consider a highly dedicated workforce Generally speaking, a hardworking and motivated workforce is the most valuable asset of any successful company. In accounting, the company’s total equity value is the sum of owners equity—the value of the assets contributed by the owner(s)—and the total income that the company earns and retains Let’s consider a company whose total assets are valued at $1,000. Financial Assets Accounting Asset Definition In accounting, an asset has two criteria a company must own or control it, and it must be expected to generate future benefit for that company Assets on Balance Sheet A company records the value of its assets on the balance sheet Assets can be classified as current assets or as noncurrent assets.

Asset accounting must keep two separate depreciation schedules when depreciating fixed assets The final group of balance sheet fixed assets is investments held by the company These items are classified as heldtomaturity, available for sale and longterm investments Asset accounting reports these items at the current market value. And ii) YouTube 12 marks c) YouTube and VEVO are both examples of brands. Definition Assets are resources that control by the entity and those resources are expected to have the economic inflow into the entity in the future Those assets included cash, account receivables, cares, computer equipment, land, building, and any other resources that control by the entity The balance sheet is one of five financial statements that report the entity’s financial.

1 Definition Of Accounting Variables Download Table

Asset Definition Accounting Terminology Acounting Definition 3 Youtube

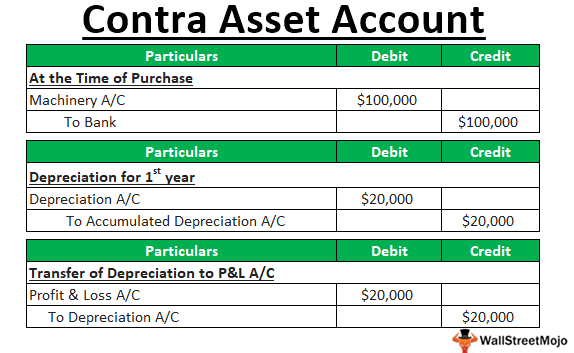

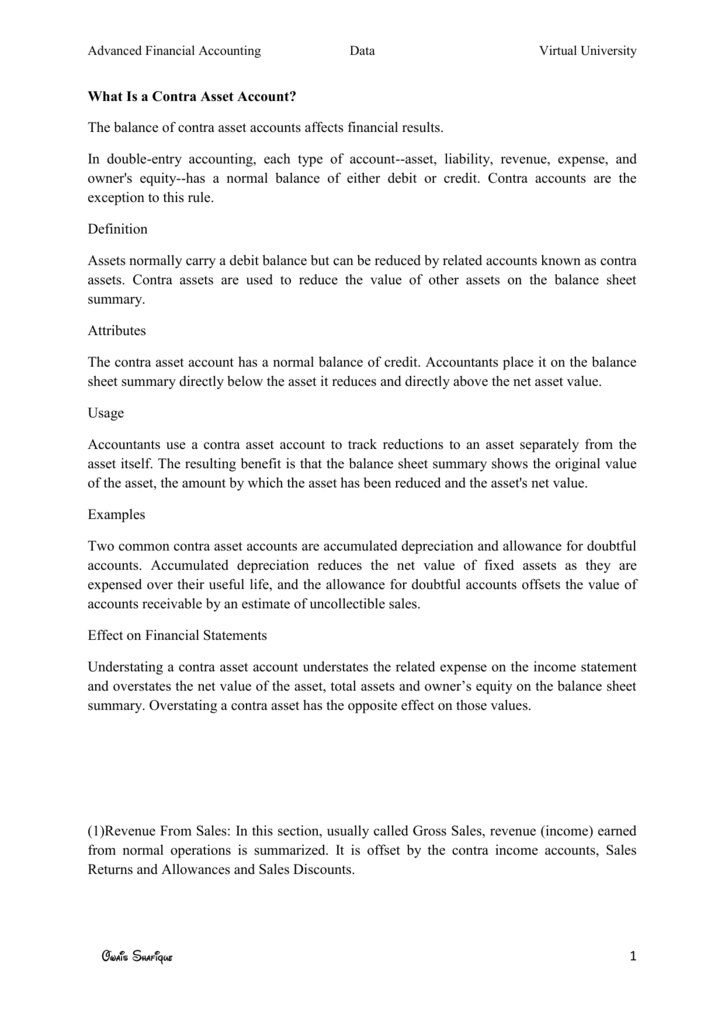

Contra Asset Account Definition List Examples With Accounting Entry

Asset Accounting Definition のギャラリー

What Are Assets Definition Types And Examples

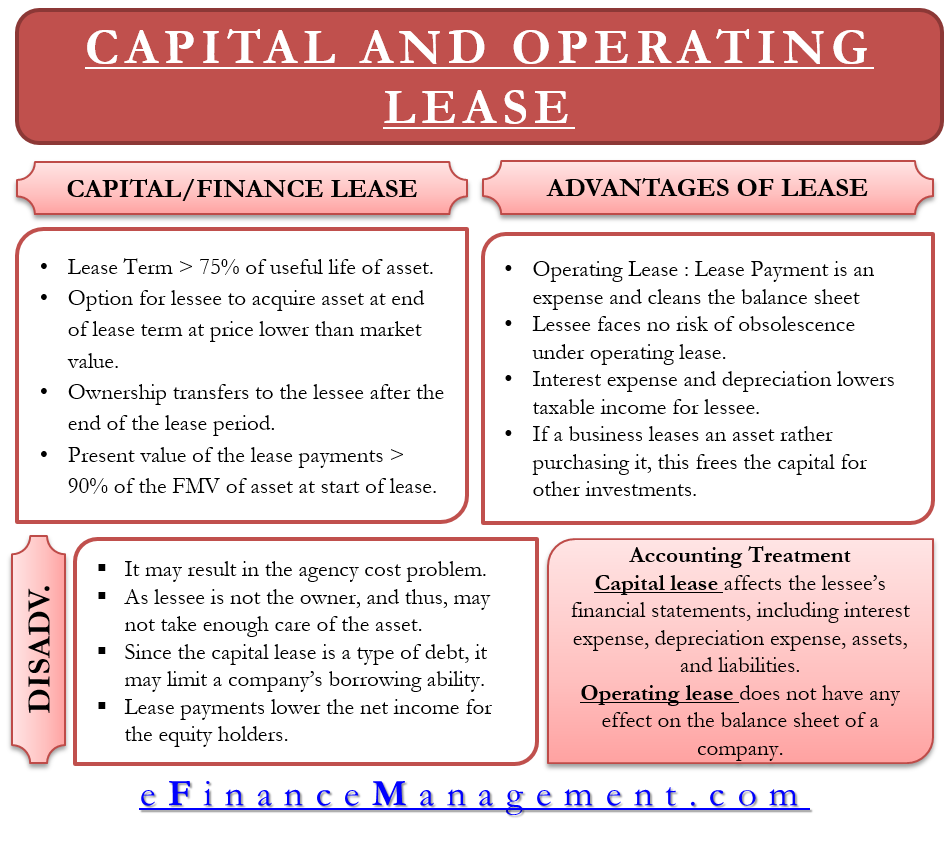

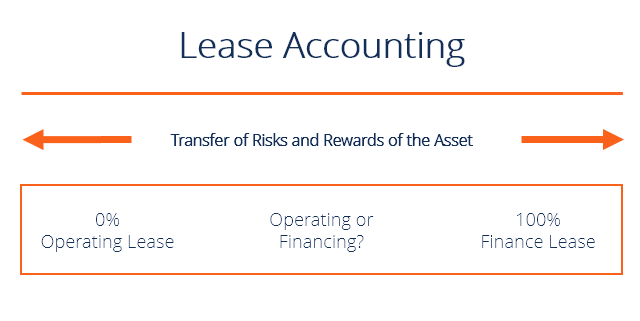

Leased Asset Types Accounting Treatment And More

/T-Account_2-cf96e42686cc4a028f0e586995b45431.png)

T Account Definition

What Is Inventory

What Is Operating Fixed Assets Definition Of Fixed Asset

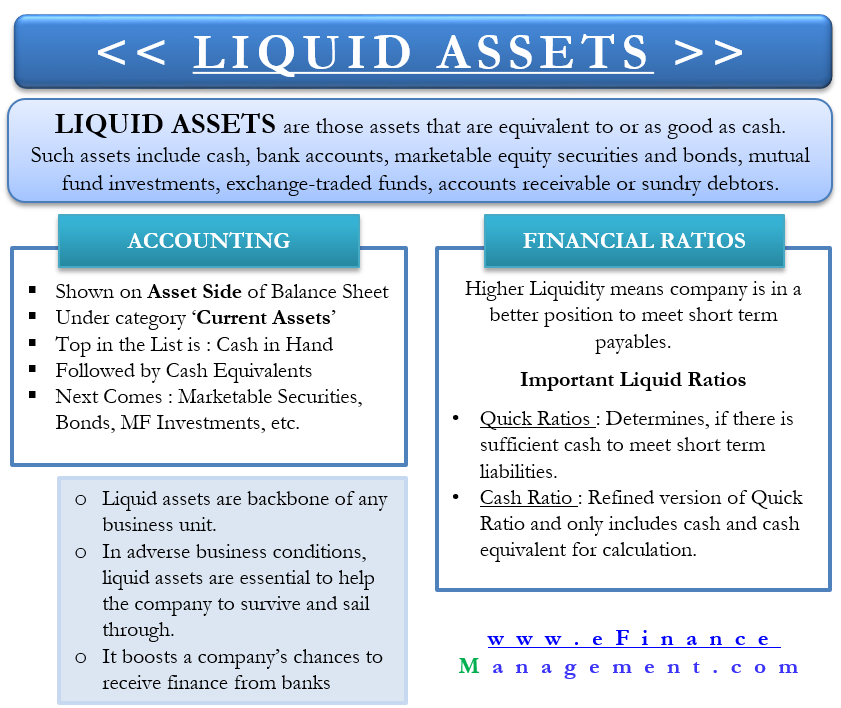

Liquid Assets Meaning Accounting Treatment Importance

Statement Of Financial Position Nonprofit Accounting Basics

What Is The Accounting Equation Overview Formula And Example Bookstime

What Is The Difference Between Fixed Asset Write Off And Disposal Wikiaccounting

What Is A Fixed Asset Definition Types Formula Examples List

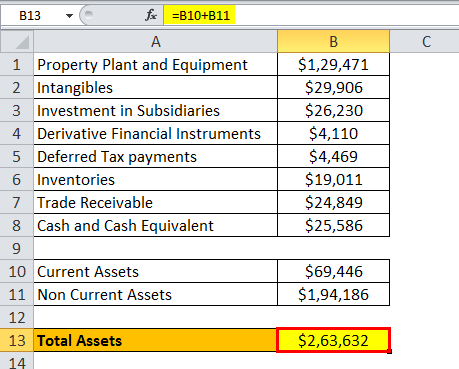

Total Assets Definition Example Applications Of Total Assets

Current Assets Definition Examples Full List Of Items Included

Fixed Assets Definition Characteristics Examples

The Basics Of Accounting Boundless Accounting

/dotdash_Final_How_Current_and_Noncurrent_Assets_Differ_Oct_2020-01-e74218e547134e3db0ac9e9a7446d577.jpg)

Current And Noncurrent Assets The Difference

Asset Definition And Meaning Market Business News

Write Off Meaning Examples What Is Write Off In Accounting

Assets In Accounting Definition Examples Of Assets On Balance Sheet

Quick Assets Definition Formula List Calculation Examples

What Are Fixed Assets A Simple Primer For Small Businesses Freshbooks Resource Hub

Prepaid Expenses Examples Accounting For A Prepaid Expense

S 4 Hana New Asset Accounting Considering Key Aspects Sap Blogs

Accounting Equation Overview Formula And Examples

:max_bytes(150000):strip_icc()/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

Deferred Tax Asset Definition

Assets Balance Sheet Definition

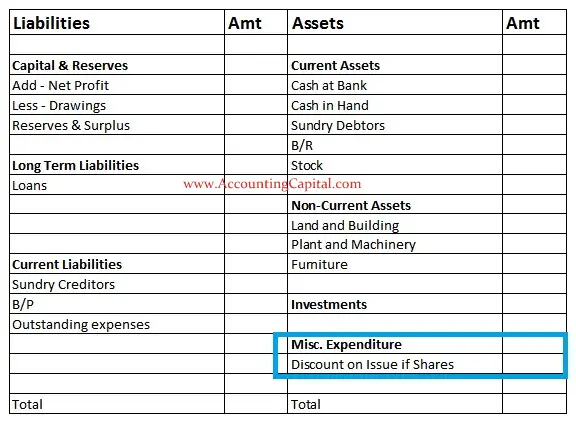

What Is A Balance Sheet Accountingcoach

What Is An Intangible Asset A Simple Definition For Small Business With Examples

What Is A Contra Asset Account Definition And Example Accounting Services

What Is Contra Account And Its Importance Tally Solutions

Fixed Asset Accounting Made Simple Netsuite

Slow Adoption Progress Of Asc 842 Leases Slow Adoption Progress Of Asc 842 Leases Audit Analyticsaudit Analytics

Fixed Asset Accounting Examples Journal Entries Dep Disclosure

/ExxonLongtermAssets2018-5c5485414cedfd0001efdb2c.jpg)

Long Term Assets Definition

Meaning And Different Types Of Assets Classification More

Define Explain And Provide Examples Of Current And Noncurrent Assets Current And Noncurrent Liabilities Equity Revenues And Expenses Principles Of Accounting Volume 1 Financial Accounting

T Accounts A Guide To Understanding T Accounts With Examples

What Is The Difference Between Fixed Asset Write Off And Disposal Wikiaccounting

Depreciation Wikipedia

How To Specify Account Determination In Sap

Definition Of Accounting

What Are Fixed Assets Type Tangible Intangible Accounting Dep

Balance Sheet Definition Examples Assets Liabilities Equity

Chapter 8 Non Current Assets

Asset Definition What Are Assets Youtube

Connolly International Financial Accounting And Reporting 4 Th Edition Chapter 9 Intangible Assets Ppt Download

S 4 Hana New Asset Accounting Considering Key Aspects Sap Blogs

Current Assets Meaning Examples Quiz Accountingcapital

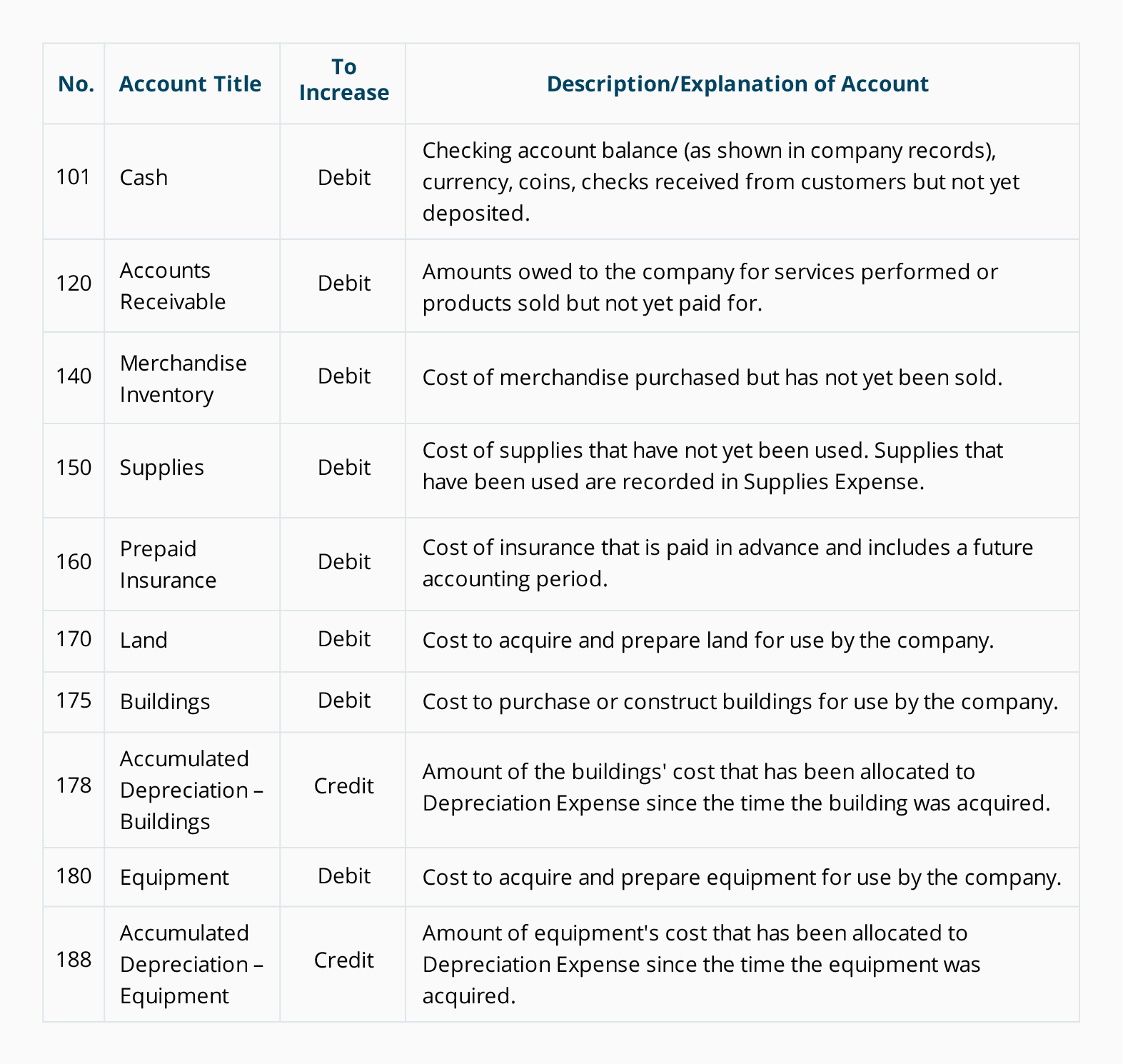

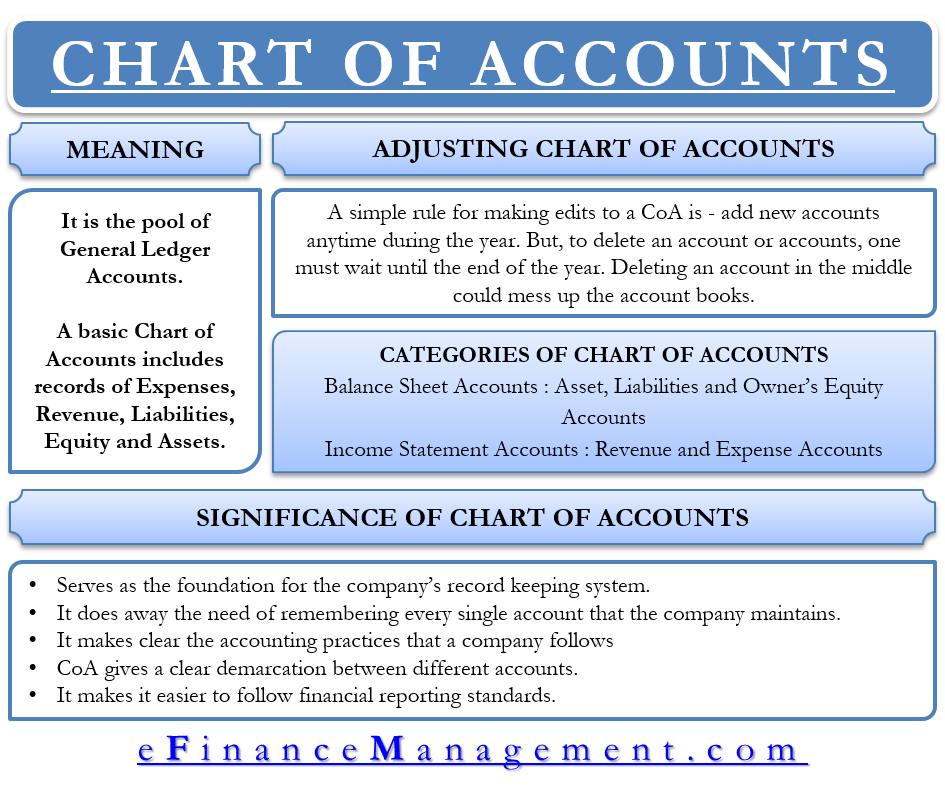

Chart Of Accounts Explanation Accountingcoach

1 What Is A Contra Asset Account The Balance Of Contra Asset

The Basics Of Accounting Boundless Accounting

Fictitious Assets Meaning Examples Quiz Accountingcapital

Q Tbn And9gct7i2xmciw5ftvktfmoudk8 Ewcvgp035uraasncdmezclyreh1 Usqp Cau

Net Assets Formula Definition Investinganswers

Total Assets Definition Example Applications Of Total Assets

Fictitious Assets Meaning And Explanation Tutor S Tips

New Business Definition Eases M A Accounting

/ExxonLongtermAssets2018-5c5485414cedfd0001efdb2c.jpg)

Long Term Assets Definition

Chart Of Accounts Meaning Importance And More

Define Deferred Tax Liability Or Asset Accounting Clarified

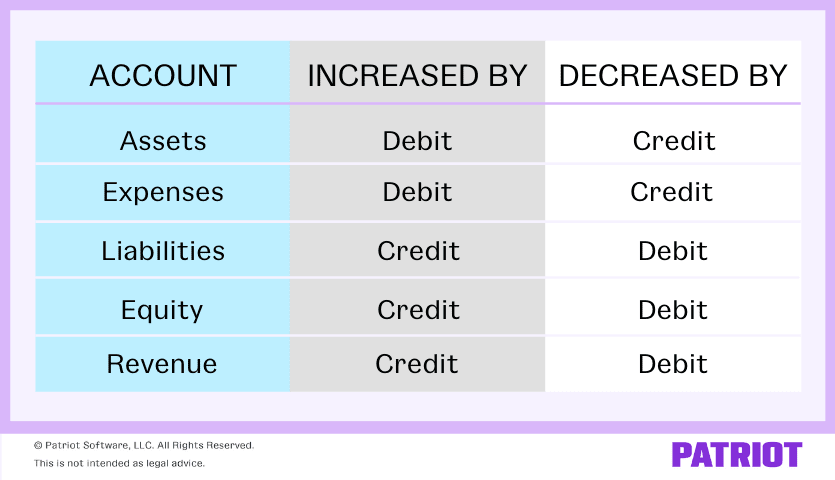

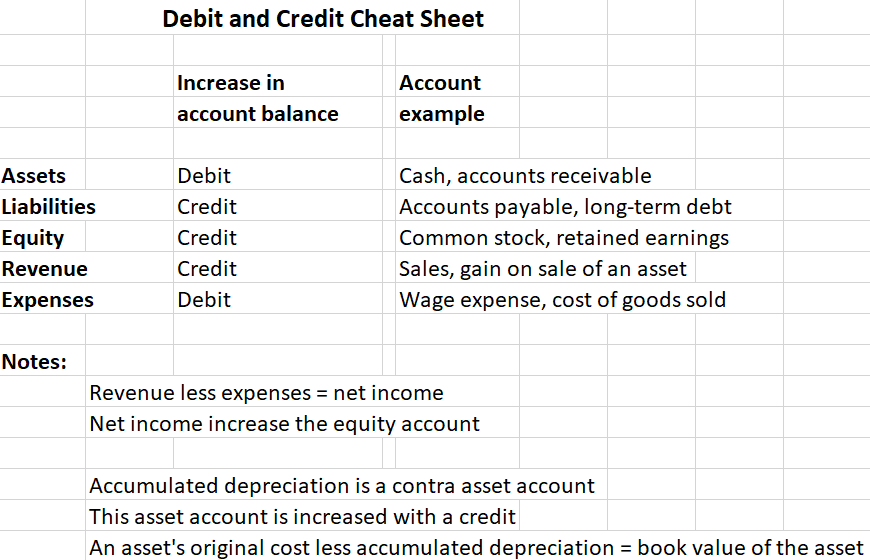

Accounting Basics Debits And Credits

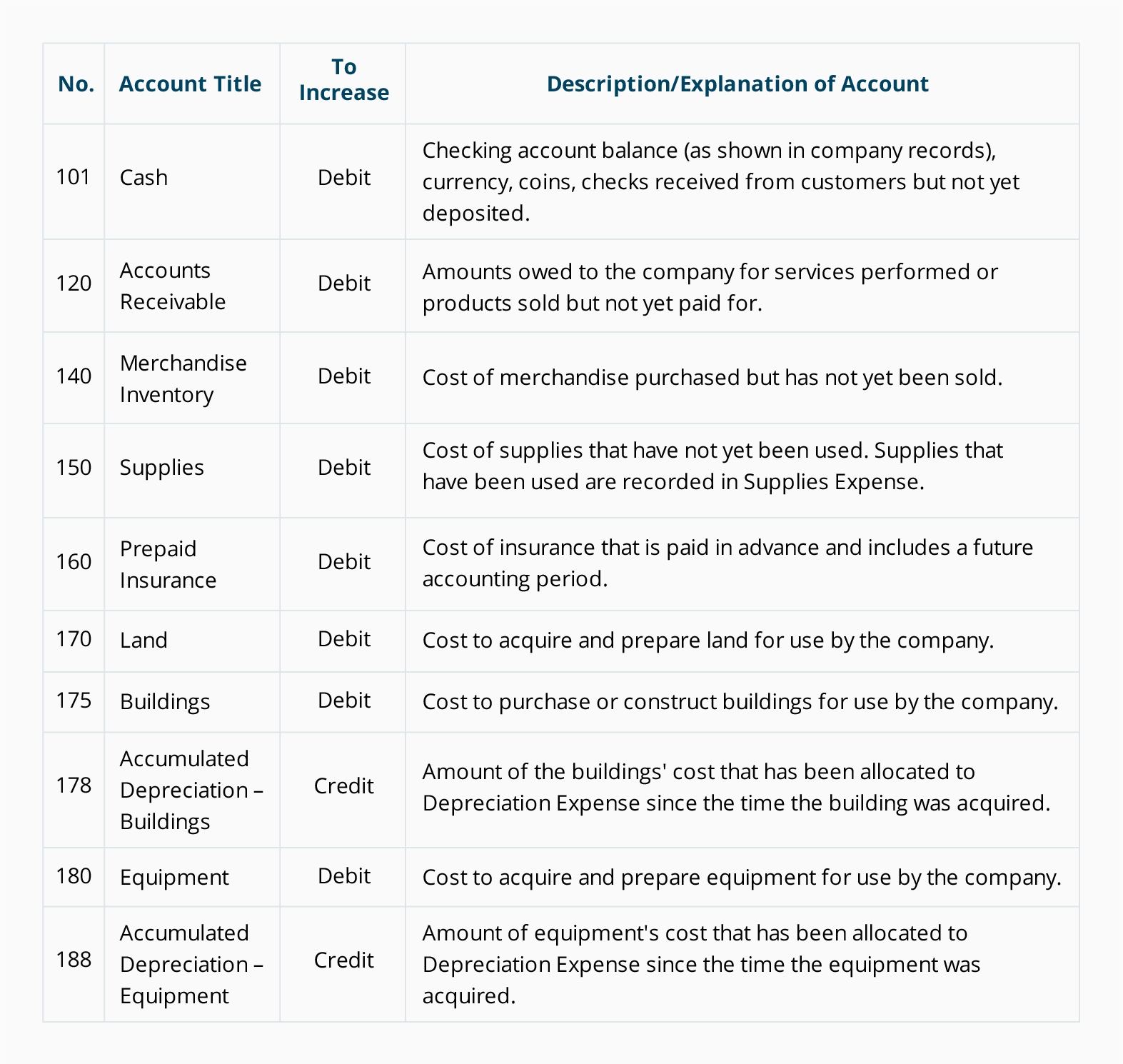

Sample Chart Of Accounts For A Small Company Accountingcoach

Define Screen Layout For Asset Master Data S Alr

S 4 Hana New Asset Accounting Considering Key Aspects Sap Blogs

Net Assets Definition Examples What Is Net Assets

The Definition Of Assets In Accounting

Lease Accounting Operating Vs Financing Leases Examples

What Are Current Assets Definition Meaning List Examples Formula Types

What Is Assets And Current Assets Definition With Examples

How Do Intangible Assets Show On A Balance Sheet

Asset Definition Assignment Point

Ppt Accounting For Company Statement Of Financial Position Assets Powerpoint Presentation Id

Assets In Accounting Definition Examples Of Assets On Balance Sheet

/dotdash_Final_How_Current_and_Noncurrent_Assets_Differ_Oct_2020-01-e74218e547134e3db0ac9e9a7446d577.jpg)

Current And Noncurrent Assets The Difference

Oracle Assets User Guide

Liquidation Basis Accounting And Reporting The Cpa Journal

Contra Asset Examples How A Contra Asset Account Works

What Is A Fixed Asset Definition And Example Goselfemployed Co Fixed Asset Finance Blog Asset

Sap Fixed Asset Configuration Presentation Updated bbbc867f D18a 41 A5f3 602af59bfe Fixed Asset Depreciation

Total Assets Definition Explanation Video Lesson Transcript Study Com

Total Assets Definition Explanation Video Lesson Transcript Study Com

New Asset Accounting In S4 Hana

Tangible Vs Intangible Assets What S The Difference

Financial Statements Overview Objectives Double Entry Accounting

:max_bytes(150000):strip_icc()/balancesheet.asp-V1-5c897eae46e0fb0001336607.jpg)

Balance Sheet Definition

Asset Characteristics Financial Accounting Balance Sheet

:max_bytes(150000):strip_icc()/dotdash_Final_Asset_Turnover_Ratio_Aug_2020-03-c36b34f0f73c4529bbfeaeee335d33d0.jpg)

Asset Turnover Ratio Definition

3

1

The Basics Of Accounting Boundless Accounting

Fixed Asset Process

Impairment Cost Meaning Benefits Indicators And More

Confluence Mobile Community Wiki

Classification Of Accounts Definition Explanation And Examples Accounting For Management

2

How To Create Asset Classes In Sap What Is An Asset Class

Fixed Assets In Sap Business One Introduction

Prepaid Expenses Definition Example Financial Edge Training

Sap Fixed Assets Accounting

Assets In Accounting Definition Examples Of Assets On Balance Sheet

Debit Vs Credit