Asset Accounting In Sap

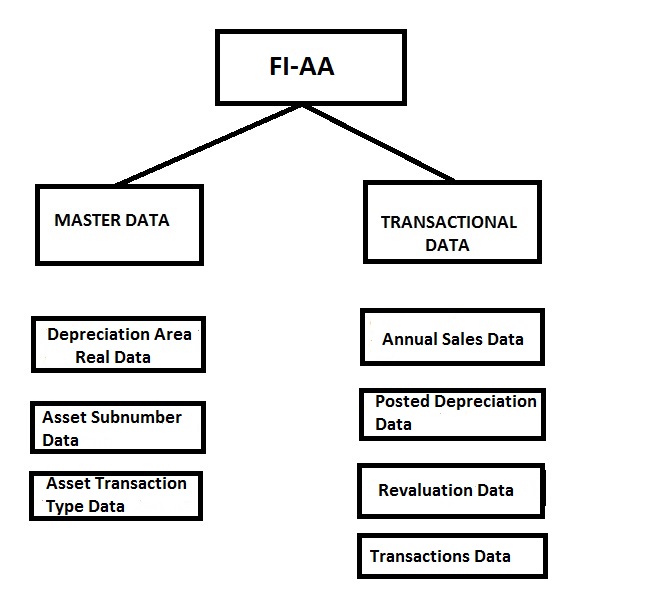

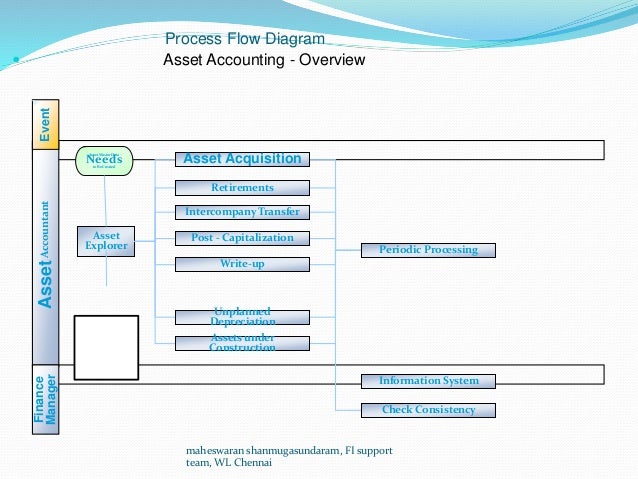

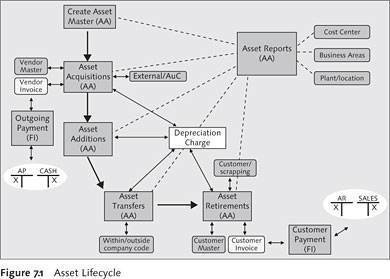

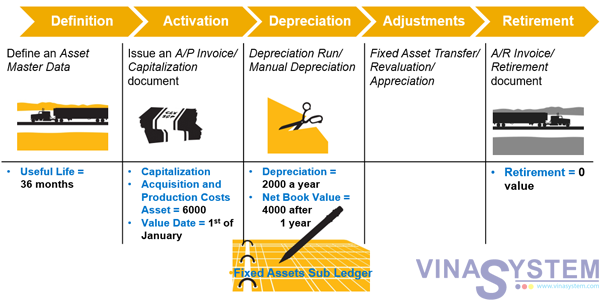

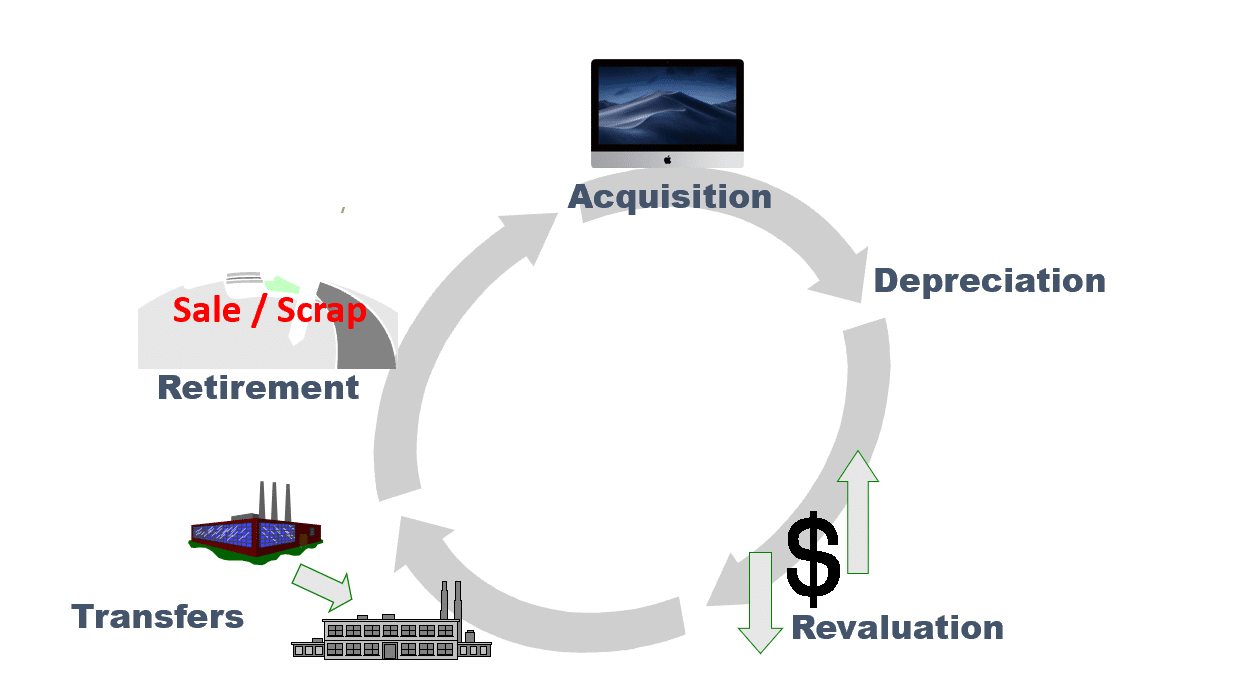

The Asset Accounting (FIAA) sub module in SAP manages a company’s fixed assets, right from acquisition to retirement/scrapping All accounting transactions relating to depreciation, insurance, etc, of assets are taken care of through this module, and all the accounting information from this module flows to FIGL on a realtime basis.

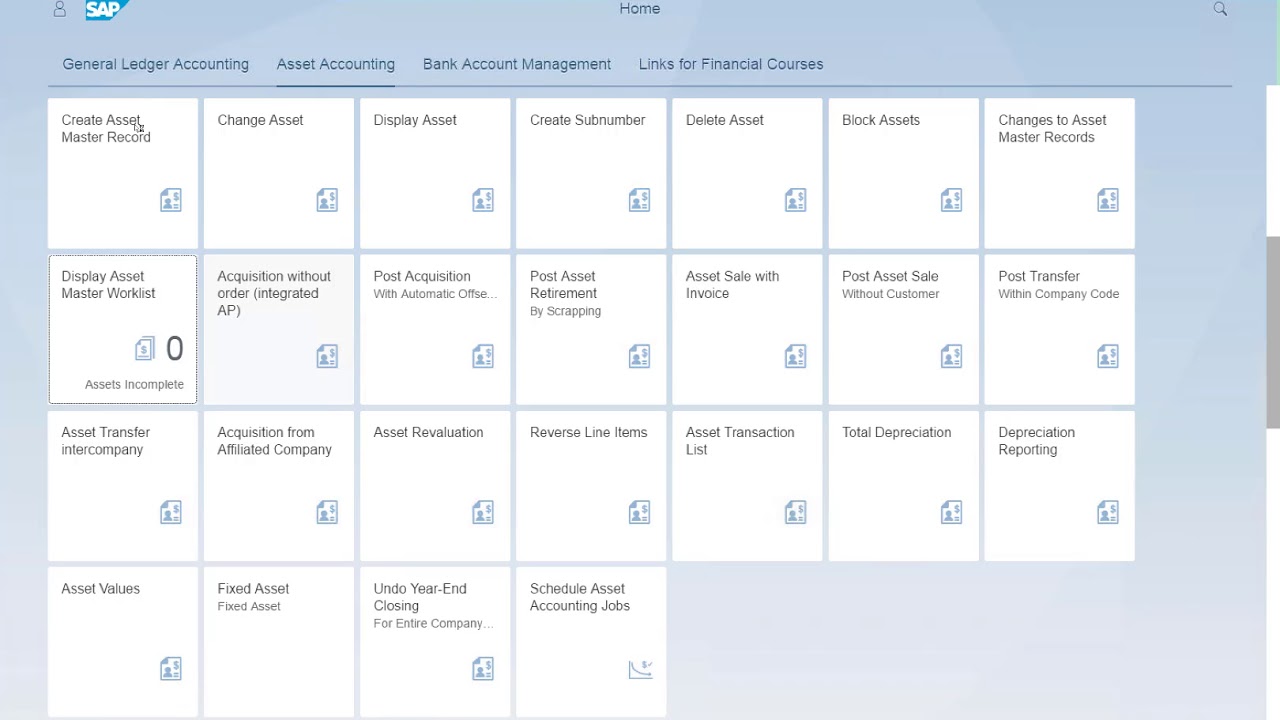

Asset accounting in sap. Asset Accounting in Simple Finance is used for monitoring of assets in SAP system In SAP Accounting powered by HANA system, you have only new asset accounting available with new G/L accounting As SAP Finance system is integrated with other modules, you can move data to and from other systems, ie you can transfer data from SAP Material Management to Asset Accounting system. Asset Accounting with SAP S/4HANA Asset accounting setup is mandatory in SAP S/4HANA — so get the details you need to get it up and running!. What you can do with Asset Accounting in SAP FICO Directly post the goods or invoice receipt from MM or PP to FIAA Post asset sales from FIAA to a customer account using FI1R Further, Capitalize the asset maintenance expenses in FIAA using asset settlements through the PM module Lastly, Pass.

SAP note – S4TWL – Asset Accounting Parallel valuation and journal entry;. Hi, I am new to asset accounting and I am looking to find the fields in SAP tables for the following descriptions If anybody has any idea please let me know the tables and the fields that will be suitable Asset Accounting. SAP S/4HANA Central Finance evolved from a pure advanced financial reporting system to a central transformation platform where you can execute financial processes centrally In this blog post I will focus on processes in Asset Accounting and share key considerations about setting up Asset Accounting in a Central Finance landscape in SAP S/4HANA.

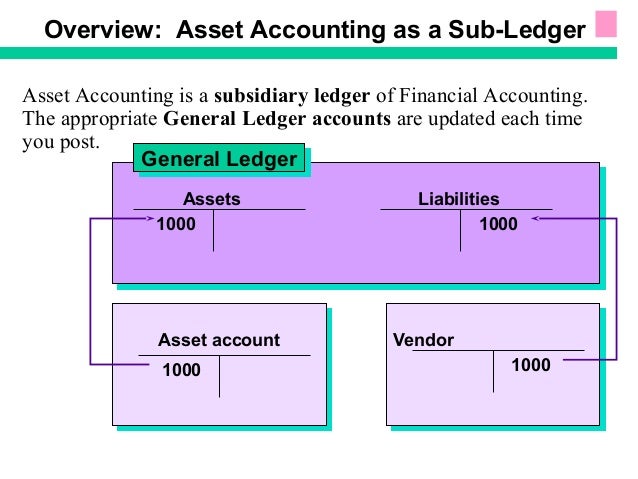

SAP Asset Accounting Minimize asset register errors and increase capital efficiency Complete timely asset creation with coordination among all involved parties, get accurate, accessible realtime assessment and reporting of asset status, respond to business events like mergers, and implement structured, standardized procedures for asset verification, transfer, revaluation and retirement. The Asset Accounting (FIAA) component is used for managing and supervising fixed assets with the SAP System In Financial Accounting it serves as a subsidiary ledger to the General Ledger, providing detailed information on transactions involving fixed assets. Leased Assets Accounting module in SAP is a valuable element in the asset accounting software management process as it manages the organization’s fixed assets data through the asset master records and asset accounting It acts as a subsidiary ledger to the SAP FI module to manage leased assets records.

Asset Accounting in SAP S/4HANA Level Details, Configuration & Transaction Languages English Course included in the following training paths SAP S/4HANA Solution Release SAP S/4HANA 1909 SAP S/4HANA ;. Walk through the configuration that underpins all of asset accounting, starting with organizational structures and master data From there, master key tasks for asset acquisition and retirement, depreciation, yearend close, reporting, and more. This course gives you a thorough overview of the SAP ERP asset accounting offering You will learn how to configure asset accounting, manage asset master data, and perform day to day and periodic asset transactions The course focuses on the accounts solution for parallel accounting.

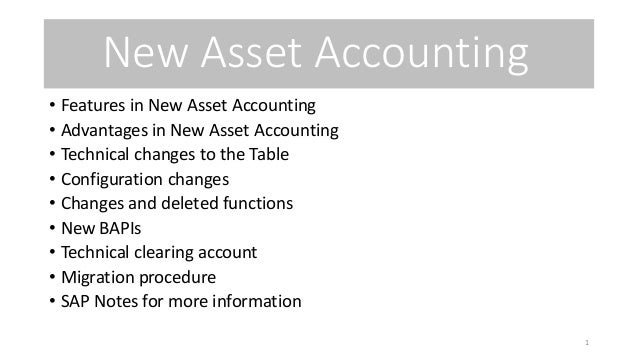

SAP Asset Transaction Codes AS91 — Create Old Asset, AS01 — Create Asset Master Record, AW01N — Asset Explorer, AS02 — Change Asset Master Record, ABT1N — Intercompany Asset Transfer, AS03 — Display Asset Master Record, and more View the full list of TCodes for Asset. This guide goes over the year end closing steps of Asset Accounting Overview of AJAB Asset year end close– You use the yearend closing program to close the fiscal year for one or more company codes from an accounting perspective Once the fiscal year is closed, you can no longer post or change values within Asset Accounting (for example, by recalculating depreciation). You will learn in this video New Asset Accounting Configuration in SAP S4 HANABuy self learning video courses wwwgauravconsultingcomAbout TrainerVikram F.

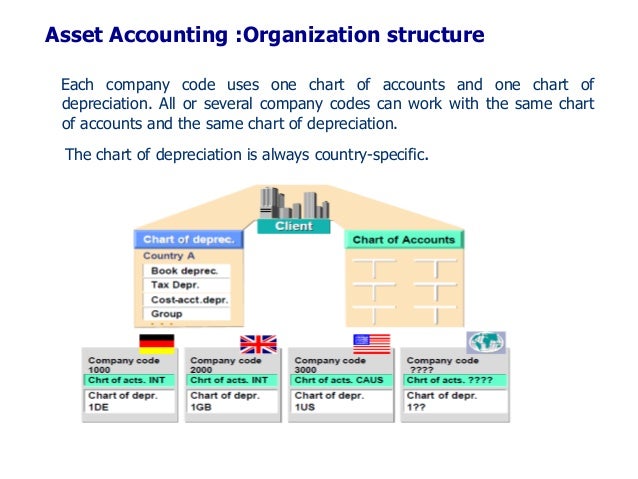

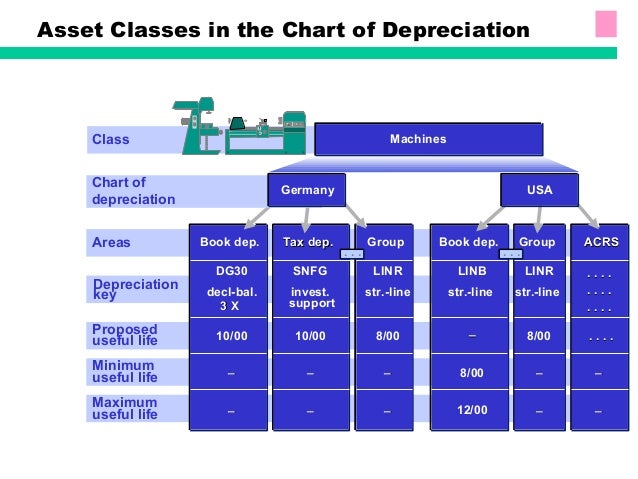

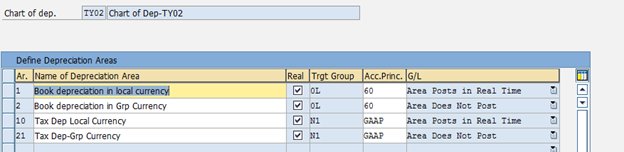

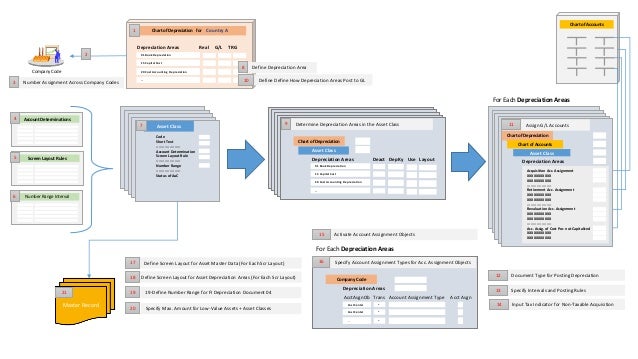

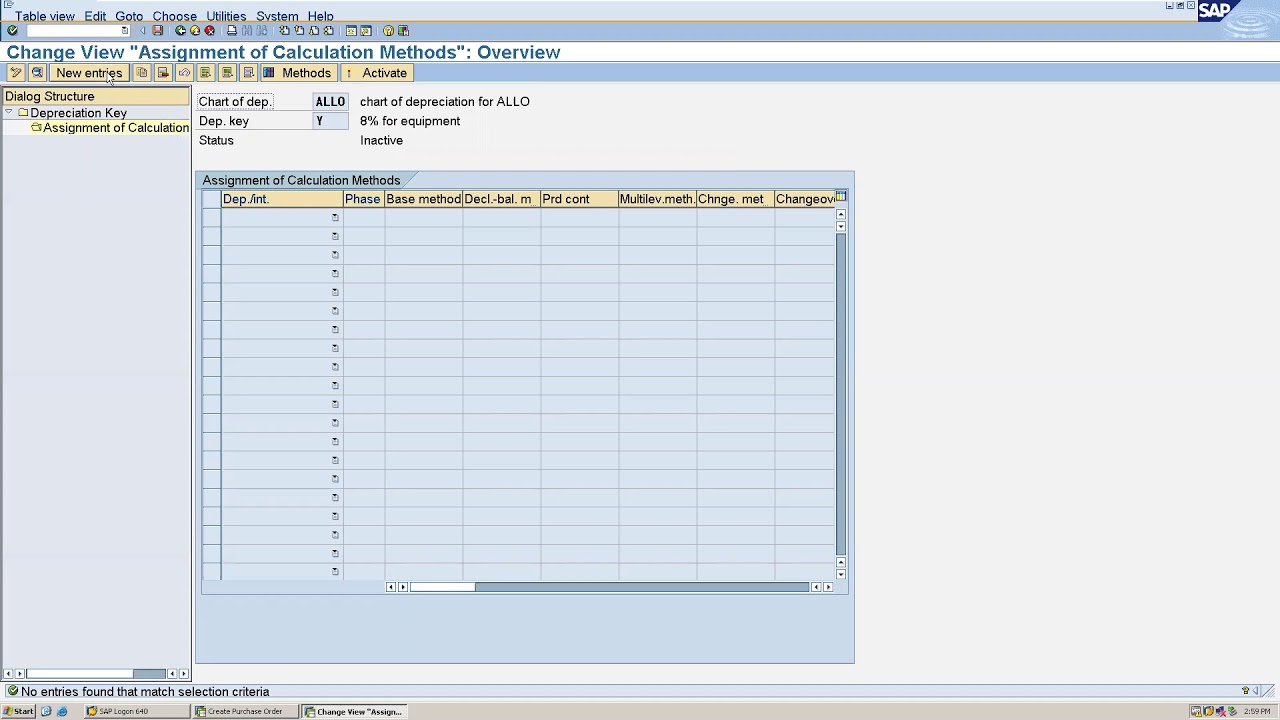

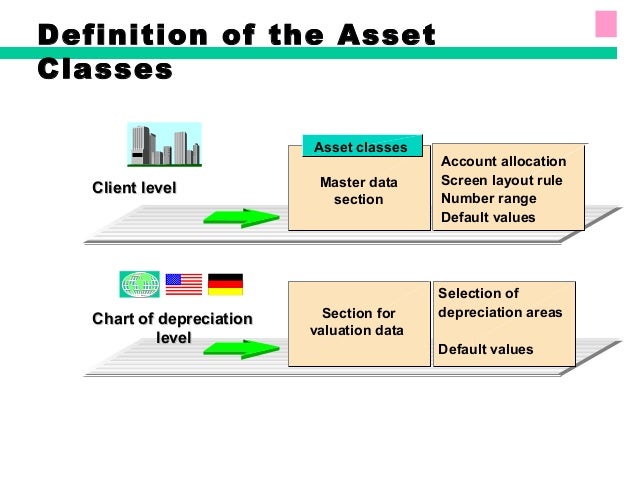

(ASAP) Duration until Option Volumefulltime (100%) Languages English (must have), German (nice to have) Your Tasks functional consulting in SAP FI AA (Asset Accounting) for S/4 HANA Transformation configuring Asset Accounting functionality in SAP integration across GL, AP, AR, Projects in SAP (understanding of asset procurement process) configuration and customizing. The Chart of Depreciation is a list of Depreciation Areas arranges according to business and legal requirement. SAP Asset Accounting Management provides a lot of different functions 1 Asset master data maintenance (asset classification, asset description, serial number, inventory number, depreciation 2 Asset lifecycle management (acquisition or construction, transfers, replacement, dispositions, and.

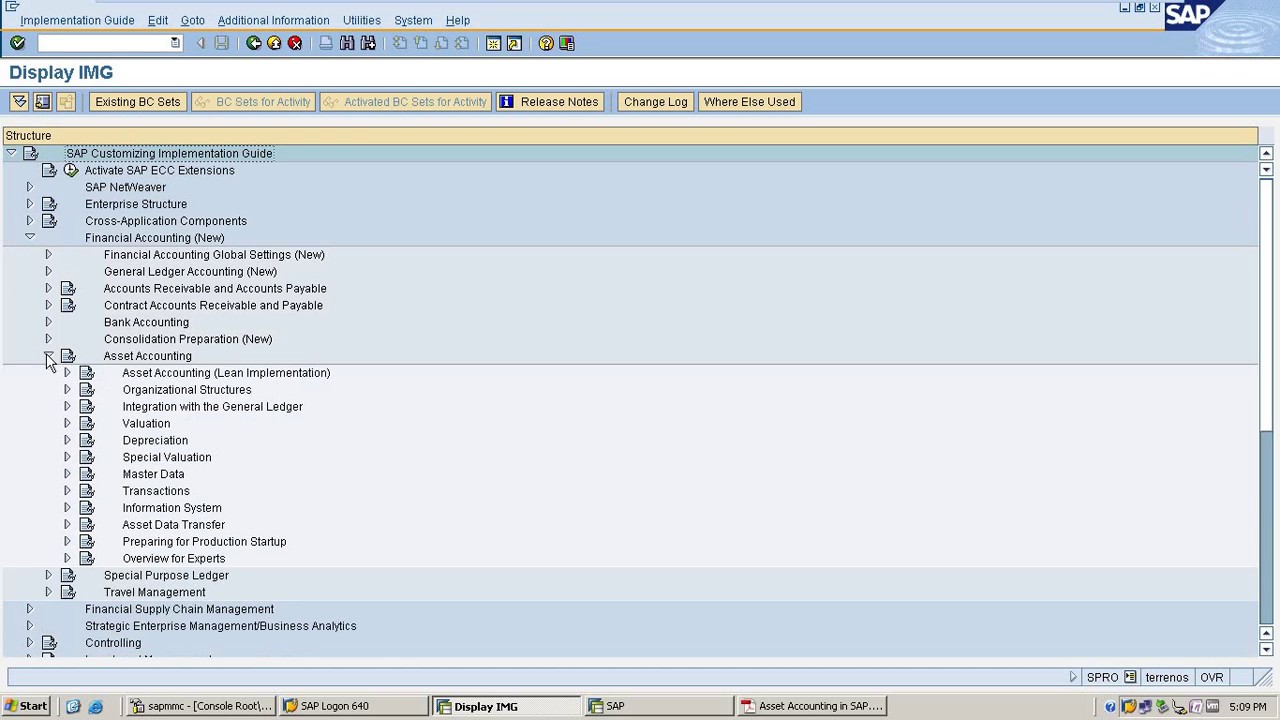

SAP Asset Accounting Configuration Steps Step 1 Copy Reference Chart of Depreciation/ Depreciation Area Step 2 Assign Chart of Depreciation to Company Code Step 3 Specify Account Determination Step 4 Create screen Layout Rule Step 5 Define Number range Interval Step 6 Define. Asset accounting configuration needed in sap Let's understand the configuration needed for asset accounting in very simple terms with the help of example Company code is assigned to chart of depreciation Chart of depreciation has list of depreciation areas depending upon the accounting requirement. SAP Asset Accounting in FI (FIAA) Transaction codes Full list Here is a list of important 139 transaction codes used with SAP FIAA component (SAP Asset Accounting in FI) coming under SAP FI Module You will get more technical details of each of these SAP FIAA tcodes by clicking on the respective tcode name link Acquis w/Autom.

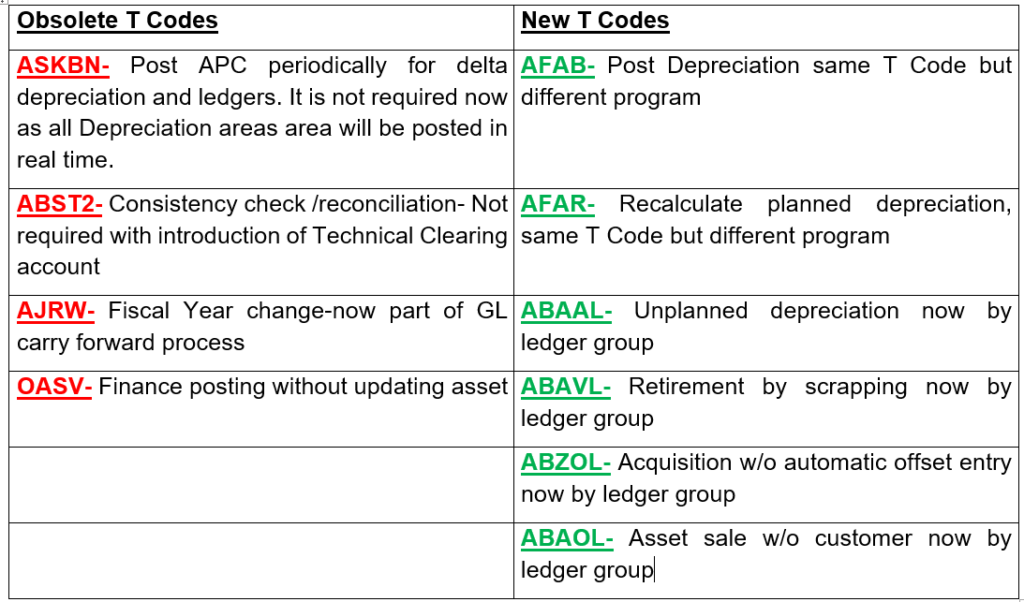

Directly to Asset Accounting (SAP FIAA) Are asset acquisitions posted on a net basis (deducting any discounts) or as a gross amount (discounts are deducted only on payment)?. SAP Asset Accounting is also called as sub ledger accounting, it is one of the important submodule of SAP financial accounting (SAP FICO) module Asset Accounting in SAP (FIAA) is used for managing and supervising the fixed assets of an organization The main purpose of asset accounting is to extract the exact values of the fixed assets owned. SAP S/4HANA has brought about a number of improvements in Asset Accounting There is a tighter integration with Finance, and postings are now realtime, updating all ledgers at the same time as the asset, allowing a smoother period end and an easier migration This is a new webcast, to update the original “Ask a Fixer What You Should Know About New Asset Accounting with SAP S/4HANA” created in 17.

SAP Menu > Accounting > Financial Accounting > Fixed Assets > Periodic Processing > YearEnd Closing > AJAB – Execute After reaching year end closing asset accounting screen enter the followings;. (ASAP) Duration until Option Volumefulltime (100%) Languages English (must have), German (nice to have) Your Tasks functional consulting in SAP FI AA (Asset Accounting) for S/4 HANA Transformation configuring Asset Accounting functionality in SAP integration across GL, AP, AR, Projects in SAP (understanding of asset procurement process) configuration and customizing. SAP Asset Transaction Codes AS91 — Create Old Asset, AS01 — Create Asset Master Record, AW01N — Asset Explorer, AS02 — Change Asset Master Record, ABT1N — Intercompany Asset Transfer, AS03 — Display Asset Master Record, and more View the full list of TCodes for Asset.

Below are some important questions on SAP FICO Asset Accounting for beginners and professionals Some of these are asked in TOP MNC company interviews 1 What is Chart of Depreciation ?. In asset accounting some transactions are assigned to FI document types, the most common are AA Asset posting AF Dep postings In the document type you say the number range (OB) you are using (our case AA01 and AF03). Do you want to show acquisitions to certain depreciation areas differently than you do in the book depreciation area (for example, to fulfill certain costaccounting, tax or group requirements)?.

Asset accounting configuration needed in sap Let's understand the configuration needed for asset accounting in very simple terms with the help of example Company code is assigned to chart of depreciation Chart of depreciation has list of depreciation areas depending upon the accounting requirement For the asset class, useful life and depreciation key is defined in depreciation area. SAP Help – Asset Accounting (FIAA) SAP note – S4TWL – Asset Accounting Changes to Data Structure;. Asset Accounting Conn guration in SAP ERP A StepbyStep Guide — Andrew Okungbowa Harold Rondon Download PDF Download Full PDF Package This paper A short summary of this paper 19 Full PDFs related to this paper READ PAPER.

Once an asset is capitalized, it can be transferred between Locations, Cost Centers and Plant Assets can be removed from the Assets Ledger by disposing them Asset accounting in SAP uses the principle of subsidiary ledger accounting This means each asset has a subledger that keeps a track of all the financial transactions of that asset 7. Download Course Index Find a course date Course announcements. (ASAP) Duration until Option Volumefulltime (100%) Languages English (must have), German (nice to have) Your Tasks functional consulting in SAP FI AA (Asset Accounting) for S/4 HANA Transformation configuring Asset Accounting functionality in SAP integration across GL, AP, AR, Projects in SAP (understanding of asset procurement process) configuration and customizing.

#assetaccounting, #sap, #sapassetaccountingAsset Accounting part 1 This video explains the concept of Asset Accounting in SAP FICO Learn how to configure. Asset Accounting Integration with General Ledger Accounting The following steps guides how to integrate asset accounting with the general ledger accounting in SAP step by step General Ledger Accounting Definition – General Ledger (G/L) possess financial accounts of balance sheet and P&L statements. Asset Accounting in the SAP system is used for managing and monitoring fixed assets In Financial Accounting, it serves as a subsidiary ledger to the general ledger, providing detailed information on transactions involving fixed assets.

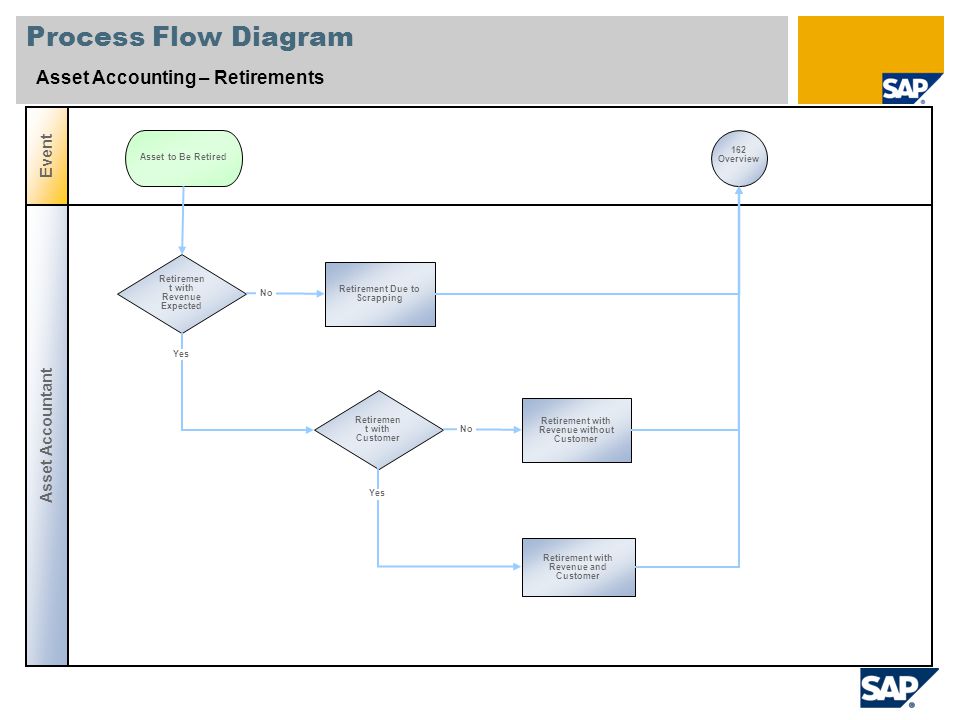

SAP S/4HANA is one of the most deployed postmodern ERPs Whilst the ERP of the th century concentrated on the digitization of business processes, The postmodern ERP focuses on the digital transformation of the business process In this blog, I will focus on how S/4HANA transforms asset accounting. Have a look to transaction AO74 Transaction type group should be 25 for 250 Note you can't do in the same posting period the aquasition and retirement!. I have highlighted challenges that I am aware of but maybe there are some more for specific use cases and depending on specific additional.

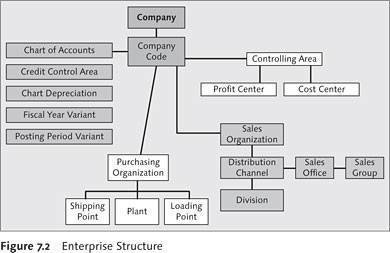

Sap Asset Accounting is the process of managing and maintaining fixed assets There are assets related to the SAP accounts that are accounted by storing all the data in their database like supplies, inventory, buildings, equipment etc These databases are managed and monitored regularly to make sure the data is not missed. In SAP R/3 Financial Accounting, it serves as a subsidiary ledger to the FI General Ledger, providing detailed information on transactions involving fixed assets 10 Organization StructureThe Organization Structure of Asset Accounting in SAP is represented by Chart of Account, Chart of Depreciation and Company Code. Asset accounting setup is mandatory in SAP S/4HANA — so get the details you need to get it up and running!.

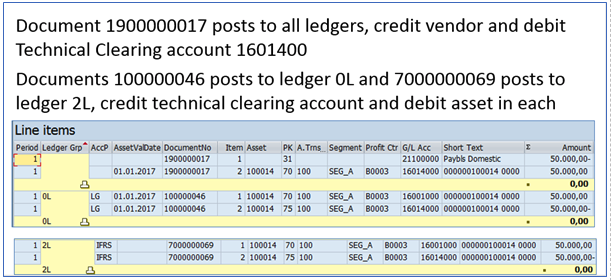

Asset Accounting Configuration The Asset Accounting module 1 Organizational structures In this section, you define the features of the Asset Accounting organizational objects (chart of depreciation, FI company code, asset class) All assets in the system have to be assigned to these organizational objects that you define In this way,. In this book, noted expert Andrew Okungbowa explains SAP Asset Accounting (FIAA) in SAPERP, including its associated business benefits, and guides you through the considerable complexities of SAPERP configuration Using FIAA for fixed asset management enables you to manage assets in multinational companies across a broad range of industries and produce reports to meet various needs in line. From release 1503 ie initial version of SAP Finance add on version in S4 Hana a new table ACDOCA is introduced which stores the asset values also per ledger /per currency on real time basis & no need to have any reconciliation between Finance and Asset accounting and to do so it is must to follow the guidelines while setting up depreciation areas & respective currencies, which I have tried to explain with an example as given below –.

#newassetaccounting #saps4hana #sapsimplefinance Overview of New Asset Accounting in SAP S4 HANA Learn the difference b/w Classic Asset Accounting and New A. Important configuration of Asset Accounting in SAP How to define charts of depreciation Define tax code on sales and purchases How to Assign chart of depreciation to company code How to specify account determination How to create screen layout rules How to Maintain asset number range intervals How. Asset Accounting (FIAA) Use Asset Accounting in the SAP system is used for managing and monitoring fixed assets In Financial Accounting, it Implementation Considerations Asset Accounting is intended for international use in many countries, irrespective of the Integration As a result of.

SAP FIXED ASSETS ACCOUNTING 1 Fixed Assets 2 Asset AccountingAA OverviewAsset Accounting as a SubledgerAsset ClassChart of DepreciationMaster 3 Asset AccountingTransfersPeriod / Year End ClosingReporting 4 Asset Accounting is a subsidiary ledger of Financial AccountingThe. SAP S/4HANA has brought about a number of improvements in Asset Accounting There is a tighter integration with Finance, and postings are now carried out in realtime, with updating of all ledgers occurring at the same time as the asset allowing for a smoother period end and an easier migration This is a new webcast. This guide goes over the year end closing steps of Asset Accounting Overview of AJAB Asset year end close– You use the yearend closing program to close the fiscal year for one or more company codes from an accounting perspective Once the fiscal year is closed, you can no longer post or change values within Asset Accounting (for example, by recalculating depreciation).

This course gives you a thorough overview of the SAP ERP asset accounting offering You will learn how to configure asset accounting, manage asset master data, and perform day to day and periodic asset transactions The course focuses on the accounts solution for parallel accounting. Let's take a look at the asset accounting process in SAP Fixed assets are defined as assets used Examples of fixed assets include real estate, buildings, both finished or under construction. Asset Accounting is a component of SAP FI module It represent as FIAA moduleIn this tutorial you will get an introduction about SAP Asset Accounting module, tcodes, tables, PDF study materials and subcomponents AA module provides the complete information about the fixed assets transactions inside a company.

Walk through the configuration that underpins all of asset accounting, starting with organizational structures and master data From there, master key tasks for asset acquisition and retirement, depreciation, yearend close, reporting. As a result of the integration in the SAP system, Asset Accounting transfers data directly to and from other systems Example It is possible to post from the Materials Management (MM) component directly to Asset Accounting When an asset is purchased or produced inhouse, you can directly post the invoice receipt or goods receipt, or the. When SAP redesigned the asset accounting solution, its intent was driven by the concept that all postings to leading and nonleading ledgers should be fully integrated and performed in real time – opposed to the classic asset accounting in SAP ERP which didn’t offer such integration options.

The Asset Accounting (FIAA) sub module in SAP manages a company’s fixed assets, right from acquisition to retirement/scrapping All accounting transactions relating to depreciation, insurance, etc, of assets are taken care of through this module, and all the accounting information from this module flows to FIGL on a realtime basis. Asset Accounting in SAP system (FIAA) is primarily used for managing, supervising and monitoring fixed assets Asset Accounting is classified as a subset of Financial Accounting and serves as a subsidiary ledger to the general ledger providing detailed information on transactions involving fixed assets. Walk through the configuration that underpins all of asset accounting, starting with organizational structures and master data.

Company code Fiscal year We suggest you to run in test mode first before your real run Now execute the transaction if you have selected in test run mode. Directly to Asset Accounting (SAP FIAA) Are asset acquisitions posted on a net basis (deducting any discounts) or as a gross amount (discounts are deducted only on payment)?. In this book, noted expert Andrew Okungbowa explains SAP Asset Accounting (FIAA) in SAPERP, including its associated business benefits, and guides you through the considerable complexities of SAPERP configuration Using FIAA for fixed asset management enables you to manage assets in multinational companies across a broad range of industries and produce reports to meet various needs in line.

Parallel Valuation in Asset Accounting SAP S/4HANA provides the tools and processes to fulfill these parallel valuation requirements Some of these requirements can be technically challenging to meet, such as when you need to use different fiscal year variants (FY variants) in the different valuation frameworks. Below are some important questions on SAP FICO Asset Accounting for beginners and professionals Some of these are asked in TOP MNC company interviews 1 What is Chart of Depreciation ?. Asset accounting is a separate sub module in sap which comes under main module SAP FI Asset is tracked in asset sub module and corresponding financial impact is recorded in finance module For each & every asset, asset master is created in sub module which captures information related to the asset.

Do you want to show acquisitions to certain depreciation areas differently than you do in the book depreciation area (for example, to fulfill certain costaccounting, tax or group requirements)?. SAP Asset Accounting Overview The Asset Accounting component is used for managing and supervising fixed assets with the SAP System In Financial Accounting, it serves as a subsidiary ledger to the General Ledger, providing detailed information on transactions involving fixed assets Asset Accounting will be covered in this tutorial in below steps Description Topics covered Organization. New Asset Accounting is available even if you are not on SAP S/4 HANA ( as long as you are on SAP ECC 60 EHP 7 or above ), but you must have the new version of the SAP General ledger implemented first and use the ledger approach It is activated at the client level and therefore, applies to all company codes.

Q Tbn And9gcrkv2dwp7xz1dw Wf2hu81dukiyuzudhogkzap5nuqwivu2ss2n Usqp Cau

Asset Accounting

Finance Fi Fi Asset Accounting Sap Bi Learning

Asset Accounting In Sap のギャラリー

Controlling Espresso Tutorials Com Onix Leseprobe 53 Pdf

Sap Asset Accounting Aumtech Solutions Sap Training

Sap Fixed Assets Accounting

Asset Accounting In Sap S 4hana

Sap Fixed Assets Accounting

Asset Accounting Configuration Steps In Sap Asset Accounting Fico Sap Tutorials

Basics Of Asset Accounting Asset Explorer Sap Simple Docs

Sap Central Finance New Asset Accounting Fi Youtube

Ppt Asset Accounting Powerpoint Presentation Free Download Id

Sap Library Asset Accounting Fi

Sap Fi Assign Chart Of Depreciation To Company Code By Feyza Derinoglu Medium

Asset Accounting Organizational Hierarchy

Introducing New Asset Accounting In S 4 Hana

(1).jpg)

Asset Accounting Data Flow What Model Type To Use Aris Bpm Community

Sap Library Asset Accounting Fi

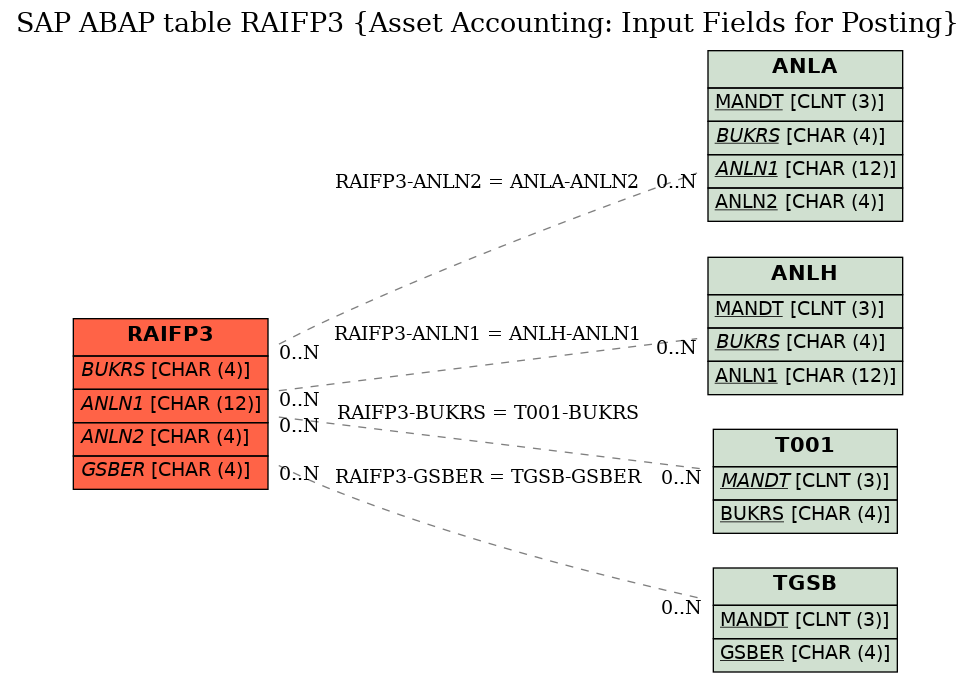

Sap Abap Table Raifp3 Asset Accounting Input Fields For Posting Sap Tables Org The Best Online Document For Sap Abap Tables

New Assets Accounting Sap S 4 Hana 1809 With New Gl Functionality Sap Blogs

Sap Fi Asset Accounting End User Guide For Beginners

Sap Asset Accounting Aumtech Solutions Sap Training

Asset Accounting Configuration Steps In Sap Fico Asset Accounting Sap Tutorials

Sap Fixed Assets Accounting

Sap S 4hana Conversion Projects Tips On Asset Accounting Preparation Phase Sap Blogs

Introducing New Asset Accounting In S 4 Hana

Asset Accounting In Central Finance Sap Blogs

Sap Fi Overview Tutorialspoint

Sap Simple Finance Asset Scrapping Tutorialspoint

1

Sap Fixed Assets Accounting

New Asset Accounting In Sap Account Vs Ledger Approach Skillstek

Edify A Virtual Learning Platform

Changeover In Asset Accounting Sap Documentation

Sap Asset Accounting Module Tutorial Tcodes And Tables

New Asset Accounting In Sap Account Vs Ledger Approach Skillstek

New Asset Accounting In Simple Finance Sap Blogs

Asset Accounting Overview Sap Documentation

Sap Asset Accounting Training Asset Accounting Got

Buy Reporting For Sap Asset Accounting Book Online At Low Prices In India Reporting For Sap Asset Accounting Reviews Ratings Amazon In

Fame Asset Accounting App For Sap Business One

Who Can Take Up Sap New Asset Accounting Training

Sap Asset Accounting Complete Process Flow Youtube

Asset Accounting In Central Finance Sap Blogs

Asset Accounting In Sap Fico Step By Step Guide Skillstek

1 Tata Consultancy Services Asset Accounting Fi Ppt Download

Asset Accounting In Central Finance Sap Blogs

Sap Simple Finance Asset Scrapping Tutorialspoint

Espresso Tutorials Reporting For Sap Br Asset Accounting

Top 250 Sap Asset Accounting Interview Questions And Answers 08 January 21 Sap Asset Accounting Interview Questions Wisdom Jobs India

Additional G L Accounts For Asset Accounting Sapspot

Asset Accounting In Sap Erp Financials

Sap Library Asset Accounting Fi

Functions Of The Asset Class Sap Documentation

Migrating Sap New Asset Accounting In S4 Hana Skillstek

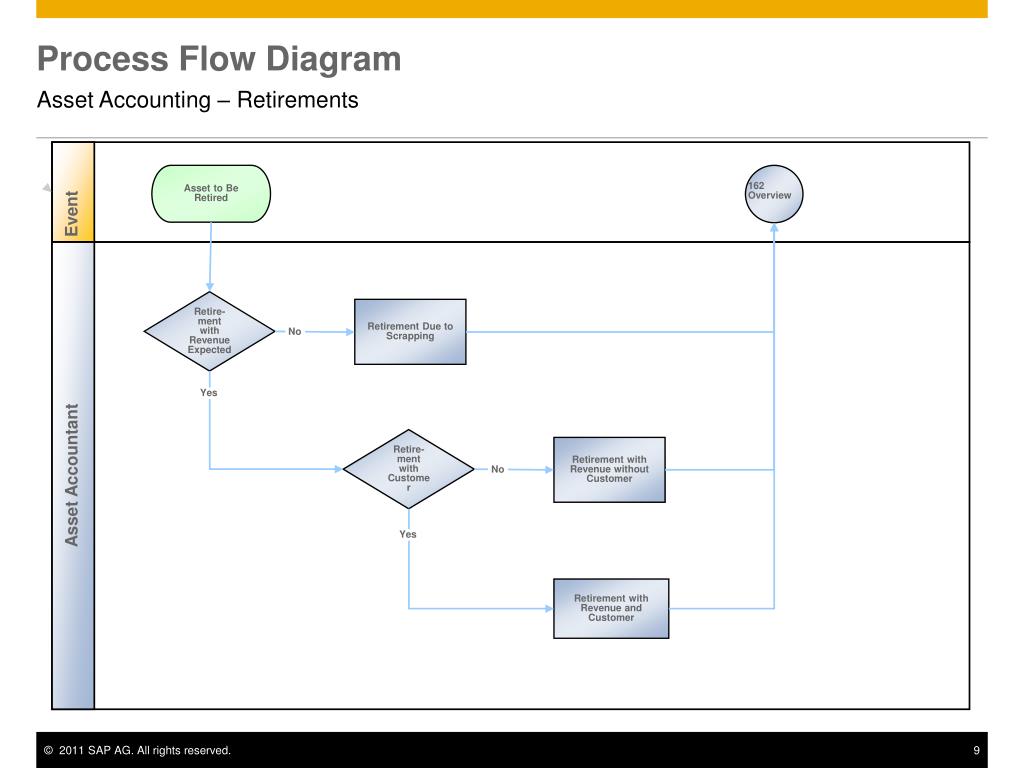

Best Practice Scenario Asset Accounting J62 S4hana 1909 Release

Asset Accounting Fi New

Asset Accounting In Sap Fico Module Book Value Depreciation

Sap Library Asset Accounting Fi

S 4hana New Asset Accounting Changes In Legacy Data Takeover Serio Consulting

Sap Assets Accounting Configuration

New Asset Accounting In S4 Hana

Introducing New Asset Accounting In Sap S 4hana Fi Sap S4hana Books Erp 360

Posting Via A Clearing Account Excerpt From Sap Fixed Asset Accounting Espresso Tutorials Blog

Additional G L Accounts For Asset Accounting Sapspot

Asset Accounting With Sap S 4hana By Stoil Jotev

Asset Accounting In Central Finance Sap Blogs

Introduction To Sap Fico

Sap Fi Define Depreciation Areas By Feyza Derinoglu Medium

Q Tbn And9gctmo9w0sptgjlu63iyrrf4bi4stwaowwiku8lerogpp34hp8oum Usqp Cau

Asset Accounting In Sap Part 3 Youtube

Asset Accounting Overview Sap Help Portal

Sap S 4hana For Sap Asset Accounting Sap Fi Beg By Sap Press

Iq0fs622qxr6rm

Process Fixed Assets Accounting In Sap Erp Solutions For Apparel And Footwear Implement Applications Frameworks Process

Organizational Plan And Workflow Sap Documentation

Asset Accounting In Sap Erp Financials

Sap Asset Accounting Pdf Document

How To Create Asset Classes In Sap What Is An Asset Class

Amazon Com Reporting For Sap Asset Accounting Learn About The Complete Reporting Solutions For Asset Accounting Michael Thomas Books

Fixed Asset Accounting In Sap S 4 Hana A Case Study Fixed Asset Sap Hana

Asset Accounting Sap Best Practices Baseline Package India Ppt Video Online Download

An Overview Of Sap Asset Accounting Mastering Sap S 4hana 1709 Strategies For Implementation And Migration

Q Tbn And9gcqk3cinatgjicexs Nqvloghyacr29e2t9foo3wicq Usqp Cau

Posting Via A Clearing Account Excerpt From Sap Fixed Asset Accounting Espresso Tutorials Blog

Asset Accounting In Central Finance Sap Blogs

Sap S 4hana Finance Fixed Asset Accounting Fi Youtube

Asset Accounting Configuration Steps In Sap Asset Accounting Fico Sap Tutorials

Reporting For Sap Asset Accounting Learn About The Complete Reporting Solutions For Asset Accounting By Thomas Michael

Fixed Assets In Sap Business One Introduction

Asset Classes And Its Functions

Introducing New Asset Accounting In S 4 Hana

Sap Fixed Assets Accounting

Asset Accounting Configuration Steps

Posting Via A Clearing Account Excerpt From Sap Fixed Asset Accounting Espresso Tutorials Blog

Asset Under Construction Through Mm Sapspot

Sap Asset Accounting Aumtech Solutions Sap Training

Structuring Fixed Assets Sap Library Asset Accounting Fi

Sap Fi Asset Accounting End User Guide For Beginners

Everything You Must Know On Asset Accounting

Sap Asset Accounting Complete Configuration Live Demo Youtube

New Asset Accounting In Sap Account Vs Ledger Approach Skillstek

Sap Asset Accounting Training Depreciation Mergers And Acquisitions

What Is Asset Accounting In Sap Fi Tutorialkart Com